PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940650

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940650

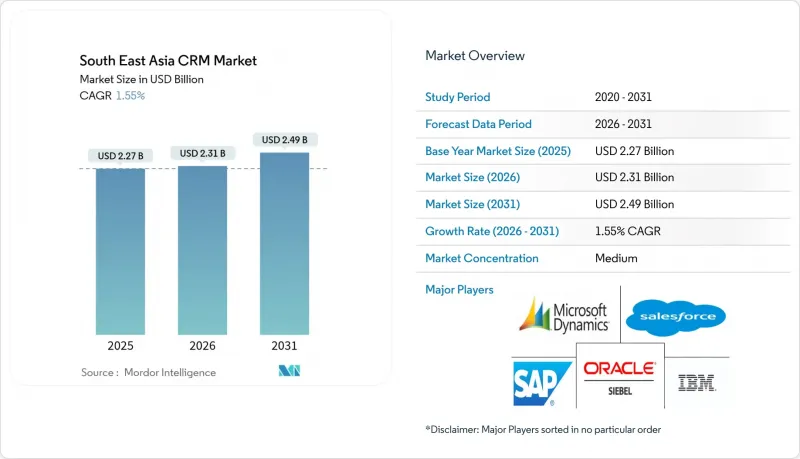

South East Asia CRM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Southeast Asia CRM market was valued at USD 2.27 billion in 2025 and estimated to grow from USD 2.31 billion in 2026 to reach USD 2.49 billion by 2031, at a CAGR of 1.55% during the forecast period (2026-2031).

Cloud-first grant schemes in Singapore, Thailand, and Malaysia are underwriting rapid adoption, while data-center investments by global hyperscalers reduce latency and satisfy sovereignty rules. Currency fluctuations have raised the cost of USD-denominated SaaS contracts, yet subsidized funding and open-API mandates offset some of the budget pressure. Social-commerce expansion is steering vendors toward LINE, WhatsApp, and TikTok integrations that deliver conversational selling at scale. At the same time, embedded artificial intelligence elevates upsell performance by predicting customer intent and generating tailored content in real time.

South East Asia CRM Market Trends and Insights

Cloud-First Digitalization Across SMEs

Government-backed grant programs are shifting technology spending toward Software-as-a-Service, allowing SMEs to bypass expensive on-premises stacks entirely. Singapore's enhanced SMEs Go Digital scheme now covers up to 50% of pre-approved CRM solutions for the city-state's 219,000 small businesses, which collectively generate USD 142.3 billion of gross value added. Thailand's Go Digital ASEAN initiative trained more than 44,000 micro and small firms, and 69% reported revenue growth after adopting customer-facing digital tools. In Indonesia, pre-pandemic digital adoption among MSMEs stood at 12.5%, yet the COVID-19 lockdowns made cloud CRM essential for sustaining buyer communication, pushing implementation rates materially higher. Malaysia's latest SME survey shows 82% online adoption, but 77% remain at the entry stage, leaving major headroom for CRM modernization. Together, these shifts anchor long-run demand for the Southeast Asia CRM market.

AI-Enabled Hyper-Personalization Driving Upsell

The next growth curve for the Southeast Asia CRM market stems from machine-learning tools that turn static customer data into predictive revenue actions. Thai banks illustrate the model, combining real-time behaviour scoring with generative AI content to raise cross-sell conversion and improve client retention. Singapore firms show the highest readiness: 94.6% have adopted at least one digital capability, and 44% run production AI workloads. Regional vendors are democratizing the technology by embedding pretrained models into SME-friendly packages; an example is the AI-enabled CRM launched by Advocado in partnership with HUAWEI CLOUD and 4Paradigm. These features resonate with social-commerce merchants that need one-to-one messaging at scale rather than blanket promotions. As deployment costs fall, AI modules will become baseline expectations rather than premium options within the Southeast Asia CRM market.

Scarcity of CRM Implementation Talent

Implementation timelines in the Southeast Asia CRM market lengthen because qualified administrators, developers, and change-management specialists remain in short supply. Singapore ranks among the world's tightest labour markets, with 83% of employers citing hiring challenges, and will need 41,000 additional tech roles by 2028. Malaysia shows only 15% of citizens possessing advanced ICT skills, yet 65% of firms list digital talent as a priority. Startups likewise struggle to fill CRM-dependent roles-40% lack customer-success talent and 46% lack marketing expertise. Indonesia's willingness-to-reskill ratio sits at 53%, a figure made more problematic by technology's rapidly shrinking skill half-life. Higher wages and longer projects raise the total cost of ownership, prompting some companies to defer upgrades even when funding is available.

Other drivers and restraints analyzed in the detailed report include:

- Social-Commerce Boom Integrating CRM Into Chat-Apps

- Government "Go-Digital" Incentives in ASEAN

- Currency Volatility Squeezing SaaS Budgets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Small and medium enterprises held 42.60% of the Southeast Asia CRM market share in 2025 and are expanding at a 2.11% CAGR to 2031. Subsidized grant schemes and pay-as-you-go cloud billing align tightly with SME cash-flow cycles. Singapore's SMEs Go Digital grants bridge upfront investment gaps, while Malaysia's collaboration between Zoho and Cradle Fund delivers USD 10 million in software credits to 4,400 start-ups. Indonesian SMEs report sales uplifts of up to 30% within one year of CRM usage.

Large enterprises still generate the bulk of absolute revenue for the Southeast Asia CRM market, but their upgrade cadence is slower due to complex legacy estates. Integration with entrenched SAP and Oracle ERPs frequently involves multi-phase projects that must align with global transformation roadmaps. Boards remain cautious about migrating mission-critical data off-premises until in-country data-center availability and legal clarity mature. As a result, SME demand is increasingly the headline growth story, while enterprise accounts drive premium professional-service revenue.

Cloud deployments captured 63.10% of the Southeast Asia CRM market size in 2025 and are projected to grow at a 2.72% CAGR. Singapore tops regional cloud readiness indices with a 56/60 score for banking, providing explicit guidelines on cross-border data flows. Indonesia's SNAP open-API mandate lowers integration costs, encouraging banks and fintechs to move client engagement workloads into the cloud.

On-premises solutions persist in heavily regulated verticals or where data localization laws remain stringent, particularly in Indonesia and Thailand. Hybrid architectures serve as a transitional setup, giving firms on-site control for sensitive fields while benefiting from cloud elasticity for customer-facing use cases. Oracle's USD 6.5 billion plan for a Malaysian cloud region expands local residency options, making full SaaS deployments more palatable for compliance teams.

The Southeast Asia CRM Market Report is Segmented by Organization Size (Small and Medium, and Large Scale), Deployment Model (Cloud, On-Premise, and Hybrid), Application (Sales Automation, Marketing Automation, Customer Service and Support, and Contact Centre), End-User Vertical (Retail and E-Commerce, BFSI, Manufacturing, Services, and Government), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Salesforce Inc.

- Microsoft Corporation (Dynamics 365)

- Oracle Corporation (Siebel and CX Cloud)

- SAP SE

- HubSpot Inc.

- International Business Machines Corporation

- Zoho Corporation Pvt. Ltd.

- Barantum PT Kosada Group

- Capillary Technologies India Limited

- Infusion Software Inc. (Keap)

- SugarCRM Inc.

- Qontak Pte. Ltd.

- Deskera Holdings Ltd.

- Soft Solvers Solutions Sdn. Bhd.

- Tigernix Pte. Ltd.

- Vinno Software Company Limited

- Creatio Inc.

- The Sage Group plc

- Insightly Inc.

- PT VADS Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first digitalisation across SMEs

- 4.2.2 AI-enabled hyper-personalisation driving upsell

- 4.2.3 Social-commerce boom integrating CRM into chat-apps

- 4.2.4 Government 'Go-Digital' incentives in ASEAN

- 4.2.5 Open-API ecosystems lowering vendor lock-in

- 4.2.6 CX outsourcing pivoting to value-add CRM services

- 4.3 Market Restraints

- 4.3.1 Patchy data-privacy enforcement across SEA

- 4.3.2 Scarcity of CRM implementation talent

- 4.3.3 Legacy on-premise ERP lock-ins slowing migration

- 4.3.4 Currency volatility squeezing SaaS budgets

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization size

- 5.1.1 Small and Medium

- 5.1.2 Large Scale

- 5.2 By Deployment model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.2.3 Hybrid

- 5.3 By Application

- 5.3.1 Sales Automation

- 5.3.2 Marketing Automation

- 5.3.3 Customer Service and Support

- 5.3.4 Contact Centre

- 5.4 By End-User Vertical

- 5.4.1 Retail and E-commerce

- 5.4.2 BFSI

- 5.4.3 Manufacturing

- 5.4.4 Services (IT, BPO, Hospitality)

- 5.4.5 Government

- 5.5 By Country

- 5.5.1 Indonesia

- 5.5.2 Singapore

- 5.5.3 Philippines

- 5.5.4 Thailand

- 5.5.5 Malaysia

- 5.5.6 Rest of the South East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Salesforce Inc.

- 6.4.2 Microsoft Corporation (Dynamics 365)

- 6.4.3 Oracle Corporation (Siebel and CX Cloud)

- 6.4.4 SAP SE

- 6.4.5 HubSpot Inc.

- 6.4.6 International Business Machines Corporation

- 6.4.7 Zoho Corporation Pvt. Ltd.

- 6.4.8 Barantum PT Kosada Group

- 6.4.9 Capillary Technologies India Limited

- 6.4.10 Infusion Software Inc. (Keap)

- 6.4.11 SugarCRM Inc.

- 6.4.12 Qontak Pte. Ltd.

- 6.4.13 Deskera Holdings Ltd.

- 6.4.14 Soft Solvers Solutions Sdn. Bhd.

- 6.4.15 Tigernix Pte. Ltd.

- 6.4.16 Vinno Software Company Limited

- 6.4.17 Creatio Inc.

- 6.4.18 The Sage Group plc

- 6.4.19 Insightly Inc.

- 6.4.20 PT VADS Indonesia

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment