Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685917

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685917

Africa Energy Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 217 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

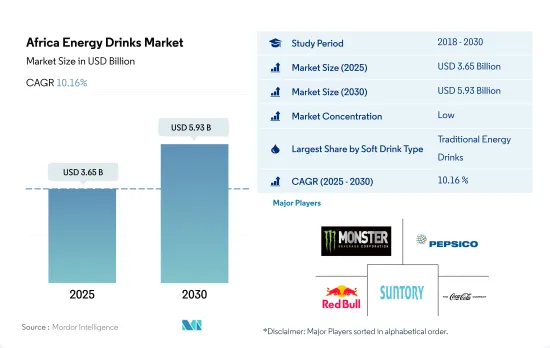

The Africa Energy Drinks Market size is estimated at 3.65 billion USD in 2025, and is expected to reach 5.93 billion USD by 2030, growing at a CAGR of 10.16% during the forecast period (2025-2030).

The rising youth population engaged in active and busy lifestyles is positively influencing energy drink purchase decisions

- From 2019 to 2023, Africa witnessed a surge in the popularity of energy drinks, with both their sales value and volume registering a growth rate of 32.92% and 26.70%, respectively. This uptick in demand can be attributed to factors like a burgeoning young population, urbanization, and rapid lifestyle changes. Global giants like Red Bull and Monster, alongside regional players like Nigerian Breweries PLC, are expanding their footprint in Africa.

- Over the study period, traditional energy drinks dominated the market, accounting for over 48.05% of the market's value in 2023. This dominance is fueled by the increasing availability of energy drinks in diverse flavors and ingredient combinations. Nigeria stands out as the largest consumer of traditional energy drinks, capturing a 50.38% volume share in 2023. This trend is bolstered by Nigeria's youthful demographic, with a median age of 19.4 in 2022, indicative of a vibrant and fast-paced lifestyle.

- The African market is witnessing a notable surge in demand for natural and organic energy drinks, projecting robust CAGRs of 12.17% and 12.21%, respectively, during 2024-2030. This uptick is driven by a rising preference for clean-label products and a heightened awareness of healthy food and beverage choices. A 2020 survey highlighted that over 20% of the urban populations in Egypt, Kenya, and South Africa favored organic food, underscoring the growing demand for organic beverages across Africa.

Growing awareness regarding energy-boosting products likely to boost the segment's sales

- The African energy drinks market witnessed robust growth, with sales surging by 18.73% in value from 2021 to 2023. This surge can be attributed to the rising urbanization and the fast-paced lifestyles of consumers. Energy drinks, known for their fatigue-fighting and alertness-enhancing properties, are gaining traction among consumers. The urban population in Africa has been on a steady rise, reaching 652 million in 2023, and is projected to climb further to 722 million by 2026.

- Urbanization in Africa has brought about a shift in consumer health patterns. With limited physical activity and an increased risk of diseases like obesity and cardiovascular ailments, the demand for energy-boosting alternatives, such as energy drinks, is on the rise. In 2022, half of South Africa's adult population was either overweight (23%) or obese (27%). The World Obesity Federation predicts a further 10% rise in adult obesity, reaching 37% by 2030.

- Nigeria is poised to lead the African energy drink market, with a projected volume CAGR of 14.14% during the period from 2024 to 2030. The Nigerian market boasts a range of energy drink brands, including Red Bull, Power Horse, and Power Fist, which are actively introducing new flavors like cranberry, watermelon, orange, and blueberry. The expanding fitness services landscape in Nigeria is also driving the demand for health and wellness products, including energy drinks. With a surge in fitness activities and improved fitness center infrastructure, Nigeria is expected to witness a notable uptick in energy drink sales.

Africa Energy Drinks Market Trends

Consumer perception of energy drinks in Africa is primarily influenced by concerns associated with excessive consumption and potential side effects

- Consumption of energy drinks products is highly valued by individuals of different ages in the African region particularly prevalent among those aged 20 to 30. Energy drink consumption was higher among people who were younger and had higher levels of education.

- Product attributes such as sugar-free and natural ingrdients enrgy drinks attract the consumers in the African region with the rising awareness of the health risks associated with sugar consumption. Sugary drinks have been linked to a number of health problems, including obesity, diabetes, and heart disease.

- The population living in large urban areas in the country has increased constantly supporting the gorwth of energy drinks. The retail price of an average energy drinks ranges between USD 1 to USD 1.50 per 250ml.

- Demand for low calories and sugar free alternatives has risen among consumers in the country due to health effects of high sugar intake and consumption diabetes and obesity. Although approximately 43% of the population is suffering from obesity in Ghana.

Africa Energy Drinks Industry Overview

The Africa Energy Drinks Market is fragmented, with the top five companies occupying 38.81%. The major players in this market are Monster Beverage Corporation, PepsiCo, Inc., Red Bull GmbH, Suntory Holdings Limited and The Coca-Cola Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49288

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Buying Behaviour

- 4.2 Innovations

- 4.3 Brand Share Analysis

- 4.4 Regulatory Framework

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Soft Drink Type

- 5.1.1 Energy Shots

- 5.1.2 Natural/Organic Energy Drinks

- 5.1.3 Sugar-free or Low-calories Energy Drinks

- 5.1.4 Traditional Energy Drinks

- 5.1.5 Other Energy Drinks

- 5.2 Packaging Type

- 5.2.1 Glass Bottles

- 5.2.2 Metal Can

- 5.2.3 PET Bottles

- 5.3 Distribution Channel

- 5.3.1 Off-trade

- 5.3.1.1 Convenience Stores

- 5.3.1.2 Online Retail

- 5.3.1.3 Supermarket/Hypermarket

- 5.3.1.4 Others

- 5.3.2 On-trade

- 5.3.1 Off-trade

- 5.4 Country

- 5.4.1 Egypt

- 5.4.2 Nigeria

- 5.4.3 South Africa

- 5.4.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Aje Group

- 6.4.2 Halewood International South Africa (Pty) Ltd

- 6.4.3 Mofaya Beverage Company (PTY) Ltd

- 6.4.4 Monster Beverage Corporation

- 6.4.5 Mutalo Group sp. z o.o

- 6.4.6 PepsiCo, Inc.

- 6.4.7 Red Bull GmbH

- 6.4.8 S. Spitz GmbH

- 6.4.9 Suntory Holdings Limited

- 6.4.10 The Alternative Power (Pty) Ltd

- 6.4.11 The Coca-Cola Company

- 6.4.12 Tiger Brands Ltd.

7 KEY STRATEGIC QUESTIONS FOR SOFT DRINK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.