PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836483

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1836483

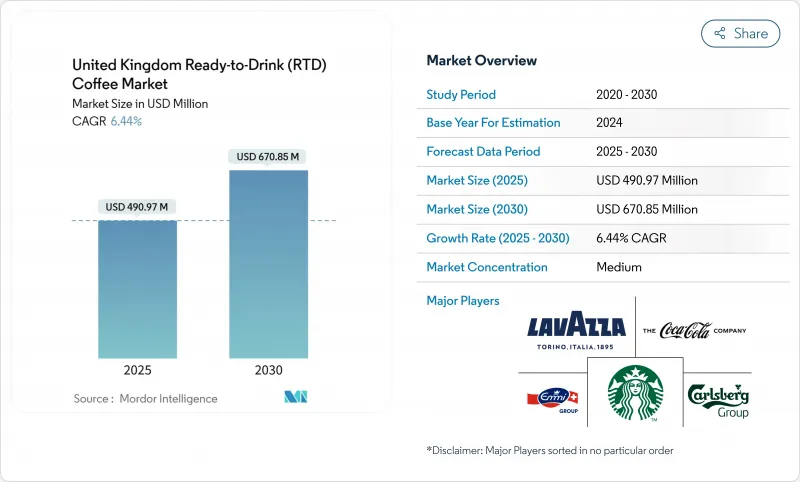

United Kingdom Ready-to-Drink (RTD) Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom Ready-to-Drink (RTD) coffee market demonstrates a valuation of USD 490.97 million in 2025 and is projected to achieve USD 670.85 million by 2030, registering a compound annual growth rate (CAGR) of 6.44%.

The market expansion is attributed to the increasing consumer preference for convenient, health-conscious, and premium portable beverages. The primary market drivers are Millennial and Generation Z consumers, who demonstrate significant demand for efficient, functional products aligned with contemporary urban lifestyles. The Ready-to-Drink (RTD) coffee segment continues to acquire substantial market share from traditional carbonated beverages and hot brewed coffee through the incorporation of functional elements, including energy-enhancing ingredients, plant-based formulations, and reduced-sugar alternatives. Market advancement is further facilitated by product development initiatives in flavor diversification and health-oriented formulations, implementation of sustainable packaging solutions, and expansion of e-commerce distribution channels.

United Kingdom Ready-to-Drink (RTD) Coffee Market Trends and Insights

Convenience and On-the-Go Consumption on the Rise

The United Kingdom's Ready-to-Drink (RTD) coffee market exhibits substantial expansion, propelled by increasing consumer preferences for convenient and portable caffeine solutions. The market trajectory demonstrates a strong correlation with transforming workplace dynamics, particularly the widespread implementation of hybrid working models. This fundamental shift in consumer behavior exemplifies broader societal transitions in work-life integration and heightened requirements for efficient caffeine consumption methods. For instance, Starbucks and Costa increased their ready-to-drink (RTD) coffee portfolio in UK retail stores through the addition of chilled lattes and espresso drinks in response to growing market demand. According to Costa Coffee's 'Lattenomics' report, a 15% increase in Drive-Thru locations and increased mobile consumption indicate the United Kingdom's shift toward flexible, on-the-go consumption patterns . This consumer behavior trend drives the expansion of Ready-to-Drink (RTD) coffee, as customers demand convenient caffeine options outside traditional cafes.

Health Trends Spotting in RTD Coffee Beverages

The United Kingdom ready-to-drink (RTD) coffee market is experiencing a significant transformation driven by increasing health consciousness among consumers, as manufacturers develop reduced-sugar formulations and functional additives that elevate coffee from a conventional caffeine delivery system to a wellness-oriented beverage. The protein-enhanced segment demonstrates this transformation in the market. For instance, in June 2024, Starbucks, in partnership with dairy company Arla, introduced a new line of high-protein coffee-based RTD beverages to the United Kingdom market. The Starbucks Protein Drink with Coffee range contains 20g of protein per bottle, utilizing low-fat milk with zero added sugar. This product development corresponds with the substantial growth in the United Kingdom protein beverage market. The wellness-oriented product development extends beyond protein to incorporate prebiotic fibers, marine collagen, and adaptogenic mushrooms.

High Amount of HFSS Sugar Limiting Iced Coffee Growth

High sugar content in Ready-to-Drink (RTD) coffee products constrains market growth in the United Kingdom, despite the category's increasing popularity. Health-conscious consumers examining ingredient labels find that many RTD coffee products contain sugar levels similar to soft drinks. This conflicts with the current consumer preference for wellness and clean-label products, especially among Millennials and Gen Z consumers. The UK's Soft Drinks Industry Levy and public health initiatives have increased consumer awareness about sugar consumption risks, leading many to avoid high-sugar beverages. RTD coffee products from major United Kingdom chains reveal substantial sugar content - a Starbucks caramel frappuccino contains 48.5g of sugar, while a Caffe Nero Belgian chocolate frappe contains 44.5g. These sugar levels highlight the disconnect between current product offerings and consumer health preferences in the United Kingdom RTD coffee market.

Other drivers and restraints analyzed in the detailed report include:

- Augmented Expenditure on Advertising and Promotional Activities

- Product Innovation Experiences Notable Surge

- Arabica Cost Volatility Post-Brexit Tariffs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cans hold 48.78% of the UK RTD coffee market in 2024, making them the dominant packaging format due to their portability, extended shelf life, and premium positioning capabilities. This dominance aligns with consumer demand for on-the-go consumption. The Automatic Vending Association (AVM) reported that the Coffee-to-Go segment generated EUR 758 million in product revenue in 2023, underlining the importance of convenience in packaging choices . Cartons are expected to grow at a 5.23% CAGR from 2025-2030, driven by their environmental benefits and cost efficiency in a market increasingly focused on sustainability.

Bottles, including glass and PET formats, retain a substantial market share despite moderate growth rates. Premium RTD coffee brands use glass bottles to emphasize quality and sustainability. In 2024, Jimmy's Iced Coffee introduced its SlimCan range priced at EUR 1.39, targeting convenience stores and impulse purchases. The packaging market is advancing with the integration of smart packaging features, including QR codes and NFC technology, which enable digital interaction with physical products.

In the United Kingdom, Iced Latte/Cappuccino products maintain a 52.08% market share in 2024, as British consumers demonstrate a preference for these familiar flavours when transitioning from hot coffee to RTD formats. Cold Brew RTD Coffee has established itself as the fastest-growing segment in the UK market, with a projected CAGR of 7.67% during 2025-2030. This growth is attributed to its refined taste profile and higher caffeine content, particularly resonating with the British youth demographic.

The Functional/Protein-Enhanced RTD Coffee segment represents a significant innovation frontier in the United Kingdom market, addressing British consumers' evolving preferences for beverages that deliver multiple nutritional benefits beyond refreshment and caffeine. Nitro RTD Coffee maintains a specialised position in the United Kingdom market, with its distinctive characteristics creating differentiation opportunities, particularly in premium British retail establishments where experiential factors influence purchasing behaviour.

The UK RTD Coffee Market is Segmented by Packaging Type (Bottles, Cans, and More); Product Type (Cold Brew RTD Coffee, Nitro RTD Coffee, and More), Flavor Profile (Plain/Classic and Flavored), Ingredient Base (Dairy-Based and Plant-Based Milk), Price Positioning (Mass and Premium), Distribution Channels (Supermarkets/Hypermarkets, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Starbucks Corporation

- The Coca-Cola Company

- Danone S.A.

- Nestle S.A.

- Carlsberg Group (Britvic plc)

- Emmi AG

- Luigi Lavazza S.p.A.

- Illycaffe S.p.A

- The JM Smucker Company

- JAB Holding Company

- Premier Foods plc

- Arla Foods Amba

- Suntory Holdings Limited

- Crediton Dairy Ltd

- A.G. Barr p.l.c. (Moma Foods)

- Sleepy Owl Coffee

- Califia Farms, LLC

- Not Guilty Food Co Ltd (Skinny Food Co)

- Grind

- Bizzimumzi Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convenience and On-the-Go Consumption on the Rise

- 4.2.2 Health Trends Spotting in RTD Coffee Beverages

- 4.2.3 Augmented Expenditure on Advertising and Promotional Activities

- 4.2.4 Product Innovation Experiences Notable Surge

- 4.2.5 Brand-retailer Partnerships Strengthen Market Presence

- 4.2.6 Cold Brew Variants Appeal to Younger Demographics

- 4.3 Market Restraints

- 4.3.1 High Amount of HFSS Sugar Limiting Iced Coffee Growth

- 4.3.2 Arabica Cost Volatility Post-Brexit Tariffs

- 4.3.3 RTD Coffee Faces Stiff Competition for Shelf Space from Emerging Alternatives

- 4.3.4 Caffeine Concerns Curbing RTD Coffee

- 4.4 Consumer Behaviour Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Packaging Type

- 5.1.1 Bottles

- 5.1.1.1 Glass Bottles

- 5.1.1.2 PET Bottles

- 5.1.2 Cans

- 5.1.3 Cartons

- 5.1.4 Others

- 5.1.1 Bottles

- 5.2 By Product Type

- 5.2.1 Cold Brew RTD Coffee

- 5.2.2 Iced Latte/Cappuccino

- 5.2.3 Nitro RTD Coffee

- 5.2.4 Functional/Protein-Enhanced RTD Coffee

- 5.3 By Flavor Profile

- 5.3.1 Plain/Classic

- 5.3.2 Flavored

- 5.4 By Ingredient Base

- 5.4.1 Dairy-Based

- 5.4.2 Plant-Based Milk

- 5.5 By Price Positioning

- 5.5.1 Mass

- 5.5.2 Premium

- 5.6 By Distribution Channel

- 5.6.1 Supermarkets/Hypermarkets

- 5.6.2 Convenience and Grocery Stores

- 5.6.3 Online Retail Stores

- 5.6.4 Others (Vending Machine, Forecourt Stores, etc)

- 5.7 By Geography

- 5.7.1 England

- 5.7.2 Scotland

- 5.7.3 Wales

- 5.7.4 Northern Ireland

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Starbucks Corporation

- 6.4.2 The Coca-Cola Company

- 6.4.3 Danone S.A.

- 6.4.4 Nestle S.A.

- 6.4.5 Carlsberg Group (Britvic plc)

- 6.4.6 Emmi AG

- 6.4.7 Luigi Lavazza S.p.A.

- 6.4.8 Illycaffe S.p.A

- 6.4.9 The JM Smucker Company

- 6.4.10 JAB Holding Company

- 6.4.11 Premier Foods plc

- 6.4.12 Arla Foods Amba

- 6.4.13 Suntory Holdings Limited

- 6.4.14 Crediton Dairy Ltd

- 6.4.15 A.G. Barr p.l.c. (Moma Foods)

- 6.4.16 Sleepy Owl Coffee

- 6.4.17 Califia Farms, LLC

- 6.4.18 Not Guilty Food Co Ltd (Skinny Food Co)

- 6.4.19 Grind

- 6.4.20 Bizzimumzi Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK