PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939654

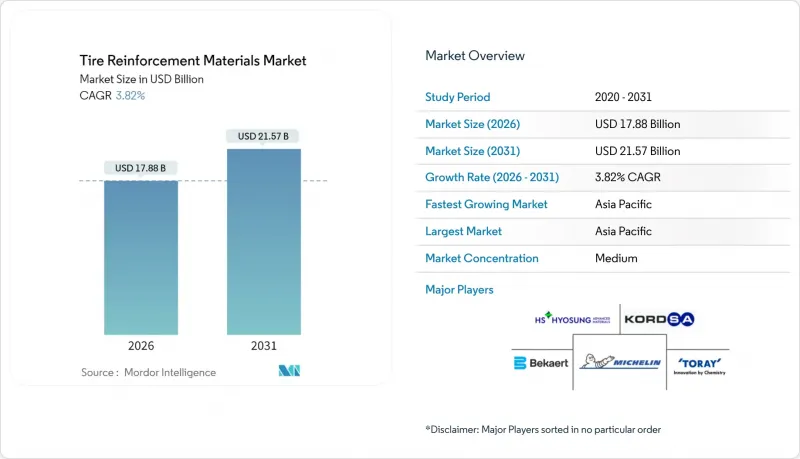

Tire Reinforcement Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Tire Reinforcement Materials Market size in 2026 is estimated at USD 17.88 billion, growing from 2025 value of USD 17.22 billion with 2031 projections showing USD 21.57 billion, growing at 3.82% CAGR over 2026-2031.

Robust radial-tire demand, tightening fuel-efficiency rules, and a steady shift toward advanced composite cords underpin expansion. Steel continues to anchor the tier-one supply chain because its high tensile strength supports heavier electric vehicles without raising costs. Lightweight aramid and graphene-modified cords are gaining traction in premium passenger and commercial segments as automakers chase lower rolling resistance. Meanwhile, melt-spinning lines with closed-loop cooling are scaling rapidly, allowing fiber makers to trim energy intensity and solvent emissions. Regional growth skews toward Asia-Pacific, where localized bead-wire plants help tire makers hedge against freight and tariff risks while meeting surging replacement-tire volumes.

Global Tire Reinforcement Materials Market Trends and Insights

Rising Global Vehicle Parc and Replacement-Tire Demand

Accelerating motorization in emerging economies is shortening replacement cycles and intensifying demand for premium steel and polyester cords. Cambodia approved USD 335 million in greenfield tire factories in 2025, positioning the country as a feeder hub for regional OEMs. Vietnam's 2024 rubber-export earnings rose 18% to USD 3.4 billion, reflecting strong pricing even as volumes eased, and confirming supply tightness that favors reinforcement suppliers. As used-car imports climb across Southeast Asia and Latin America, fleets age faster and require durable bead wire and belt-ply fabrics. Brand owners are therefore signing multi-year off-take accords with cord producers to lock in capacity and hedge price swings. This predictable demand profile supports incremental capex in steel-cord drawing mills and polyester melt-spinning lines.

Rapid Asia-Pacific Logistics Boom Spurring Radial-Tire Output

E-commerce fulfillment and highway-freight growth are lifting medium- and heavy-truck tire production. ZC Rubber's Indonesian plant launched all-steel radial output in 2024 with digitally integrated curing presses to serve ASEAN logistics operators. Shifting U.S. antidumping duties have also rerouted truck-bus radial exports from Thailand to newer bases like Cambodia, reshaping bead-wire sourcing patterns. Local reinforcement facilities shorten lead times for fleet customers that cannot afford downtime. High-modulus polyester and extra-ultra-tensile (EUT) steel cords thus enjoy priority allocation in contracts with commercial-tire makers, solidifying the growth trajectory in Asia-Pacific.

Raw-Material Price Volatility (Steel, Nylon)

Spikes in coking coal, iron ore, and para-xylene feedstocks lifted reinforcement input costs by double digits in 2024. Apollo Tyres' operating profit slid 24% year over year despite topline growth, underscoring the margin pinch from steel and nylon swings. Natural-rubber disruptions in Thailand and Malaysia further strained working capital for cord makers already juggling energy surcharges. Smaller processors without hedge programs faced liquidity crunches, triggering opportunistic acquisitions by integrated steel-wire majors. Such volatility shaves near-term EBITDA for the tire reinforcement materials market.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight High-Strength Cords to Meet Fuel-Efficiency Norms

- Safety Regulations Elevating Premium Reinforcement Adoption

- Emission Regulations on Carbon-Black and Steel-Cord Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Steel held a 39.75% of global value, and is on track for a 4.12% CAGR through 2031. High-carbon wire featuring tensile strengths up to 11,000 N enables lighter carcass profiles without sacrificing safety. Bekaert leverages global melt-shop integration and closed-loop pickling to support a 30% share of world tire-cord demand, reinforcing supply-security preferences among OEMs. Over the forecast horizon, extra-ultra-tensile grades will migrate into mass-market EV tires, expanding revenue for steel-cord lines operating in proximity to gigafactories.

Polyester yarns continue to serve cost-sensitive passenger-tire plies because of stable pricing and easy processing. Nylon retains niches that involve sustained high temperatures, such as high-speed motorcycle tires, but its reliance on caprolactam exposes producers to petrochemical swings. Aramid occupies premium slots where weight savings translate directly into fuel-economy or EV-range gains, though feedstock availability remains tight. Overall, diversified material menus give tire makers the flexibility to optimize SKUs by region and regulation without diluting brand performance commitments.

Melt-spinning accounted for 56.05% of 2025 output and is guiding a projected 4.14% CAGR by 2031 as fiber houses deploy energy-efficient quench systems. ]. Direct-chip-to-yarn extrusion paired with high-frequency (HF) godets lowers electricity use and delivers finer denier control. The tire reinforcement materials market share for melt-spun polyester already surpasses 70% within that sub-segment, while nylon players are steadily migrating away from solvent-heavy solution spinning.

Drawing technology remains critical in specialty cords, where multi-stage orientation improves crystallinity and abrasion resistance. Research testing two-step drawing achieved a 15% smoother surface than single-step methods, which elevates adhesion with skim-stock rubber. Solution spinning persists in aramid and meta-aramid fibre, though solvent-recovery mandates are escalating operating costs. A blended approach-melt spin for base loads, solution spin for performance fibers-will characterize capex decisions over the next five years.

The Tire Reinforcement Materials Report is Segmented by Material (Steel, Polyester, Nylon, Rayon, Aramid, and Other Materials), Technology (Drawing, Melt Spinning, and Solution Spinning), Reinforcement Type (Tire Cord Fabric and Tire Bead Wire), Application (Automotive Carcasses, Belt Ply, and Cap Ply), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 50.70% of 2025 revenue and is slated for a 4.54% CAGR through 2031 as China, India, and Southeast Asia expand OEM and replacement tire output. Cambodia's two new tire plants, underwritten by Chinese investors, secure bead-wire and cord supply contracts that prioritize just-in-time delivery across the Mekong subregion.

North America holds a sizable share in premium segments, propelled by fleet adherence to U.S. SmartWay fuel-efficiency benchmarks. Evonik's USD 50 million silica expansion in Charleston targets "green" tire compounds that function best when paired with low-gauge, high-modulus polyester cords. Trelleborg's North Carolina plant will fabricate bio-based coated fabrics that can double as inner-liner reinforcements, reflecting a regional push toward circular materials.

Europe emphasizes sustainability and automation. Michelin invested EUR 300 million in Roanne to run C3M small-lot production of ultra-high-performance tires, each embedding aramid belts and low-spill bead wires. Stricter carbon-border adjustments raise hurdles for imported cord fabric that lacks low-carbon verification. Eastern European plants in Slovakia and Romania are therefore adopting closed-loop acid recovery in pickling baths to secure future compliance and customer acceptance.

- Bekaert

- Century Enka Limited

- CORDENKA GmbH & Co. KG

- Dupont

- FORMOSA TAFFETA CO. LTD

- HS HYOSUNG ADVANCED MATERIALS

- Indorama Ventures Mobility

- Jiangsu Xingda Steel Cord Co., Ltd

- Kolon Industries Inc.

- Kordsa Teknik Tekstil AS

- Michelin

- SRF LIMITED

- Sumitomo Electric Industries, Ltd

- TEIJIN LIMITED

- TOKUSEN KOGYO Co.,ltd

- TORAY INDUSTRIES, INC. (Toray Hybrid Cord Inc.)

- Wuxi Taiji Industrial Co., Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Vehicle Parc and Replacement-Tire Demand

- 4.2.2 Rapid APAC Logistics Boom Spurring Radial Tire Output

- 4.2.3 Lightweight High-Strength Cords to Meet Fuel-Efficiency Norms

- 4.2.4 Safety Regulations Elevating Premium Reinforcement Adoption

- 4.2.5 Graphene-Enhanced Cords Cutting Rolling Resistance by More than or Equal to 30%

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Steel, Nylon)

- 4.3.2 Emission Regulations on Carbon-Black/Steel-Cord Plants

- 4.3.3 Global Aramid-Fiber Supply Crunch (Defense Demand Spikes)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material

- 5.1.1 Steel

- 5.1.2 Polyester

- 5.1.3 Nylon

- 5.1.4 Rayon

- 5.1.5 Aramid

- 5.1.6 Other Materials

- 5.2 By Technology

- 5.2.1 Drawing

- 5.2.2 Melt Spinning

- 5.2.3 Solution Spinning

- 5.3 By Reinforcement Type

- 5.3.1 Tire Cord Fabric

- 5.3.2 Tire Bead Wire

- 5.4 By Application

- 5.4.1 Automotive Carcasses

- 5.4.2 Belt Ply

- 5.4.3 Cap Ply

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of APAC

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Bekaert

- 6.4.2 Century Enka Limited

- 6.4.3 CORDENKA GmbH & Co. KG

- 6.4.4 Dupont

- 6.4.5 FORMOSA TAFFETA CO. LTD

- 6.4.6 HS HYOSUNG ADVANCED MATERIALS

- 6.4.7 Indorama Ventures Mobility

- 6.4.8 Jiangsu Xingda Steel Cord Co., Ltd

- 6.4.9 Kolon Industries Inc.

- 6.4.10 Kordsa Teknik Tekstil AS

- 6.4.11 Michelin

- 6.4.12 SRF LIMITED

- 6.4.13 Sumitomo Electric Industries, Ltd

- 6.4.14 TEIJIN LIMITED

- 6.4.15 TOKUSEN KOGYO Co.,ltd

- 6.4.16 TORAY INDUSTRIES, INC. (Toray Hybrid Cord Inc.)

- 6.4.17 Wuxi Taiji Industrial Co., Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment