PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939679

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939679

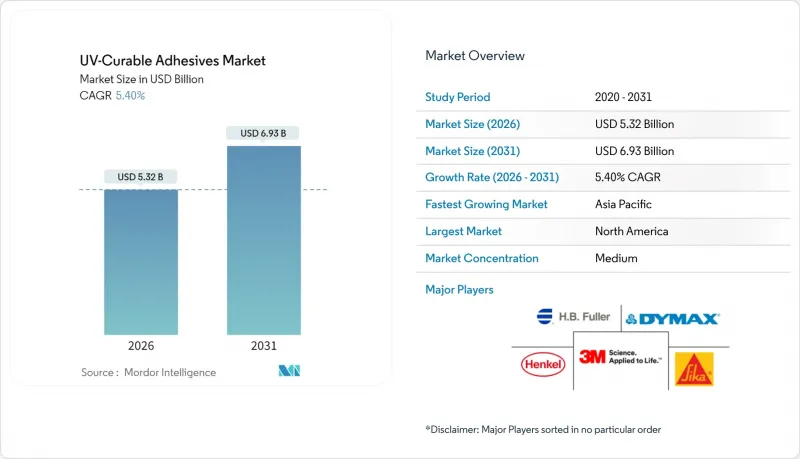

UV-Curable Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The UV-Curable Adhesives Market is expected to grow from USD 5.05 billion in 2025 to USD 5.32 billion in 2026 and is forecast to reach USD 6.93 billion by 2031 at 5.4% CAGR over 2026-2031.

Across every major end-use domain, such as medical devices, consumer electronics, automotive composites, and packaging, the UV-curable adhesives market is evolving from niche usage to an essential production input, primarily because instant on-demand curing eliminates oven dwell time, removes volatile organic compound emissions, and supports lightweight mixed-material assemblies. Growth momentum also benefits from semiconductor miniaturization, stricter VOC caps in Europe and North America that favor solvent-free chemistries, and vertically integrated supply chains that secure photoinitiator availability. North America keeps its technological edge through advanced medical manufacturing and early automotive adoption of light-curing structural bonds, while Asia-Pacific accelerates on the back of semiconductor packaging capacity additions. Competitive dynamics reward firms that pair product innovation with regulatory expertise, especially in formulations meeting ISO 10993 and REACH guidelines.

Global UV-Curable Adhesives Market Trends and Insights

UV-Curable Adhesives Adoption in Automotive and Aerospace

Rising electric-vehicle production pushes automakers to bond dissimilar substrates such as aluminum and carbon fiber without inducing thermal distortion, and the UV-curable adhesives market supplies formulations that fully cure in seconds while retaining high lap-shear strength. Polestar 1 and London's TX5 taxi platforms demonstrate the mass-manufacturing viability of this approach, achieving both weight reduction and cabin noise management. Aerospace production mirrors automotive trends as UV-curing shortens autoclave schedules and lowers energy consumption for composite laminates. With global battery-pack production ramping, stakeholders expect demand for high-temperature-tolerant UV-curable epoxies to intensify through 2030.

Stricter VOC/REACH Regulations Favor Solvent-Free Chemistries

The August 2023 EU restriction on diisocyanates above 0.1% content forces converters to shift toward zero-emission solutions, giving the UV-curable adhesives market an immediate regulatory tailwind. Canada's January 2024 VOC limits mirror these caps and further raise adoption in North American flexible-packaging lines. As life-cycle-assessment metrics become procurement criteria, zero-solvent curing scores superior eco-labels, and enhance brand ESG credentials. Leading suppliers like Henkel now commercialize CO2-captured raw-material routes, lowering the embedded carbon of finished adhesives. Because similar VOC directives are under review in APAC, global alignment on solvent-free standards is likely within two years, accelerating UV penetration ahead of competing two-part epoxies.

High Capital Cost of UV-LED Curing Systems

Industrial LED arrays cost USD 50,000-500,000, and although electricity savings recover cash over high-volume runs, small firms struggle to finance upgrades, slowing full-line conversions. Process re-validation for wavelength changes adds downtime risk, and fast innovation cycles create perceived obsolescence before payback concludes. Vendors respond with leasing models and modular head units, yet credit access remains uneven worldwide. Incentives linked to energy-efficiency grants in the EU and U.S. can close gaps, but until uptake broadens, equipment expense will restrain some adhesives volumes.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization in Consumer Electronics

- Rapid Uptake in Wearable Medical Devices

- Supply Volatility of Key Photoinitiators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations captured 47.10% of the UV-curable adhesives market share in 2025, owing to mature supply chains and multi-substrate compatibility. The UV-curable adhesives market size for acrylic grades benefits from commodity-scale raw materials that steady pricing and facilitate global sourcing. Yet epoxies, forecast to compound at 5.55% through 2031, are eroding acrylic headroom in automotive structural joints and semiconductor under-fills where high modulus and thermal cycling endurance are non-negotiable.

Recent innovations in cationic photoinitiators shorten epoxy cure from minutes to seconds without compromising glass-transition temperature, enabling high-speed line takt. Silicone and polyurethane niches persist where extreme temperature swing or high flexibility outweigh tensile strength needs. Over the forecast horizon, ongoing REACH scrutiny of certain acrylate monomers may narrow the acrylic cost advantage, potentially pushing specialty epoxies further into mainstream applications of the UV-curable adhesives market.

The UV-Curable Adhesives Report is Segmented by Resin Type (Silicon, Acrylic, Polyurethane, Epoxy, and Other Resin Types), End-User Industry (Medical, Electrical and Electronics, Transportation, Packaging, Furniture, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.80% of global revenue in 2025 as OEMs in Minnesota, California, and Ontario relied on FDA-cleared grades for catheters and diagnostic sensors, while Detroit electric-vehicle plants adopted UV structural bonds for battery packs. The region also benefits from transparent regulatory pathways that shorten time-to-market for new chemistries, reinforcing supplier research and development investment.

Asia-Pacific delivers the fastest 5.65% CAGR on the back of surging semiconductor packaging capacity in China, Taiwan, and South Korea. Changhong Polymer's USD 1.6 billion acrylic-acid complex and DuPont's photoresist expansion in Niigata shore up regional raw-material and advanced-material ecosystems. Automotive demand rises as Japanese and Chinese OEMs scale mixed-material chassis, creating fresh pull for high-modulus UV epoxies.

Europe's balance grows under the weight of stringent REACH rules that both eliminate solvent competitors and add compliance costs. Sustainability mandates drive the adoption of Henkel-Celanese CO2-derived feedstocks and circular designs like Saperatec-enabled adhesive recycling. Middle East and Africa and South America remain emerging but show momentum in flexible-packaging installations targeting food exports, adding incremental volume to the UV-curable adhesives market

- 3M

- Arkema

- artience Co., Ltd.

- AVERY DENNISON CORPORATION

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Dymax

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parson Adhesives, Inc.

- Permabond LLC

- Sika AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 UV-Curable Adhesives Adoption in Automotive and Aerospace

- 4.2.2 Stricter VOC/REACH Regulations Favor Solvent-Free Chemistries

- 4.2.3 Miniaturisation in Consumer Electronics

- 4.2.4 Rapid Uptake in Wearable Medical Devices

- 4.2.5 In-Line Digital Packaging Print Lines Demanding Instant Bonding

- 4.3 Market Restraints

- 4.3.1 High Capital Cost of UV-LED Curing Systems

- 4.3.2 Availability of Alternative 2-Part Epoxies and Cyanoacrylates

- 4.3.3 Supply Volatility of Key Photoinitiators

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Silicon

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Other Resin Types

- 5.2 By End-user Industry

- 5.2.1 Medical

- 5.2.2 Electrical and Electronics

- 5.2.3 Transportation

- 5.2.4 Packaging

- 5.2.5 Furniture

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 India

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 artience Co., Ltd.

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 DELO Industrie Klebstoffe GmbH & Co. KGaA

- 6.4.6 Dymax

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Master Bond Inc.

- 6.4.10 Panacol-Elosol GmbH

- 6.4.11 Parson Adhesives, Inc.

- 6.4.12 Permabond LLC

- 6.4.13 Sika AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment