PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851927

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851927

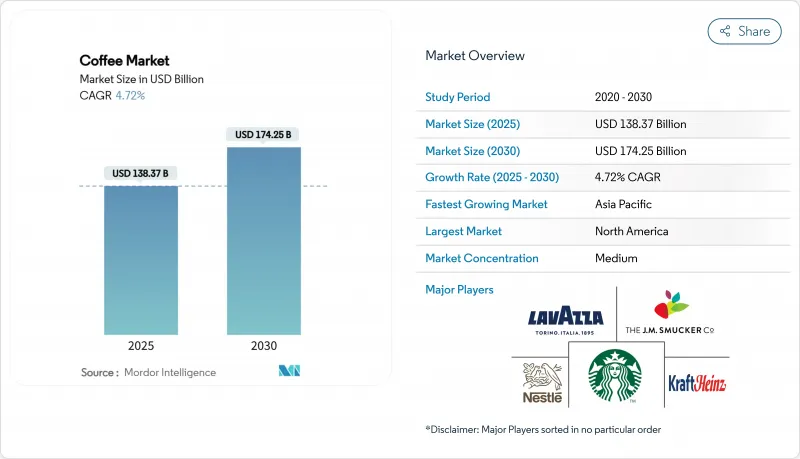

Coffee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global coffee market is estimated to be worth USD 138.37 billion in 2025 and is projected to grow to USD 174.25 billion by 2030, with a CAGR of 4.72% during the forecast period.

The market is driven by growing demand for premium coffee, ready-to-drink options, and stricter sustainability regulations, even though volume growth remains slower. Vertically integrated coffee roasters are focusing on traceability to secure their supply chains, while specialty brands are benefiting from consumers' interest in unique flavors. North America holds the largest market share, but Asia-Pacific is experiencing the fastest growth as younger urban consumers increasingly choose coffee over tea. Arabica remains the most popular coffee type due to its flavor, but developing climate-resilient crops is becoming essential to maintain production amid changing weather conditions. By Product Type, Premium Ground leads the market while Instant Coffee is growing quickly. By Origin, Mixed Origin dominates but Single Origin is gaining traction. Competition in the market is moderate, with major players like JM Smucker, Nestle, and Luigi Lavazza S.p.A. standing out. Strategies such as technology-driven supply chain transparency and direct-to-consumer sales are becoming key for differentiation.

Global Coffee Market Trends and Insights

Rising demand for specialty and premium coffee

Growing demand for specialty and premium coffee is driving the global coffee market, as consumer preferences continue to evolve, particularly among younger generations. In the United States, specialty coffee has become a significant part of retail consumption. According to the National Coffee Association of the USA, 46% of American adults consumed specialty coffee in 2024. This trend highlights a growing interest in single-origin beans, ethically sourced products, and cafe-style experiences. Globally, specialty coffee consumption is increasing at a faster pace compared to traditional coffee, supported by strong demand for out-of-home consumption and its ability to withstand economic challenges. In India, domestic coffee consumption has been steadily rising, while the country's coffee exports have doubled over the past decade, reaching USD 1.8 billion in FY24, according to the Ministry of External Affairs as of June 2025. As consumers place greater importance on quality, unique flavors, and ethical sourcing rather than focusing solely on price, specialty coffee continues to expand its market share.

Growing coffee culture among millennials and gen Z

Millennials and Gen Z are playing a major role in the growth of the global coffee market. These younger consumers are looking for high-quality, ethically sourced coffee and prefer unique flavors and premium experiences. Many of them enjoy specialty cafes and artisanal coffee over regular options. According to Convenience Org, Gen Z coffee drinkers are just as likely to start with iced coffee as hot coffee, and about 85% of them add creamer, compared to 70% of coffee drinkers overall. This shows their preference for personalized and flavorful coffee. They also tend to drink more coffee outside the home, boosting the popularity of cafe culture. In India, urbanization, higher incomes, and the rise of cafe chains have made coffee more popular among young adults, as reported by the Coffee Board of India. These changing preferences are reshaping the coffee market worldwide, driving innovation and steady growth.

Regulatory pressure and import/export restrictions

Regulatory pressure and changing trade restrictions are creating significant challenges for the global coffee market. For instance, in August 2025, the U.S. introduced a 50% tariff on Brazilian coffee, disrupting established supply chains. This forced exporters to redirect shipments to alternative markets like China and the European Union, creating uncertainty for Brazil, one of the largest coffee suppliers globally. Similarly, India has implemented new import rules requiring fumigation certificates for coffee beans to prevent pest infestations. These regulations have added extra compliance burdens for exporters. As a result, operational costs are rising, shipments are facing delays, and smaller producers are struggling to adapt to the new standards and documentation requirements. These challenges are reshaping the market dynamics, particularly for producers and exporters who lack the resources to navigate these regulatory changes effectively.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability and ethical sourcing awareness

- Corporate and workplace coffee solutions

- Consumer concerns over caffeine and health risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground coffee made up 37.56% of the global coffee market share in 2024, maintaining its position as the top revenue generator among coffee products. Its popularity is driven by consumers valuing the rich aroma, flavor, and brewing experience it offers. With more people buying home brewing equipment like French presses, moka pots, and espresso machines, there is a growing demand for cafe-style coffee at home. This trend highlights the focus on premium quality, especially in established markets like Europe and North America.

On the other hand, instant coffee is expected to grow at a CAGR of 5.92% from 2025 to 2030, making it the fastest-growing segment in the coffee market. Once seen as a low-cost or convenient option, instant coffee is now evolving with better flavor options, single-origin varieties, and advanced freeze-drying methods that improve quality. The increasing demand for single-serve sachets, ready-to-mix blends, and portable coffee options is appealing to younger, urban consumers with busy lifestyles. This shift reflects a preference for convenience without sacrificing taste, positioning instant coffee as a key growth area in both developing and established markets.

Arabica remained the top choice in the global coffee market in 2024, holding 57.54% of the total share. Its smooth flavor and lower caffeine content make it popular among consumers who value quality. Grown in cooler, high-altitude regions, Arabica is widely used in specialty coffee and premium blends, especially in developed markets like North America, Europe, and Japan. Its popularity is further boosted by the rise in at-home brewing and the demand for single-origin and traceable coffee products, where flavor and quality are key.

While Arabica leads in value, Robusta is expected to grow the fastest among coffee types, with a CAGR of 5.00% through 2030. Known for its stronger, more bitter taste and higher caffeine content, Robusta is increasingly used in espresso blends, ready-to-drink coffee, and instant coffee due to its affordability and bold flavor. It is also more resistant to climate change and diseases, making it a preferred choice for producers in countries like Vietnam, Brazil, and parts of Africa. With improvements in processing and flavor, Robusta is gaining acceptance and expanding in both budget-friendly and innovative market segments.

The Coffee Market Report is Segmented by Product Type (Whole-Bean, Ground Coffee, and More), Distribution Channel (On-Trade and Off-Trade), Coffee Species (Arabica, Robusta and More), Origin (Single Origin/Specialty and Mixed), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

Geography Analysis

North America accounted for 23.45% of the global coffee market revenue in 2024, driven by a strong cafe culture, the popularity of cold-brew coffee, and the widespread adoption of specialty coffee. The region has one of the highest per-capita coffee consumption rates globally which supports higher pricing for premium products. Roasters in North America are also leading sustainability initiatives, such as partnering with farmers in Mexico for regenerative agriculture and providing adaptation loans to Colombian growers. These efforts are setting global standards for sustainable coffee production and supply chain practices. The region's focus on innovation and sustainability continues to shape the global coffee market landscape.

Asia-Pacific is the fastest-growing region in the coffee market, with a projected CAGR of 5.23% through 2030. Rising middle-class incomes and changing consumer preferences are driving demand for coffee across the region. In China, smaller cities are now seeing the emergence of third-wave cafes, similar to those in Shanghai, reflecting the growing interest in premium coffee experiences. Indonesia is witnessing increased domestic consumption, attracting investments in micro-roasteries that highlight locally grown arabica beans. South Korea, known for its high cafe density, has become a hub for launching limited-edition beverages that gain global popularity through K-pop influence. The region's dynamic coffee culture and evolving consumer tastes are fueling its rapid growth.

Europe is playing a significant role in reshaping the global coffee market, particularly through its strict sustainability regulations. These regulations are pushing for greater traceability in coffee sourcing, which is becoming a standard expectation worldwide. Scandinavian countries are leading the way in adopting fair-trade coffee, while traditional markets like Italy and France are balancing their love for classic coffee with a growing interest in single-origin espressos. Latin America, as both a major producer and an emerging consumer market, is experiencing growth in domestic coffee consumption. In the Middle East and Africa, specialty coffee chains are targeting affluent urban consumers, while the introduction of cold-brew coffee in Gulf airports indicates potential for broader regional growth despite existing infrastructure challenges.

- Nestle S.A.

- UCC Ueshima Coffee Co.

- Starbucks Corporation

- The Kraft Heinz Company

- Luigi Lavazza S.p.A.

- Massimo Zanetti Beverage Group SpA

- The J. M. Smucker Company

- Tata Consumer Products

- Keurig Dr Pepper Inc.

- Tchibo GmbH

- Louis Dreyfus Company Coffee

- Inspire Brands

- Trung Nguyen Legend Group

- Mayora Group

- The Coca-Cola Company

- Unilever PLC

- CCL Products (India) Limited

- Sleepy Owl Coffee

- Melitta Group

- Strauss Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for specialty and premium coffee

- 4.2.2 Growing culture among millennials and gen Z

- 4.2.3 Booming RTD/cold-brew consumption

- 4.2.4 Sustainability and ethical sourcing awareness

- 4.2.5 Corporate and workplace solutions

- 4.2.6 Influence of social media and influencer marketing

- 4.3 Market Restraints

- 4.3.1 Volatility in prices

- 4.3.2 Tariffs and european union deforestation regulation barriers

- 4.3.3 Regulatory pressure and import/export restrictions

- 4.3.4 Consumer concerns over caffeine and health risks

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Whole-bean

- 5.1.2 Ground Coffee

- 5.1.3 Instant Coffee

- 5.1.4 Ready-to-Drink (RTD)

- 5.2 By Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Supermarkets/Hypermarkets

- 5.2.2.2 Convenience Stores

- 5.2.2.3 Specialist Retailers

- 5.2.2.4 E-commerce

- 5.2.2.5 Other Off-trade Channels

- 5.3 By Species

- 5.3.1 Arabica

- 5.3.2 Robusta

- 5.3.3 Liberica

- 5.3.4 Others

- 5.4 By Origin

- 5.4.1 Single Origin/Specialty

- 5.4.2 Mixed

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Colombia

- 5.5.2.3 Argentina

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Indonesia

- 5.5.4.7 Vietnam

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle S.A.

- 6.4.2 UCC Ueshima Coffee Co.

- 6.4.3 Starbucks Corporation

- 6.4.4 The Kraft Heinz Company

- 6.4.5 Luigi Lavazza S.p.A.

- 6.4.6 Massimo Zanetti Beverage Group SpA

- 6.4.7 The J. M. Smucker Company

- 6.4.8 Tata Consumer Products

- 6.4.9 Keurig Dr Pepper Inc.

- 6.4.10 Tchibo GmbH

- 6.4.11 Louis Dreyfus Company Coffee

- 6.4.12 Inspire Brands

- 6.4.13 Trung Nguyen Legend Group

- 6.4.14 Mayora Group

- 6.4.15 The Coca-Cola Company

- 6.4.16 Unilever PLC

- 6.4.17 CCL Products (India) Limited

- 6.4.18 Sleepy Owl Coffee

- 6.4.19 Melitta Group

- 6.4.20 Strauss Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK