PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940668

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940668

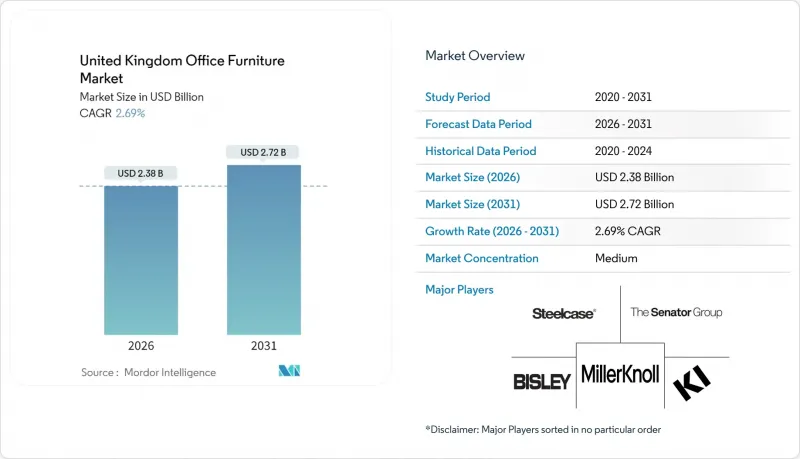

United Kingdom Office Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom office furniture market is expected to grow from USD 2.32 billion in 2025 to USD 2.38 billion in 2026 and is forecast to reach USD 2.72 billion by 2031 at 2.69% CAGR over 2026-2031.

Structural growth arises from hybrid-working adoption, which elevates the need for mobile desks, collaborative zones, and acoustically treated pods that make smaller footprints more productive. Domestic makers benefit from post-Brexit trade complexity because buyers now favor shorter lead times and ESG transparency, while resellers emphasize UK-sourced wood to align with public-sector procurement frameworks that reward local content. Height-adjustable desks are no longer niche items; inclusive wellness policies push many employers to specify sit-stand workstations as standard, enlarging the total addressable opportunity. Technology-ready furniture featuring embedded power, IoT sensors, and cable-management grommets gains traction as enterprises roll out hot-desking software that requires reliable connectivity. Leasing models that combine supply, maintenance, and end-of-life recovery spread from coworking operators to mainstream occupiers, diversifying revenue streams for vendors and reinforcing circular-economy principles.

United Kingdom Office Furniture Market Trends and Insights

Hybrid-working driven space redesign

Hybrid policies shift buying priorities from fixed benches toward modular kits that reconfigure in minutes, making each square meter serve multiple purposes. Booths and dividers that cut 32-45 dB reach premium price points because open-plan floors now require quiet zones for video calls. Facility managers also demand lightweight casters, locking brakes, and integrated charging to permit quick layout changes between team huddles and individual focus work. This constant re-planning encourages suppliers to bundle furniture with move-management services, adding downstream revenue and boosting repeat orders. Height and width adjustability even in storage units shows how flexibility has become a base-line expectation rather than an upgrade. The resulting churn in legacy inventory pushes used assets into secondary marketplaces, accelerating the shift toward subscription models and recycled materials.

Height-adjustable desks enter mainstream

Regulatory guidance on sedentary behaviour plus corporate wellness targets elevate sit-stand solutions from executive suites to general task areas. New lines arrive with collision sensors, Bluetooth controllers, and app-linked memory profiles that let users restore favourite heights, enriching the value proposition. Insurers increasingly reimburse wellness investments, translating health-related claims savings into faster ROI calculations. Procurement teams embed desk power packs to minimize cable clutter when desks travel up and down, thereby simplifying facilities compliance. Suppliers counter installation complexity with prefabricated cable spines and single-socket daisy-chain systems, reducing electrician call-outs. Volume discounts gained from wider deployments push unit prices down, reinforcing mainstream adoption cycles.

Macro office-space downsizing

Permanent cuts in corporate footprints dampen overall volume despite unit upgrades. City landlords report lease-renewal negotiations that shrink area by 20-35% as tenants pivot to hub-and-spoke or hybrid models, removing entire rows of traditional workstations. Although average spend per remaining desk rises on ergonomic and aesthetic enhancements, the absolute count of desks, pedestals, and lockers falls. Design teams offset some decline with collaborative enclaves that require lounge furniture and writable surfaces, but not at one-for-one ratios. Prime-zone real-estate pressures mean that every square meter carries high opportunity cost, forcing furniture to earn its keep through modularity and fold-away forms. Suppliers that fail to pivot toward multi-use solutions risk losing relevance as conventional cubicles fade.

Other drivers and restraints analyzed in the detailed report include:

- ESG-linked public-sector procurement rules

- Circular-economy leasing models

- Import-price volatility for metal frames

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seating held a commanding 37.65% share of the United Kingdom office furniture market in 2025, confirming its irreplaceable role in employee wellness and legal compliance surrounding display-screen equipment risk assessments. The United Kingdom office furniture market size for chairs alone is projected to rise at a modest clip as employers upgrade task models to meet enhanced lumbar-support guidelines. Ergonomic innovations now include synchronized slide mechanisms and breathable mesh backs that dissipate heat during extended video calls. At the same time, booths and office dividers represent the fastest-growing niche at a 2.98% CAGR, powered by privacy needs that stem from hybrid attendance patterns and high call volumes. These self-contained units integrate ventilation fans, acoustic panels, and motion-sensor lighting, making them near-architectural elements that command prices well above conventional desks. Suppliers tout quick assembly kits and forklift-friendly bases to win installation contracts in buildings with tight delivery windows, broadening their revenue beyond manufacturing margins.

Momentum in modular sofas and soft seating illustrates how corporate aesthetics borrow from residential design, blending productivity with comfort to attract staff back on site. Low coffee tables with concealed wireless chargers and high-back lounge pieces that double as impromptu meeting pods satisfy the vogue for informal collaboration corners. Storage lines evolve with lockable credenzas that support planter boxes, merging biophilic design with organization needs to create fresher ambience in shrinking footprints. "Other office furniture" segments reception counters, stools, and height-nested side tables gain relevance because flexible floor plates require diverse perches that enable quick reconfiguration without professional movers. Across all product groups, manufacturers embed QR-coded asset tags that link to manuals, repair videos, and carbon data, meeting ESG reporting duties while facilitating circular-economy take-back.

Wood retained 46.35% share of the United Kingdom office furniture market in 2025, buoyed by its timeless visual warmth and ability to accept bespoke finishes that match branded interiors. Supply-chain resilience further improves as domestic mills source FSC-certified timber from Scotland and Scandinavia, shrinking lead times that importers once dominated. Oak veneer credenzas and ash executive desks remain status symbols within boardrooms, sustaining the premium tier even as overall corporate footprints shrink. Conversely, the plastic and polymer segment advances at a 3.55% CAGR as recycled polypropylene and bio-resins shed their stigma by passing durability and fire-rating tests. Furniture specifiers highlight that each stackable chair now diverts as much as 2 kg of ocean-bound waste, turning sustainability narratives into tangible numbers that satisfy procurement scorecards.

Metal frames, primarily powder-coated steel, remain essential for structural integrity in height-adjustable desks, yet volatility in commodity pricing forces design engineers to optimize gauge thickness and introduce hybrid wood-metal skeletons that cut weight without compromising strength. Glass modesty panels and acoustic PET felt, made from recycled plastic bottles, populate the "other materials" category, opening new design languages that marry transparency with sound absorption. Meanwhile, R&D departments experiment with mycelium-based composites and compressed hemp boards, aspiring to deliver carbon-negative furniture lines that could reset sustainability benchmarks. The multi-material push encourages OEMs to invest in disassembly-friendly fastener systems so each component can be separated for recycling, aligning with incoming extended producer-responsibility rules.

The United Kingdom Office Furniture Market Report is Segmented by Product (Chairs, Tables, Storage Units, and More), Material (Wood, Metal, and More), Price Range (Economy, Mid-Range, Premium), End-User (Corporate Offices, Healthcare Offices, and More), Distribution Channel (B2C/Retail, B2B/Directly From Manufacturers), and Geography (England, Scotland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Senator Group

- Steelcase Inc.

- MillerKnoll (Herman Miller + Knoll)

- Bisley Office Furniture

- KI Europe

- Orangebox Ltd

- Triumph Furniture

- Kinnarps UK

- Humanscale Corporation

- Haworth Inc.

- Teknion UK

- Nowy Styl Group

- Vitra International AG

- Senator Allermuir

- Elite Office Furniture UK

- Verco Office Furniture

- Bene GmbH

- Connection Seating

- Ahrend UK

- Actiu Berkshire

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Hybrid-working driven space re-design

- 4.2.2 Height-adjustable desks enter mainstream

- 4.2.3 ESG-linked public-sector procurement rules

- 4.2.4 Reshoring of bespoke wood furniture

- 4.2.5 Circular-economy leasing models

- 4.2.6 AI-enabled ergonomics optimisation

- 4.3 Market Restraints

- 4.3.1 Macro office-space downsizing

- 4.3.2 Import-price volatility for metal frames

- 4.3.3 Used-furniture surplus pressure

- 4.3.4 Post-Brexit REACH divergence costs

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.8 Insights on Regulatory Framework and Industry Standards for Office Furniture

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Chairs

- 5.1.1.1 Employee Chairs

- 5.1.1.2 Meeting Chairs

- 5.1.1.3 Guest Chairs

- 5.1.2 Tables

- 5.1.2.1 Conference Tables

- 5.1.2.2 Desks

- 5.1.2.3 Other Tables

- 5.1.3 Storage Units

- 5.1.3.1 Filing Cabinets

- 5.1.3.2 Bookcases & Shelving

- 5.1.4 Sofas/Soft Seating

- 5.1.5 Booths and Office Dividers

- 5.1.6 Other Office Furniture (Stools, Reception Area Furniture, Accessories, Others)

- 5.1.1 Chairs

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-range

- 5.3.3 Premium

- 5.4 By End-user

- 5.4.1 Corporate Offices

- 5.4.2 Healthcare Offices

- 5.4.3 Educational Institutions

- 5.4.4 Government & Public Offices

- 5.4.5 Hospitality & Retail Back-office

- 5.4.6 Others

- 5.5 By Distribution Channel

- 5.5.1 B2C / Retail

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Furniture Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B / Directly from Manufacturers

- 5.5.1 B2C / Retail

- 5.6 By Geography

- 5.6.1 England

- 5.6.2 Scotland

- 5.6.3 Wales

- 5.6.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 The Senator Group

- 6.4.2 Steelcase Inc.

- 6.4.3 MillerKnoll (Herman Miller + Knoll)

- 6.4.4 Bisley Office Furniture

- 6.4.5 KI Europe

- 6.4.6 Orangebox Ltd

- 6.4.7 Triumph Furniture

- 6.4.8 Kinnarps UK

- 6.4.9 Humanscale Corporation

- 6.4.10 Haworth Inc.

- 6.4.11 Teknion UK

- 6.4.12 Nowy Styl Group

- 6.4.13 Vitra International AG

- 6.4.14 Senator Allermuir

- 6.4.15 Elite Office Furniture UK

- 6.4.16 Verco Office Furniture

- 6.4.17 Bene GmbH

- 6.4.18 Connection Seating

- 6.4.19 Ahrend UK

- 6.4.20 Actiu Berkshire

7 Market Opportunities & Future Outlook

- 7.1 Modular Home-Office Solutions Supporting Hybrid Work

- 7.2 Space-Saving Designs Supporting High-Rent Work Environments