PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940613

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940613

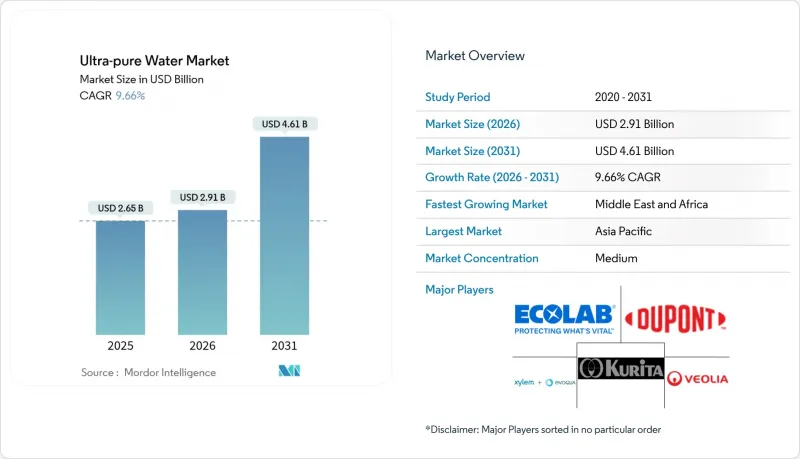

Ultra-pure Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Ultra-pure Water Market is expected to grow from USD 2.65 billion in 2025 to USD 2.91 billion in 2026 and is forecast to reach USD 4.61 billion by 2031 at 9.66% CAGR over 2026-2031.

Growth stems from stricter purity targets in semiconductor fabs, the rapid scaling of cell-and-gene-therapy plants, and the emergence of gigawatt-scale green hydrogen projects. Semiconductor lines below 5 nanometers now require sub-0.1 ppb total organic carbon, driving upgrades to multistage treatment. Biopharmaceutical facilities utilize continuous processing and single-use technologies, which intensify water-for-injection (WFI) requirements. Large electrolysis parks in the Middle-East are introducing feed-water specifications that approach semiconductor standards, thereby accelerating demand for membrane-based polishing, electrodeionization, and online monitoring. Supply pressures in ultrapure ion-exchange resins and the capital expenditure (capex) burden of multibarrier trains temper immediate adoption, yet create longer-term opportunities for integrated, chemical-free systems.

Global Ultra-pure Water Market Trends and Insights

Intensifying wafer-cleaning volumes in advanced-node semiconductor fabs

Next-generation logic and memory lines operating below 7 nanometers require multiple wet-clean steps and stringent organic contamination limits of sub-0.1 ppb, rendering legacy mixed-bed polishers inadequate. Fab operators now require up to six times more ultrapure water per wafer than in 28-nanometer processes, forcing the implementation of integrated treatment schemes that combine reverse osmosis, electrodeionization, UV oxidation, and membrane contactors. A 2024 technical briefing revealed that wastewater at modern fabs contains more than 60 elements, doubling the complexity of reclamation compared to previous nodes. Water-scarce regions such as Taiwan thus prioritize closed-loop reuse systems that sustain resistivity at 18.2 MΩ*cm.

Rapid expansion of 300 mm and 12-inch silicon-carbide device lines

Silicon-carbide substrates demand aggressive chemistries and elevated temperatures, each intensifying rinse-water purity requirements. Automotive OEMs moving toward vertical integration of power-electronics lines place new orders for purpose-built fabs, each consuming roughly 40% more ultrapure water per unit wafer area than traditional silicon lines. System designers must ensure fluoride-rich waste streams do not degrade downstream ion-exchange beds, prompting a shift to electrodeionization stacks with PTFE spacers rated for high-fluoride service.

High CAPEX of multi-stage polishing systems for less than 0.1 ppb TOC

Industrial-scale platforms that blend UV oxidation, ozone, and dual-stage electrodeionization often exceed USD 5 million per install. Smaller fabs and fill-finish suites struggle to justify the upfront burden, even if lifecycle cost analyses favor chemical-free operation. Veolia's E-Cell stacks provide continuous, reagent-free polishing, yet they still require a high initial investment for auxiliary controls and redundancy.

Other drivers and restraints analyzed in the detailed report include:

- Scale-up of novel cell-and-gene-therapy fill-finish suites

- Booming green-hydrogen electrolyzer build-out

- Supply-demand imbalance of ultrapure ion-exchange resins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cleaning accounted for 38.12% of the ultrapure water market in 2025 as wafer rinse cycles intensified across 5-nanometer logic and SiC power devices. The segment's volume growth drives integrated reclamation loops that recycle up to 80% of spent rinse, while still meeting 18.2 MΩ*cm resistivity thresholds-a shift that underpins broader sustainability targets. High-performance liquid chromatography labs in emerging pharmaceutical clusters represent the fastest-growing niche, expanding at a 9.89% CAGR. Their growth reinforces the demand for low-TOC feeds, ensuring that baseline drift and ghost peaks remain within pharmacopoeial limits.

The application mix is gradually reallocating budget from conventional etching support toward analytical and ingredient-grade water. Immune chemistry platforms for decentralized diagnostics add steady demand as global test volumes rise. Measurement complexity increases across all uses; standard pH probes polarize under low-ionic-strength conditions, prompting uptake of optical redox and differential conductivity sensors. These shifts broaden the supplier landscape while embedding stringent monitoring directly into the treatment train.

The Ultrapure Water Market Report is Segmented by Application (Cleaning, Etching, Ingredient, and More), End-User Industry (Semiconductor and Electronics, Pharmaceuticals and Biotechnology, Power Generation, Food and Beverage, and More), Treatment Technology (Reverse Osmosis, Electrodeionization, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained 47.35% of the ultrapure water market in 2025, as foundry powerhouses in Taiwan, South Korea, and China ramped up production for 3-nanometer and DRAM nodes. Taiwan Semiconductor Manufacturing Company alone consumes more than 160,000 m3/day of ultrapure water, prompting mandatory 90% recycle ratios at its newest facilities. Regional regulators are encouraging closed-loop architectures to protect constrained aquifers, thereby accelerating investments in membrane hybrid trains and high-flux EDI stacks. Domestic suppliers leverage policy support to localize key consumables such as cation resins and two-pass RO modules, but leading-edge fabs still source metrology and online analyzers from U.S. and Japanese specialists.

North America's resurgence is driven by the CHIPS and Science Act, which allocates multibillion-dollar incentives for local fabrication. Projects in Arizona, Texas, and New York collectively add more than 100 million gallons per day of planned ultrapure water capacity over the next five years. The region's mature pharmaceutical base further stimulates WFI demand, driving adoption of membrane-only generation systems that align with updated U.S. Pharmacopeia standards. Europe mirrors this trajectory, backed by EU semiconductor subsidies and strict sustainability directives that favor low-chemical, low-energy treatment packages.

The Middle-East and Africa record the highest 9.73% CAGR, propelled by multi-gigawatt hydrogen programs in Saudi Arabia, the UAE, and Oman. These schemes require integrated desalination and polishing trains capable of delivering 1,000 m3/h of water with a conductivity of 1 µS/cm to proton exchange membrane stacks. South Africa's platinum refining and battery precursor projects add niche, high-margin demand, while Morocco and Egypt explore desalination-powered green ammonia value chains. Successful execution depends on securing resin and membrane supply routes, as well as developing skilled local operators.

- 3M

- Applied Membranes Inc.

- Aquatech

- Asahi Kasei Corp.

- DuPont

- ECOLAB

- Evoqua Water Technologies LLC

- Komal Industries

- Kurita Water Industries Ltd

- Lenntech B.V.

- METTLER TOLEDO

- Organo Corporation

- Ovivo

- Pall Corporation

- Pentair

- Puretec Industrial Water

- Rodi Systems Corporation

- Sartorius AG

- SnowPure, LLC

- Veolia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Intensifying wafer-cleaning volumes in advanced-node semiconductor fabs

- 4.2.2 Rapid expansion of 300 mm and 12-inch silicon carbide (SiC) device lines

- 4.2.3 Scale-up of novel cell-and-gene-therapy fill-finish suites

- 4.2.4 Booming green-hydrogen electrolyzer build-out (Giga-scale)

- 4.2.5 Pharmaceutical shift toward continuous bioprocessing

- 4.3 Market Restraints

- 4.3.1 Pervasive micropollutant contamination in feed-water sources

- 4.3.2 High CAPEX of multi-stage polishing systems for less than 0.1 ppb TOC

- 4.3.3 Supply-demand imbalance of ultrapure ion-exchange resins

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Cleaning

- 5.1.2 Etching

- 5.1.3 Ingredient

- 5.1.4 High-performance Liquid Chromatography (HPLC)

- 5.1.5 Immune Chemistry

- 5.2 By End-user Industry

- 5.2.1 Semiconductor and Electronics

- 5.2.2 Pharmaceuticals and Biotechnology

- 5.2.3 Power Generation

- 5.2.4 Food and Beverage

- 5.2.5 Oil, Gas and Petrochemicals

- 5.2.6 Personal Care and Cosmetics

- 5.3 By Treatment Technology

- 5.3.1 Reverse Osmosis (RO)

- 5.3.2 Electrodeionization (EDI)

- 5.3.3 Ultrafiltration / Microfiltration

- 5.3.4 UV Oxidation and TOC Reduction

- 5.3.5 Ion-Exchange Resin Polishing

- 5.3.6 Degasification and Membrane Contactors

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 South Korea

- 5.4.1.4 India

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Applied Membranes Inc.

- 6.4.3 Aquatech

- 6.4.4 Asahi Kasei Corp.

- 6.4.5 DuPont

- 6.4.6 ECOLAB

- 6.4.7 Evoqua Water Technologies LLC

- 6.4.8 Komal Industries

- 6.4.9 Kurita Water Industries Ltd

- 6.4.10 Lenntech B.V.

- 6.4.11 METTLER TOLEDO

- 6.4.12 Organo Corporation

- 6.4.13 Ovivo

- 6.4.14 Pall Corporation

- 6.4.15 Pentair

- 6.4.16 Puretec Industrial Water

- 6.4.17 Rodi Systems Corporation

- 6.4.18 Sartorius AG

- 6.4.19 SnowPure, LLC

- 6.4.20 Veolia

7 Market Opportunities and Future Outlook

- 7.1 Requirement of Ultra-pure Water in Green Hydrogen Production

- 7.2 White-space and Unmet-need Assessment