Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686242

Middle East Feed Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 203 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

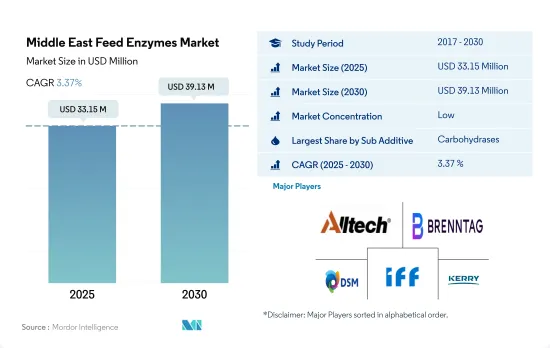

The Middle East Feed Enzymes Market size is estimated at 33.15 million USD in 2025, and is expected to reach 39.13 million USD by 2030, growing at a CAGR of 3.37% during the forecast period (2025-2030).

- The feed enzymes market in the Middle East is a small but growing segment of the overall feed additives market. In 2022, it accounted for only 3.6% of the feed additives market. However, the advantages of using feed enzymes to increase nutrient availability for animals, especially when cereal prices are high, make it a promising market.

- The market experienced a decline of 6.2% in 2019 compared to 2018 due to a decrease in feed production, which was directly related to the usage of feed additives. Saudi Arabia was the largest country in the feed enzymes market, accounting for a 40.2% share in 2022, owing to the country's higher feed production and demand for meat and dairy products.

- Among all the feed enzymes, carbohydrases were the most significant in terms of market value, accounting for 47.9% of the feed enzymes market in 2022. Carbohydrases are preferred because of their ability to increase the intake of protein, minerals, and lipids from animal feed. The largest animal type segment in the region was poultry birds, accounting for 57.9% of the feed carbohydrases market in 2022. The usage was associated with their digestion of non-soluble polysaccharides.

- The fastest-growing country in the Middle East during the forecast period is expected to be Iran, registering a CAGR of 3.7%. Phytases are expected to be the fastest-growing segment in the region, registering a CAGR of 3.4% during the forecast period.

- The increase in the awareness of the usage of feed additives and the demand for meat and livestock are expected to be the major drivers of the feed enzymes market in the region.

- In 2022, feed enzymes held a 3.6% share by value in the Middle Eastern feed additives market, representing an increase of over 2.8% from the previous year. However, the market witnessed a slight dip in 2019-2020, mainly due to the impact of the COVID-19 pandemic, which disrupted global trade and local supply chains, resulting in reduced feed production.

- Saudi Arabia held the largest share of the Middle Eastern feed enzymes market in 2022, accounting for around USD 12.1 million by value in the market, followed by Iran with USD 8.0 million. The high adoption of feed additives in animal diets in Saudi Arabia resulted in the highest consumption in the country compared to others in the region.

- Poultry birds were the largest consumers of feed enzymes in the Middle Eastern region in 2022, accounting for a 57.5% share by value in the market, followed by ruminants and aquaculture with 39.7% and 2.2% shares, respectively. The growth of the enzymes market is driven by the region's livestock-rearing technologies, which aim to limit meat imports and encourage water-scarce countries to benefit from their meat industries.

- In 2022, the Middle Eastern region produced around 24 million metric tons of compound feed for all animal types, with Iran alone accounting for more than 45% of the share. This high production was attributed to the country's large animal population, including more than 18% of ruminant cattle in the Middle Eastern region in 2021.

- The demand for feed enzyme usage has increased with the rising demand for meat and growing awareness of healthy diets in animal feeds. The Middle Eastern region is expected to witness strong growth in the market, recording a CAGR of 3.4% during 2023-2029.

Middle East Feed Enzymes Market Trends

Expanding poultry sector in the Middle East region with establishment of new farms with increasing per capita consumption of poultry has been increasing the demand for poultry production

- In the Middle East, the poultry industry is the largest segment in the agriculture sector. It accounted for 90% of the animal headcount in the region in 2022. The sector experienced significant growth, with production increasing by 10.9% in 2022 compared to 2017. The rise in demand for meat and egg products in the region has been the primary driver of the growth. The tourism, business travel, and the hotels, restaurants, and institutional (HRI) sectors contributed to a 2.5% increase in poultry production in 2022 compared to the previous year. This increased production led to a 2.9% rise in the value of feed additives used in poultry production.

- Middle Eastern countries are investing in their poultry sectors to boost production to meet the growing demand. For example, Saudi Arabia's Almarai company is investing USD 1.12 billion to establish a factory and new farms to increase poultry production. In 2022, the Saudi Arabian Ministry of Environment, Water, and Agriculture issued 275 poultry project licenses, including 119 for broiler projects, 26 for egg production with a capacity of more than two billion eggs per year, and 12 for breeding and producing broiler mothers and operating hatcheries with a capacity of 480.5 million chicks per year.

- The per capita consumption of poultry products in the region increased from 44.9 kg in 2017 to 45.5 kg in 2022, driving the demand for increased production. Factors such as increasing investments in the poultry industry and growing demand for poultry products are expected to continue to boost poultry production during the forecast period.

Government in the countries such as Saudi Arabia, Oman and the United Arab Emirates invested to establish large fish farms which will increase the demand for aqua feed in the region

- The aquaculture industry in the Middle East has experienced significant growth in recent years, leading to a rise in demand for aquaculture feed. Demand for aquaculture feed increased by 25.1% between 2017 and 2022. This growth was due to the expansion of the aquaculture industry in the region, which led to increased production of aquaculture species. In 2022, aquaculture feed production accounted for 2.1% of total feed production in the region, totaling 0.5 million metric tons. Iran is the largest producer of aquaculture feed in the region, with a production of 0.28 million metric tons in 2022. This high production could be attributed to the country's strong aquaculture production, which benefits from the availability of freshwater resources for the cultivation of different types of aquaculture species.

- Fish is the largest aquaculture species produced in the region, accounting for 78.6% of aquaculture feed production. Countries such as Saudi Arabia, Oman, and the United Arab Emirates have invested in aquaculture and partnered with international experts and organizations to establish productive local fish farms. Aquaculture organizations in the Gulf region are working with the UK Government's Centre for Environment Fisheries and Aquaculture Science (Cefas) through the UK Gulf Marine Environment Partnership (GMEP) Programme to improve fish farming and tackle biodiversity loss.

- Oman and the United Arab Emirates have the highest per capita consumption of aquaculture species in the region, with consumption reaching 28.6 kg per person annually. In an effort to reduce exports and increase domestic production, the Omani government aims to transform the fisheries and aquaculture industry from a subsidy sector to a significant contributor to the country's economy.

Middle East Feed Enzymes Industry Overview

The Middle East Feed Enzymes Market is fragmented, with the top five companies occupying 25.79%. The major players in this market are Alltech, Inc., Brenntag SE, DSM Nutritional Products AG, IFF(Danisco Animal Nutrition) and Kerry Group Plc (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 51033

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Iran

- 4.3.2 Saudi Arabia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Carbohydrases

- 5.1.2 Phytases

- 5.1.3 Other Enzymes

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Iran

- 5.3.2 Saudi Arabia

- 5.3.3 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 BASF SE

- 6.4.4 Brenntag SE

- 6.4.5 Cargill Inc.

- 6.4.6 DSM Nutritional Products AG

- 6.4.7 Elanco Animal Health Inc.

- 6.4.8 IFF(Danisco Animal Nutrition)

- 6.4.9 Kemin Industries

- 6.4.10 Kerry Group Plc

- 6.4.11 Novus International, Inc.

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.