PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836461

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836461

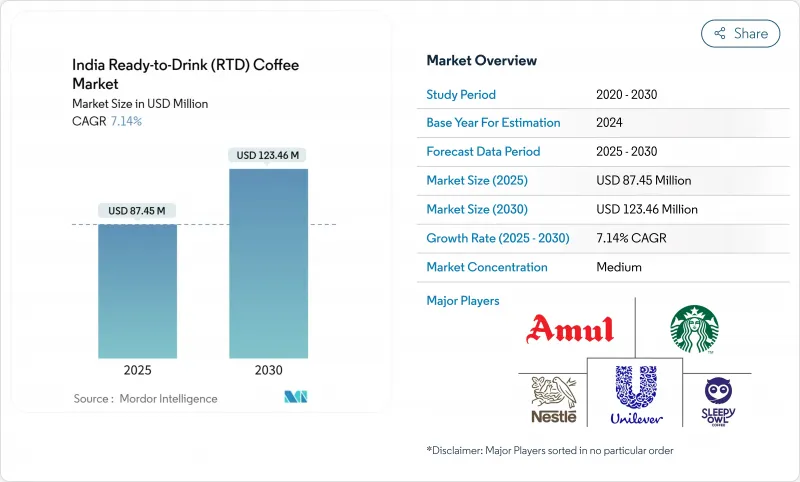

India Ready-to-Drink (RTD) Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Ready-to-Drink Coffee market is estimated to be USD 87.45 million in 2025 and is projected to grow at a CAGR of 7.14% from 2025-2030, reaching USD 123.46 million by 2030.

This growth trajectory reflects a fundamental shift in Indian beverage consumption patterns, where traditional chai dominance faces increasing competition from convenience-driven coffee formats. The Coffee Board of India reported that domestic coffee consumption increased to 191,000 tonnes in 2023, with instant coffee accounting for a significant share of total consumption. Government initiatives supporting value-added coffee exports have simultaneously strengthened domestic processing capacity, creating supply-side advantages for RTD manufacturers. The emergence of functional RTD coffee variants with protein and health-enhancing ingredients creates competition across beverage categories. Cold chain logistics limitations beyond tier-2 cities result in uneven market development, with urban areas experiencing rapid innovation while rural regions remain underserved. The cultural preference for fresh-brewed coffee, particularly in South India, presents opportunities for market expansion through targeted product development and distribution strategies.

India Ready-to-Drink (RTD) Coffee Market Trends and Insights

Convenience and On-the-Go Consumption on the Rise

The growth in urban mobility has increased the demand for ready-to-drink (RTD) beverages, particularly among working professionals in metropolitan cities. The transition from traditional coffee shops to portable beverage options aligns with busy schedules and flexible work arrangements. The convenience and accessibility of RTD beverages make them an attractive choice for consumers who need quick refreshment during their daily commute or work hours. Tata Consumer Products recorded 17% volume growth in its RTD segment for 2025, demonstrating increased consumer preference for convenient formats as per the financial highlights of Tata Consumer Products. Office buildings and transit hubs serve as key consumption points where RTD coffee provides an alternative to traditional tea vendors. The availability of RTD beverages at these locations ensures easy access for consumers during peak hours. This consumption pattern has expanded beyond major cities into Tier-2 locations, driven by growing corporate presence and evolving workplace practices. The adoption of RTD beverages in smaller cities reflects changing consumer preferences and modernizing lifestyles across urban India.

Augmented Expenditure on Advertising and Promotional Activities

Brand-building investments are intensifying as companies recognize the need to educate consumers about RTD coffee benefits over traditional alternatives. Nestle's partnership with Starbucks in February 2025 for retail distribution represents a strategic shift toward FMCG marketing approaches rather than cafe-centric promotion. Digital marketing spend is particularly pronounced as brands target younger demographics through social media platforms and influencer partnerships. Companies in the ready-to-drink (RTD) coffee market are increasingly adopting celebrity endorsements and premium positioning strategies to enhance brand visibility and market presence. For instance, Blue Tokai received investment from actress Deepika Padukone in 2023, demonstrating the growing intersection of entertainment and beverage industries. Marketing campaigns focus on lifestyle associations and aspirational messaging to position RTD coffee as a contemporary beverage choice, moving away from traditional product-centric advertising that emphasizes taste or caffeine content.

High Amount of HFSS Sugar Limiting Iced Coffee Growth

FSSAI's mandatory labeling requirements for high-fat, salt, and sugar content in bold fonts create consumer awareness that could limit the growth of sugar-heavy RTD coffee variants. The regulatory framework requires a clear display of nutritional information, potentially deterring health-conscious consumers from high-sugar formulations. Companies must reformulate products or accept reduced market appeal, creating development costs and potential taste compromises. The prohibition of "health drink" terminology on e-commerce platforms further restricts marketing flexibility for functional coffee products. These regulations align with government initiatives to combat non-communicable diseases but create compliance burdens for manufacturers seeking mass-market appeal through sweetened variants.

Other drivers and restraints analyzed in the detailed report include:

- Product Innovation Experiences Notable Surge

- Government Push for Value-Added Coffee Exports Boosting Domestic Processing Capacity

- Cold-Chain Logistics Gaps Beyond Tier-2 Cities Inflate Spoilage Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bottles (glass and PET combined) commanded 58.35% market share in 2024, reflecting consumer preference for resealable packaging and premium positioning opportunities. Glass bottles particularly appeal to health-conscious consumers seeking chemical-free storage, while PET variants offer cost advantages and distribution flexibility. Cans represent the fastest-growing segment at 9.34% CAGR through 2030, driven by convenience factors and extended shelf life capabilities that reduce cold-chain dependencies.

Cartons maintain a stable position in the mass market through cost advantages, though limited premium positioning restricts growth potential. Other packaging formats, including pouches and innovative dispensing systems, remain niche but offer differentiation opportunities for specialized applications. The packaging evolution reflects broader sustainability concerns and regulatory compliance requirements. Aluminum can adoption accelerates through recycling advantages and brand differentiation opportunities, particularly among environmentally conscious consumers. Premium glass packaging enables luxury positioning but increases distribution costs and breakage risks that limit market penetration in rural areas.

Iced latte and cappuccino variants secured 43.52% market share in 2024, leveraging familiar flavor profiles that ease consumer transition from traditional hot coffee formats. These products benefit from established taste preferences while offering convenience advantages over cafe-prepared alternatives. Nitro RTD coffee emerges as the fastest-growing segment at 10.64% CAGR, targeting premium consumers seeking unique sensory experiences and perceived quality differentiation.

Cold brew RTD coffee maintains steady growth through specialty positioning and health-conscious messaging around reduced acidity levels. Functional and protein-enhanced variants represent emerging opportunities, though market education requirements limit immediate adoption rates. Nitro infusion technology requires specialized equipment investments but enables premium pricing strategies that improve unit economics. Functional ingredients like protein enhancement target fitness-conscious consumers, though regulatory compliance around health claims creates marketing constraints under FSSAI guidelines.

The India Ready To Drink (RTD) Coffee Market is Segmented by Packaging (Bottles, and More), Product Type (Cold Brew RTD Coffee, and More), Flavor Profile (Plain/Classic and More), Ingredient Base(Dairy Based and Plant-Based), Price Positioning (Mass and Premium), Distribution Channels (Supermarkets/Hypermarkets, and More) and by Region (North India, West India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nestle SA

- Gujarat Co-operative Milk Marketing Federation (Amul)

- Starbucks Corporation

- Coca-Cola (Honest Coffee)

- PepsiCo (Starbucks Frappuccino Licensed)

- ITC Ltd (Sunbean)

- Hindustan Unilever (Bru Ready-to-Drink)

- Parle Agro (Smack)

- Sleepy Owl Coffee

- Rage Coffee

- Hatti Kaapi

- Blue Tokai Coffee Roasters

- Bevzilla

- Third Wave Coffee Roasters

- Monster Energy Company

- Lotte Corporation (Let's Be)

- Asahi Group Holdings Ltd

- Arla Foods

- Ajinomoto Co Inc.

- Devyani International (Costa RTD)

- Hector Beverages (Paper Boat - Cold Brew)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and On-the-Go Consumption on the Rise

- 4.2.2 Augmented Expenditure on Advertising and Promotional Activities

- 4.2.3 Product Innovation Experiences Notable Surge

- 4.2.4 Government Push for Value-Added Coffee Exports Boosting Domestic Processing Capacity

- 4.2.5 Rising E-Commerce Growth

- 4.2.6 Increasing Coffee Cultures among Gen Z Consumers

- 4.3 Market Restraints

- 4.3.1 High Amout of HFSS Sugar Limiting Iced Coffee Growth

- 4.3.2 Cold-Chain Logistics Gaps Beyond Tier-2 Cities Inflate Spoilage Costs

- 4.3.3 RTD Coffee Faces Stiff Competition for Shelf Space from Emerging Alternatives

- 4.3.4 Cultural Preference for Freshly Brewed Coffee in India

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Bottles

- 5.1.1.1 Glass Bottles

- 5.1.1.2 PET Bottles

- 5.1.2 Cans

- 5.1.3 Cartons

- 5.1.4 Others

- 5.1.1 Bottles

- 5.2 By Product Type

- 5.2.1 Cold Brew RTD Coffee

- 5.2.2 Iced Latte / Cappuccino

- 5.2.3 Nitro RTD Coffee

- 5.2.4 Functional / Protein-Enhanced RTD Coffee

- 5.3 By Flavor Profile

- 5.3.1 Plain/Classic

- 5.3.2 Flavored

- 5.4 By Ingredient Base

- 5.4.1 Dairy-Based

- 5.4.2 Plant-Based Milk

- 5.5 By Price Positioning

- 5.5.1 Mass

- 5.5.2 Premium

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets / Hypermarkets

- 5.6.2 Convenience and Grocery Stores

- 5.6.3 Online Retail Stores

- 5.6.4 Others (Vending Machine, Forecourt Stores, etc)

- 5.7 By Region

- 5.7.1 North India

- 5.7.2 West India

- 5.7.3 South India

- 5.7.4 East and North-East India

- 5.7.5 Central India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Gujarat Co-operative Milk Marketing Federation (Amul)

- 6.4.3 Starbucks Corporation

- 6.4.4 Coca-Cola (Honest Coffee)

- 6.4.5 PepsiCo (Starbucks Frappuccino Licensed)

- 6.4.6 ITC Ltd (Sunbean)

- 6.4.7 Hindustan Unilever (Bru Ready-to-Drink)

- 6.4.8 Parle Agro (Smack)

- 6.4.9 Sleepy Owl Coffee

- 6.4.10 Rage Coffee

- 6.4.11 Hatti Kaapi

- 6.4.12 Blue Tokai Coffee Roasters

- 6.4.13 Bevzilla

- 6.4.14 Third Wave Coffee Roasters

- 6.4.15 Monster Energy Company

- 6.4.16 Lotte Corporation (Let's Be)

- 6.4.17 Asahi Group Holdings Ltd

- 6.4.18 Arla Foods

- 6.4.19 Ajinomoto Co Inc.

- 6.4.20 Devyani International (Costa RTD)

- 6.4.21 Hector Beverages (Paper Boat - Cold Brew)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK