PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851988

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851988

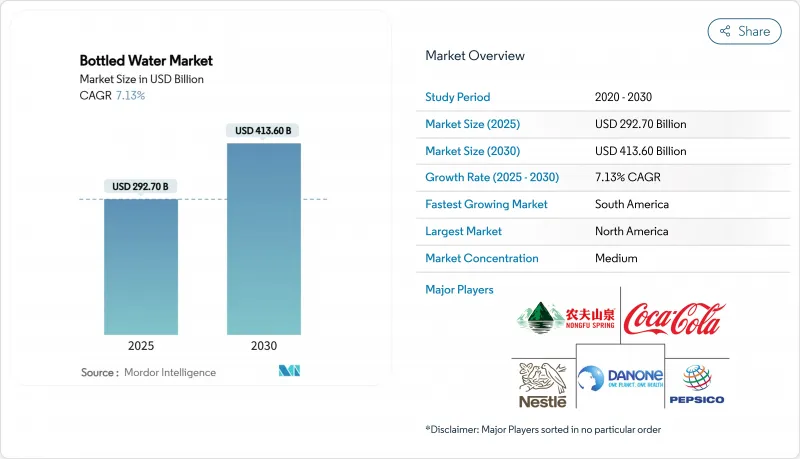

Bottled Water - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bottled water market size is USD 292.7 billion in 2025 and is forecast to reach USD 413.6 billion in 2030, advancing at a 7.13% CAGR.

As regulators clamp down on single-use plastics, industry players are turning to premiumization strategies, successfully elevating average selling prices. Consumers, increasingly prioritizing wellness, hydration, and brand narratives, are driving up the category's value. Meanwhile, technological advancements in purification and packaging are helping to counterbalance the rising costs of compliance. Major players in the industry are ramping up mergers, forging partnerships, and investing in recycled materials, all in a bid to navigate cost pressures and safeguard their reputations. Yet, local and regional contenders are making their mark, leveraging artisanal branding and strategic channel placements. As a result, the bottled water market is transitioning from mere convenience to a holistic focus on health, sustainability, and brand experience.

Global Bottled Water Market Trends and Insights

Premiumisation and "Permissible Indulgence" Positioning

Shifts in consumer psychology have transformed bottled water purchases from mere necessities to choices driven by wellness-oriented lifestyles. This evolution has granted brands pricing power, challenging the norms of traditional commodity markets. In 2023, Nongfu Spring showcased this trend, raking in RMB 42.67 billion (USD 5.8 billion) in revenue. Despite facing a nationalist backlash, the company leveraged a premium positioning strategy for its natural spring water products. The concept of "permissible indulgence" plays a pivotal role, allowing consumers to view their premium water purchases as investments in health rather than mere luxuries. This shift in perception empowers brands to set prices 200-400% higher than mass-market counterparts, all while enjoying consistent volume growth. Categories like electrolyte-enhanced and vitamin-fortified waters are riding this wave, presenting clear health benefits that validate their premium pricing. This approach finds particular resonance in developed markets, where higher disposable incomes make discretionary spending on health perceptions more feasible.

Innovative Packaging Solutions for Convenience and Environmental Impact

In response to regulatory pressures and growing consumer concerns about the environment, the packaging industry is turning to innovation. Technological breakthroughs are not only helping companies meet sustainability standards but also offering them a chance to stand out in the market. A notable leap forward came in November 2024, when Suntory unveiled the world's first commercial PET bottles made from bio-paraxylene, sourced from used cooking oil. This move, as highlighted by the Suntory Group, aims to produce 45 million beverage PET bottles each year and promises a reduction in CO2 emissions when compared to traditional petroleum-based materials. Meanwhile, the European Union is tightening its grip on plastic use. Their Single-Use Plastics Directive requires PET bottles to contain 25% recycled content by 2025, increasing to 30% by 2030. Such mandates are pushing companies across the value chain to ramp up their innovation investments, a sentiment echoed by the European Commission. On the technology front, KHS Freshsafe's PET Plasmax glass coating is making waves. It offers a hybrid solution, ensuring PET remains recyclable while boasting premium glass-like barrier properties. In South Korea, a legislative move is reshaping the market. By 2026, external labels on bottled water will be banned, a shift that's propelling the adoption of labelless bottle technologies. This change, as noted by Domino Printing Sciences, could potentially wipe out 24.6 million tonnes of plastic waste annually.

Microplastic and Nanoplastic Health Concerns

Scientific research revealing widespread microplastic contamination in bottled water poses challenges to consumer confidence and invites regulatory scrutiny, jeopardizing market fundamentals. Research from the National Institutes of Health (NIH) highlights that bottled water harbors an average of 240,000 plastic particles per liter, predominantly in the form of nanoplastics. Notably, 90% of these detected particles are identified as polyamide and polyethylene terephthalate (PET). In August 2024, the FDA launched a webpage addressing micro- and nanoplastics, confirming their presence in various foods, including bottled water. However, the FDA noted a lack of conclusive evidence linking these particles to health risks, introducing a layer of regulatory ambiguity that could sway industry investment choices, as highlighted by the Food Packaging Forum. Major brands are facing class action lawsuits, accused of misleading advertising concerning microplastic content. Courts have permitted these cases to advance, focusing on claims of consumer deception rather than substantiated health risk evidence. The International Bottled Water Association (IBWA) is under mounting pressure to tackle these contamination issues, advocating for heightened industry standards and rigorous testing protocols. Environmental groups, through consumer awareness campaigns, are amplifying concerns over health implications, potentially steering consumers towards pricier alternatives like different packaging materials or advanced filtration systems.

Other drivers and restraints analyzed in the detailed report include:

- Growing On-the-Go Hydration in Emerging Megacities

- Adoption of Advanced Purification and Bottling Technologies

- Anti-Single-Use-Plastic Legislation Momentum

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, still water commands a dominant 73.62% share of the market, underscoring entrenched consumer preferences and a robust distribution network. Meanwhile, the functional and flavored water segments are on an upward trajectory, boasting an 8.53% CAGR projected through 2030. This shift underscores a notable evolution in hydration consumption patterns. The pivot towards premium water products highlights successful strategies that elevate basic hydration to wellness-centric lifestyle choices. Sparkling water enjoys consistent growth, buoyed by trends in natural carbonation and its role as a mixer. Concurrently, the functional waters segment diversifies, branching into vitamin-enhanced, electrolyte sports, and botanical fruit-infused categories, each catering to distinct health objectives.

Vitamin-enhanced waters tap into the supplement market, providing a convenient nutrient boost. This appeals to health-conscious consumers who desire more than just hydration. Waters infused with electrolytes and marketed for sports are riding the wave of an expanding fitness culture. Urban markets, with their bustling gym memberships and outdoor activities, showcase a pronounced demand for these specialized hydration solutions. Meanwhile, botanical and fruit-infused waters strike a balance, catering to flavor enthusiasts while upholding a health-centric image. They steer clear of artificial additives, a concern for many in the wellness community. Insights from consumer perception studies, as highlighted by the SupplySide Food & Beverage Journal, reveal that functional waters command premium pricing. This is largely due to their perceived tangible health benefits, granting them a sustainable edge over traditional commodity alternatives.

In 2024, PET bottles dominate the market with a 61.83% share, thanks to their cost advantages and established recycling infrastructure. Meanwhile, glass bottles are on the rise, boasting a 9.25% CAGR, fueled by growing sustainability concerns and a push for premium positioning. This shift in packaging underscores consumers' readiness to pay a premium for perceived environmental benefits and enhanced product protection. Aluminum cans and bottles are carving out a niche, especially in sparkling water and functional beverages, where their metallic allure boosts brand differentiation and shelf visibility. Glass packaging, while commanding a premium price, offers full recyclability and chemical inertness, traits that resonate with health-conscious consumers wary of plastic migration.

However, the heavier weight of glass poses transportation cost hurdles, challenging distribution efficiency. Yet, premium brands adeptly counterbalance these costs with elevated margins and strategic market positioning. Innovations in PET, such as bio-based materials and cutting-edge barrier coatings, are striving to close the sustainability gap without sacrificing cost competitiveness, as highlighted by the Suntory Group. The EU's recycled content mandates, emphasizing a 25% recycled content by 2025, are not just pushing PET technology advancements but are also reshaping supply chains, a sentiment echoed by the European Commission. Meanwhile, alternative packaging materials like plant-based plastics and hybrid solutions are emerging as potential game-changers, though their commercial success is currently hampered by cost and performance challenges.

The Bottled Water Report is Segmented by Type (Still Water, Sparkling Water, Functional/Flavoured Water), Packaging Material (PET Bottles, Glass Bottles, Aluminum Cans and Bottles, Others), Pricing (Mass, Premium/Luxury), Distribution Channel (On-Trade, Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a dominant 28.44% share of the bottled water market, leveraging its established infrastructure and premium consumption habits. The region's advanced logistics and extensive rPET collection networks cater to a growing consumer preference for functional hydration. Retailers are allocating significant shelf space to electrolyte, alkaline, and flavored water extensions, which command higher price points. Furthermore, deposit-return schemes across several states have boosted recycling rates to over 70%, according to the U.S. Environmental Protection Agency. However, with California and Washington tightening recycled content mandates, there's a looming concern: these regulations could elevate costs for traditional PET formats. Meanwhile, grocery chains are intensifying competition by rolling out organic-focused private labels, putting pressure on mid-tier national brands.

South America is on the fast track, boasting the highest CAGR at 10.37%. Swift urbanization, infrastructure challenges, and a rise in disposable incomes fuel this surge. In Brazil's megacities, sporadic municipal water quality concerns have led middle-class families to view packaged water as a necessity. While government water-public-partnership initiatives promise to address long-term water scarcity, immediate reliability issues are driving consumers towards multi-pack purchases. In Chile and Colombia, a trend towards premiumization is evident, spurred by health-conscious lifestyles and an influx of tourists favoring glass or recycled-content PET. Although regional production is fragmented, there's a noticeable trend of consolidation as multinational bottlers snap up artisanal brands to gain rights to local aquifers.

Asia-Pacific, while a major player in global bottled water consumption, showcases vast disparities in purchasing power and regulatory rigor. Urban consumers in China are gravitating towards premium mineral water. In contrast, India's bottled water sector grapples with inconsistent enforcement of BIS standards, influencing technology investments. Distribution challenges arise in Indonesia due to its archipelagic nature, leading to a rise in refill-station formats alongside conventional PET retail. In the Middle East and parts of Africa, deep-aquifer sourcing caters to high-margin desert tourism and expatriates. Yet, political instability and logistical challenges hinder consistent market growth. These regional nuances highlight the importance of localized production, tailored supply strategies, and proactive regulatory engagement for sustained market expansion.

- Nestle SA

- Danone SA

- The Coca-Cola Company

- PepsiCo Inc.

- Nongfu Spring Co. Ltd

- Suntory Holdings Ltd

- BlueTriton Brands Inc.

- Fiji Water Company LLC

- Bisleri International Pvt Ltd

- VOSS of Norway ASA

- Icelandic Glacial

- CG Roxane LLC (Crystal Geyser)

- Wahaha Group Co. Ltd

- Tingyi (Cayman Islands) Holding Corp.

- Alma Group

- Danone Waters China

- Roxane SAS (Cristaline)

- Parle Agro Pvt Ltd

- Suntory Beverage & Food Asia

- China Resources Holdings Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Premiumisation and "permissible indulgence" positioning

- 4.2.2 Innovative packaging solutions for convenience and environmental impact

- 4.2.3 Growing on-the-go hydration in emerging megacities

- 4.2.4 Adoption of advanced purification and bottling technologies

- 4.2.5 Deep-aquifer sourcing in water-stressed regions

- 4.2.6 Expansion of the tourism and hospitality sector

- 4.3 Market Restraints

- 4.3.1 Microplastic and nanoplastic health concerns

- 4.3.2 Anti-single-use-plastic legislation momentum

- 4.3.3 Carbon-footprint labelling and scope-3 scrutiny

- 4.3.4 Strict government bans and penalties

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Still Water

- 5.1.2 Sparkling Water

- 5.1.3 Functional / Flavoured Water

- 5.1.3.1 Vitamin-Enhanced

- 5.1.3.2 Electrolyte / Sports

- 5.1.3.3 Botanical / Fruit-Infused

- 5.2 By Packaging Material

- 5.2.1 PET Bottles

- 5.2.2 Glass Bottles

- 5.2.3 Aluminum Cans and Bottles

- 5.2.4 Others

- 5.3 By Pricing

- 5.3.1 Mass

- 5.3.2 Premium/ Luxury

- 5.4 By Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Supermarkets / Hypermarkets

- 5.4.2.2 Convenience / Grocery Stores

- 5.4.2.3 Home and Office Space

- 5.4.2.4 Online Retail

- 5.4.2.5 Other Off-trade chanels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Danone SA

- 6.4.3 The Coca-Cola Company

- 6.4.4 PepsiCo Inc.

- 6.4.5 Nongfu Spring Co. Ltd

- 6.4.6 Suntory Holdings Ltd

- 6.4.7 BlueTriton Brands Inc.

- 6.4.8 Fiji Water Company LLC

- 6.4.9 Bisleri International Pvt Ltd

- 6.4.10 VOSS of Norway ASA

- 6.4.11 Icelandic Glacial

- 6.4.12 CG Roxane LLC (Crystal Geyser)

- 6.4.13 Wahaha Group Co. Ltd

- 6.4.14 Tingyi (Cayman Islands) Holding Corp.

- 6.4.15 Alma Group

- 6.4.16 Danone Waters China

- 6.4.17 Roxane SAS (Cristaline)

- 6.4.18 Parle Agro Pvt Ltd

- 6.4.19 Suntory Beverage & Food Asia

- 6.4.20 China Resources Holdings Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS