PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640431

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1640431

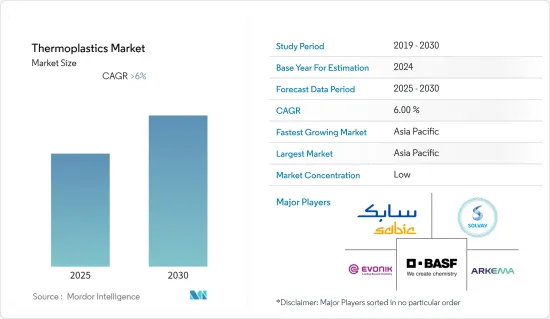

Thermoplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Thermoplastics Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 outbreak caused worldwide lockdown, disruption in manufacturing activity and supply networks, and production halts, all of which harmed the market in 2020. However, conditions began to improve in 2021, resuming the market's growth trajectory throughout the projection period.

Key Highlights

- The expanding capacity additions in downstream processing and the growing consumer goods and electronic sectors are projected to benefit the market under consideration.

- However, environmental concerns related to thermoplastics are expected to hinder the market's growth.

- The growing popularity of bio-based products is expected to act as an opportunity for the market.

- The Asia-Pacific region is expected to dominate the market and will likely witness the highest CAGR during the forecast period.

Thermoplastic Market Trends

Increasing Demand from Automotive and Transportation

- Thermoplastics are widely employed in a variety of automotive and transportation applications. Automobile airbags, under-the-hood uses, and automotive electrical and electronics are some engineering plastics applications.

- The growing demand for lightweight materials in the automotive industry to improve the economy and provide design flexibility is driving the thermoplastics market's expansion.

- After a difficult COVID era, the automobile sector began to see a resurgence in investments and production, particularly in Asia-Pacific countries such as China, India, Indonesia, and Malaysia.

- The International Energy Agency, in its global EV Outlook of 2022, also stated that there had been an exponential increase in the sales of electric vehicles. The sales of electric vehicles (EVs) doubled in 2021 from the previous year to a new record of 6.6 million units. Sales of electric cars have kept rising strongly in 2022 as well, with 2 million units sold in the first quarter, up 75% from the same period in 2021.

- According to the China Association of Automobile Manufacturers, China saw an increase in automotive production in the country of around 3.4% in the year 2022 compared to the previous year. Around 27 million units of automobiles were produced in the year 2022 as compared to 26.08 million units produced in 2021.

- North America is witnessing a huge demand for lightweight automobiles, driven by the growing consumer preference for high-quality, fuel-efficient automobiles. Therefore, the region's utilization of engineering plastics for manufacturing automobiles is rapidly increasing.

- Furthermore, the presence of automotive giants in the European region and massive investments in the automotive R&D industry by European firms and governments are fueling the region's thermoplastics growth.

China to Dominate the Market Growth in Asia-Pacific

- The Asia-Pacific region is expected to dominate the market. China is one of the fastest emerging economies and became one of the world's biggest production houses for automobiles, plastics, electronics, and construction.

- According to the China Association of Automobile Manufacturers, sales of New Energy Vehicles increased by 93.4% in 2022 compared to 2021. The overall sales of new energy cars at the end of 2022 were around 6.8 million, compared to only approximately 3.5 million sales for the entire year in 2021.

- China is experiencing massive growth in its construction sector. According to the National Bureau of Statistics of China, in the fourth quarter of 2022, the construction output in China was valued at approximately CNY 276 billion (~USD 40 billion), a growth of approximately 50% compared to the previous quarter (~USD 27.6 billion).

- According to the National Bureau of Statistics of China, in the first eight months of 2022, the total plastic production in China stood at 53.07 million metric tons, compared to the previous year's 53.32 million metric tons of plastic products for the same period.

- China also proposed its FY 2022 defense budget of around CNY 1.45 trillion (USD 230 billion), a 7.1% year-on-year increase from 2021. Also, by 2025, China's total number of aircraft is expected to reach 5,343, according to the reports issued by the Aviation Industry Development Research Center of China, thus augmenting the market studied.

- Therefore, the demand for thermoplastics from various end-user industries is expected to increase during the forecast period.

Thermoplastic Industry Overview

The thermoplastics market is fragmented, with few players holding the major share in the market. Key players in the thermoplastics market (not in any particular order) include BASF SE, Evonik Industries AG, Solvay, SABIC, and Arkema.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapid Increase in Downstream Processing Capacity Additions

- 4.1.2 Growing Consumer Goods and Eelctronics Industries

- 4.2 Restraints

- 4.2.1 Environmental Concerns Related to thermoplastics

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Commodity Thermoplastics

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polypropylene (PP)

- 5.1.1.3 Polyvinyl chloride (PVC)

- 5.1.1.4 Polystyrene (PS)

- 5.1.2 Engineering Thermoplastics

- 5.1.2.1 Polyamide (PA)

- 5.1.2.2 Polycarbonates (PC)

- 5.1.2.3 Polymethyl methacrylate (PMMA)

- 5.1.2.4 Polyoxymethylene (POM)

- 5.1.2.5 Polyethylene terephthalate (PET)

- 5.1.2.6 Polybutylene terephthalate (PBT)

- 5.1.2.7 Acrylonitrile Butadiene Styrene (ABS)/Styrene Acrylonitrile (SAN)

- 5.1.3 High-performance Engineering Thermoplastics

- 5.1.3.1 Polyether Ether Ketone (PEEK)

- 5.1.3.2 Liquid Crystal Polymer (LCP)

- 5.1.3.3 Polytetrafluoroethylene (PTFE)

- 5.1.3.4 Polyimide (PI)

- 5.1.4 Other Product Types (PPE, PSU, PEI, PPS, ETFE, PFA, FEP, PBI)

- 5.1.1 Commodity Thermoplastics

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Automotive and Transportation

- 5.2.4 Electrical and Electronics

- 5.2.5 Sports and Leisure

- 5.2.6 Medical

- 5.2.7 Other End-user Industries (Agriculture, Consumer Goods)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M (incl. Dyneon LLC)

- 6.4.2 Arkema

- 6.4.3 Asahi Kasei Corporation

- 6.4.4 BASF SE

- 6.4.5 Celanese Corporation

- 6.4.6 Chevron Phillips Chemical Company

- 6.4.7 Covestro AG

- 6.4.8 Daicel Corporation

- 6.4.9 DuPont

- 6.4.10 DSM

- 6.4.11 Eastman Chemical Company

- 6.4.12 Evonik Industries AG

- 6.4.13 INEOS AG

- 6.4.14 LANXESS

- 6.4.15 LG Chem

- 6.4.16 LyondellBasell Industries Holdings BV (incl. A. Schulman Inc.)

- 6.4.17 Mitsubishi Engineering-Plastics Corporation

- 6.4.18 Polyplastics Co. Ltd

- 6.4.19 SABIC

- 6.4.20 Solvay

- 6.4.21 TEIJIN LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Popularity of Bio-based Products