PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849974

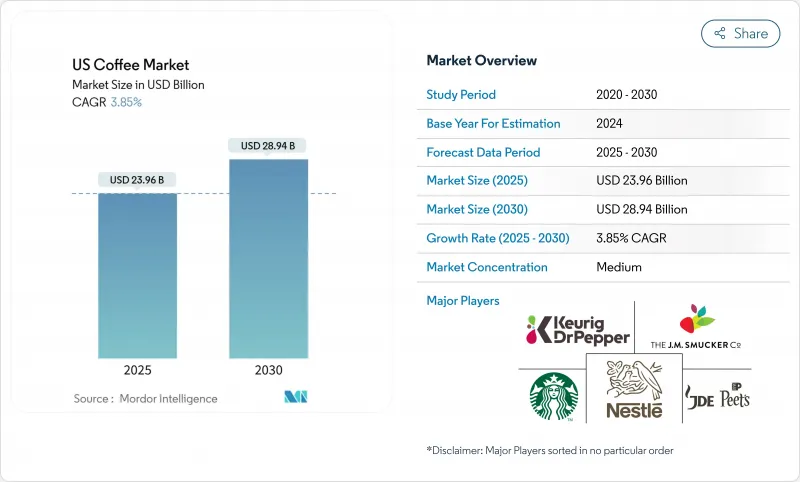

US Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States coffee market value is expected to grow from USD 23.96 billion in 2025 to USD 28.94 billion by 2030, at a CAGR of 3.85%.

The market demonstrates resilience through premium product offerings, incorporation of functional ingredients, and sustained at-home consumption patterns, despite challenges from climate variability and rising costs. Urban areas have experienced an expansion of specialty coffee establishments and sophisticated coffee houses, which serve as social and work spaces while enhancing local community engagement. Off-trade sales constitute the largest market share, driven by the growing preference for home consumption and accessibility through retail channels. While ground coffee maintains a strong market presence, single-serve pods show the highest growth rate, with convenience outweighing environmental considerations. California leads the market in sales and coffee imports, while Florida exhibits the strongest growth rate, supported by tourism and Hispanic cultural influences. Sustainability and ethical sourcing have become paramount considerations in the coffee industry, influencing both consumer preferences and corporate strategies.

US Coffee Market Trends and Insights

Premiumization and third-wave adoption among consumers

The third-wave coffee movement is reshaping consumer preferences, with Millennials and Gen Z driving demand for premium, artisanal coffee. Single-origin beans, ethical sourcing, and sustainability are increasingly important, creating high-margin opportunities for brands. Consumers are willing to pay more for certified coffees like Fair Trade and Rainforest Alliance, prompting companies to offer organic, responsibly sourced products. In December 2023, Metropolis Coffee launched four Fairtrade-certified coffees across retail and online channels. Retailers are also enhancing packaging and educating buyers through workshops and digital tools. While urban areas lead specialty coffee growth, suburban markets are catching up as brands expand their reach. This shift reflects a broader lifestyle alignment, where coffee is seen not just as a beverage but as an expression of personal values and identity.

Growing demand for functional and specialty coffee range

In the U.S., functional coffee is growing in popularity as consumers seek health benefits alongside caffeine. These coffees include adaptogens for stress relief, nootropics for cognitive enhancement, and vitamins for immunity. Market growth is driven by innovations combining traditional coffee with health-focused ingredients. For instance, in January 2025, Grateful Earth launched a blend with Lion's Mane and Chaga mushroom extracts, turmeric, cinnamon, L-theanine, and black pepper to support cognitive function and immunity. Younger consumers prefer cold-brew options for focus, while former tea drinkers opt for calming blends. Brands like Throne Sport Coffee add B-vitamins, and Four Sigmatic offers mushroom-infused varieties. This trend has created new consumption occasions, from pre-workout drinks to evening adaptogenic blends, encouraging CPG companies to develop natural products. A 2024 National Coffee Association survey found 45% of U.S. participants consumed specialty coffee the previous day, reflecting its growing integration into daily routines .

Climate-induced yield volatility raising costs

Severe weather in major coffee-growing regions has disrupted production, impacting U.S. market prices. FAO data shows that weather-related supply disruptions caused 40% of price hikes in 2024. Vietnam's coffee production fell 20% in 2023/24 due to prolonged dry spells, with exports dropping 10% for the second consecutive year. Indonesia's production declined 16.5% year-on-year, as April-May 2023 rains damaged coffee cherries and cut exports by 23%. Brazil's 2023/24 production forecast shifted from a 5.5% increase to a 1.6% decline due to drought in key states like Minas Gerais and Sao Paulo . These supply issues have raised retail coffee prices. Climate models predict reduced suitable land for coffee cultivation, sustaining price pressures and limiting growth in price-sensitive markets.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in coffee brewing methods

- Growth in the coffee house stores fueling market demand

- Detrimental impact of coffee pods and capsules on the environment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, ground coffee holds 38.60% of the U.S. coffee market, driven by its versatility across brewing methods and competitive pricing. Its adaptability and cost advantages secure its market dominance. The pods and capsules segment is set to grow at a 5.73% CAGR through 2030, fueled by demand for convenience, cleanliness, and consistent flavor. Increased household coffee machine adoption and expanded roast and flavor options support this growth, while environmental concerns drive demand for recyclable and biodegradable pods.

Whole-bean coffee gains momentum through the home-barista movement, appealing to consumers who value freshness and grinding customization for optimal brewing. Instant coffee manufacturers respond to market changes by introducing specialty origin products and micro-ground additions, though growth remains below other formats. The category continues development through premium ingredients and enhanced processing methods. Sustainable innovations, including plastic-free pods and Solinatra's natural capsule development, align with environmental regulations and consumer preferences for eco-friendly options.

In 2024, conventional coffee commands a robust 53.35% share of the U.S. market, bolstered by established economies of scale, deep-rooted consumer familiarity, and savvy pricing strategies. Meanwhile, the specialty coffee segment is on an upward trajectory, boasting a 6.83% CAGR. This growth is largely fueled by a rising consumer appetite for unique flavor profiles, a push for transparency in the supply chain, and a commitment to verifiable, sustainable sourcing. Notably, younger demographics, especially Millennials and Gen Z, are steering this shift, increasingly favoring specialty products and premium coffee experiences.

While the overall coffee market sees steady growth, the U.S. specialty coffee sector is outpacing it, with consumers showing a marked preference for single-origin beans, light roasts, and advanced brewing techniques. Many now view specialty coffee not just as a treat but as a healthier choice, often with lower sugar content and heightened antioxidant levels. This perception solidifies its premium status. In light of these trends, conventional coffee producers are pivoting, rolling out limited-edition micro-lot offerings, and pursuing robust sustainability certifications to stay relevant and competitive.

The US Coffee Market Report is Segmented by Product Type (Whole Bean, Ground Coffee, Instant Coffee, and Coffee Pods and Capsules), Type (Conventional and Specialty), Packaging Type (Flexible, Rigid, and Single-Serve), Distribution Channel (On-Trade and Off-Trade Channel) and Geography (California, Texas, Florida, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Starbucks Corporation

- J.M. Smucker Co.

- Keurig Dr Pepper Inc.

- Nestle SA

- Kraft Heinz Co.

- JDE Peet's

- Luigi Lavazza S.p.A

- Community Coffee Company

- Dunkin' Brands Group, Inc.

- Farmer Brothers Co.

- La Colombe Coffee Roasters

- Death Wish Coffee Co.

- Black Rifle Coffee Company

- High Brew Coffee

- Bulletproof 360 Inc.

- Allegro Coffee Company

- RISE Brewing Co.

- Coffee Bros

- Philz Coffee

- Counter Culture Coffee

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumization and Third-Wave Coffee Adoption amoung Consumers

- 4.2.2 Growing demand for Functional and Specialty Coffee Range

- 4.2.3 Urbanization and a Fast-Paced Lifestyle Drive Demand in On-Trade Distribution

- 4.2.4 Innovativation in Coffee Brewing Methods

- 4.2.5 Growth of Home-Barista Equipment Boosting Whole-Bean Sales

- 4.2.6 Growth in the Coffee House Stores Fueling Market Demand

- 4.3 Market Restraints

- 4.3.1 Climate-Induced Yield Volatility Raising Costs

- 4.3.2 Detrimental Impact of Coffee Pods and Capsules on the Environment

- 4.3.3 Growing Consumers Awareness Regading the Adverse Impacts of Caffeine on Human Health

- 4.3.4 Competition from Alternative Beverages

- 4.4 Value/Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Trade and Production Analysis

- 4.7 Consumer Behaviour Analysis

- 4.8 Technological Outlook

- 4.9 Specialized Certifications by Coffee Producers and Manufactuers

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Buyers/Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Whole Bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Coffee Pods and Capsules

- 5.2 By Type

- 5.2.1 Conventional Coffee

- 5.2.2 Specialty Coffee

- 5.3 By Packaging Type

- 5.3.1 Flexible (Bags, Pouches)

- 5.3.2 Rigid (Cans, Jars)

- 5.3.3 Single-Serve (Capsules, Pods, Sachets)

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Convenience/Grocery Stores

- 5.4.2.3 Online Retail

- 5.4.2.4 Other Off-Trade Channels

- 5.5 By Geography

- 5.5.1 California

- 5.5.2 Texas

- 5.5.3 Florida

- 5.5.4 New York

- 5.5.5 Pennsylvania

- 5.5.6 Illinois

- 5.5.7 Rest of United States

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products AND Services, and Recent Developments)

- 6.4.1 Starbucks Corporation

- 6.4.2 J.M. Smucker Co.

- 6.4.3 Keurig Dr Pepper Inc.

- 6.4.4 Nestle SA

- 6.4.5 Kraft Heinz Co.

- 6.4.6 JDE Peet's

- 6.4.7 Luigi Lavazza S.p.A

- 6.4.8 Community Coffee Company

- 6.4.9 Dunkin' Brands Group, Inc.

- 6.4.10 Farmer Brothers Co.

- 6.4.11 La Colombe Coffee Roasters

- 6.4.12 Death Wish Coffee Co.

- 6.4.13 Black Rifle Coffee Company

- 6.4.14 High Brew Coffee

- 6.4.15 Bulletproof 360 Inc.

- 6.4.16 Allegro Coffee Company

- 6.4.17 RISE Brewing Co.

- 6.4.18 Coffee Bros

- 6.4.19 Philz Coffee

- 6.4.20 Counter Culture Coffee

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK