PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939024

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939024

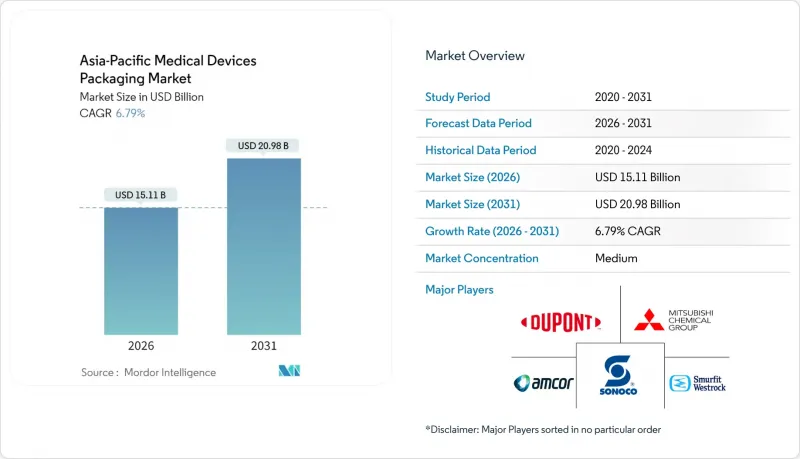

Asia-Pacific Medical Devices Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific medical devices packaging market size in 2026 is estimated at USD 15.11 billion, growing from 2025 value of USD 14.15 billion with 2031 projections showing USD 20.98 billion, growing at 6.79% CAGR over 2026-2031.

Robust manufacturing expansion across China, India, and Southeast Asia, rising healthcare spending in developed economies such as Japan and Australia, and a steady shift toward smart, sensor-enabled packs form the core growth drivers of the Asia-Pacific medical devices packaging market. Cost-efficient regional production hubs stimulate large-volume demand for plastics, even as bio-based alternatives gain regulatory traction. Hospitals, clinics, and contract service providers represent the largest buyers, while direct-to-patient e-commerce distribution urges tertiary pack redesign for parcel integrity. Competitive intensity revolves around sterile barrier validation, sustainability credentials, and digital traceability, allowing suppliers that master these capabilities to capture higher-margin contracts in the Asia-Pacific medical devices packaging market.

Asia-Pacific Medical Devices Packaging Market Trends and Insights

Expansion of APAC Medical-Device Manufacturing Hub

Multinational device makers intensified production migration to Asia in 2024, with China's output rising 12.3% and India's capacity climbing 18.7% after Production Linked Incentive funding. Clustered factories in Vietnam and Malaysia now feed sterile-pack volume lines that demand validated barrier materials at competitive cost. Such scaling enables packaging converters to amortize automation investment while satisfying ISO 11607 across multijurisdiction export lanes. Regional resin supply constraints nonetheless force dual-sourcing, nud,ging converters toward Southeast Asian petrochemical partners. The result is a manufacturing ecosystem that underpins steady orders for trays, pouches and labels in the Asia-Pacific medical devices packaging market.

Growing Demand for Sterile Barrier Systems

ASEAN regulators harmonized toward ISO 11607 in 2024, prompting OEMs to upgrade peel-pouch and thermoformed tray validation. Contract sterilizers saw a 23% capacity-utilization jump as gamma, ethylene oxide, and vaporized hydrogen peroxide runs accelerated. Barrier substrates with antimicrobial coatings gain favor because they extend device shelf life without altering sterilization cycles. Suppliers that provide cross-method validation increasingly win multi-country contracts, boosting their footprint in the Asia-Pacific medical devices packaging market. Hospitals likewise mandate tamper-proof sterile barriers to curb healthcare-associated infections, reinforcing long-term demand.

Volatility in Polymer-Resin Prices

Polyethylene and polypropylene spot swings hit 23% in 2024, pulling converter margins downward on fixed-price supply deals. China's stricter refinery emissions rules shrank domestic resin availability, pushing regional prices 15% above global averages. Larger converters hedge through multi-country sourcing and long-term contracts, while small firms face consolidation pressure. Elevated resin risk tempers capital spending across family-owned converters, mildly restraining growth in the Asia-Pacific medical devices packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Healthcare Expenditure and Aging Demographics

- Stringent Regulatory Norms Mandating Tamper-Evident Packs

- Cost-Reduction Pressure from Device OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics held 54.78% of the Asia-Pacific medical devices packaging market share in 2025, underpinned by cost-efficiency and broad sterilization compatibility. Bio-based variants, including DuPont's next-generation Tyvek, earned multi-country clearance and drive a 7.78% CAGR through 2031. The Asia-Pacific medical devices packaging market size allocated to plastics reached USD 7.75 billion in 2025. Yet regulatory carbon caps in Japan and Australia push procurement teams toward renewable feedstocks, accelerating pilot projects with chemically recycled polyethylene. Metals and foils retain niche value in radiation shielding and moisture-barrier layers for implant kits, while glass remains confined to reusable scopes and premium analyzers.

Investment in integrated resin-to-film lines secures supply continuity for leading converters. Multilayer co-extrusion that combines recycled core layers with virgin contact surfaces reduces virgin-polymer intensity without jeopardizing ISO 10993 compliance. Converters partnering with petrochemical suppliers on mass-balance certification now bid advantageously on multinational device tenders. The sustainability mandate, therefore, refines, but does not overturn, the plastic-led material portfolio in the Asia-Pacific medical devices packaging market.

Pouches and bags contributed 36.05% to 2025 revenue, owing to the form-fill-seal economy and validated peelability. The Asia-Pacific medical devices packaging market size for pouches is projected to advance at a 6.04% CAGR to 2031. Thermoformed trays and rigid containers, however, are expanding 7.12% annually as robotic surgery kits and implant systems need custom cavities and drop resistance. Sonoco's 2024 recyclable tray launch married rigid protection with sustainable resin blends, aligning with hospital waste-reduction targets.

Blister packs bridge pharmaceutical-device hybrids like insulin pens, leveraging existing blistering infrastructure. Corrugated cartons evolve into smart secondary carriers, embedding QR codes that sync with hospital inventory software. Automated line efficiency drives pack geometry standardization to maximize throughput in high-speed sealers. Collectively, product-type innovation sustains broad option ranges within the Asia-Pacific medical devices packaging market.

The Asia-Pacific Medical Devices Packaging Market Report is Segmented by Material (Plastics, Paper and Paperboard, and More), Product Type (Pouches and Bags, Trays and Containers, and More), Application (Sterile Packaging, and More), End User (Hospitals and Clinics, Diagnostic and Imaging Centers, and More), Packaging Level (Primary, Secondary, Tertiary), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor plc

- DuPont de Nemours, Inc.

- Mitsubishi Chemical Group Corp.

- Smurfit WestRock

- Sonoco Products Company

- 3M Company

- Technipaq Inc.

- SteriPack Group Ltd.

- CCL Industries Inc.

- Sealed Air Corporation

- Nelipak Healthcare Packaging

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Wihuri Group (Winpak)

- Oliver Healthcare Packaging

- Tekni-Plex Inc.

- UFP Technologies, Inc.

- AptarGroup, Inc.

- Clondalkin Group Holdings B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 The Impact of Macroeconomic Factors on the Market

- 4.5 Market Drivers

- 4.5.1 Expansion of Asia-Pacific medical-device manufacturing hub

- 4.5.2 Growing demand for sterile barrier systems

- 4.5.3 Increasing healthcare expenditure and aging demographics

- 4.5.4 Stringent regulatory norms mandating tamper-evident packs

- 4.5.5 Rise of direct-to-patient e-commerce deliveries

- 4.5.6 Integration of smart sensors and digital tracking

- 4.6 Market Restraints

- 4.6.1 Volatility in polymer-resin prices

- 4.6.2 Cost-reduction pressure from device OEMs

- 4.6.3 Weak recycling infrastructure for multi-material packs

- 4.6.4 ASEAN ISO-11607 harmonization delays

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Paper and Paperboard

- 5.1.3 Metals and Foils

- 5.1.4 Glass

- 5.1.5 Bio-based Plastics

- 5.2 By Product Type

- 5.2.1 Pouches and Bags

- 5.2.2 Trays and Containers

- 5.2.3 Boxes and Cartons

- 5.2.4 Blister Packs

- 5.2.5 Other Product Types

- 5.3 By Application

- 5.3.1 Sterile Packaging

- 5.3.2 Non-sterile Packaging

- 5.3.3 Active / Smart Packaging

- 5.4 By End User

- 5.4.1 Hospitals and Clinics

- 5.4.2 Diagnostic and Imaging Centers

- 5.4.3 Home Healthcare

- 5.4.4 Contract Manufacturing and Sterilization Organization

- 5.5 By Packaging Level

- 5.5.1 Primary

- 5.5.2 Secondary

- 5.5.3 Tertiary

- 5.6 By Country

- 5.6.1 China

- 5.6.2 Japan

- 5.6.3 India

- 5.6.4 South Korea

- 5.6.5 Australia

- 5.6.6 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Amcor plc

- 6.4.2 DuPont de Nemours, Inc.

- 6.4.3 Mitsubishi Chemical Group Corp.

- 6.4.4 Smurfit WestRock

- 6.4.5 Sonoco Products Company

- 6.4.6 3M Company

- 6.4.7 Technipaq Inc.

- 6.4.8 SteriPack Group Ltd.

- 6.4.9 CCL Industries Inc.

- 6.4.10 Sealed Air Corporation

- 6.4.11 Nelipak Healthcare Packaging

- 6.4.12 Gerresheimer AG

- 6.4.13 West Pharmaceutical Services, Inc.

- 6.4.14 Wihuri Group (Winpak)

- 6.4.15 Oliver Healthcare Packaging

- 6.4.16 Tekni-Plex Inc.

- 6.4.17 UFP Technologies, Inc.

- 6.4.18 AptarGroup, Inc.

- 6.4.19 Clondalkin Group Holdings B.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment