PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852112

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1852112

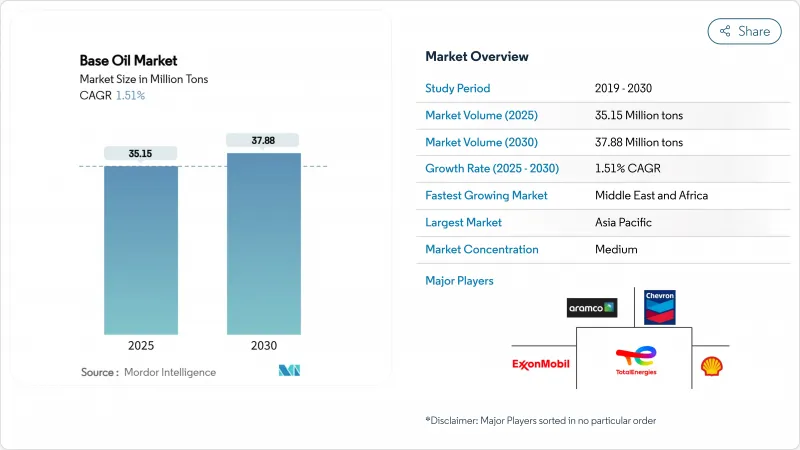

Base Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Base Oil Market size is estimated at 35.15 million tons in 2025, and is expected to reach 37.88 million tons by 2030, at a CAGR of 1.51% during the forecast period (2025-2030).

The measured growth of the base oil market is underpinned by three forces: the migration from Group I to higher-performance Group II and III stocks, tightening global emission rules, and the expanding role of synthetic formulations in electric-vehicle (EV) drivetrains. Asia-Pacific commands volume leadership, yet the Middle East and Africa records the fastest expansion, signaling a gradual realignment of supply chains toward crude-advantaged regions. Competitive positioning hinges on hydroprocessing technology, while refiners confront margin pressure from compressed Brent-Dubai spreads and rising capital outlays for catalyst upgrades. Opportunities emerge in immersion-cooling fluids for data centers and closed-loop re-refining initiatives that meet circular-economy targets.

Global Base Oil Market Trends and Insights

Rapid Industrialization Across APAC Production Clusters

Asia-Pacific's manufacturing boom underpins a significant share of incremental base oil market demand. China processed 14.8 million barrels per day of crude in 2024, creating robust pull for metal-working and hydraulic fluids. An expanding network of integrated refinery-petrochemical complexes increases operational flexibility, enabling producers to shift yields toward the most profitable base-stock grades. PETRONAS projects 2 million barrels of oil-equivalent output per day in its 2025-2027 outlook, with a downstream push into specialty chemicals supported by a biorefinery startup in 2028. These investments solidify the region's pre-eminence in the base oil market and accelerate the displacement of legacy Group I capacity.

Stricter Euro 7 and China VII Emission Norms Boosting Group III/IV Demand

The adoption of Euro 7 standards obliges automakers to fit particulate-filter systems across all light-duty gasoline engines, upping demand for ultra-low-volatility Group III stocks. China's parallel China VII framework intensifies the requirement for low-SAPS lubricants, while forty-four refining projects approved between 2022-2026 are poised to reinforce local supply. ILSAC GF-7, effective 31 March 2025, calls for a 10% fuel-economy gain, nudging blenders toward higher-quality base oils [ORONITE.COM]. Hydrocracking and hydro-isomerization units thus attract capital, accelerating the premiumization of the base oil market.

Volatile Brent-Dubai Crude Differentials Squeezing Margins

The Brent-Dubai spread turned negative at times in 2024, signaling scarce medium-sour barrels crucial for VGO-based base-oil feed. New Kuwait, Oman, and Nigeria refineries lifted global capacity, depressing margins and driving some operators, such as LyondellBasell Houston, to exit refining by early 2025. The crunch pressures independent players in the base oil market to trim runs or shutter older assets.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for High-Performance Lubricants in EV Thermal-Management Systems

- Expansion of Data-Center Immersion-Cooling Fluids

- Impending Micro-Plastic Classification of PAOs in the EU

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Group II maintained leadership with 42.89% of the base oil market share in 2024, owing to its balanced performance-cost equation and established distribution networks. Shell's 300,000-ton conversion at Wesseling underscores sustained confidence in hydrocracked stocks. Group III, though smaller on an absolute basis, advances at a 4.22% CAGR to 2030, buoyed by Euro 7 and EV-cooling mandates that call for ultra-low volatility and high oxidation resistance. The base oil market size for Group III is thus poised to expand faster than any other grade during the forecast horizon.

Group I endures in select rubber-processing and metal-working fluids requiring solvency, yet closures continue as economics deteriorate. Group V's diverse chemistries, including secondary polyol esters for bio-lubricants, round out innovation pathways. Altogether, the base oil market is migrating toward higher API groups to meet stricter OEM specifications and sustainability goals.

The Base Oil Report is Segmented by Base-Stock Type (Group I, Group II, Group III, Group IV, and Others), Application (Engine Oils, Transmission and Gear Oils, Metalworking Fluids, Hydraulic Fluids, Greases, and Other Applications), and Geography ( Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Million Tons).

Geography Analysis

Asia-Pacific generated 46.78% of 2024 volume, underpinned by China's record 14.8 million barrels-per-day crude runs and India's INR 1.9-2.2 lakh crore expansion program slated for completion by 2025. The base oil market benefits from vertically integrated complexes able to toggle between fuels, chemicals, and base stocks as margins dictate. Japan and South Korea supply precision synthetic technology for electronics thermal management, while Southeast Asian nations add capacity to serve regional industrial demand.

The Middle East and Africa posts a 3.48% CAGR to 2030, the fastest globally. ADNOC's USD 3.5 billion Ruwais Crude Flexibility Project enables processing heavier sour crudes, optimizing Group II and III output. Europe contends with margin compression and decarbonization pivots such as TotalEnergies' Grandpuits conversion into a zero-crude platform by 2026.

North America, bolstered by shale-oil economics, invests in specialty PAO and Group III projects; Chevron's Pasadena upgrade lifts throughput to 125,000 barrels per day while raising jet-fuel flexibility. South America enjoys moderate upside from Brazil's petrochemical integration, although macro volatility dampens large-scale investments. Collectively, geographic dynamics reflect a gradual diffusion of capacity into crude-advantaged and demand-rich locales while traditional centers adapt through specialization.

- ADNOC

- Chevron Corporation

- China Petrochemical Corporation (SINOPEC)

- CNOOC Limited

- Exxon Mobil Corporation

- Formosa Petrochemical Corporation

- Gazprom Neft PJSC

- GS Caltex Corporation

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- LUKOIL

- Nynas AB

- Petrobras

- PetroChina

- PETRONAS Lubricants International

- Philips 66 Company

- Repsol

- Saudi Arabian Oil Co.

- Sepahan Oil Company

- Shandong Qingyuan Group Co. Ltd.

- Shell plc

- SK Innovation Co. Ltd.

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid industrialisation across APAC production clusters

- 4.2.2 Stricter Euro 7 and China VII emission norms boosting Group III/IV demand

- 4.2.3 Rising demand for high-performance lubricants in EV thermal-management systems

- 4.2.4 Expansion of data-centre immersion-cooling fluids (novel synthetic base-stocks)

- 4.2.5 Closed-loop re-refining economics under circular-economy mandates

- 4.3 Market Restraints

- 4.3.1 Rapid substitution away from Group I capacities

- 4.3.2 Volatile Brent-Dubai crude differentials squeezing margins

- 4.3.3 Impending micro-plastic classification of PAOs in the EU (ECHA)

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Base-Stock Type

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Engine Oils

- 5.2.2 Transmission and Gear Oils

- 5.2.3 Metalworking Fluids

- 5.2.4 Hydraulic Fluids

- 5.2.5 Greases

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Thailand

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ADNOC

- 6.4.2 Chevron Corporation

- 6.4.3 China Petrochemical Corporation (SINOPEC)

- 6.4.4 CNOOC Limited

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Formosa Petrochemical Corporation

- 6.4.7 Gazprom Neft PJSC

- 6.4.8 GS Caltex Corporation

- 6.4.9 Hindustan Petroleum Corporation Limited

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 LUKOIL

- 6.4.12 Nynas AB

- 6.4.13 Petrobras

- 6.4.14 PetroChina

- 6.4.15 PETRONAS Lubricants International

- 6.4.16 Philips 66 Company

- 6.4.17 Repsol

- 6.4.18 Saudi Arabian Oil Co.

- 6.4.19 Sepahan Oil Company

- 6.4.20 Shandong Qingyuan Group Co. Ltd.

- 6.4.21 Shell plc

- 6.4.22 SK Innovation Co. Ltd.

- 6.4.23 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Renewable/Bio-based PAO commercial scale-up

- 7.3 Integrated re-refining and virgin-base-oil hubs