PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939622

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939622

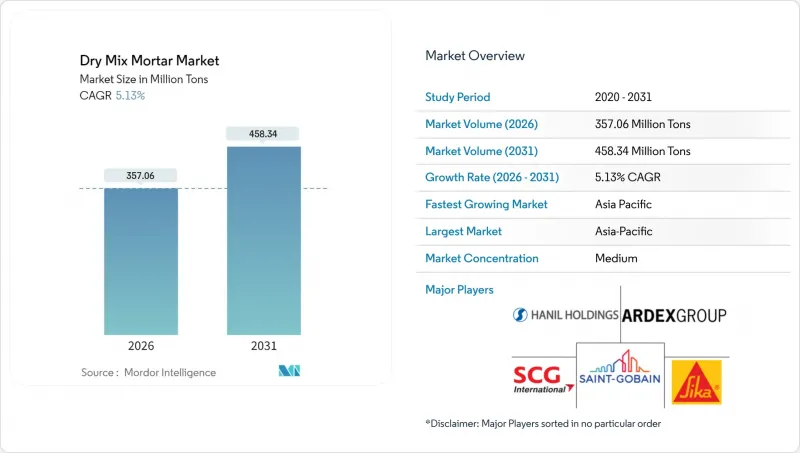

Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Dry Mix Mortar Market is expected to grow from 339.65 million tons in 2025 to 357.06 million tons in 2026 and is forecast to reach 458.34 million tons by 2031 at 5.13% CAGR over 2026-2031.

Persistently high urbanization rates, mandatory pre-mixed mortar policies in several Asian countries, and contractors' need to shorten project schedules underpin this expansion. Factory-produced formulations minimize on-site variability, improve quality consistency, and reduce labor requirements, advantages that resonate strongly in regions facing skilled-worker shortages. Segmental demand is also shifting toward value-added blends such as tile adhesives, EIFS mortars, and renovation compounds that deliver higher productivity or energy-saving functionality. Consolidation among leading manufacturers continues as they secure raw material supplies and invest in automated production lines that cut operating costs and reduce carbon intensity. At the same time, volatile cement and additive prices, as well as the significant capital required for state-of-the-art plants, temper the overall growth outlook.

Global Dry Mix Mortar Market Trends and Insights

Rapid Urbanization and Infrastructure Outlay in Asia-Pacific

China's urbanization rate reached 68% in 2025, resulting in steady demand for mortar in residential renovations and infrastructure upgrades. High-speed rail expansion is driving an increase in specialized mortar consumption, as thin-layer products gain traction in prefabricated segments. Government infrastructure budgets in Thailand and Vietnam are sustaining double-digit construction spending, encouraging local producers to boost capacity and replace imported volumes. The region's incremental use of fly ash and slag lowers production costs and addresses environmental mandates. Together, these elements contribute significantly to the long-term growth of the dry mix mortar market.

Energy-Efficient Building Codes - Demand for EIFS and Insulation Mortars

Tighter thermal-performance regulations raise demand for mortars that bond and coat insulation boards in EIFS systems. The European Union's Carbon Border Adjustment Mechanism imposes charges on high-emission imports, prompting local sourcing of low-carbon mortars. China's new autoclaved aerated concrete standard increased compressive-strength metrics, prompting builders to adopt compatible high-adhesion mixes. Digital quality-monitoring prototypes, such as the DigiCoPro system, highlight the shift toward sensor-enabled mortars that track curing conditions and ensure optimal performance. Revised ISO 13007:2025 benchmarks and China's stricter certification rules formalize these higher requirements, supporting specialty-mortar uptake in multiple regions.

Raw-Material Price Volatility

Cement input costs fluctuated considerably in 2024, while river-sand prices fell, producing margin swings that small-scale manufacturers struggle to absorb. Producers respond by increasing industrial-waste substitution rates; however, these alternatives often require additional processing and stricter quality controls. Regional carbon pricing further compounds variability. Supply disruptions tied to trade disputes and additive shortages aggravate the challenge, forcing frequent price revisions that strain customer relations.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortages Driving Ready-to-Use Pre-Mixed Solutions

- Smart-Job-Site Adoption of RFID-Linked Silo Dosing

- High Capex for Automated Dry-Mix Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tile adhesive holds the fastest trajectory within the dry mix mortar market, growing at a 6.35% CAGR through 2031, driven by the sales of ceramic tiles. Large-format tiles require high-performance bonding agents with extended open times, and off-site panelization in prefabricated schemes amplifies the demand for controlled-viscosity products. In contrast, plaster maintains the largest volume base at 33.45% in 2025, due to its ubiquity across both structural and finishing layers. Render and grouts capture incremental volume from renovation of kitchens and bathrooms in urban housing stock, while waterproofing slurries find niche uptake in coastal infrastructure facing elevated moisture stress. Insulation-compatible mortars align with energy-code upgrades, bundling thermal and structural performance.

The dry mix mortar market size tied to tile adhesive is projected to surge as new housing starts pivot toward premium interior finishes. Commercial flooring contractors cite lower rework rates and quicker turnaround as key benefits, justifying price premiums. Manufacturers differentiate via polymer-modified formulations that resist efflorescence and accommodate substrate movement. The plaster sub-segment remains price-competitive, with growth largely tracking floor-space additions. Specialist providers, meanwhile, focus on composite-layer systems where a single brand can supply adhesive, grout, and waterproofing components to capture higher lifecycle value.

The Dry Mix Mortar Report is Segmented by Application (Plaster, Render, Tile Adhesive, Grouts, Water Proofing Slurries, Concrete Protection and Renovation, and More), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

The Asia-Pacific region continued to dominate the dry mix mortar market in 2025, accounting for 46.80% of the global volume, and is forecast to expand at a 5.32% CAGR through 2031. Chinese regulations mandating the use of pre-mixed mortar in new buildings, coupled with ongoing urban renewal, sustain the momentum in demand. Southeast Asian governments are pushing transport and energy projects, which reinforces volume growth while localizing production to reduce imports.

North America is expected to post moderate growth, anchored by infrastructure bills and a rebound in commercial interiors. Persistent skilled-labor constraints heighten the appetite for bucketed or silo-fed mortars that streamline wall assemblies. Domestic producers continue adding regional depots to offset a drop in Chinese imports triggered by trade barriers. Canada's residential starts and Mexico's industrial build-outs stabilize regional consumption, with cross-border supply chains ensuring a steady flow of materials.

Europe retains a sizeable base fueled by stringent energy regulations and accelerated refurbishments of aging building stock. The Carbon Border Adjustment Mechanism effectively rewards local low-carbon mortars, giving regional producers a cost advantage versus importers. Standardization of fly-ash-blended mixes gains traction across Germany, France, and the Nordics. South America shows promise, particularly in Brazil, where rail and metro projects are adopting specialty grouts, while the Middle East and Africa benefit from construction chemicals expenditure tied to large-scale housing and tourism developments.

- Ardex Group

- CEMEX S.A.B. de C.V.

- Grupo Puma

- HANIL HOLDINGS CO., LTD.

- Holcim

- LATICRETE International Inc.

- MAPEI S.p.A.

- Saint-Gobain

- SAMPYO Group

- SCG International Corporation

- SIG

- Sika AG

- Trimurti Wall Care Products Pvt Ltd

- UltraTech Cement Ltd.

- Votorantim Cimentos

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanization and infrastructure outlay in Asia-Pacific

- 4.2.2 Energy-efficient building codes - demand for EIFS and insulation mortars

- 4.2.3 Labour shortages driving ready-to-use pre-mixed solutions

- 4.2.4 Smart-job-site adoption of RFID-linked silo dosing

- 4.2.5 3-D concrete printing using mortar-based printable mixes

- 4.3 Market Restraints

- 4.3.1 Raw-material (cement and additive) price volatility

- 4.3.2 High capex for automated dry-mix plants

- 4.3.3 Shortage of skilled applicators in emerging economies

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Plaster

- 5.1.2 Render

- 5.1.3 Tile Adhesive

- 5.1.4 Grouts

- 5.1.5 Water Proofing Slurries

- 5.1.6 Concrete Protection and Renovation

- 5.1.7 Insulation and Finishing Systems

- 5.1.8 Others

- 5.2 By End-use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Ardex Group

- 6.4.2 CEMEX S.A.B. de C.V.

- 6.4.3 Grupo Puma

- 6.4.4 HANIL HOLDINGS CO., LTD.

- 6.4.5 Holcim

- 6.4.6 LATICRETE International Inc.

- 6.4.7 MAPEI S.p.A.

- 6.4.8 Saint-Gobain

- 6.4.9 SAMPYO Group

- 6.4.10 SCG International Corporation

- 6.4.11 SIG

- 6.4.12 Sika AG

- 6.4.13 Trimurti Wall Care Products Pvt Ltd

- 6.4.14 UltraTech Cement Ltd.

- 6.4.15 Votorantim Cimentos

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs