PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850277

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850277

Zero Liquid Discharge (ZLD) Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

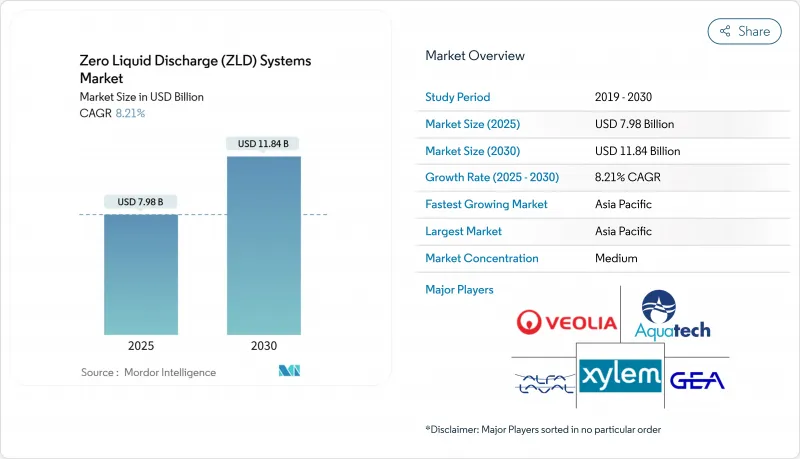

The Zero Liquid Discharge Systems Market size is estimated at USD 7.98 billion in 2025, and is expected to reach USD 11.84 billion by 2030, at a CAGR of 8.21% during the forecast period (2025-2030).

Growth stems from rising water-scarcity risks, tougher discharge rules, and clear cost advantages once water reuse offsets disposal fees. Power generators, semiconductor fabs, and petrochemical complexes are installing closed-loop recovery trains to secure low-risk water supplies. Decision-makers are prioritizing pretreatment upgrades that shrink evaporation loads and cut operating energy, while hybrid membrane-thermal trains deliver the best lifecycle economics. Consolidation is accelerating: diversified water majors are buying niche membrane innovators to deepen research and development pipelines and offer turnkey plants that meet performance guarantees.

Global Zero Liquid Discharge (ZLD) Systems Market Trends and Insights

Increasing Demand for Freshwater

Forty percent of announced low-emission hydrogen projects now sit in high-stress basins, creating long-run pull for closed-loop recovery. Corporations are embedding water security targets: Repsol will cap withdrawals by 2030 and cut a further 30% by 2035. Such commitments accelerate procurement decisions for the zero liquid discharge systems market, turning compliance tools into strategic assets.

Surging Brine-Treatment Demand from Semiconductor Fabs

Ultrapure-water fabs discharge high-TDS, metal-laden streams; advanced ZLD trains now reclaim copper and gallium, lowering net costs while meeting strict reuse mandates. Forward-osmosis pilot lines tailored for microelectronics were showcased at the European Desalination Society's 2025 forum. The sector's push into on-shore capacity gives the zero liquid discharge systems market a high-margin specialty niche.

High Capital and Energy Cost of Technology

Thermal plants may consume 80-100 kWh/m3, lifting payback beyond five years in tariff-sensitive zones. Energy-lean membrane lines now approach 2-6 kWh/m3 and drop CO2 by 90-95% when coupled to renewables. Such gains shrink the negative drag on the zero liquid discharge systems market, yet still limit uptake where financing costs are high.

Other drivers and restraints analyzed in the detailed report include:

- Upstream Produced-Water Reuse Targets in Middle East

- More Stringent Regulations for Wastewater Disposal

- ZLD Requires Highly Skilled Labor to Operate and Maintain

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Thermal evaporators and crystallizers held 62% of the zero liquid discharge systems market in 2024, thanks to robust salt tolerance. They remain the default in power and chemical complexes that mandate total dissolved solids removal. At the same time, membrane platforms are advancing with a 9.07% CAGR, propelled by material breakthroughs that slash energy demand. Hybrid trains, utilizing forward osmosis pretreatment followed by low-pressure brine concentrators, significantly reduce electricity consumption while delivering distillate with a TDS content below industry standards.

Recent field pilots showcased 2-stage membrane distillation operating at 55 °C feed, a major drop from legacy 80+ °C steam-driven units. Nitto's fouling-resistant RO sheets extended clean-in-place intervals to six months. These gains ensure the zero liquid discharge systems market size for membrane-based lines will continue to expand into heavy brine sectors once considered exclusive to thermal designs.

The Zero Liquid Discharge Systems Market Report Segments the Industry by Technology (Thermal-Based and Membrane-Based), Process Phase (Pretreatment, Brine Concentration, Evaporation and Crystallization and More), End-User Industry (Power Generation, Oil and Gas, Chemicals and Petrochemicals, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific owns a 32% share of the zero liquid discharge systems market and logs the fastest 9.66% CAGR. China enforces ZLD for coal-chemical parks, and India mandates it across viscose staple fiber zones, creating large bundled tenders that favor turnkey suppliers. Increasing industrial reuse quotas and state subsidies for energy-efficient modules keep regional order books full, turning the zone into the primary test bed for next-gen hybrid lines.

North America follows, driven by pending PFAS limits, chronic drought in the Colorado basin, and the Inflation Reduction Act's emphasis on clean-tech reshoring. Semiconductor expansions in Arizona and Texas require onsite ZLD, while federal tax incentives spur investment in low-carbon desalination. Canadian R&D funding helped Saltworks scale an electrodialysis unit purpose-built for battery-grade brine.

Desalination-dependent economies in the Middle East and Africa are focusing on achieving complete brine valorization, underscoring the region's notable growth potential. NEOM's ENOWA Water Innovation Center is piloting mineral recovery from reject streams, signaling policy alignment toward circular resource targets. In Europe, circular-economy rules and cap-and-trade pricing steer chemical clusters to full-recovery lines; the EU Industrial Emissions Directive revision adds momentum. South America is earlier on the curve, yet Brazil's new effluent tax incentivizes pulp and paper mills to consider ZLD retrofits, adding depth to the global zero liquid discharge systems market.

- ALFA LAVAL

- Aquarion AG

- Aquatech

- Doosan Corporation

- Dow

- GEA Group Aktiengesellschaft

- H2O GmbH

- Hydranautics - A Nitto Group Company

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Praj Industries

- SafBon Water Technology

- Saltworks Technologies Inc.

- Siemens

- Thermax Limited

- TOSHIBA WATER SOLUTIONS PRIVATE LIMITED.

- Veolia Water Solutions & Technologies

- Xylem

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Freshwater

- 4.2.2 Surging Brine-Treatment Demand from Semiconductor Fabs

- 4.2.3 Upstream Produced-Water Reuse Targets in Middle-East

- 4.2.4 More Stringent Regulations for Wastewater Disposal

- 4.2.5 Growth in Water-intensive Industries like Textiles, Chemicals, and Power is Fueling ZLD Demand

- 4.3 Market Restraints

- 4.3.1 High Capital and Energy Cost of Technology

- 4.3.2 ZLD Requires Highly Skilled Labor to Operate and Maintain.

- 4.3.3 Lack of Awareness and Incentives

- 4.4 Value-Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Thermal-based

- 5.1.2 Membrane-based

- 5.2 By Process Phase

- 5.2.1 Pretreatment

- 5.2.2 Brine Concentration

- 5.2.3 Evaporation and Crystallization

- 5.2.4 Solids Handling and Disposal

- 5.3 By End-User Industry

- 5.3.1 Power Generation

- 5.3.2 Oil and Gas

- 5.3.3 Chemicals and Petrochemicals

- 5.3.4 Metallurgy and Mining

- 5.3.5 Pharmaceuticals

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ALFA LAVAL

- 6.4.2 Aquarion AG

- 6.4.3 Aquatech

- 6.4.4 Doosan Corporation

- 6.4.5 Dow

- 6.4.6 GEA Group Aktiengesellschaft

- 6.4.7 H2O GmbH

- 6.4.8 Hydranautics - A Nitto Group Company

- 6.4.9 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 6.4.10 Praj Industries

- 6.4.11 SafBon Water Technology

- 6.4.12 Saltworks Technologies Inc.

- 6.4.13 Siemens

- 6.4.14 Thermax Limited

- 6.4.15 TOSHIBA WATER SOLUTIONS PRIVATE LIMITED.

- 6.4.16 Veolia Water Solutions & Technologies

- 6.4.17 Xylem

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 More Investments in the Deployment of ZLD Systems