PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939593

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939593

United States Hair Care - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

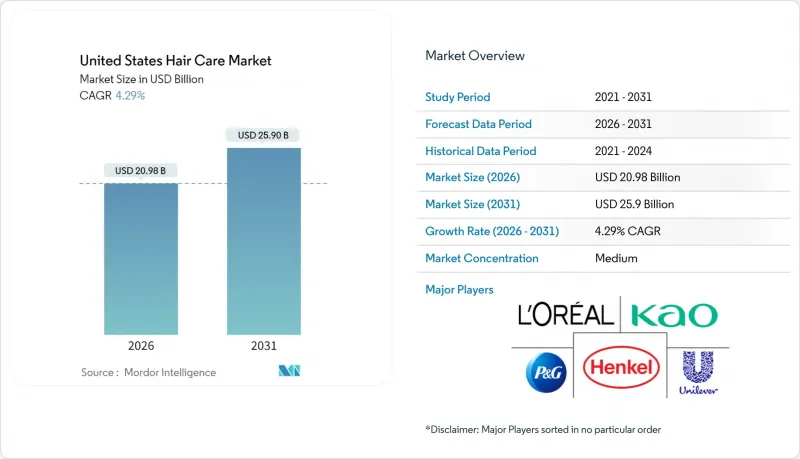

United States hair care market size in 2026 is estimated at USD 20.98 billion, growing from 2025 value of USD 20.12 billion with 2031 projections showing USD 25.9 billion, growing at 4.29% CAGR over 2026-2031.

This growth highlights a shift in the market, where innovation, specialized therapeutic products, and online sales are becoming more important than simply increasing the volume of products sold. Companies are focusing on creating unique products with personalized formulations, advanced delivery systems, and seamless integration of physical and digital shopping experiences to stand out in the market. The market is also seeing a growing demand for products that offer therapeutic benefits, use transparent and safe ingredients, and follow sustainable practices. As a result, competition in the market is no longer just about securing shelf space in stores. Instead, it is influenced by factors such as strong research and development capabilities, compliance with regulatory standards, and the ability to generate demand through influencers and digital platforms. The competitive landscape shows moderate consolidation, with the top 5 multinational companies holding a significant share of the market. However, smaller niche brands are continuing to disrupt the market by introducing innovative and unique products that cater to specific consumer needs.

United States Hair Care Market Trends and Insights

Growing demand for multi-functional and damage repair products

Demand for multi-functional and damage-repair hair care solutions is becoming a key factor driving the United States hair care market. Women are increasingly looking for products that simplify their routines by addressing hydration, repair, and scalp care in a single solution. According to the National Council on Aging, as of April 2025, United States women experiencing hair loss are willing to spend up to USD 5,000 on treatments, showcasing the emotional importance of hair care and the readiness to invest in effective products. In response, brands are launching innovative products to meet these needs. For example, on March 25, 2024, Dove launched its scalp + hair therapy collection, a premium 6-product range developed through 65 years of Dove research and dermatological expertise. The collection claims that 89% of women experienced thicker and stronger hair after using the Dove Fullness Restore Scalp Serum, which is part of the line. This product line focuses on enhancing scalp health and improving hair density by incorporating ingredients like niacinamide, peptides, and zinc.

Increasing awareness of male grooming

Awareness of male grooming is growing rapidly, driving significant growth in the United States hair care market. Men are increasingly adopting hair care routines to address issues like hair loss, curl care, and beard maintenance. According to the American Hair Loss Association, around two-thirds of American men experience some level of hair loss by the age of 35, and this figure rises to approximately 85% by the age of 50. This concern has led to a rising demand for specialized products. For example, BosleyMD offers shampoos, conditioners, and scalp therapies made with botanical ingredients as alternatives to minoxidil-based treatments. Similarly, Kerastase homme provides high-end, salon-quality products focused on strengthening hair and improving scalp health. These solutions combine luxury with proven clinical benefits, encouraging more men to invest in hair care. As a result, the availability of such targeted products is expanding men's involvement in the hair care market and diversifying consumer demand across the United States.

Growing preference for traditional at-home hair care practices

The increasing popularity of traditional at-home hair care routines is slowing the growth of the United States hair-care market, as more consumers opt for natural, time-tested methods over commercial products. According to NSF Org, 74% of Americans prioritize organic ingredients in personal care items, highlighting a strong preference for do-it-yourself (DIY) solutions or simpler, natural formulations. Home remedies like coconut oil treatments, shea butter applications, and herbal rinses are gaining traction due to their affordability, accessibility, and perceived effectiveness, especially during periods of economic uncertainty. This shift is challenging commercial brands to adapt by creating products with transparent ingredient lists, straightforward formulations, and clear advantages over homemade alternatives. At the same time, brands must continue to innovate and differentiate their offerings to remain competitive in this evolving market.

Other drivers and restraints analyzed in the detailed report include:

- Growing emphasis on scalp health

- Impact of social media and beauty influencers

- Concerns over health and safety of chemical-based items

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shampoo remains a key product in the United States hair-care market, accounting for a 18.62% portion of revenue in 2025. As an everyday essential, it enjoys consistent demand across households, though its growth is limited due to widespread market penetration. Conditioners and styling products also play an important role, as they are integral to daily hair maintenance and enhancing appearance. These categories collectively contribute to the market's stability by addressing routine consumer needs and preferences, ensuring steady performance over time.

On the other hand, hair-loss treatment products are emerging as the fastest-growing segment, with a projected growth rate of 6.11% CAGR through 2031. Factors such as stress, aging, and hormonal changes are driving an increase in hair-thinning issues, leading to higher demand for specialized solutions. Innovations in scalp treatments, DHT-blocking products, and premium restorative formulas are further boosting this segment. This trend reflects a shift in consumer focus from basic maintenance to targeted, performance-driven products, positioning hair-loss treatments as a key driver of growth in the market.

Conventional/synthetic hair-care products continue to dominate the United States market in 2025, making up 86.08% of sales. These products remain popular due to their affordability, consistent performance, and widespread availability across retail channels like supermarkets, drugstores, and online platforms. Consumers often stick to these options because of their familiarity, trusted brands, and appealing features such as pleasant fragrances and effective results. This segment's accessibility and affordability ensure it remains a staple for a broad range of customers, maintaining its stronghold in the market.

On the other hand, natural and organic hair-care products are rapidly gaining traction, with a projected growth rate of 6.75% CAGR through 2031, outpacing the overall market. Increasing consumer awareness about the benefits of clean and sustainable products is driving demand, especially among younger and environmentally conscious buyers. These products emphasize plant-based ingredients, eco-friendly packaging, and safety, which resonate with consumers seeking healthier and more ethical choices. As a result, brands focusing on transparency and sustainability are experiencing higher customer loyalty, signaling a shift in consumer preferences toward wellness-oriented and environmentally responsible hair-care solutions.

The United States Hair Care Market Report is Segmented by Product Type (Shampoo, Conditioner, and More), Nature (Natural/Organic, and Conventional/Synthetic), Price Range (Mass and Premium), and Distribution Channel (Supermarkets/Hypermarkets, Online Retail Stores, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- L'Oreal SA

- Procter & Gamble Co.

- Unilever PLC

- Henkel AG & Co. KGaA

- Kao Corporation

- Estee Lauder Companies Inc.

- Kenvue Inc.

- Shiseido Company Limited

- Amway Corporation

- Coty Inc.

- Moroccanoil

- Olaplex Holdings Inc.

- Dyson Inc.

- American Securities LLC (Conair Corporation)

- John Paul Mitchell Systems

- Beiersdorf AG

- Colgate-Palmolive Company

- Revlon Inc.

- LolaVie

- BondiBoost

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for products catering to ethnic and textured hair

- 4.2.2 Growing demand for multi-functional and damage repair products

- 4.2.3 Advancements in product formulation technologies

- 4.2.4 Increasing awareness of male grooming

- 4.2.5 Impact of social media and beauty influencers

- 4.2.6 Growing emphasis on scalp health

- 4.3 Market Restraints

- 4.3.1 Growth of counterfeit products

- 4.3.2 Growing preference for traditional at-home hair care practices

- 4.3.3 Challenges in meeting regulatory standards for imported products

- 4.3.4 Concerns over health and safety of chemical-based items

- 4.4 Regulatory Outlook

- 4.5 Consumer Behaviour Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Shampoo

- 5.1.2 Conditioner

- 5.1.3 Hair Styling products

- 5.1.4 Hair Colorants

- 5.1.5 Hair Loss Treatment Products

- 5.1.6 Other product types

- 5.2 By Nature

- 5.2.1 Natural/Organic

- 5.2.2 Conventional/Synthetic

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Drugstores/Pharmacies

- 5.4.3 Specialty and Beauty Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 L'Oreal SA

- 6.4.2 Procter & Gamble Co.

- 6.4.3 Unilever PLC

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 Kao Corporation

- 6.4.6 Estee Lauder Companies Inc.

- 6.4.7 Kenvue Inc.

- 6.4.8 Shiseido Company Limited

- 6.4.9 Amway Corporation

- 6.4.10 Coty Inc.

- 6.4.11 Moroccanoil

- 6.4.12 Olaplex Holdings Inc.

- 6.4.13 Dyson Inc.

- 6.4.14 American Securities LLC (Conair Corporation)

- 6.4.15 John Paul Mitchell Systems

- 6.4.16 Beiersdorf AG

- 6.4.17 Colgate-Palmolive Company

- 6.4.18 Revlon Inc.

- 6.4.19 LolaVie

- 6.4.20 BondiBoost

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK