PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940906

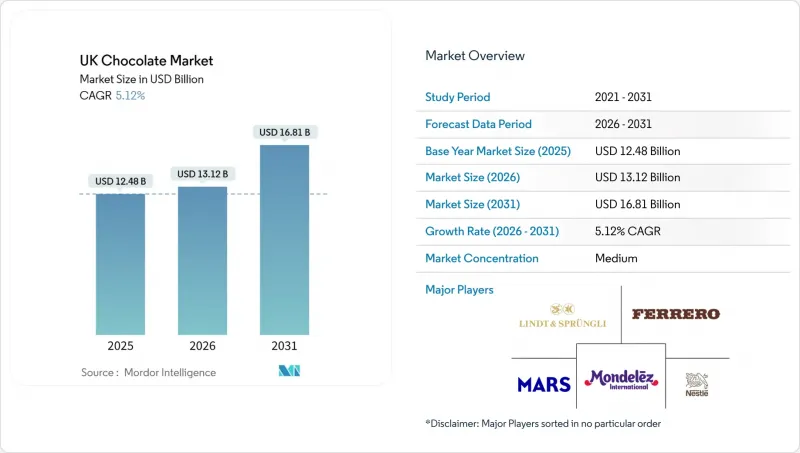

UK Chocolate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom chocolate market size in 2026 is estimated at USD 13.1 billion, growing from 2025 value of USD 12.46 billion with 2031 projections showing USD 16.81 billion, growing at 5.12% CAGR over 2026-2031.

The market's growth is primarily driven by factors such as premiumization, the increasing popularity of plant-based recipes, and the expansion of online retail channels. However, challenges such as fluctuating cocoa prices and the implementation of HFSS (high fat, sugar, and salt) restrictions are exerting pressure on operating margins. To mitigate these challenges, manufacturers have adopted strategies like reducing pack sizes, reformulating recipes, and emphasizing their commitments to ethical sourcing practices. Premium chocolates have successfully retained consumer loyalty, supported by compelling provenance storytelling and the rising demand for health-conscious dark chocolate variants, which justify higher price points. Additionally, the introduction of plant-based chocolate products, often made with alternatives like oat or rice milk, has expanded the category's reach to include flexitarian consumers and those with allergen sensitivities. Furthermore, direct-to-consumer platforms have emerged as a significant growth avenue, enabling manufacturers to secure recurring revenue streams through offerings such as gift subscriptions and tasting clubs. As a result, the United Kingdom's chocolate market is advancing by leveraging innovation in flavor profiles, product formats, and distribution channels, rather than relying solely on headline volume growth.

UK Chocolate Market Trends and Insights

Rising Demand for Premium and Artisanal Chocolate

In 2024, premium chocolate holds a dominant 68.71% share of the United Kingdom market, highlighting a significant transformation in consumer preferences. United Kingdom consumers increasingly perceive chocolate as more than just a daily snack; it is now regarded as an affordable luxury and a thoughtful gift option. This shift is propelling the growth of premium and artisanal chocolate segments, which are distinguished by their sophisticated flavor profiles and superior-quality ingredients. Artisanal and bean-to-bar chocolates, in particular, emphasize craftsmanship, transparency in sourcing, and the exclusivity of limited-edition offerings. These attributes strongly appeal to younger, affluent, and health-conscious consumers who prioritize unique and authentic experiences. Additionally, the United Kingdom's high median household disposable income of GBP 36,700 enables consumers to purchase premium chocolates, even at elevated price points. Premium chocolates often incorporate innovative ingredients, such as spices and superfoods, while also offering healthier alternatives, including reduced sugar content and higher cocoa percentages. This combination caters to the evolving preferences of modern consumers, who seek a balance between wellness and indulgence.

Growing Popularity of Dark Chocolate for Health Benefits

Dark chocolate is anticipated to grow at a robust CAGR of 6.18% through 2030, driven by strong peer-reviewed evidence that highlights the health benefits of cocoa flavanols. These compounds have been shown to improve endothelial function and significantly reduce cardiovascular risks. For instance, studies indicate that consuming 20 grams of high-flavanol dark chocolate daily can result in a clinically meaningful reduction in systolic blood pressure. In response to these findings, manufacturers in the United Kingdom are actively reformulating their products to emphasize higher cocoa percentages and increased polyphenol content. Additionally, they are incorporating functional ingredients such as adaptogens and probiotics to cater to health-conscious consumers. However, the segment's growth is not without challenges. The natural bitterness of dark chocolate often deters mainstream consumers, limiting its appeal. Furthermore, higher cocoa content, while desirable for its health benefits, also increases the risk of exposure to cadmium and lead. These trace metals, which accumulate in cacao beans, are subject to evolving regulatory scrutiny in both the EU and the United Kingdom, posing an additional hurdle for manufacturers.

Sugar Content Concerns and Regulatory Pressure

From October 2025, the United Kingdom government's HFSS regulations will prohibit volume-based promotions, such as "3 for 2" deals, and restrict the prominent placement of high-sugar products in stores. These measures directly challenge the impulse-buying model of chocolate sales. However, reformulating products is less appealing due to taste compromises and the high costs of alternative sweeteners. The advertising restrictions, which include online platforms, also ban paid promotions of HFSS products on broadcast media before 9 PM. This will reduce brand-building budgets, favoring established brands with strong equity over new entrants. Consumers are increasingly aware of "health-washing," where products are marketed as healthy despite containing high sugar levels. This highlights the need for stricter regulatory oversight and consistent labeling to maintain consumer trust. Rising diabetes cases in the United Kingdom are amplifying concerns about sugar content in chocolate. According to Diabetes United Kingdom, nearly 4.6 million people in the UK were living with diabetes in 2024. For chocolate manufacturers, reducing sugar while preserving taste and texture remains a costly and technically challenging task. This complexity affects product acceptance and may lead to higher production costs.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media and Health Lifestyle Trends

- Surge in Sustainable and Ethical Sourcing Practices

- Cocoa Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milk and white chocolate accounted for 53.62% of the market in 2025, driven by their widespread appeal, affordability, and versatility in confectionery applications. Meanwhile, dark chocolate's projected 6.01% CAGR through 2031 highlights a growing preference for health-oriented products. This trend is particularly evident among consumers aged 35-55, who are increasingly looking for functional benefits without relying on pharmaceuticals. The acknowledgment of cocoa flavanols' contribution to vascular health has positioned dark chocolate as a permissible indulgence, enabling manufacturers to charge premium prices compared to milk chocolate. White chocolate, often excluded from health-related claims due to its lack of cocoa solids, remains a niche product but benefits from flavor innovations. For example, ruby chocolate, a berry-flavored variant made from specially processed cocoa beans, has gained traction among premium brands for exclusive limited-edition offerings.

Despite this, the segment's growth faces challenges. The bitterness of 85%+ cocoa bars limits their appeal to mainstream consumers, while the use of sweeteners like stevia to improve taste often results in aftertastes that discourage repeat purchases. To address these issues, manufacturers are introducing "stepped" product lines. Additionally, dark chocolate's higher cocoa content increases the risk of cadmium exposure, a heavy metal found in cacao beans. In response, the Food Standards Agency issued 2024 guidelines recommending a daily consumption limit of 20 grams for high-cocoa products, which could restrict per-capita volume growth. On the other hand, milk chocolate continues to dominate due to its balanced sweetness, creaminess, and affordability. These attributes strongly appeal to budget-conscious families and children. Although the latter group is shrinking due to declining birth rates, they remain a significant market segment, especially as parents increasingly opt for "better-for-you" snack alternatives.

In 2025, tablets and bars accounted for 64.95% of the market, driven by their convenience, portion control, and suitability for on-the-go consumption. Single-serve bars, weighing between 30-50 grams, comply with HFSS portion-size guidelines and enable manufacturers to retain a strong shelf presence despite placement restrictions. Pralines and truffles, growing at a 6.48% CAGR, are leveraging gifting occasions, such as Valentine's Day, Mother's Day, and Christmas. These products are also popular for experiential consumption, where consumers prioritize craftsmanship and presentation over cost. Examples of this premiumization trend include Hotel Chocolat's velvet truffle collections and Charbonnel et Walker's hand-finished pralines. Molded blocks, commonly associated with baking and seasonal gifting, remain in a stable but slow-growth niche, while the "other forms" segment, including chocolate spreads, drinking chocolate, and novelty shapes, benefits from cross-category innovation.

Barry Callebaut's Cabosse Naturals platform, introduced in January 2024, has established a new "whole-fruit chocolate" category by upcycling cacao fruit pulp, peel, and juice into functional ingredients for beverages and snacks. This initiative aligns with the growing consumer focus on sustainability and environmental responsibility, offering a unique value proposition that appeals to eco-conscious buyers. At the same time, advancements in automated enrobing and molding technologies have enabled the replication of praline aesthetics on a larger scale. However, these technologies often fail to replicate the essential textural qualities, such as the snap, melt rate, and ganache viscosity, that define premium pralines. This limitation poses significant scalability challenges for artisan brands, which rely on these nuanced textures to justify their higher price points and maintain their distinct market positioning.

The United Kingdom Chocolate Market Report is Segmented by Product Type (Dark Chocolate, Milk and White Chocolate), Form (Tablets and Bars, and More), Price Range (Mass, Premium), Ingredient Type (Dairy-Based, Plant-Based, Single Origin), and Distribution Channel (Supermarket/Hypermarket, and More). The Market Forecasts are Provided in Terms of Both Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Artisan du Chocolat Ltd

- Barry Callebaut AG

- Chocoladefabriken Lindt and Sprungli AG

- Charbonnel et Walker

- Ferrero International SA

- Hotel Chocolat Group plc

- Land Chocolate Ltd

- Mars Incorporated

- Mondelez International Inc.

- The London Chocolate Company

- Montezuma's Chocolates Ltd

- Moo Free Ltd

- Nestle SA

- Premier Chocolate Ltd

- Whitakers Chocolates Ltd

- Y?ld?z Holding AS

- Tony's Chocolonely UK Ltd

- Green and Black's Organic

- Divine Chocolate Ltd

- Pecan Deluxe Candy Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for premium and artisanal chocolate

- 4.2.2 Growing popularity of dark chocolate for health

- 4.2.3 The influence of social media and health lifestyle

- 4.2.4 Surge in sustainable and ethical sourcing

- 4.2.5 Health-conscious product innovations

- 4.2.6 Innovative new flavors and formats

- 4.3 Market Restraints

- 4.3.1 Sugar content concerns and regulatory pressure

- 4.3.2 Cocoa-price volatility

- 4.3.3 HFSS display and advertising restrictions

- 4.3.4 Artisan-skilled labour shortages

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Product Type

- 5.1.1 Dark Chocolate

- 5.1.2 Milk and White Chocolate

- 5.2 By Form

- 5.2.1 Tablets and Bars

- 5.2.2 Molded Blocks

- 5.2.3 Pralines and Truffles

- 5.2.4 Other Forms

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 Ingredient Type

- 5.4.1 Dairy-based

- 5.4.2 Plant-based

- 5.4.3 Single Origin

- 5.5 Distribution Channel

- 5.5.1 Supermarket/Hypermarket

- 5.5.2 Online Retail Store

- 5.5.3 Convenience Store

- 5.5.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Artisan du Chocolat Ltd

- 6.4.2 Barry Callebaut AG

- 6.4.3 Chocoladefabriken Lindt and Sprungli AG

- 6.4.4 Charbonnel et Walker

- 6.4.5 Ferrero International SA

- 6.4.6 Hotel Chocolat Group plc

- 6.4.7 Land Chocolate Ltd

- 6.4.8 Mars Incorporated

- 6.4.9 Mondelez International Inc.

- 6.4.10 The London Chocolate Company

- 6.4.11 Montezuma's Chocolates Ltd

- 6.4.12 Moo Free Ltd

- 6.4.13 Nestle SA

- 6.4.14 Premier Chocolate Ltd

- 6.4.15 Whitakers Chocolates Ltd

- 6.4.16 Y?ld?z Holding AS

- 6.4.17 Tony's Chocolonely UK Ltd

- 6.4.18 Green and Black's Organic

- 6.4.19 Divine Chocolate Ltd

- 6.4.20 Pecan Deluxe Candy Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK