PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940842

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940842

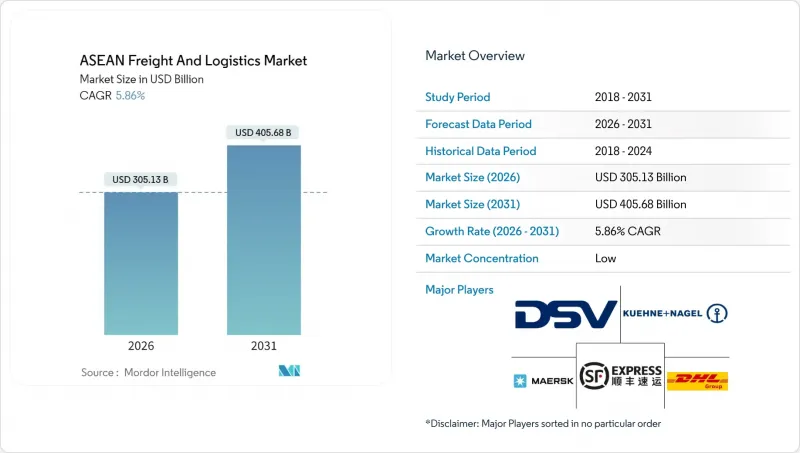

ASEAN Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ASEAN freight and logistics market is expected to grow from USD 288.24 billion in 2025 to USD 305.13 billion in 2026 and is forecast to reach USD 405.68 billion by 2031 at 5.86% CAGR over 2026-2031.

Robust e-commerce uptake, the relocation of manufacturing supply chains, tariff-cutting trade pacts, and large-scale public infrastructure programs collectively sustain growth momentum across all ten member states. The ASEAN freight and logistics market benefits from the June 2025 entry into force of the Philippines' RCEP accession, which removes duties on 90% of traded goods and accelerates customs clearances. Intensifying competition prompts mergers and acquisitions that aim to build dense regional networks, while new service niches such as EV-battery logistics and pharmaceutical cold chains diversify revenue streams. Nonetheless, high logistics-to-GDP ratios in emerging markets, cabotage restrictions, and equipment imbalances add cost pressures that operators must offset through technology and modal optimization.

ASEAN Freight And Logistics Market Trends and Insights

Explosive B2C E-commerce Growth Fuelling CEP Volumes

E-commerce platforms such as TikTok, Shopee, and Lazada have driven parcel counts that outpace traditional freight volumes across major ASEAN cities. Platform-controlled carrier allocation increases network density and bargaining power over third-party providers, prompting operators to invest in automated sortation hubs that handle millions of parcels daily. Unicorn Flash Express scaled to 1,300 branches and now processes up to 2 million parcels per day across six countries, illustrating the operational intensity required for rapid deliveries. Distributed fulfillment, urban consolidation hubs, and micro-mobility fleets improve last-mile efficiency, although inconsistent local regulations on electric bikes and trikes slow uniform deployment. Real-time tracking and predictive delivery windows become standard customer expectations, reinforcing the digitization push among CEP players.

Manufacturing FDI Shift into ASEAN Boosting Intra-Regional Trade

Foreign investors relocating production from Northeast Asia to ASEAN spur sustained demand for cross-border freight, component shuttle services, and specialized warehousing. Electronics and electrical goods dominate capital inflows, with Malaysia exporting integrated circuits worth MYR 34.1 billion (USD 7.2 billion) in September 2024. Vietnam's industrial parks link directly to upgraded deep-sea ports and double-track rail corridors, enabling seamless hinterland connectivity. Just-in-time manufacturing raises the premium on schedule reliability and customs efficiency, reinforcing the value proposition of end-to-end logistics integrators. Rules of origin under RCEP further localize supply chains by incentivizing regional content, stimulating intra-ASEAN freight volumes.

Infrastructure Gaps and 16-25% Logistics-Cost-to-GDP in Emerging AMS

Road quality deficits, limited inland waterways, and power shortages prolong transit times and inflate handling expenses, particularly in landlocked and archipelagic sub-regions. The International Energy Agency notes that oil demand from Southeast Asian freight transport rose from 1.3 million to 2.8 million barrels per day between 2000 and 2024, magnifying congestion and emissions. Cold-chain rollout is hampered by grid unreliability and high diesel generator costs, constraining pharmaceutical and fresh-produce logistics. Without accelerated infrastructure finance, emerging members risk lower service quality and missed participation in high-value supply chains.

Other drivers and restraints analyzed in the detailed report include:

- Large-Scale Public-Sector Spend on Multimodal Corridors and Ports

- Expansion of Tariff-Cutting Trade Pacts (RCEP, ACFTA Upgrades)

- Cabotage and Licensing Rules Fragmenting Regional Freight Networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing generated 31.74% of 2025 revenue, underscoring the region's vital role in global electronics, automotive, and textile supply chains. Flexible warehousing footprints and time-definite freight services enable just-in-sequence deliveries to factories clustered in Vietnam, Thailand, and Malaysia. The ASEAN freight and logistics market share for wholesale and retail trade will rise quickly on a 6.31% CAGR (2026-2031) as modern grocery, fashion, and general merchandise segments expand omnichannel distribution networks. Agriculture and forestry continue to contribute sizable tonnage via bulk and reefer cargoes, while construction drives heavy-lift activity linked to public infrastructure builds.

Retail supply chains embrace automation to align inventory with volatile online demand. Dark stores and micro-fulfillment sites multiply in dense urban pockets, shrinking delivery promises to sub-two-hour windows. Manufacturers, meanwhile, diversify plant footprints to hedge geopolitical risk, prompting service providers to secure bonded trucking corridors and regional distribution centers that synchronize component flows. Temperature-controlled warehousing gains traction across food and pharma verticals, and capacity utilization in Malaysia's Tasco cold storage network averaged 85-90% in 2024.

The freight transport segment supplied 60.12% of 2025 revenue, reflecting its core role in bulk commodity and container movements. CEP, however, grows fastest at 6.78% CAGR (2026-2031), fueled by urban e-commerce that demands high-frequency parcel drops and transparent tracking. The ASEAN freight and logistics market size for CEP operators improves through automation investments such as 3-million-parcel-per-day sorters in Bangkok and Jakarta. Freight forwarding maintains revenue stability by orchestrating customs brokerage and multi-leg shipping for expanding intra-regional trade. Warehousing benefits from inventory localization, including chilled storage nodes that support growing online grocery traffic. Small but lucrative specialized services-project cargo, reverse logistics, and aftermarket parts-round out the portfolio and insulate operators from cyclicality.

Digital transformation is no longer optional. Leading CEP firms integrate route-optimization algorithms and handheld scanners that push real-time status updates to merchants and buyers. Temperature-controlled CEP consignments escalate as online pharmacies and meal-kit services scale in metro areas. Operators with regional footprints can consolidate cross-border parcels and leverage the ASEAN Single Window to shorten cycle times, creating stickier customer relationships. Fragmented regulations on electric delivery bikes present an operational wildcard that companies navigate by piloting compliant fleets city by city.

The ASEAN Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, and More), by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services), and by Country (Indonesia, Malaysia, Thailand, Vietnam, and Rest of ASEAN). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller - Maersk

- CJ Logistics Corporation

- DHL Group

- DP World

- DSV A/S (Including DB Schenker)

- FedEx

- Flash Express

- Kuehne+Nagel

- LOGISTEED, Ltd. (Including Alps Logistics)

- Ninja Van (Including Ninja Express)

- NYK (Nippon Yusen Kaisha) Line

- Pos Indonesia (Persero)

- POS Malaysia Bhd

- PT Jalur Nugraha Ekakurir (JNE Express)

- SCGJWD Group

- SF Express (KEX-SF)

- SPX Express

- Tiong Nam Logistics Holdings Bhd

- United Parcel Service of America, Inc. (UPS)

- YCH Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.22.1 Indonesia

- 4.22.2 Malaysia

- 4.22.3 Thailand

- 4.22.4 Vietnam

- 4.23 Regulatory Framework (Sea and Air)

- 4.23.1 Indonesia

- 4.23.2 Malaysia

- 4.23.3 Thailand

- 4.23.4 Vietnam

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 Explosive B2C E-Commerce Growth Fuelling CEP Volumes

- 4.25.2 Manufacturing FDI Shift into ASEAN Boosting Intra-Regional Trade

- 4.25.3 Large-Scale Public-Sector Spend on Multimodal Corridors and Ports

- 4.25.4 Expansion of Tariff-Cutting Trade Pacts (RCEP, ACFTA Upgrades)

- 4.25.5 Roll-Out of ASEAN Single Window Enabling <24-Hour Customs

- 4.25.6 Emergence of EV-Battery Supply Chains Needing Specialised Logistics

- 4.26 Market Restraints

- 4.26.1 Infrastructure Gaps and 16-25 % Logistics-Cost-To-GDP in Emerging AMS

- 4.26.2 Cabotage and Licensing Rules Fragmenting Regional Freight Networks

- 4.26.3 Geopolitical Tariffs (E.G., Proposed 2025 US Hikes) Redirecting Flows

- 4.26.4 Equipment Imbalance-ISO-Tank and Container Oversupply Post-Rerouting

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of ASEAN

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 CJ Logistics Corporation

- 6.4.3 DHL Group

- 6.4.4 DP World

- 6.4.5 DSV A/S (Including DB Schenker)

- 6.4.6 FedEx

- 6.4.7 Flash Express

- 6.4.8 Kuehne+Nagel

- 6.4.9 LOGISTEED, Ltd. (Including Alps Logistics)

- 6.4.10 Ninja Van (Including Ninja Express)

- 6.4.11 NYK (Nippon Yusen Kaisha) Line

- 6.4.12 Pos Indonesia (Persero)

- 6.4.13 POS Malaysia Bhd

- 6.4.14 PT Jalur Nugraha Ekakurir (JNE Express)

- 6.4.15 SCGJWD Group

- 6.4.16 SF Express (KEX-SF)

- 6.4.17 SPX Express

- 6.4.18 Tiong Nam Logistics Holdings Bhd

- 6.4.19 United Parcel Service of America, Inc. (UPS)

- 6.4.20 YCH Group

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment