PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939582

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939582

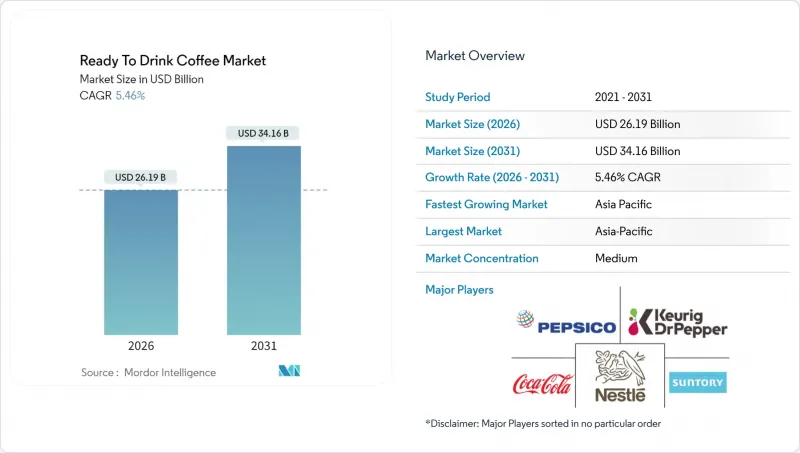

Ready To Drink Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Ready-to-Drink Coffee market was valued at USD 24.83 billion in 2025 and estimated to grow from USD 26.19 billion in 2026 to reach USD 34.16 billion by 2031, at a CAGR of 5.46% during the forecast period (2026-2031).

This growth is primarily driven by rising demand for convenience, the growing popularity of premium cold-brew products, and the incorporation of functional formulations that align with changing consumer preferences. Urbanization continues to influence on-the-go consumption patterns, while a heightened focus on health-conscious ingredients encourages consumers to choose higher-quality offerings. Advances in cold brew extraction techniques are enabling brands to achieve higher price points, mitigating the impact of raw bean cost fluctuations and supporting market growth. Additionally, investments in sustainable packaging and improvements in direct-to-consumer logistics are fostering further opportunities, particularly in regions such as Asia-Pacific and North America.

Global Ready To Drink Coffee Market Trends and Insights

Growing Global Coffee Culture and Adoption of Coffeehouse Trends

The expansion of specialty coffee culture beyond traditional markets is creating new consumption opportunities, extending beyond morning routines into afternoon and evening segments. The growing appreciation for third-wave coffee is driving demand for premium ready-to-drink (RTD) options that emulate coffeehouse quality. Cold brew concentrates, in particular, enable consumers to customize beverages at home, replicating barista-crafted experiences. This cultural shift is gaining momentum in emerging markets, where coffeehouse visits are seen as a lifestyle aspiration, while the convenience of RTD products meets the needs of daily consumption. This trend is especially evident in Asian markets, where the adoption of coffee culture aligns with rapid urbanization and rising disposable incomes. Coffee consumption is becoming a sustainable demand driver, embedded in social and professional routines rather than serving purely functional purposes. Additionally, regulatory frameworks in key markets are increasingly classifying coffee as a food category with specific labeling requirements. This development benefits established players with the resources to ensure compliance, while posing challenges for smaller entrants.

Increasing Demand for Convenience and On-the-Go Beverage Options

The acceleration of modern lifestyles is increasingly steering consumers toward convenient grab-and-go formats that minimize preparation time while still meeting their expectations for quality. This shift represents a significant move away from traditional home brewing methods to more portable consumption options. The evolving dynamics of remote work and urban mobility have further amplified the need for products that seamlessly adapt to diverse consumption scenarios, whether during commutes, in office environments, or during leisure activities. This growing preference has particularly benefited shelf-stable ready-to-drink (RTD) formats, which eliminate the need for refrigeration and enable distribution through unconventional channels such as vending machines and workplace micro-markets. As convenience becomes a critical factor, supply chain efficiency has emerged as a key focus area, driving brands to expand their distribution networks and refine inventory management strategies. Moreover, the adoption of aseptic packaging technologies has gained momentum, as these solutions extend product shelf life without compromising taste, allowing brands to penetrate regions with limited cold chain infrastructure. Even in times of economic uncertainty, consumers continue to demonstrate a strong willingness to pay a premium for convenience, underscoring the enduring and structural nature of this shift in demand.

Health Concerns Over High Sugar, Additives, and Artificial Ingredients in Traditional RTD Products

Increasing consumer awareness of sugar content and artificial additives in ready-to-drink (RTD) coffee products is driving resistance to traditional formulations. This trend compels manufacturers to reformulate their offerings to avoid losing market share to healthier alternatives. Health-conscious consumers are increasingly scrutinizing ingredient labels, rejecting products with high fructose corn syrup, artificial flavors, or preservatives used to extend shelf life. This shift poses significant challenges for mass-market RTD coffee brands that have historically relied on high sugar content to compensate for lower coffee quality. Conversely, it creates opportunities for premium brands that focus on natural ingredients and reduced sugar formulations. Additionally, regulatory pressures from health authorities, including stricter sugar content labeling requirements and potential taxation on high-sugar beverages, are increasing compliance costs and may further dampen demand for traditional RTD coffee products.

Other drivers and restraints analyzed in the detailed report include:

- Rising Consumer Health Consciousness Driving Interest in Organic, Plant-Based, and Low-Sugar/Functional Variants

- Increasing Urbanization and Busy Lifestyles Favoring RTD Formats

- Regulatory Compliance Complexity for Ingredient Labeling and Health Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cold brew coffee is anticipated to be the fastest-growing segment, with a compound annual growth rate (CAGR) of 7.08% through 2031. In contrast, iced coffee is expected to maintain its leading position, holding a significant 51.52% market share in 2025. The rising popularity of cold brew coffee can be attributed to its perceived superior quality and smoother taste profile, which resonate strongly with consumer preferences. This perception allows brands to adopt premium pricing strategies, effectively compensating for the lower sales volumes typically associated with cold brew compared to traditional iced coffee products.

Nitro cold brew variants further elevate the segment by offering a coffeehouse-quality experience in a convenient, portable format. These products cater to consumers who are willing to pay a premium for enhanced taste and quality, even if it comes at a higher cost. Meanwhile, other ready-to-drink (RTD) coffee options, such as espresso-based beverages and specialty flavored products, continue to serve niche markets. However, these variants face notable challenges, including limited shelf space in retail outlets and lower levels of consumer familiarity, which can hinder their broader adoption.

Glass bottles are anticipated to maintain a 37.02% market share in 2025, driven by their premium positioning and the perception of higher quality among consumers. These bottles are often associated with superior taste preservation, making them a preferred choice for certain products. However, they also present challenges, particularly in regions with limited glass recycling infrastructure, which can hinder their environmental appeal. On the other hand, PET bottles are gaining traction, with a projected CAGR of 6.71%. This growth is fueled by their sustainability benefits, such as being lightweight and easier to recycle, as well as their efficiency in supply chain operations. These factors make PET bottles an increasingly popular option in the packaging market.

The packaging landscape reflects a broader consumer dilemma between prioritizing quality and addressing environmental concerns. Metal cans have carved out a niche by offering advantages like portability and effective temperature retention, making them suitable for specific use cases. Aseptic packages, meanwhile, are enabling shelf-stable distribution, which is particularly beneficial in developing markets where cold chain logistics may not be feasible. Disposable cups continue to dominate foodservice channels, where their convenience aligns with the immediate consumption habits of consumers, reducing concerns about packaging disposal. Together, these packaging formats illustrate the diverse and evolving preferences shaping the market.

The Ready To Drink Coffee Market Report is Segmented by Soft Drink Type (Cold Brew Coffee, Iced Coffee, Other RTD Coffee), Packaging Type (Aseptic Packages, Glass Bottles, and More), Distribution Channel (Off-Trade, On-Trade), Functionality (Protein-Enriched, Energy-Infused, and Other) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liters).

Geography Analysis

Asia-Pacific continues to lead the global RTD coffee market, holding a 36.74% market share in 2025. The region benefits from a combination of urbanization and the growing adoption of coffee culture, particularly in China and India. In China, the market is supported by advanced e-commerce infrastructure and mobile payment systems, which simplify direct-to-consumer distribution. Meanwhile, India's price-sensitive consumers are driving demand for affordable RTD coffee options, competing with traditional tea consumption. Japan, as a mature market, focuses on premium offerings, leveraging functional ingredients and innovative packaging formats to achieve higher margins. Additionally, Southeast Asian markets like Thailand and Indonesia are witnessing rapid adoption, driven by younger demographics and the influence of Western lifestyles.

North America showcases steady growth, driven by innovations in cold brew and functional beverages that appeal to health-conscious consumers seeking premium experiences. The United States leads the region, supported by established distribution networks and consumer willingness to pay for quality and convenience. Canada follows a similar trajectory, with an added emphasis on sustainable packaging solutions. Mexico presents growth opportunities due to its expanding urban population and cross-border cultural influences, though economic sensitivity limits the adoption of premium products compared to the United States and Canada. Despite saturation in traditional RTD coffee segments, premiumization trends continue to drive value growth across the region.

In Europe, sustainability and organic certification are key factors shaping the RTD coffee market. Germany and the United Kingdom are at the forefront, adopting environmentally conscious products that command premium pricing. The region benefits from strong regulatory frameworks supporting organic and fair-trade certifications, enabling brands to differentiate through ethical sourcing and environmental responsibility. France and Italy face challenges due to their strong traditional coffee cultures, which create resistance to RTD formats. However, younger consumers in these markets are increasingly embracing convenient alternatives that maintain high-quality standards. Growth in Europe is expected to be driven by sustainability-focused positioning rather than volume expansion, as environmental awareness continues to influence purchasing decisions across demographic groups.

- Nestle S.A

- Suntory Holdings Limited

- The Coca-Cola Company

- PepsiCo, Inc.

- Keurig Dr Pepper Inc.

- Starbucks Corporation

- Danone S.A.

- Asahi Group Holdings, Ltd.

- Luigi Lavazza S.p.A.

- Califia Farms LLC

- La Colombe Coffee Roasters

- DyDo Group Holdings Inc.

- Emmi AG

- Kirin Holdings

- JAB Holding Company

- Monster Beverage Corporation

- Arla Foods amba

- Unilever PLC

- Rauch Fruchtsafte GmbH & Co OG

- High Brew Coffee Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing global coffee culture and adoption of coffeehouse trends

- 4.2.2 Increasing demand for convenience and on-the-go beverage options.

- 4.2.3 Rising consumer health consciousness driving interest in organic, plant-based, and low-sugar/functional variants.

- 4.2.4 Increasing urbanization and busy lifestyles favoring RTD formats.

- 4.2.5 Sustainable sourcing and ethical supply chain initiatives

- 4.2.6 Customization and personalization trends

- 4.3 Market Restraints

- 4.3.1 Health concerns over high sugar, additives, and artificial ingredients in traditional RTD products.

- 4.3.2 Regulatory compliance complexity for ingredient labeling and health standards.

- 4.3.3 Shelf-life limitations for dairy-based and organic variants

- 4.3.4 Coffee bean price volatility impacting supply and margins.

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Soft Drink Type

- 5.1.1 Cold Brew Coffee

- 5.1.2 Iced Coffee

- 5.1.3 Other RTD Coffee

- 5.2 By Packaging Type

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Metal Can

- 5.2.4 Aseptic packages

- 5.2.5 Disposable Cups

- 5.3 By Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarket/Hypermarket

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Specialty Stores

- 5.3.2.4 Online Retail

- 5.3.2.5 Other Distribution Channels

- 5.4 By Functionality

- 5.4.1 Protein-Enriched

- 5.4.2 Energy-Infused

- 5.4.3 Other

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle S.A

- 6.4.2 Suntory Holdings Limited

- 6.4.3 The Coca-Cola Company

- 6.4.4 PepsiCo, Inc.

- 6.4.5 Keurig Dr Pepper Inc.

- 6.4.6 Starbucks Corporation

- 6.4.7 Danone S.A.

- 6.4.8 Asahi Group Holdings, Ltd.

- 6.4.9 Luigi Lavazza S.p.A.

- 6.4.10 Califia Farms LLC

- 6.4.11 La Colombe Coffee Roasters

- 6.4.12 DyDo Group Holdings Inc.

- 6.4.13 Emmi AG

- 6.4.14 Kirin Holdings

- 6.4.15 JAB Holding Company

- 6.4.16 Monster Beverage Corporation

- 6.4.17 Arla Foods amba

- 6.4.18 Unilever PLC

- 6.4.19 Rauch Fruchtsafte GmbH & Co OG

- 6.4.20 High Brew Coffee Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK