PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939094

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939094

Spain Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

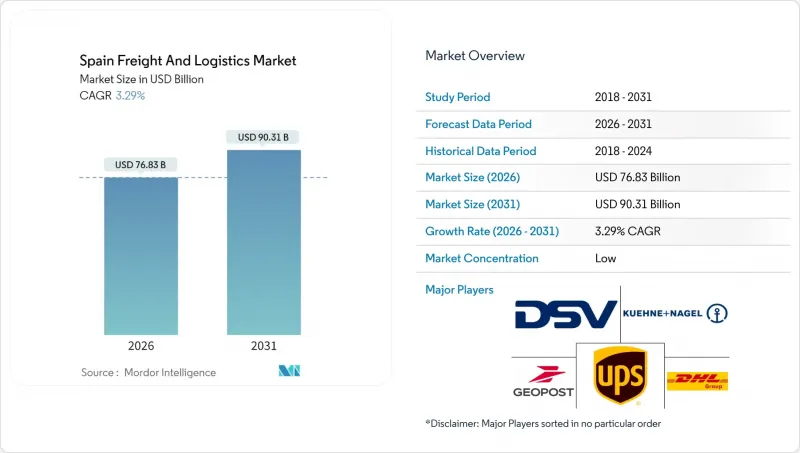

The Spain freight and logistics market was valued at USD 74.38 billion in 2025 and estimated to grow from USD 76.83 billion in 2026 to reach USD 90.31 billion by 2031, at a CAGR of 3.29% during the forecast period (2026-2031).

Spain's position as a Mediterranean gateway, coupled with Asia-Europe trade diversions toward western Mediterranean ports, lifts throughput at Valencia, Barcelona, and Algeciras. E-commerce proliferation enlarges parcel volumes and fuels automation investments, illustrated by DHL's EUR 350 million (USD 386 million) Barcelona hub capable of sorting 30,000 packages per hour. Manufacturing recovery, led by automotive and pharmaceuticals, intensifies just-in-time (J-I-T) freight needs and underpins road transport's 77.62% share. Public investments worth EUR 1.4 billion (USD 1.55 billion) in the Mediterranean Corridor and port LNG bunkering infrastructure are catalyzing rail uptake and greener vessel calls.

Spain Freight And Logistics Market Trends and Insights

E-Commerce Boom Powering Parcel and Last-Mile Volumes

Domestic online spending continues to climb, pushing CEP shipments to record highs. DHL's fully automated Barcelona hub scales processing capacity and trims cut-off times, enabling next-day coverage for 80% of the population. Correos has deployed more than 2,400 pickup points to facilitate click-and-collect, a model favored by omnichannel retailers. Cross-border parcels flow through Madrid-Barajas air gateway, where alliances with Chinese operators accelerate Asian deliveries into Europe. Autonomous sidewalk robots and rural drone pilots indicate a pivot toward tech-enabled last-mile solutions that mitigate driver shortages. Collectively, these initiatives consolidate Spain's reputation as a parcel logistics test bed for southern Europe.

Manufacturing Resurgence Driving J-I-T Freight Demand

Automotive plants in Catalonia and Navarra synchronize inbound components via time-definite trucking corridors, shrinking inventory buffers and lifting premium-service demand. Pharmaceutical producers dispatch temperature-sensitive APIs under Good Distribution Practice, reinforcing the need for real-time tracking. Select exporters switch long-haul legs to rail on the Mediterranean Corridor to reduce emissions and hedge against driver scarcity. Predictive analytics platforms help manufacturers balance throughput and cost, favoring logistics providers that offer integrated control-tower visibility. The interplay of lean production and sustainability pledges sustains multimodal freight innovation.

Severe Driver Shortages and Wage Inflation

Spain lacks roughly 25,000 licensed truck drivers, equal to 15% of capacity, as retirement outpaces new entrants. Average annual wages in Madrid and Catalonia rose 10% in 2025, squeezing margins for SME hauliers and lifting freight rates. Salvesen Logistica operates 550 long-haul trailers daily and must continually recruit to maintain service, illustrating the cost burden of retention programs. Capacity shortfalls compel shippers to book farther in advance, and some switch to rail where feasible. Persistent shortages pose structural limits on road freight growth until training initiatives scale.

Other drivers and restraints analyzed in the detailed report include:

- Public-Sector Spend on Mediterranean and Atlantic Corridors

- Outsourced Cold-Chain Uptake in Iberia

- Fuel-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing accounted for 33.95% of the Spain freight and logistics market share in 2025, underpinned by strong automotive output, chemical processing, and high-value machinery exports. Automotive plants rely on synchronized inbound flows to minimize line-side inventory, stimulating growth in sequencing centers and shuttle trucks.

Wholesale and retail trade, slated for a 3.49% CAGR (2026-2031), capitalizes on omnichannel strategies that fuse store inventory with e-commerce fulfillment. Retailers demand real-time stock visibility and later order cut-offs, favoring integrators that combine urban hubs, micro-fulfillment, and last-mile networks. The dynamic encourages 3PLs to bundle warehousing, transport, and returns handling into unified contracts that deepen customer stickiness.

Freight transport produced 63.05% of revenue in 2025, confirming its centrality to the Spain freight and logistics market. Demand stems from the country's role as an entry point for Euro-Mediterranean trade and a distribution base for automotive, pharma, and FMCG flows. Bulk road movements from factory gates to ports dominate volumes, while rail intermodal units rise on infrastructure upgrades and green mandates.

CEP, expanding at a projected 3.78% CAGR (2026-2031), benefits from online retail that demands speed, small-parcel density, and precise tracking. Investment in sortation automation, route-planning AI, and alternative delivery stations differentiates CEP leaders from traditional general-cargo hauliers. The widening service gap reinforces the freight-to-parcel value migration likely to shape the Spain freight and logistics market through 2031.

The Spain Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Across Logistics

- Alfil Logistics

- Americold

- Careers Logistics Group

- CMA CGM Group (Including CEVA Logistics)

- Correos

- DHL Group

- DSV A/S (Including DB Schenker)

- FedEx

- GEODIS

- Geopost (including DPD Group and SEUR)

- Grupo Sese

- ID Logistics

- Kuehne+Nagel

- Lineage, Inc.

- Marcotran

- Rhenus Group

- Salvesen Logistica SA

- TSB Trans

- United Parcel Service of America, Inc. (UPS)

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Boom Powering Parcel and Last-Mile Volumes

- 4.25.2 Manufacturing Resurgence Driving J-I-T Freight Demand

- 4.25.3 Public-Sector Spend on Mediterranean and Atlantic Corridors

- 4.25.4 Outsourced Cold-Chain Uptake in Iberia

- 4.25.5 LNG Bunkering Infrastructure in Major Ports

- 4.25.6 Logistics Real-Estate Yield Compression Spurring Supply

- 4.26 Market Restraints

- 4.26.1 Severe Driver Shortages and Wage Inflation

- 4.26.2 Fuel-Price Volatility

- 4.26.3 Peak-Season Port Bottlenecks for Reefer Cargo

- 4.26.4 Slow Customs Digitalisation for Canary Flows

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Across Logistics

- 6.4.2 Alfil Logistics

- 6.4.3 Americold

- 6.4.4 Careers Logistics Group

- 6.4.5 CMA CGM Group (Including CEVA Logistics)

- 6.4.6 Correos

- 6.4.7 DHL Group

- 6.4.8 DSV A/S (Including DB Schenker)

- 6.4.9 FedEx

- 6.4.10 GEODIS

- 6.4.11 Geopost (including DPD Group and SEUR)

- 6.4.12 Grupo Sese

- 6.4.13 ID Logistics

- 6.4.14 Kuehne+Nagel

- 6.4.15 Lineage, Inc.

- 6.4.16 Marcotran

- 6.4.17 Rhenus Group

- 6.4.18 Salvesen Logistica SA

- 6.4.19 TSB Trans

- 6.4.20 United Parcel Service of America, Inc. (UPS)

- 6.4.21 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment