PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940688

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940688

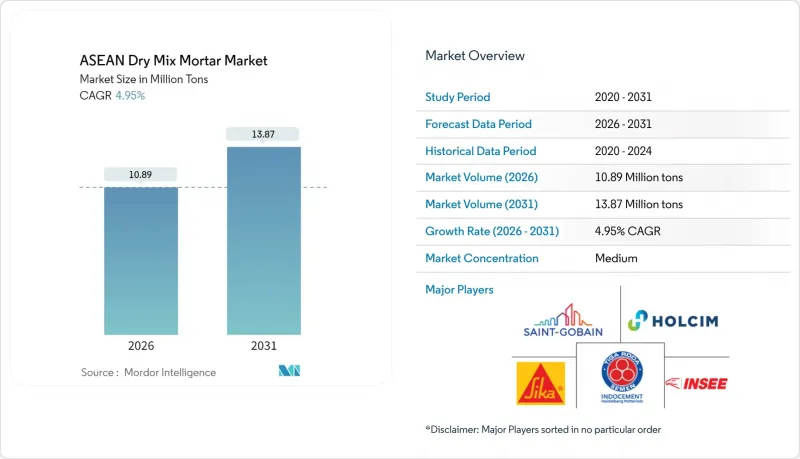

ASEAN Dry Mix Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ASEAN Dry Mix Mortar Market is expected to grow from 10.38 million tons in 2025 to 10.89 million tons in 2026 and is forecast to reach 13.87 million tons by 2031 at 4.95% CAGR over 2026-2031.

This expansion reflects large public-sector housing programs, private real-estate recovery, and industrial capacity additions, pushing mortar volumes across the region. The ASEAN dry mix mortar market benefits from rapid urban migration, stronger building codes, and rising labor costs that favor pre-mixed solutions. Competitive intensity is growing as multinational producers add local plants and domestic cement majors move downstream into value-added mortars, creating a landscape where supply-chain control and product differentiation determine margin performance. Logistics constraints in archipelagic markets and raw-material price swings remain structural challenges, yet they also open opportunities for localized plants and premium specialty grades that reduce transport cost ratios. Sustainability mandates, particularly adopting low-carbon binder systems, are expected to tilt procurement choices toward formulations that meet new green codes.

ASEAN Dry Mix Mortar Market Trends and Insights

Rapid Urbanization and Infrastructure Megaprojects

ASEAN cities are forecast to absorb 84 million additional residents by 2030, lifting urbanization to 56% and driving sustained demand for housing, transport corridors, and social infrastructure. Annual infrastructure needs run to USD 60 billion, with projects such as the Trans-Sumatra toll road and Tuas mega-port underpinning mortar consumption. Indonesia's 2024 construction strategy highlights supply-chain agility, ensuring local producers scale capacity to meet pipeline timelines. Secondary cities outside national capitals now represent growth nodes, reshaping distribution maps for mortar suppliers. From flood mitigation to coastal defenses, climate adaptation requires specialty mixes that withstand aggressive environments, amplifying value-added volume opportunities.

Labor-Scarcity-Driven Demand for Pre-Bagged Mortars

Tighter foreign-worker quotas and an aging workforce have sharpened labor shortages in Malaysia and Singapore, encouraging contractors to adopt ready-mixed mortars that minimize on-site skill requirements. Small and medium enterprises increasingly favor standardized mixes that guarantee consistent quality and faster application. Digital commerce solutions let SME builders order pre-bagged formulations online, bypassing traditional distributors and shortening lead times. High-rise projects gain added value because uniform mixes reduce rework and material waste. Singapore's Housing and Development Board has formal specifications for polymer-modified mortars in public housing, setting a regional benchmark for advanced products.

Price Sensitivity of Informal Residential Users

Self-build homeowners in rural Indonesia, the Philippines, and Myanmar favor manual sand-cement mixes because packaged mortars carry price premiums they are unwilling to absorb. Cash transactions dominate these segments, limiting financing options that could justify higher upfront outlays through long-term performance gains. Smaller projects rarely specify quality benchmarks, so cheapest materials often win orders. Inflation shocks raise household costs and trigger project deferrals, directly trimming mortar demand in price-sensitive tiers.the

Other drivers and restraints analyzed in the detailed report include:

- Green-Building Codes and Low-Carbon Mandates

- On-Site Silo Systems Adoption in High-Rise Projects

- High CAPEX for Plant and Silo Logistics in Archipelagos

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Render accounted for 40.62% of the ASEAN dry mix mortar market share in 2025, supported by its dual protective and decorative roles in humid climates. Tile adhesives are expected to post a 6.31% CAGR through 2031 as rising income levels drive demand for premium ceramic flooring in high-rise apartments and retail interiors. The ASEAN dry mix mortar market size for tile adhesives is forecast to expand by 2026-2031 alongside urban condominium pipelines. Grout maintains a steady niche in infrastructure joints, while waterproofing slurries grow in coastal cities coping with heavy rainfall. Concrete protection and renovation receive support from aging bridges and ports requiring durable overlay solutions. National standards such as SNI 6880:2016 authorize packaged dry combined materials for structural concrete, reinforcing confidence in specialty formulations.

Second-generation renders with integral water repellents are winning specifications in public housing because they cut maintenance cycles. Tile adhesive producers offer deformability classes to fit new large-format porcelain tiles. Digital commerce platforms spotlight ready-to-use product calculators, easing contractor adoption. Waterproofing slurry demand dovetails with climate adaptation investments that prioritize building-envelope integrity. Innovation in low-carbon binders and recycled aggregate infill is set to differentiate suppliers targeting sustainable renovation.

The ASEAN Dry Mix Mortar Market Report is Segmented by Application (Plaster, Render, Tile Adhesive, Water Proofing Slurry, Concrete Protection and Renovation, and More), End-User Industry (Residential, Commercial, Infrastructure, and Industrial and Institutional), and Geography (Malaysia, Indonesia, Thailand, Singapore, Philippines, Vietnam, Myanmar, and Rest of ASEAN). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Ardex Group

- Greco Asia Sdn Bhd

- Holcim Ltd.

- JORAKAY CORPORATION CO.,LTD

- Knauf Group

- Laticrete International

- Mapei S.p.A.

- Pidilite Industries

- PT Drymix Indonesia

- PT Indocement Tunggal Prakarsa Tbk

- Saint-Gobain

- Siam City Cement Group

- Sika AG

- Starken Drymix Solutions Sdn Bhd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanisation and infrastructure megaprojects

- 4.2.2 Labour-scarcity-driven demand for pre-bagged mortars

- 4.2.3 Green-building codes and low-carbon mandates

- 4.2.4 On-site silo systems adoption in high-rise projects

- 4.2.5 E-commerce platforms widening SME contractor access

- 4.3 Market Restraints

- 4.3.1 Price sensitivity of informal residential users

- 4.3.2 High CAPEX for plant and silo logistics in archipelagos

- 4.3.3 Additive supply-chain volatility (polymer powders)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Application

- 5.1.1 Plaster

- 5.1.2 Render

- 5.1.3 Tile Adhesive

- 5.1.4 Grout

- 5.1.5 Water Proofing Slurry

- 5.1.6 Concrete Protection and Renovation

- 5.1.7 Insulation and Finishing System

- 5.1.8 Others

- 5.2 By End-user Industry

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Infrastructure

- 5.2.4 Industrial and Institutional

- 5.3 By Geography

- 5.3.1 Malaysia

- 5.3.2 Indonesia

- 5.3.3 Thailand

- 5.3.4 Singapore

- 5.3.5 Philippines

- 5.3.6 Vietnam

- 5.3.7 Myanmar

- 5.3.8 Rest of ASEAN

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Ardex Group

- 6.4.2 Greco Asia Sdn Bhd

- 6.4.3 Holcim Ltd.

- 6.4.4 JORAKAY CORPORATION CO.,LTD

- 6.4.5 Knauf Group

- 6.4.6 Laticrete International

- 6.4.7 Mapei S.p.A.

- 6.4.8 Pidilite Industries

- 6.4.9 PT Drymix Indonesia

- 6.4.10 PT Indocement Tunggal Prakarsa Tbk

- 6.4.11 Saint-Gobain

- 6.4.12 Siam City Cement Group

- 6.4.13 Sika AG

- 6.4.14 Starken Drymix Solutions Sdn Bhd

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment