PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940850

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940850

Europe Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

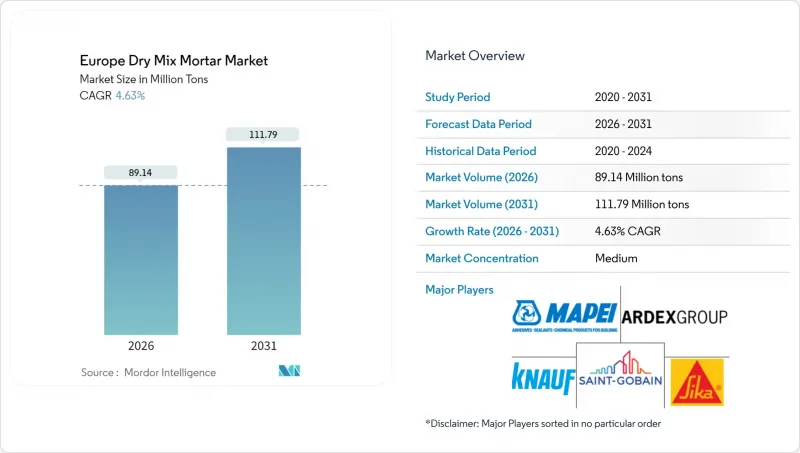

The Europe Dry Mix Mortar Market is expected to grow from 85.19 million tons in 2025 to 89.14 million tons in 2026 and is forecast to reach 111.79 million tons by 2031 at 4.63% CAGR over 2026-2031.

This growth trajectory stems from the region's decisive shift toward lower-carbon construction, substantial public-sector renovation budgets, and regulatory alignment under the European Green Deal. Renovation activity in the aging housing stock, the wider adoption of automated silo batching, and rapid product innovation around recycled content formulations are all reinforcing demand. Competitive strategies center on vertical integration to buffer raw material volatility and on continuous product research and development that meets strict VOC and silica dust thresholds. Across the competitive landscape, investments in digitalized plants and circular economy additives are unlocking new market opportunities while enabling differentiation in sustainability credentials.

Europe Dry Mix Mortar Market Trends and Insights

Ageing Building Stock Drives Renovation Demand

More than three-quarters of Europe's buildings were erected before 1990 and fail to meet today's energy-performance thresholds. Germany's federal incentives and France's MaPrimeRenov programs channel steady demand toward render, insulation, and repair mortars. Specialized blends with improved adhesion, low dust, and embedded fibers hold a competitive advantage in this retrofit-heavy environment, encouraging manufacturers to scale formulations that ease site application for smaller contractor crews. At the same time, automated silo systems are mitigating skilled-plasterer shortages and delivering consistent mix quality on dense urban job sites.

EU Decarbonisation and Energy-Efficiency Directives

The recast Energy Performance of Buildings Directive (EPBD) requires all new buildings to achieve nearly zero-energy status by 2030 and mandates the deep renovation of the existing stock. These mandates are prompting product developers to adopt lower-carbon-embodied recipes that incorporate recycled fines and supplementary cementitious materials. With environmental product declarations (EPDs) set to become compulsory under the revised Construction Products Regulation, early movers that can certify cradle-to-gate emissions under 250 kg CO2e per ton are likely to seize specification priority across public tenders.

Raw-Material Price Volatility

Cement prices rose in 2024, driven by energy inflation and carbon allowance costs under the EU ETS, while aggregates increased amid logistical bottlenecks and tighter mining permits. Raw inputs represent up to 70% of production expenses, so unhedged manufacturers faced margin compression and adjustment lags in contract pricing. Sand scarcity in parts of Germany and the Netherlands added a premium on specialty fines, compelling producers to qualify recycled glass and crushed concrete as substitute fillers. Fluctuating input costs thereby temper volume growth until pass-through mechanisms or alternative raw materials stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Prefabricated/Off-Site Construction

- Post-Pandemic Green Infrastructure Stimulus

- Stringent VOC and Silica-Dust Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential projects accounted for 52.00% of the European dry mix mortar market in 2025, as accelerating energy-retrofit mandates drove increased demand for insulation, render, and screed volumes. Commercial premises, although smaller in scale, are projected to post the fastest 6.2% CAGR through 2031 as hybrid office refurbishments and retail format updates intensify. Industrial and institutional demand is fueled by pharmaceutical cleanroom builds that favor antimicrobial tile adhesives. Infrastructure upgrades under TEN-T add steady volumes in anchoring, repair grout, and waterproofing slurries.

The residential segment's primacy stems from Germany's 1.2 million-unit retrofit record in 2024 and France's target of 500,000 deep renovations annually. High-performance render systems integrating bio-based fibers and phase-change microcapsules secure premium pricing while meeting stringent U-value thresholds. Commercial growth benefits from owners' drive to repurpose office layouts into collaborative work zones, boosting demand for rapid-set leveling compounds. Industrial activity leans on legislative incentives for cleaner manufacturing plants, which mandate low-VOC flooring mortars. Contractors note that automated silo batching mitigates labor shortages, particularly those that are acute in residential refurbishment, thereby preventing delays and improving finishing quality.

The Europe Dry Mix Mortar Market Report is Segmented by End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), Application (Plaster, Render, Tile Adhesive, Grout, Waterproofing Slurry, Concrete Protection and Renovation, and More), and Geography (France, Germany, Italy, Russia, Spain, United Kingdom, and Rest of Europe). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Ardex Group

- Baumit Group

- Cemex S.A.B DE C.V.

- Fassa Bortolo

- Holcim

- Kerakoll Spa

- Knauf Group

- LATICRETE International, Inc.

- MAPEI S.p.A.

- Murexin GmbH

- Saint-Gobain

- Sika AG

- SOPREMA International

- Terraco Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ageing building stock drives renovation demand

- 4.2.2 EU decarbonisation and energy-efficiency directives

- 4.2.3 Growth in prefabricated/off-site construction

- 4.2.4 Post-pandemic green infrastructure stimulus

- 4.2.5 Automated silo batching adoption

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Stringent VOC and silica-dust regulations

- 4.3.3 Skilled spray-plaster labour shortage

- 4.4 Value Chain Analysis

- 4.5 Regulatory Framework

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By End-Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 By Application

- 5.2.1 Plaster

- 5.2.2 Render

- 5.2.3 Tile Adhesive

- 5.2.4 Grout

- 5.2.5 Waterproofing Slurry

- 5.2.6 Concrete Protection and Renovation

- 5.2.7 Insulation and Finishing Systems

- 5.2.8 Other Applications

- 5.3 By Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Baumit Group

- 6.4.3 Cemex S.A.B DE C.V.

- 6.4.4 Fassa Bortolo

- 6.4.5 Holcim

- 6.4.6 Kerakoll Spa

- 6.4.7 Knauf Group

- 6.4.8 LATICRETE International, Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Murexin GmbH

- 6.4.11 Saint-Gobain

- 6.4.12 Sika AG

- 6.4.13 SOPREMA International

- 6.4.14 Terraco Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOs