PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907346

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907346

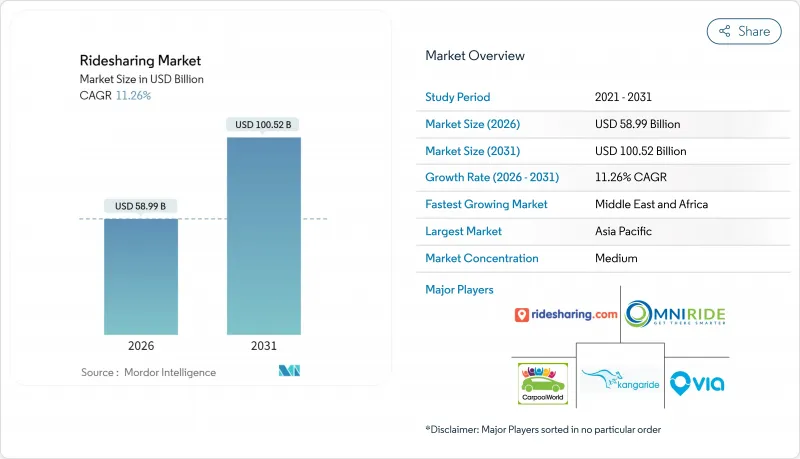

Ridesharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ridesharing market is expected to grow from USD 53.02 billion in 2025 to USD 58.99 billion in 2026 and is forecast to reach USD 100.52 billion by 2031 at 11.26% CAGR over 2026-2031.

Rising smartphone adoption, the spread of 5G, corporate sustainability mandates, and supportive policy measures such as congestion pricing are reinforcing demand. Platform-led electrification of driver fleets is lowering per-mile economics while super-apps bundle scooters, bikes, and transit tickets to lift user retention. Fragmented but consolidating competitive dynamics favour operators that secure autonomous-vehicle partnerships and enterprise contracts. Regulatory clarity on worker classification and data localization will remain a decisive growth moderator as platforms scale across borders.

Global Ridesharing Market Trends and Insights

Rise of Super-Apps Integrating Micromobility

Platforms are widening their service mix to include scooters and bikes within the same interface, creating network effects that cut customer-acquisition costs and lengthen lifetime value. Lyft's app users can now rent scooters and Citi Bikes, completing 45 million rides across 35,000 bikes in 2024. Cities such as San Francisco have rolled out unified permits that let one operator serve multiple modes, simplifying compliance. The shift boosts trip frequency, especially for journeys under two miles, where cars are less efficient. Because users stay inside a single app, cross-selling rates on higher-margin car trips improve. The strategy also buffers operators against regulatory shocks in any one segment.

Growing Corporate Sustainability Mandates

Enterprises are embedding ridesharing into Scope-3 emission plans, replacing taxis and rental cars with pooled trips that cut per-employee carbon footprints. Large U.S. banks and tech firms now reimburse only shared rides for airport transfers, creating predictable weekday demand spikes. Dedicated business dashboards offer carbon tracking, automated billing, and policy controls, positioning corporate ridesharing well for double-digit expansion over the forecast period. Steady enterprise volumes cushion seasonality, improve driver earnings, and raise platform valuation multiples.

Increasing Regulatory Caps on Drivers and Surge Pricing

Minimum-wage ordinances in U.S. cities are pushing platforms to trim driver pools or raise fares. Minneapolis mandated USD 15 per driver hour in 2024, triggering temporary ride suspensions by leading platforms while they recalibrated pricing models. Restrictions on surge multipliers dampen supply elasticity during peak demand, elongating wait times and eroding user satisfaction.

Other drivers and restraints analyzed in the detailed report include:

- Urban Congestion Pricing and Curbside Reform

- High Smartphone and 5G Penetration in Emerging Economies

- Safety-Related Brand Perception Issues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corporate customers are reshaping the global ridesharing market as firms formalize travel policies that prioritize low-carbon, pooled mobility. The corporate segment is on an 17.85% CAGR path to 2031, steadily enlarging its slice of the global ridesharing market size. Enterprise bookings often occur during business-day peaks, yielding higher per-mile yields than consumer off-peak trips. Dynamic ridesharing, still the volume leader with 45.62% of 2025 revenue, benefits from dense urban networks that match riders efficiently, but its growth rate now lags the premium corporate tier.

Large companies value end-to-end reporting of greenhouse-gas savings and automatic expensing interfaces, capabilities that consumer-focused products rarely offer. As corporate contracts typically run multi-year, churn risk is lower, allowing platforms to forecast driver hours and fleet electrification needs with greater accuracy. Competitive differentiation pivots on integrating ride-level carbon dashboards and duty-of-care features like real-time itinerary sharing with travel managers. Over the forecast period, dynamic ridesharing will keep enlarging absolute revenue given its broad addressable base, yet the share shift underscores how enterprise demand is becoming a stabilizing anchor for the global ridesharing market.

App-centric models continue to dominate, capturing 71.84% of 2025 turnover. The mobile interface remains unrivalled for push notifications, surge alerts, and digital-wallet convenience, anchoring user engagement in the global ridesharing market. Nonetheless, hybrid web-plus-app services are expanding fastest at 15.05% CAGR because corporate travel desks and accessibility regulations require browser-based booking.

Integrated channels broaden reach to non-smartphone users and offer redundancy when cellular data is spotty. Customer-service AI embedded in apps cut resolution times by 87% for Lyft, freeing agents for complex cases. Web portals, meanwhile, allow batch booking for events and conferences, a capability mobile apps lack. As omnichannel access becomes table stakes, platforms that streamline code bases across devices will curb maintenance costs and speed feature deployment, reinforcing brand preference in the global ridesharing market.

The Global Ridesharing Market Report is Segmented by Membership Type (Fixed, Dynamic, Corporate), Service Type (Web-Based, App-Based, Web and App-Based), Vehicle Type (ICE Vehicle, Hybrid Vehicle, Electric Vehicle, Micro-Mobility), Trip Distance (Intracity, Intercity), Payment Mode (Cash, Card, Digital Wallets), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 37.48% share anchored the global ridesharing market in 2025, supported by population density, low car ownership, and policymaker support for shared mobility. DiDi's Q1 2025 rebound, with revenue up 8.5%, affirmed post-regulation resilience in China. India followed with Ola trimming FY23 losses by 65%, achieving sustainable profitability amid surging demand. High 5G penetration and digital-wallet ubiquity enable platforms to overlay advanced safety and loyalty features, strengthening network effects across megacities and Tier-2 towns.

Africa posted the fastest trajectory, projected at 16.55% CAGR, propelled by urban migration and mobile-money ubiquity. Bolt's commitment to invest EUR 500 million across the continent underscores the region's strategic priority for global operators. Nairobi, Lagos, and Johannesburg are early beneficiaries, with young demographics fostering rapid uptake. Nonetheless, inconsistent road infrastructure and electricity reliability pose operational challenges that platforms address through localized driver-support hubs and offline booking kiosks.

North America and Europe display mature yet incremental growth driven by technological upgrades and corporate programs. Uber's tie-up with Waymo began offering 250,000 weekly autonomous rides in Atlanta and Austin, a milestone that trims driver-cost overheads. The EU's Platform Worker Directive, effective December 2026, will standardize benefits, elevating compliance barriers for smaller apps. Consolidation is intensifying, exemplified by Lyft's purchase of FREENOW that enlarged its European reach to nine markets. Regulatory certainty plus high disposable incomes underpins sustained, if moderate, volume expansion in both regions, keeping them pivotal revenue pools within the global ridesharing market.

- OmniRide (Potomac and Rappahannock Transportation Commission)

- Kangaride

- Plante Covoiturage Inc./CarpoolWorld Inc.

- Via Transportation Inc.

- Ridesharing.com (COVOITURAGEMONTREAL Inc.)

- Scoop Commute Inc. (Spacer Technologies)

- BlaBlaCar (Comuto SA)

- KINTO Join Limited (TOYOTA MOTOR CORPORATION)

- GoMore ApS

- Hitch Technologies Inc.

- Liftshare (Mobilityways Limited)

- gobyRIDE (RideShark Corporation)

- Sameride LLC

- Carma Technology Corporation

- Enterprise Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

- 4.5 Technological Developments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services

- 5.1.2 Incentives and Rebates Provided by Governments in Major Markets

- 5.1.3 Increasing Cost of Vehicle Ownership and Environmental Benefits

- 5.2 Market Challenges

- 5.2.1 Last-mile Connectivity Concerns and Dynamic Nature of the Industry and Increasing Number of Ride Hailing Vendors Poses a Challenge for Existing Operators

- 5.3 Market Opportunties

- 5.4 Parameters for Car-sharing Regulation

- 5.5 Business/Revenue Model Use Cases

6 MARKET SEGMENTATION

- 6.1 By Membership Type

- 6.1.1 Fixed Ridesharing

- 6.1.2 Dynamic Ridesharing

- 6.1.3 Corporate Ridesharing

- 6.2 By Service Type

- 6.2.1 Web-Based

- 6.2.2 App-Based

- 6.2.3 Web and App Based

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OmniRide (Potomac and Rappahannock Transportation Commission)

- 7.1.2 Kangaride

- 7.1.3 Plante Covoiturage Inc./CarpoolWorld Inc.

- 7.1.4 Via Transportation Inc.

- 7.1.5 Ridesharing.com (COVOITURAGEMONTREAL Inc.)

- 7.1.6 Scoop Commute Inc. (Spacer Technologies)

- 7.1.7 BlaBlaCar (Comuto SA)

- 7.1.8 KINTO Join Limited (TOYOTA MOTOR CORPORATION)

- 7.1.9 GoMore ApS

- 7.1.10 Hitch Technologies Inc.

- 7.1.11 Liftshare (Mobilityways Limited)

- 7.1.12 gobyRIDE (RideShark Corporation)

- 7.1.13 Sameride LLC

- 7.1.14 Carma Technology Corporation

- 7.1.15 Enterprise Holdings Inc.

- 7.2 Market Positioning of Vendors in Ridesharing Business Models

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET