Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639403

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1639403

Secondary Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

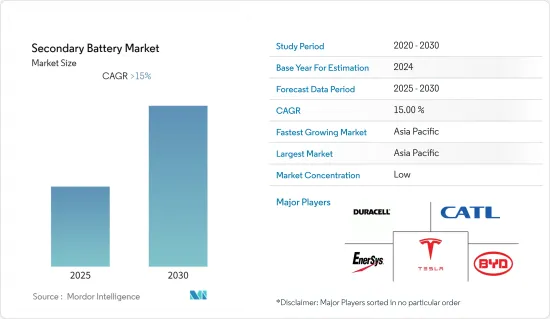

The Secondary Battery Market is expected to register a CAGR of greater than 15% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, declining lithium-ion battery prices and increasing adoption of electric vehicles are likely to be the major factors driving the market.

- On the other hand, the demand-supply mismatch of raw materials is likely to hinder the market's growth.

- Developing new and advanced battery chemistries will likely create immense opportunities for the overall secondary battery market.

- Asia-Pacific is expected to be the largest market, with the majority of the demand coming from China, Japan, and India.

Secondary Battery Market Trends

Lithium-ion Battery Technology to Dominate the Market

- Among different types of battery technologies, lithium-ion battery (LIB) is expected to dominate the secondary battery market in the latter part of the forecast period, majorly due to its favorable capacity-to-weight ratio. Also, other factors that play an important role in boosting the LIB adoption include better performance, higher energy density, and decreasing price.

- Due to its high energy density, the price of lithium-ion batteries decreased considerably from USD 668/kWh in 2013 to USD 123/kWh in 2021, making it a lucrative choice among all batteries.

- Lithium-ion batteries have traditionally been used in consumer electronic devices, such as mobile phones, notebooks, and PCs. However, they are increasingly being redesigned for use as the power source of choice in hybrid and the complete electric vehicle (EV) range, owing to factors such as low environmental impact, as EVs do not emit any CO2, nitrogen oxides, or any other greenhouse gases.

- LIB manufacturing facilities are majorly located in Asia-Pacific, North America, and Europe. Major market players, such as BYD Company Limited and LG Chem Ltd, have plans to set up new manufacturing facilities in the Asia-Pacific region, primarily in India, China, and South Korea.

- Therefore, based on such factors, lithium-ion battery technology is expected to dominate the secondary battery market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region has multiple growing economies with substantial natural and human resources, with China and India expected to be major investment hotspots for secondary battery companies in the coming years due to policy-level support from governments for both renewables and EVs and a growing middle-class population creating demand for consumer electronics.

- India has been witnessing a surge in manufacturing batteries locally due to the government's push toward e-mobility. The Indian government aims to achieve a 30% electric fleet by 2030 and has been formulating policies and programs to achieve the target. For example, in 2021, the government amended the ongoing FAME-II (Faster Adoption and Manufacturing of Electric Vehicles-II) scheme to increase the subsidy rate for electric vehicles from INR 120/kWh to INR 180/kWh to reduce the gap between petrol-powered two-wheelers and electric powered.

- China was the largest electric car market and sold more than 3.3 million electric vehicles, accounting for almost 16% of the global electric car sales in 2021. It is expected to remain the world's largest EV market in the future. The development of charging infrastructure is further propelling EV adoption in the country. Apart from EVs, the increasing penetration of telecommunication services indicates a high demand for secondary batteries.

- Similarly, in Japan, 5G services started in 2020, and an increasing number of subscribers are likely to switch to 5G during the forecast period, thus resulting in a surge in the demand for 5G towers and secondary batteries.

- Therefore, based on such factors, Asia-Pacific is likely to dominate the secondary battery market during the forecast period.

Secondary Battery Industry Overview

The secondary battery market is highly fragmented. Some of the major players include (in no particular order) Contemporary Amperex Technology Co. Limited, BYD Co. Ltd, Duracell Inc., EnerSys, and Tesla Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49322

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Battery/Raw Material Price Trends and Forecast (in USD per kWh or USD per metric ton), by Major Technology Type, till 2027

- 4.5 International Trade Statistics (Import/Export Data) in USD million, by Major Technology Type, by Major Countries, till 2020

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Technologies (NiMh, NiCD, etc.)

- 5.2 Application

- 5.2.1 Automotive Batteries (HEV, PHEV, and EV)

- 5.2.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.2.3 Portable Batteries (Consumer Electronics, etc.)

- 5.2.4 Other Applications (Power Tools Batteries, SLI Batteries, etc.)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Asia-Pacific

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Co. Ltd

- 6.3.2 Contemporary Amperex Technology Co. Limited

- 6.3.3 Duracell Inc.

- 6.3.4 EnerSys

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Clarios

- 6.3.7 LG Chem Ltd

- 6.3.8 Panasonic Corporation

- 6.3.9 Saft Groupe SA

- 6.3.10 Samsung SDI Co. Ltd

- 6.3.11 Showa Denko KK

- 6.3.12 Tesla Inc.

- 6.3.13 TianJin Lishen Battery Joint-Stock Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.