PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940765

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940765

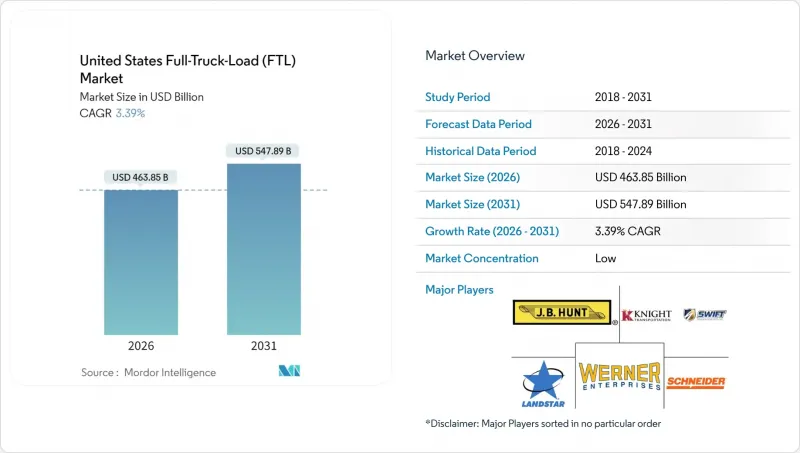

United States Full-Truck-Load (FTL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States full-truck-load market is expected to grow from USD 448.65 billion in 2025 to USD 463.85 billion in 2026 and is forecast to reach USD 547.89 billion by 2031 at 3.39% CAGR over 2026-2031.

This growth arises from a resilient freight mix shaped by e-commerce parcelization, near-shore manufacturing, and the escalating use of dedicated contract carriage. Carriers continue adjusting networks to serve dense fulfillment corridors that replenish distribution centers on predictable schedules, even as driver shortages and diesel-price volatility persist. Federal infrastructure spending keeps construction material flows lively, while cannabis legalization and pharmaceutical cold-chain requirements create premium-priced niches. Strategic lane optimization, asset utilization above 90%, and technology-enabled dispatching are now baseline expectations rather than differentiators in the United States Full-Truck-Load market.

United States Full-Truck-Load (FTL) Market Trends and Insights

Explosive E-commerce Parcelization

Amazon's fast-growing fulfillment estate and the wider omnichannel pivot keep full-truck-load lanes busy between upstream distribution centers and last-mile cross-dock sites. Predictable replenishment schedules enable carriers to lock in dedicated routing contracts, with drop-and-hook models now exceeding 95% of FreightPower platform shipments. Higher return volumes also create reverse-logistics demand, supporting balanced backhauls and superior asset turns. These dynamics underpin service reliability expectations that favor asset-based fleets in the United States Full-Truck-Load market.

Manufacturing Reshoring and Near-shore Trends

The USD 52 billion CHIPS and Science Act catalyzes semiconductor plant construction across the Southeast and Southwest, spawning continuous inbound flows of high-value equipment and construction inputs. Near-shore automotive production in Mexico feeds cross-border corridors where intermodal options now link Monterrey, Laredo, and Atlanta. Shorter yet more frequent hauls lift trip counts, stimulate specialized trailer demand, and lift overall volumes in the United States Full-Truck-Load market.

Driver Shortage and Escalating Labor Costs

Owner-operator exits trimmed Schneider's independent fleet by 12% year-over-year in Q3 2024, mirroring an industry-wide contraction in entrepreneurial capacity. Credit stress resembles 2008 levels as equipment repossessions rise, shifting volume to costlier company drivers. Insurance premiums surge amid nuclear verdict exposure, adding USD 10 million to annual overhead at large carriers. AI-based recruiting and wellness tools show a 49% return on investment, yet the labor gap still depresses long-haul capacity in the United States Full-Truck-Load market.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Investment and Jobs Act Freight Stimulus

- Growth in Dedicated Contract Carriage

- Diesel-Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing held 31.55% of the United States Full-Truck-Load market share in 2025 and is pacing for a 4.03% CAGR between 2026-2031, cementing its status as both volume anchor and growth engine. Semiconductor plant construction, automotive reshoring, and machinery upgrades widen lane density across the Midwest and Southeast. The United States Full-Truck-Load market size tied to manufacturing is anticipated to add more than USD 30.5 billion over the forecast horizon, supported by predictable raw-material inflows and finished-goods outflows. Dedicated flatbed and temperature-controlled equipment gains prominence for sensitive components, a niche where carriers command premium rates. Competitive differentiation hinges on real-time visibility and just-in-time reliability, prompting investment in AI route-planning and sensor-equipped trailers. The United States Full-Truck-Load industry, therefore, witnesses asset mixtures tilting toward specialized rigs that lift yields and bolster carrier.

Outside manufacturing, construction sustains elevated volume on the back of federal infrastructure projects and robust residential demand. Wholesale & retail trade leverages cross-dock networks for e-commerce order pooling, while oil, gas, and mining lanes stay stable on equipment repositioning rhythms. Agriculture's seasonal output supports flexible capacity models, and emerging cannabis logistics further diversifies load mixes with high-margin, compliance-heavy freight.

The United States Full-Truck-Load (FTL) Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others), and Destination (Domestic and International). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ArcBest

- C.H. Robinson

- Covenant Logistics Group Inc.

- CR England Inc.

- DHL Group

- Hirschbach Motor Lines Inc.

- J.B. Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Marten Transport Ltd.

- P.A.M. Transport Inc.

- Penske Logistics

- Prime Inc.

- R+L Carriers

- Ryder System, Inc.

- Schneider National Inc.

- TFI International Inc.

- TransAm Truck Lines Inc.

- United Parcel Service of America, Inc. (UPS)

- Werner Enterprises Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Explosive E-Commerce Parcelization

- 4.20.2 Manufacturing Reshoring and Near-Shore Trends

- 4.20.3 Infrastructure Investment and Jobs Act Freight Stimulus

- 4.20.4 Growth in Dedicated Contract Carriage

- 4.20.5 Cannabis-Supply Legalization Wave

- 4.20.6 Cold-Chain Pharma Expansion

- 4.21 Market Restraints

- 4.21.1 Driver Shortage and Escalating Labor Costs

- 4.21.2 Diesel-Price Volatility

- 4.21.3 Urban Congestion-Pricing Zones

- 4.21.4 Limited Public EV-Truck Charging Corridors

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 ArcBest

- 6.4.2 C.H. Robinson

- 6.4.3 Covenant Logistics Group Inc.

- 6.4.4 CR England Inc.

- 6.4.5 DHL Group

- 6.4.6 Hirschbach Motor Lines Inc.

- 6.4.7 J.B. Hunt Transport, Inc.

- 6.4.8 Knight-Swift Transportation Holdings Inc.

- 6.4.9 Landstar System Inc.

- 6.4.10 Marten Transport Ltd.

- 6.4.11 P.A.M. Transport Inc.

- 6.4.12 Penske Logistics

- 6.4.13 Prime Inc.

- 6.4.14 R+L Carriers

- 6.4.15 Ryder System, Inc.

- 6.4.16 Schneider National Inc.

- 6.4.17 TFI International Inc.

- 6.4.18 TransAm Truck Lines Inc.

- 6.4.19 United Parcel Service of America, Inc. (UPS)

- 6.4.20 Werner Enterprises Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment