PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852184

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852184

Health And Fitness Club - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

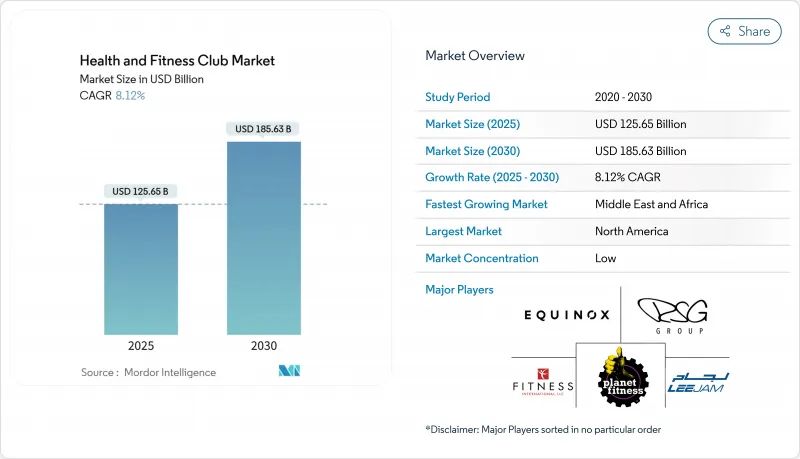

The Health And Fitness Club Market size is estimated at USD 125.65 billion in 2025, and is expected to reach USD 185.63 billion by 2030, at a CAGR of 8.12% during the forecast period (2025-2030).

This growth trajectory reflects the convergence of escalating obesity rates, government health initiatives, and technological integration, reshaping how consumers approach fitness and active lifestyle choices. The CDC's Active People, Healthy Nation initiative, targeting 27 million Americans by 2027, combined with the HHS multimillion-dollar "Take Back Your Health" campaign, creates unprecedented policy momentum supporting fitness club expansion

Global Health And Fitness Club Market Trends and Insights

Rising Prevalence of Obesity and Lifestyle Diseases

The obesity epidemic creates sustained demand pressure across health and fitness markets. According to the Government of the UK data from 2023, 69.2% of men and 58.6% of women in the United Kingdom were overweight. Southern US states are witnessing the highest prevalence of obesity, unveiling concentrated market opportunities for fitness club expansion in these underserved regions. This trend highlights the potential for fitness businesses to address the growing demand for health and wellness solutions in these areas. According to 2024 data from the Centers for Disease Control and Prevention, the annual economic burden of obesity-related healthcare costs hits a staggering USD 173 billion. This hefty figure propels both individuals and employers to invest in preventive fitness solutions. As a result, there's a noticeable shift, with more consumers opting to join gyms and fitness centers. Additionally, fitness clubs in these regions can leverage this demand by offering tailored programs and services to cater to the specific needs of the local population.

Growing Health Awareness and Wellness Trends

Health club operators anticipate a surge in memberships, driven by a shift in consumer perception. Fitness is now viewed as a vital component of health, rather than a luxury. This shift is further supported by increasing awareness of the long-term health benefits of regular physical activity, including improved cardiovascular health, enhanced mental well-being, and reduced risk of chronic diseases. Additionally, rising sports participation across the world, physical activity, and fitness focus are increasing. According to the Sports England data from 2024, 6,695.5 thousand people in the United Kingdom participated in fitness classes twice a month. As members gravitate towards holistic wellness, clubs are responding by merging mental health benefits with traditional fitness offerings. This evolution underscores the growing demand for comprehensive wellness experiences that cater to both physical and mental health needs. Meanwhile, corporate wellness programs are gaining traction, with employers acknowledging their role in boosting productivity and curbing healthcare costs. Additionally, fitness clubs are forging retail partnerships, broadening their revenue horizons by integrating products related to nutrition, recovery, and overall lifestyle. These partnerships enable clubs to offer a more diverse range of services and products, enhancing customer engagement and loyalty.

High Operational and Membership Costs

Rising operational expenses from equipment maintenance, facility leases, and staffing costs pressure profit margins while limiting membership accessibility for price-sensitive consumers. Planet Fitness's USD 800 million securitized financing facility demonstrates the capital intensity required for large-scale operations, with proceeds allocated to debt refinancing and expansion funding. Membership pricing increases, implemented for the first time in over two decades by major chains, test consumer price elasticity amid inflationary pressures across the economy. Energy costs for climate control, lighting, and equipment operation create ongoing expense volatility that affects pricing strategies and market positioning. The challenge of balancing premium service offerings with affordable membership rates constrains market expansion in middle-income demographics, creating opportunities for value-oriented fitness concepts.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Technology and Digital Fitness Solutions

- Corporate Wellness Programs and Fitness in Work Culture

- Market Saturation in Developed Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membership fees represent 52.53% of market share in 2024, reflecting the subscription-based foundation of fitness club business models, while personal training and instruction services demonstrate the fastest growth at 7.92% CAGR through 2030. The dominance of membership revenue creates predictable cash flow streams that support facility investments and operational stability, yet the accelerating personal training segment indicates consumer willingness to pay premium rates for customized fitness experiences. Other service types, including group classes, nutrition counseling, and wellness services, contribute supplementary revenue streams that enhance member engagement and reduce churn rates.

The shift toward personal training growth reflects broader consumer preferences for individualized health solutions, supported by the integration of AI-powered coaching tools that enhance trainer effectiveness and member outcomes. Corporate wellness contracts increasingly demand personalized fitness programming for employees, creating B2B opportunities for clubs that can scale individual training services.

The Health and Fitness Club Market Report is Segmented Into Service Type (Membership Fees, Personal Training & Instruction, Other Service Type), Business Model (Independent Clubs, Chained Clubs), End-User (Male, Female), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a dominant 35.03% market share, bolstered by its well-established fitness infrastructure, proactive government health initiatives, and the widespread embrace of corporate wellness programs. These factors collectively fuel a robust demand across diverse demographic segments. Additionally, Canada and Mexico play pivotal roles in this growth narrative, driven by cross-border franchise expansions and heightened health awareness campaigns. The region's maturity presents ripe consolidation opportunities, with industry giants like Planet Fitness actively pursuing acquisitions and franchise conversions to harness economies of scale. With 40.3% of U.S. adults classified as obese, as reported by the Centers for Disease Control and Prevention (2023), rising obesity rates ensure sustained demand, driving market expansion despite economic headwinds.

Meanwhile, the Middle East & Africa is on a rapid ascent, charting a projected CAGR of 10.39% through 2030. This growth surge is attributed to urbanization, increasing disposable incomes, and a heightened awareness of health and wellness, especially among the youth. Key players like the UAE, Saudi Arabia, and South Africa are capitalizing on this momentum, thanks to government-led initiatives championing active lifestyles, a surge in boutique and premium fitness concepts, and a growing inclination towards lifestyle-centric wellness solutions. The region's dynamic economic and demographic shifts pave the way for varied business models, ranging from upscale wellness clubs in metropolitan hubs to budget-friendly fitness options in burgeoning urban locales.

Europe and Asia-Pacific are witnessing steady growth, albeit driven by distinct market dynamics. Europe's growth is underpinned by government health campaigns, an aging demographic, and a deeply ingrained wellness culture. Countries like Germany, the UK, and France are at the forefront, boasting high membership penetration and premium offerings. In contrast, Eastern European nations, notably Poland, are experiencing a growth spurt, fueled by rising disposable incomes and heightened health consciousness. Asia-Pacific, with its vast potential, sees China, India, and Southeast Asia as key growth engines, driven by urbanization and a burgeoning middle class. Innovative fitness concepts, from budget-friendly gyms in Japan to boutique wellness clubs in Southeast Asia, are sprouting across both established and emerging markets. Furthermore, a growing emphasis on sustainability and environmental stewardship is reshaping club operations in both regions, leading to a broader adoption of green practices and renewable energy solutions.

- Planet Fitness Inc.

- Basic-Fit NV

- RSG Group GmbH (Gold's Gym, McFIT)

- Life Time Group Holdings

- Xponential Fitness Inc.

- Equinox Holdings Inc.

- Fitness International LLC (LA Fitness)

- Self Esteem Brands (Anytime Fitness)

- F45 Training Holdings Inc.

- The Gym Group plc

- PureGym Ltd.

- Viva Leisure Ltd.

- Crunch Fitness

- Orangetheory Fitness

- The Bay Club Company

- David Lloyd Leisure Ltd.

- Leejam Sports Co. (Fitness Time)

- Town Sports International

- Snap Fitness Inc.

- EXOS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Obesity and Lifestyle Diseases

- 4.2.2 Growing Health Awareness and Wellness Trends

- 4.2.3 Integration of Technology and Digital Fitness Solutions

- 4.2.4 Corporate Wellness Programs and Fitness in Work Culture

- 4.2.5 Government Initiatives and Public Health Campaigns

- 4.2.6 Expansion of Fitness Franchises and Personalized Services

- 4.3 Market Restraints

- 4.3.1 High Operational and Membership Costs

- 4.3.2 Market Saturation in Developed Regions

- 4.3.3 Changing Consumer Preferences and Time Constraints

- 4.3.4 Impact of Digital Fitness and At-Home Workouts

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE & GROWTH FORECAST (VALUE)

- 5.1 By Service Type

- 5.1.1 Membership Fees

- 5.1.2 Personal Training & Instruction

- 5.1.3 Other Service Type

- 5.2 By Business Model

- 5.2.1 Independent Clubs

- 5.2.2 Chained Clubs

- 5.3 By End-User

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Poland

- 5.4.2.8 Belgium

- 5.4.2.9 Sweden

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Indonesia

- 5.4.3.6 South Korea

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.5.9 Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Planet Fitness Inc.

- 6.4.2 Basic-Fit NV

- 6.4.3 RSG Group GmbH (Gold's Gym, McFIT)

- 6.4.4 Life Time Group Holdings

- 6.4.5 Xponential Fitness Inc.

- 6.4.6 Equinox Holdings Inc.

- 6.4.7 Fitness International LLC (LA Fitness)

- 6.4.8 Self Esteem Brands (Anytime Fitness)

- 6.4.9 F45 Training Holdings Inc.

- 6.4.10 The Gym Group plc

- 6.4.11 PureGym Ltd.

- 6.4.12 Viva Leisure Ltd.

- 6.4.13 Crunch Fitness

- 6.4.14 Orangetheory Fitness

- 6.4.15 The Bay Club Company

- 6.4.16 David Lloyd Leisure Ltd.

- 6.4.17 Leejam Sports Co. (Fitness Time)

- 6.4.18 Town Sports International

- 6.4.19 Snap Fitness Inc.

- 6.4.20 EXOS

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK