PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940837

Africa Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

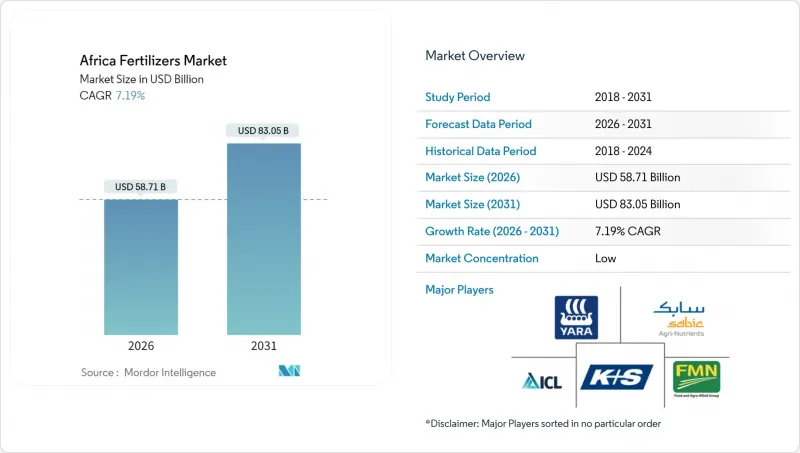

The Africa fertilizer market was valued at USD 54.77 billion in 2025 and estimated to grow from USD 58.71 billion in 2026 to reach USD 83.05 billion by 2031, at a CAGR of 7.19% during the forecast period (2026-2031).

Steady policy alignment across the continent and domestic capacity expansions support this advance as governments prioritize input self-sufficiency and food security. Complex fertilizers dominate volumes by offering balanced nutrient packages that fit precision programs, while straight urea gains cost tailwinds from new Nigerian plants. Digital agronomy, green ammonia investments, and targeted subsidies are broadening smallholder access and stimulating private capital flows toward distribution upgrades. Persistent logistics gaps and recurring global price spikes remain headwinds, but sustained demand for nutrient-dense staple production underpins a resilient growth outlook for the Africa fertilizer market.

Africa Fertilizers Market Trends and Insights

Rising Food-Security Pressure in Africa

Africa's growing population, projected to reach 1.4 billion by 2030, combined with declining arable land per capita, creates sustained demand for increased fertilizer use. Nigeria's zinc-biofortified rice program, launched in April 2024, exemplifies how governments are linking food security to micronutrient density rather than just caloric sufficiency, driving demand for specialized formulations beyond traditional NPK blends. This shift toward nutrient-dense crop production requires higher fertilizer application rates and more sophisticated nutrient management, particularly in maize systems where split applications of straight fertilizers increased yields 22-46% over NPK blends in Nigeria's Middle-Belt trials. The economic imperative intensifies as food import bills strain foreign exchange reserves, making domestic production efficiency a national security priority. Agricultural productivity gains through fertilizer intensification become the primary pathway to food self-sufficiency, creating sustained demand growth even during price volatility cycles.

Subsidy Reforms & Abuja Nairobi Policy Momentum

The Nairobi Declaration 2024 establishes binding fertilizer application targets of 50 kilograms per hectare across African Union member states, creating policy-driven demand that transcends traditional market dynamics. Kenya's Finance Bill 2025 paradoxically removes VAT exemptions on fertilizers while allocating KES 10 billion (USD 77.4 billion) for fertilizer subsidies, indicating the government's commitment to maintaining input access despite fiscal pressures. Nigeria's National Agricultural Technology and Innovation Policy (2022-2027) demonstrates coordinated continental approaches, with subsidy programs increasingly targeting specific crops and regions to maximize food security outcomes. The policy momentum creates predictable demand patterns that enable private sector investment in distribution networks and local blending facilities. Implementation effectiveness varies significantly, with Ghana and Nigeria achieving higher subsidy delivery rates than landlocked Sahel countries facing logistics constraints.

Fertilizer Price-Affordability Shocks

In July 2025, global fertilizer prices increased by 15% in the first half of 2025. Diammonium phosphate (DAP) prices rose by 23%, while triple superphosphate (TSP) prices increased by 43%. These increases resulted from strong Asian demand, China's export restrictions, and high sulfur input costs. The price surge affected smallholder farmers' ability to maintain input intensity levels, as the World Bank's DAP accessibility index reached 1.72 in June 2025, surpassing the early-2022 crisis peaks. Kenya's Finance Bill 2025 compounds affordability pressures by imposing 16% VAT on previously exempt fertilizers, potentially increasing costs by KES 480 (USD 3.71) per 50-kilogram bag and raising total production costs by 15% for smallholders. The price transmission mechanism varies significantly across countries, with Nigeria's rice import duty waivers in 2024 depressing farm-gate prices and reducing farmers' capacity to invest in fertilizers for subsequent seasons. Currency devaluations amplify import cost pressures, while limited access to credit markets prevents farmers from smoothing input purchases across price cycles. Subsidy programs provide partial relief but often suffer from timing delays and targeting inefficiencies that limit their effectiveness during acute price spikes.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Scale-Up of Domestic Production Capacity

- Digital Agronomy Platforms Driving Optimized Use

- Weak Logistics and Retail Distribution Networks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Complex fertilizers dominate with 58.02% market share in 2025, driven by their ability to deliver balanced nutrition in single applications that reduce labor costs and improve nutrient synchronization for smallholder farmers. The 8.27% CAGR growth rate through 2031 reflects increasing sophistication in crop nutrition management, particularly as extension services promote integrated nutrient management practices. Complex fertilizers maintain a significant presence through urea's affordability advantage and flexibility in customized application programs, while micronutrients experience rapid adoption in biofortification programs across Nigeria, Ghana, and Kenya.

In Africa, complex fertilizer market growth is driven by their ability to provide multiple plant nutrients necessary for crop growth in a single application, including primary nutrients, secondary nutrients, and micronutrients. The segment's expansion is supported by increasing awareness among farmers about the benefits of balanced crop nutrition and the environmental advantages of complex fertilizers, which allow for reduced application rates while minimizing both environmental and soil impacts. The emergence of advanced fertilizer types, such as controlled-release and slow-release variants, is further bolstering the adoption of complex fertilizers in the region, particularly in high-value crops and modern farming operations.

Conventional fertilizers hold a 90.76% market share in 2025 and are expected to grow at a 7.14% CAGR through 2031. This dominance reflects the cost sensitivity of smallholder farmers who prioritize affordability over advanced formulations. The segment shows strong growth potential due to increasing awareness of efficient agricultural practices and rising demand for high-value crops. Conventional fertilizers see high adoption rates in intensive farming systems and horticultural crops, where precise nutrient management is essential. The growth is supported by modern irrigation system adoption in commercial farming operations and expanding agricultural practices across the region.

The market leadership of conventional fertilizers stems from their widespread availability, established distribution networks, and lower prices compared to specialty alternatives. These fertilizers dominate field crop applications, accounting for 96% of total fertilizer consumption. Large-scale farming operations and farmers' experience with traditional fertilizer applications strengthen this position. The extensive retail network and accessibility of conventional fertilizers, particularly in rural areas, reinforce their market dominance. In Africa, where cost is a primary factor in fertilizer selection, the conventional segment's value proposition remains strong.

The Africa Fertilizers Market Report is Segmented by Type (Complex, Straight), by Form (Conventional, Specialty), by Application Mode (Fertigation, Foliar, Soil), by Crop Type (Field Crops, Horticultural Crops, Turf & Ornamental), and by Country (Nigeria, South Africa, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons)

List of Companies Covered in this Report:

- Yara International ASA

- SABIC Agri-Nutrients Co.

- ICL Group Ltd

- K+S Aktiengesellschaft

- Golden Fertilizer Company Limited

- OCP S.A.

- Dangote Fertiliser Limited

- Indorama Eleme Fertilizer & Chemicals Limited

- Foskor (Pty) Ltd.

- Haifa Chemicals Ltd.

- Omnia Fertilizer (Pty) Ltd.

- CF Industries Holdings, Inc

- Nutrien Ltd.

- UPL Limited

- Olam Agri Holdings Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

- 4.6 Market Drivers

- 4.6.1 Rising food-security pressure in Africa

- 4.6.2 Subsidy reforms & Abuja+ Nairobi policy momentum

- 4.6.3 Rapid scale-up of domestic production capacity

- 4.6.4 Digital agronomy platforms driving optimized use

- 4.6.5 Low-carbon (green) ammonia investments

- 4.6.6 Micronutrient-led bio-fortification demand

- 4.7 Market Restraints

- 4.7.1 Fertilizer price affordability shocks

- 4.7.2 Weak logistics & retail distribution networks

- 4.7.3 Agro-ecology policy headwinds on synthetics

- 4.7.4 High cost of capital for African green projects

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 Micronutrients

- 5.1.2.1.1 Boron

- 5.1.2.1.2 Copper

- 5.1.2.1.3 Iron

- 5.1.2.1.4 Manganese

- 5.1.2.1.5 Molybdenum

- 5.1.2.1.6 Zinc

- 5.1.2.1.7 Others

- 5.1.2.2 Nitrogenous

- 5.1.2.2.1 Ammonium Nitrate

- 5.1.2.2.2 Urea

- 5.1.2.2.3 Others

- 5.1.2.3 Phosphatic

- 5.1.2.3.1 DAP

- 5.1.2.3.2 MAP

- 5.1.2.3.3 SSP

- 5.1.2.3.4 TSP

- 5.1.2.4 Potassic

- 5.1.2.4.1 MoP

- 5.1.2.4.2 SoP

- 5.1.2.5 Secondary Macronutrients

- 5.1.2.5.1 Calcium

- 5.1.2.5.2 Magnesium

- 5.1.2.5.3 Sulfur

- 5.1.2.1 Micronutrients

- 5.2 Form

- 5.2.1 Conventional

- 5.2.2 Speciality

- 5.2.2.1 CRF

- 5.2.2.2 Liquid Fertilizer

- 5.2.2.3 SRF

- 5.2.2.4 Water Soluble

- 5.3 Application Mode

- 5.3.1 Fertigation

- 5.3.2 Foliar

- 5.3.3 Soil

- 5.4 Crop Type

- 5.4.1 Field Crops

- 5.4.2 Horticultural Crops

- 5.4.3 Turf & Ornamental

- 5.5 Country

- 5.5.1 Nigeria

- 5.5.2 South Africa

- 5.5.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Yara International ASA

- 6.4.2 SABIC Agri-Nutrients Co.

- 6.4.3 ICL Group Ltd

- 6.4.4 K+S Aktiengesellschaft

- 6.4.5 Golden Fertilizer Company Limited

- 6.4.6 OCP S.A.

- 6.4.7 Dangote Fertiliser Limited

- 6.4.8 Indorama Eleme Fertilizer & Chemicals Limited

- 6.4.9 Foskor (Pty) Ltd.

- 6.4.10 Haifa Chemicals Ltd.

- 6.4.11 Omnia Fertilizer (Pty) Ltd.

- 6.4.12 CF Industries Holdings, Inc

- 6.4.13 Nutrien Ltd.

- 6.4.14 UPL Limited

- 6.4.15 Olam Agri Holdings Pte Ltd.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS