PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444953

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444953

Europe Continuous Glucose Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

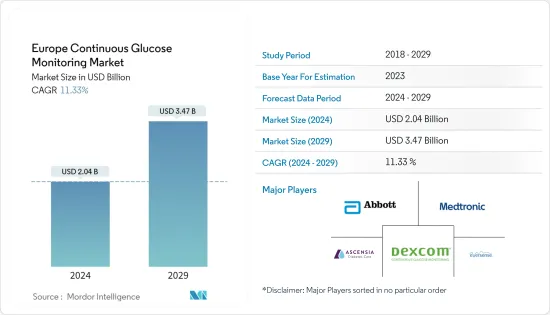

The Europe Continuous Glucose Monitoring Market size is estimated at USD 2.04 billion in 2024, and is expected to reach USD 3.47 billion by 2029, growing at a CAGR of 11.33% during the forecast period (2024-2029).

COVID-19 pandemic has had a substantial impact on the Continuous Glucose Monitoring Devices Market. Type-1 diabetes patients are impacted more during Covid-19. People with diabetes are having a weak immune system so, with COVID-19, the immune system gets weaker very fast. People with diabetes will have more chances to get into serious complications rather than normal people. According to the diabetes category, the estimated cost per hospital admission during the first wave of COVID-19 in Europe ranged from EUR 25,018 for type 2 diabetes patients in good glycaemic control to EUR 57,244 for type 1 diabetes patients in poor glycaemic control, reflecting a higher risk of intensive care, ventilator support, and a longer hospital stay. The estimated cost for patients without diabetes was EUR 16,993. The expected total direct expenditures for COVID-19 secondary care in Europe were 13.9 billion euros. Diabetes treatment thus accounted for 23.5% of total expenditures.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Europe Continuous Glucose Monitoring Market Trends

Continuous Glucose Monitoring Devices Prove to be an Instrumental Tool in maintaining Glycemic Balance

CGMs are used to deliver a more descriptive picture of blood glucose patterns and trends than can be achieved by traditional routine checking of glucose levels at set intervals. The current CGM devices can either retrospectively display the trends in the levels of blood glucose by downloading the data or give a real-time picture of glucose levels through receiver displays. Most real-time CGMs can offer an alert to patients, parents, or caregivers during actual or pending glycemic visits to facilitate timely management of blood glucose. This factor, along with the fact that CGM devices are becoming cheaper with the advent of new technologies like cell phone integration, means the CGM market is expected to witness steady growth during the forecast period.

European countries are suffering from the burden of high diabetes expenditures. According to the IDF, the overall diabetes expenditure in Europe among the population aged 20-79 years was USD 156 billion, and it is expected to increase to USD 174 billion by 2040. According to other statistics from the IDF, every year 21,600 children are added to the type-1 diabetic population pool. These figures indicate that approximately 9% of the total healthcare expenditure is spent on diabetes in Europe. For patients relying on insulin pumps or multiple daily injections (MDI) therapy, the CGMs prove to be an effective tool that helps in the improvement of glycemic balance without aggregating the danger of severe hypoglycemia.

Germany is Expected to Dominate the Europe Continuous Glucose Monitoring Devices Market.

In the European continuous glucose monitoring market, Germany accounted for approximately 21% of the market value in the current year. Germany has one of the highest diabetes populations in the European region, with more than 9 million diabetes cases in the present year. By forecasting years, the continuous glucose monitoring market in Europe is expected to be valued at more than USD 2.8 billion. The German Center for Diabetes Research (DZD) conducts extensive scientific research to develop effective prevention and treatment measures to halt the emergence or progression of diabetes. The CGM devices must be used alongside insulin pumps. It is observed that there may be a potential increase in the diabetes population, which can be directly related to a higher number of diabetic patients using insulin pumps for diabetes management. Thus, the number of units of CGM devices sold is also expected to rise.

Comparing a routine examination of blood glucose levels at predetermined intervals to the current CGM devices reveals a detailed picture of blood glucose patterns and trends. Also, modern continuous glucose monitoring devices can either provide a real-time image of glucose levels through receiver displays or retrospectively exhibit trends in blood glucose levels by downloading the data. Patients with type-1 diabetes use CGM much less frequently than those with type-2 diabetes. Yet, type-1 diabetes patients spend almost twice as much on these devices as type-2 diabetic patients do. The Abbott Freestyle Libre and the Dexcom G6 are the two most recent CGM devices, and they surmounted several technical challenges.

Throughout the coming years, it is anticipated that the prevalence of type-2 diabetes will rise significantly as a result of an aging population and an unhealthy lifestyle. The most important elements in preventing complications in German type-2 diabetes patients are high-quality care, which includes proper monitoring, control of risk factors, and active self-management. The development of novel medications to give diabetic patients more treatment options has been driven by the disease's increasing incidence, prevalence, and progressive nature.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the European region.

Europe Continuous Glucose Monitoring Industry Overview

CGM manufacturers who are concurrent with strategy-based M&A operations hold a sizable portion of the European continuous glucose monitoring devices market study, and these manufacturers are constantly entering new markets to generate new revenue streams and boost existing ones. The market studied is consolidated, with Dexcom, Abbott, and Medtronic holding a high market share, followed by regional manufacturers accounting for a relatively smaller share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Continuous Glucose Monitoring

- 5.1.1 Sensors

- 5.1.2 Durables

- 5.2 Geography

- 5.2.1 France

- 5.2.2 Germany

- 5.2.3 Italy

- 5.2.4 Spain

- 5.2.5 Russia

- 5.2.6 United Kingdom

- 5.2.7 Rest of Europe

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Abbott

- 7.1.2 Dexcom

- 7.1.3 Medtronics

- 7.1.4 Senseonics

- 7.1.5 Ascensia

- 7.2 Company Share Analysis

- 7.2.1 Abbott

- 7.2.2 Dexcom

- 7.2.3 Medtronics

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS