PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939682

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939682

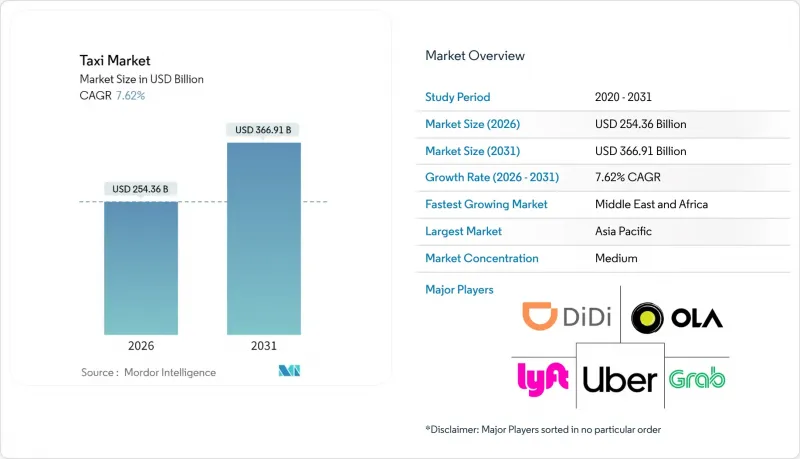

Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Taxi Market was valued at USD 236.36 billion in 2025 and estimated to grow from USD 254.36 billion in 2026 to reach USD 366.91 billion by 2031, at a CAGR of 7.62% during the forecast period (2026-2031).

Underscoring a sizeable taxi market size that continues to expand on the back of digital integration, AI-driven dispatch systems, and growing urban populations. Demand accelerates as super-apps embed on-demand mobility alongside food, payments, and finance, enabling single-tap bookings that raise platform stickiness and average revenue per user. Operators are widening service portfolios with electric, autonomous, and accessibility-focused fleets that lower lifetime operating costs and open new revenue layers such as in-vehicle advertising. Governments increasingly view app-based taxis as complements to public transit and are issuing incentives for EV adoption, improved accessibility, and data sharing that favor agile players with strong regulatory teams. Taken together, these forces are reshaping driver economics, pushing industry participants to invest in algorithmic pricing, dynamic routing, and vertical integration that compress time-to-pickup and improve fleet utilization.

Global Taxi Market Trends and Insights

Rapid Smartphone & Internet Penetration

Smartphone penetration above four-fifths in leading urban centers lets platforms algorithmically match riders and drivers faster, shrinking average wait times from 15-20 minutes to under 5 minutes in top-tier cities. Ubiquitous 5G coverage allows richer location data, which boosts fleet utilisation and lowers deadhead mileage. Higher data speeds also mean in-app video ads and real-time driver coaching, unlocking diversified revenue streams. Mobile wallets embedded in ride-hailing apps now account for more than four-fifths of transactions in developed markets, lowering cash-handling risk and reducing airport queue times. In emerging economies, internet upgrades bypass legacy dispatch systems, enabling leap-frog adoption of digital bookings.

Urban Congestion & Declining Private-Car Ownership

Vehicle utilisation in dense cities often falls slightly, motivating residents to replace private cars with on-demand rides that eliminate parking fees. Municipal congestion charges plus rising fuel prices raise the total cost of car ownership, reinforcing the appeal of taxi services, especially pooled formats that can cut per-trip fares by up to 40%. Younger consumers aged 25-35 are most receptive, preferring bundled mobility-as-a-service subscriptions integrating taxis with rail, bus, and micro-mobility in one app. Congestion costs topping USD 100 billion annually in the U.S. place political pressure on cities to privilege high-occupancy modes, indirectly boosting taxi market demand.

Evolving Licensing & Regulatory Crack-Downs

City regulators are modernising medallion structures and tightening background-check rules, raising compliance costs for app-based and traditional operators. Seattle plans to phase out its medallion regime by March 2026, while New York City requires half of all cabs to be wheelchair-ready by March 2025. The Singaporean watchdog blocked Grab's planned acquisition of Trans-Cab over antitrust concerns, signalling closer scrutiny of platform consolidation. Divergent regional standards increase legal complexity and can delay market entries, suppressing near-term growth momentum.

Other drivers and restraints analyzed in the detailed report include:

- Ride-Hailing Platform Expansion In Emerging Economies

- AI-Based Dynamic Routing & Pricing Optimisation

- Intensifying Price Wars Eroding Driver Earnings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Online channels delivered 63.78% of the taxi market share in 2025, illustrating the structural pivot toward app-based demand aggregation. The dominance of digital bookings strengthened business intelligence loops that sharpen demand prediction, resulting in higher asset utilisation and lower passenger wait times. The offline segment remains relevant among older demographics and jurisdictions where medallion systems still confer street-hail privilege, yet its growth trajectory lags the broader taxi market. Operators are therefore integrating voice-based IVR and kiosk interfaces alongside apps to preserve legacy users while nudging them toward digital interactions.

Looking forward, online bookings are forecast to grow at an 7.92% CAGR. Super-apps bundling mobility with payments and e-commerce will underpin incremental trip volumes, especially in APAC megacities where smartphone penetration exceeds four-fifths. Online channels also furnish granular trip-level data that powers targeted loyalty and dynamic pricing, reinforcing share gains. Contractual corporate accounts, airport concessions, and mandated accessibility services sustain the offline channel's CAGR. Yet, its revenue mix is expected to shrink below one-third of the taxi market size by 2031.

Ride-hailing controlled 74.85% of taxi market size in 2025, owing to network effects that ensure quicker matches and transparent pricing. Market-leading platforms invest heavily in safety verification, real-time monitoring, and driver training that elevate service reliability above informal rivals. Pooled rides are projected to outpace overall taxi market expansion with an 7.78% CAGR because they ease congestion and lower per-seat fares by sharing costs among passengers. Environmental compliance agendas further catalyse pooled demand as corporates set fleet-wide carbon reduction targets.

Corporate mobility contracts, once dominated by black-car fleets, are increasingly awarded to app-based providers offering digital receipts and per-seat expense allocation. The embedded data facilitates carbon-reporting dashboards now demanded by ESG-focused boards. Although ride-hailing maintains gross-booking supremacy, pooled formats generate higher occupancy and superior asset productivity, especially during peak hours when single-occupancy trips face surge pricing.

The Taxi Market Report is Segmented by Booking Type (Online Booking and Offline Booking), Service Type (Ride-Hailing, Ride-Sharing, and Corporate & Institutional Contracts), Vehicle Type (Passenger Cars, Motorcycles & Scooters, Vans & MPVs, and Auto-Rickshaws & Tuk-Tuks), Propulsion Type (ICE, Electric, and Hybrid), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 37.42% taxi market share in 2025, sustained by rapid urbanisation, smartphone usage above four-fifth, and widespread two-wheeler taxis that thrive in dense corridors. Government policies offering EV subsidies and medallion exemptions accelerate fleet turnover throughout India, Vietnam, and Thailand. Japan's taxi incumbents partner with Uber to integrate 20,000 vehicles on the platform, reinforcing cross-border digital standardisation.

The Middle East and Africa is projected to register an 7.88% CAGR through 2031, due to national digital-economy programmes and mega-city infrastructure. Dubai Taxi Company aims to migrate around four-fifth of rides to e-booking by 2029 while electrifying one-quarter of its fleet, aligning with the UAE Net-Zero 2050 roadmap. Ride-hailing apps proliferate in Egypt, Saudi Arabia, and Nigeria where youthful, tech-savvy populations leapfrog legacy dispatch models. Pan-regional super-apps such as Careem integrate payments, delivery, and transport under one umbrella, enhancing user retention. Authorities impose stricter accessibility and data-privacy mandates, requiring material compliance outlays that favor scaled operators. Lyft's acquisition of FREENOW in April 2025 doubled its European reach to 11 countries and opened access to nearly 300 billion annual personal vehicle trips. Meanwhile, city councils across Germany are testing zero-emission zones that could bump EV adoption thresholds earlier than corporate plans anticipate. Net effect: growth slows but remains positive as platforms diversify into deliveries and subscription mobility passes.

- Uber Technologies Inc.

- Beijing Xiaoju Technology Co. Ltd (DiDi)

- Lyft Inc.

- Grab Holdings Inc.

- Bolt Technology OU

- ANI Technologies Pvt Ltd (Ola)

- Gojek Tech

- FREE NOW (Intelligent Apps GmbH)

- BlaBlaCar

- Curb Mobility LLC

- Flywheel Software Inc.

- Kabbee Exchange Ltd

- Addison Lee Group

- Gett Inc.

- Yandex Go (Yandex NV)

- Careem Networks FZ-LLC

- Via Transportation Inc.

- Beat Mobility Services Ltd

- Easy Taxi (Tappsi SAS)

- Cabify Espana SL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Smartphone & Internet Penetration

- 4.2.2 Urban Congestion & Declining Private-Car Ownership

- 4.2.3 Ride-Hailing Platform Expansion In Emerging Economies

- 4.2.4 AI-Based Dynamic Routing & Pricing Optimisation

- 4.2.5 Accessibility Mandates Driving Fleet Renewal

- 4.2.6 Super-App Api Integrations Boosting Embedded Demand

- 4.3 Market Restraints

- 4.3.1 Evolving Licensing & Regulatory Crack-Downs

- 4.3.2 Intensifying Price Wars Eroding Driver Earnings

- 4.3.3 Limited Public Ev-Charging Slowing E-Taxi Uptake

- 4.3.4 Data-Privacy Litigation Around Trip-Tracking

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Booking Type

- 5.1.1 Online Booking

- 5.1.2 Offline Booking

- 5.2 By Service Type

- 5.2.1 Ride-hailing

- 5.2.2 Ride-sharing (pooled)

- 5.2.3 Corporate & Institutional Contracts

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Motorcycles & Scooters

- 5.3.3 Vans & MPVs

- 5.3.4 Auto-Rickshaws & Tuk-tuks

- 5.4 By Propulsion Type

- 5.4.1 Internal Combustion Engine (ICE)

- 5.4.2 Electric

- 5.4.3 Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Uber Technologies Inc.

- 6.4.2 Beijing Xiaoju Technology Co. Ltd (DiDi)

- 6.4.3 Lyft Inc.

- 6.4.4 Grab Holdings Inc.

- 6.4.5 Bolt Technology OU

- 6.4.6 ANI Technologies Pvt Ltd (Ola)

- 6.4.7 Gojek Tech

- 6.4.8 FREE NOW (Intelligent Apps GmbH)

- 6.4.9 BlaBlaCar

- 6.4.10 Curb Mobility LLC

- 6.4.11 Flywheel Software Inc.

- 6.4.12 Kabbee Exchange Ltd

- 6.4.13 Addison Lee Group

- 6.4.14 Gett Inc.

- 6.4.15 Yandex Go (Yandex NV)

- 6.4.16 Careem Networks FZ-LLC

- 6.4.17 Via Transportation Inc.

- 6.4.18 Beat Mobility Services Ltd

- 6.4.19 Easy Taxi (Tappsi SAS)

- 6.4.20 Cabify Espana SL

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment