PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641943

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641943

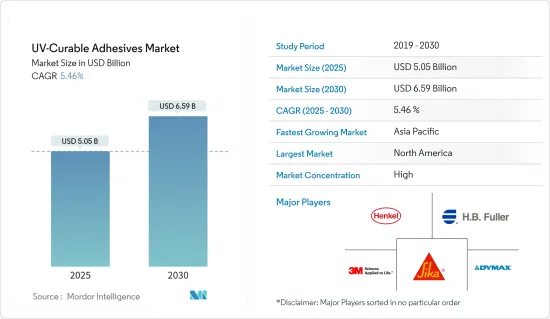

UV-Curable Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UV-Curable Adhesives Market size is estimated at USD 5.05 billion in 2025, and is expected to reach USD 6.59 billion by 2030, at a CAGR of 5.46% during the forecast period (2025-2030).

Due to the COVID-19 pandemic, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- The major factors driving the market studied are the rising demand for UV adhesives in automotive and aerospace applications and the increasing demand for these adhesives due to favorable environmental regulations.

- On the flip side, the high cost of producing UV-curable adhesives and the availability of alternative adhesives are expected to hinder the market's growth.

- An increase in demand from the packaging industry and a rise in the technologies for UV-curable adhesives are expected to act as opportunities for the market studied.

- North America dominated the global market, with the highest consumption registered in the United States.

UV-Curable Adhesives Market Trends

Medical Segment to Witness Strong Market Growth

- UV-curable adhesives, celebrated for their durability, biocompatibility, lubricity, and resistance to chemicals and scratches, are pivotal in meeting labeling standards for various medical applications. These include medicines, medication patches, hydrogels, filters, test strips, and disposable items like blood bags and medical electronics.

- Owing to their distinct properties, UV-curable adhesives are carving a niche in the medical industry. They are instrumental in medical device assembly, notably bonding catheter components for robust, leak-proof seals.

- China is one of the world's largest and fastest-growing healthcare markets. In 2023, the National Medical Products Administration (NMPA) received a total of 13,260 applications for initial registrations, registration renewals, and changes in licensing items of Class III (Domestic and Overseas) and Class II (Overseas) medical devices and IVDs. The number of applications represented a 25.4% increase when compared to 2022. Of the 13,260 applications, the NMPA approved a total of 12,213 applications, and an additional 278 products were approved in comparison with the previous year.

- The healthcare and medical device industries in India have experienced significant growth in recent years. A wide range of medical devices, from consumables to implantable medical devices, are manufactured in India. Most medical devices produced in India are disposables like catheters, perfusion sets, extension lines, cannulas, feeding tubes, needles, syringes, and implants like cardiac stents, drug-eluting stents, intraocular lenses, and orthopedic implants.

- As per MedTech Europe, the European medical technologies market has been projected to reach approximately EUR 160 billion (USD 177.25 billion) in 2024. The leading markets include Germany, France, the United Kingdom, Italy, and Spain. Valued at manufacturer prices, the European medical devices market constitutes 26.1% of the global market, making it the second-largest shareholder after the United States, which accounts for a 47.2% share. Over the past decade, the European medical devices market registered an average annual growth of 5.4%. In 2024, Europe boasts a positive trade balance in medical devices, standing at EUR 11 billion. Consistent with previous years, Europe's primary trade partners for medical devices have been the United States, China, Japan, and Mexico.

- All the abovementioned factors indicate a positive outlook for growth in market demand over the coming years.

North America to Dominate the Market

- North American countries are expected to dominate the UV-curable adhesives market. In recent times, there have been growing investments in semiconductor production in the United States and Canada, which has propelled demand for UV-curable adhesives in the region.

- In August 2024, the US Department of Commerce announced a USD 1.6 billion investment to enhance semiconductor production at Texas Instruments. Once fully operational, TI's Sherman facilities are projected to churn out over 100 million chips daily.

- In July 2024, Innovation, Science and Economic Development Canada (ISED) unveiled a USD 120 million investment into the FABrIC (Fabrication of Integrated Components for the Internet's Edge) network. This five-year initiative, with a total commitment exceeding USD 220 million, is set to strengthen Canada's semiconductor manufacturing and commercialization landscape.

- The medical industry has been another major consumer of UV-curable adhesives in the region in recent times. UV-curable adhesives are used in a wide range of medical applications, including syringe assembly and electronic components in medical devices.

- North America boasts the largest medical devices industry globally, spearheaded by the United States. In recent times, significant investments have been made in new healthcare manufacturing facilities across the country.

- In November 2023, Eli Lilly, a US pharmaceutical company, invested around USD 2.5 billion to build a new pharmaceutical manufacturing facility in Germany for producing injectable pharmaceutical products and medical devices, including those for diabetes and obesity. The construction began in 2024, and the facility is expected to be operational by 2027.

- Such developments are expected to boost the demand for UV-curable adhesives in pharmaceutical products and medical device manufacturing.

- All such factors are expected to boost the demand in the North American UV-curable adhesives market during the forecast period.

UV-Curable Adhesives Industry Overview

The UV-curable adhesives market is fragmented and features diverse participants, ranging from major corporations to smaller regional entities. The major market players (not in any particular order) include Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, and Dymax.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 UV-curable Adhesives Gaining Traction in the Automotive and Aerospace Sectors

- 4.1.2 Growing Popularity Due to Favorable Environmental Regulations

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 High Costs Associated With the Production of UV-curable Adhesives

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Silicone

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electrical and Electronics

- 5.2.3 Transportation

- 5.2.4 Packaging

- 5.2.5 Furniture

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Delo

- 6.4.3 Dymax

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Master Bond Inc.

- 6.4.7 Panacol-elosol Gmbh

- 6.4.8 Parson Adhesives Inc.

- 6.4.9 Permabond LLC

- 6.4.10 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for UV-curable Adhesives in the Booming Packaging Industry

- 7.2 Integration With Advanced Technologies