PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906949

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906949

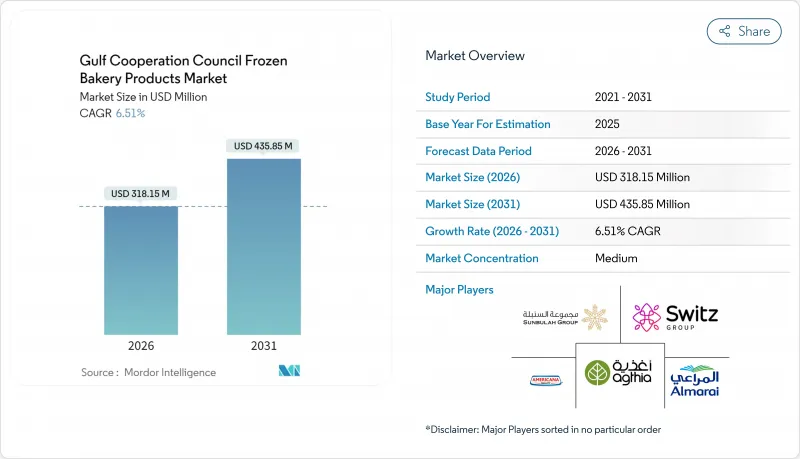

Gulf Cooperation Council Frozen Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

GCC frozen bakery market size in 2026 is estimated at USD 318.15 million, growing from 2025 value of USD 298.70 million with 2031 projections showing USD 435.85 million, growing at 6.51% CAGR over 2026-2031.

Investments in food-service infrastructure are on the rise, tourism is rebounding swiftly, and national food-security programs are gaining traction. These trends are making frozen formats increasingly appealing as a quick, safe, and labor-efficient choice for commercial kitchens. In Saudi Arabia, a surge in quick-service restaurants is evident. Concurrently, the UAE witnesses a notable uptick in visitor spending. These factors, along with the ongoing establishment of modern cold chains, are driving the demand for standardized dough, bread, and viennoiserie. There's a noticeable premiumization trend in categories like croissants and pastries, signaling heightened tourist expectations and an increase in disposable income. Regulatory measures limiting trans fats, alongside commitments from retailers to eliminate artificial additives, are fueling a wave of reformulation and a surge in "free-from" product launches. On the production side, companies are adopting digital forecasting, implementing blast-freezing techniques, and localizing their capacities. These moves aim to safeguard profit margins against freight volatility and geopolitical uncertainties.

Gulf Cooperation Council Frozen Bakery Products Market Trends and Insights

Expansion of food-service chains across the GCC

Quick-service giants, both international and regional, are aggressively launching new outlets, employing a hub-and-spoke model to ensure consistent quality across borders. A prime example is Alshaya Group's centralized bakery, which produces 60,000 items daily for 400 Starbucks stores, highlighting the benefits of frozen inputs in maintaining uniformity and scaling operations efficiently. This strategy also fuels ALBAIK's franchising ambitions, enabling the brand to expand its footprint across borders, and underpins Landmark Group's goal of adding 400 stores by 2028, reflecting the growing demand for quick-service dining options. Chain operators favor par-baked dough for its labor-saving, training-simplifying, and service-speeding advantages, which are critical in maintaining operational efficiency and meeting customer expectations. With the unified GCC tourist visa set to roll out by the end of 2025, a surge in outlet expansions and broader distribution channels for frozen suppliers is on the horizon, further driving growth opportunities in the quick-service market.

Increased adoption of blast-freezing technology in in-store bakeries

Large retailers and commissaries are now using cryogenic freezers that can plunge to -196 °C in mere minutes, effectively locking in moisture and color. These freezers are particularly beneficial for preserving the quality and texture of perishable food items during storage and transportation. Linde's CRYOLINE units facilitate "crust-freeze" steps, ensuring that delicate croissants remain intact during transit, which is crucial for maintaining product integrity in the supply chain. The UAE's National Food Security Strategy 2051, aiming for a 40% reduction in food import reliance, is backing this move by offering grants to processors that embrace advanced freezing techniques. This initiative not only supports local food production but also enhances the adoption of innovative technologies in the food processing industry. New tunnels, equipped with IoT sensors, relay real-time temperature data, significantly reducing waste and maintenance downtimes by enabling proactive monitoring and timely interventions. As digital capabilities surge, brands are not only hiring data officers but are also weaving predictive analytics into their baking processes, optimizing production efficiency and ensuring consistent product quality.

Mandates on salt- and trans-fat reformulation

Starting May 2025, Technical Regulation GSO 2483:2024 will cap industrial trans fats at 2%, pushing companies to rethink recipes and scrutinize suppliers. This regulation aims to enhance public health by reducing the consumption of harmful trans fats, aligning with global trends in food safety and nutrition. In response, multinationals are channeling research and development funds into creating palm-free lamination fats and sodium-reduced dough conditioners, which are seen as healthier alternatives. Reformulating recipes not only increases raw material costs but also lengthens validation cycles, posing significant challenges for SMEs that often lack pilot-plant facilities and the financial resources to adapt swiftly. However, early adopters who secure "clean recipe" certifications gain a competitive advantage. These companies benefit from enhanced shelf visibility, stronger brand positioning, and the ability to command premium pricing in hypermarkets, ultimately strengthening their market presence.

Other drivers and restraints analyzed in the detailed report include:

- Rising demand for thaw-and-serve SKUs in convenience retail

- GCC tourism driving demand for premium viennoiserie

- Fluctuating refrigerated freight rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, frozen bread dominated the GCC frozen bakery market, capturing a notable 47.62% share. Its widespread use in food-service meal occasions ranging from QSR breakfast wraps and shawarma rolls to panini offerings in institutional canteens fuels this dominance. Quick-service and casual dining operators consistently rotate frozen bread in their menus, ensuring steady demand. Hospitality providers, facing fluctuating tourist numbers, find blast-frozen baguettes to be a flexible solution with minimal wastage. Institutional buyers, valuing the long ambient shelf life essential for buffet service, rely on this category for 39% of their frozen bakery purchases. While frozen bread remains a volume driver, rising consumer interest in rustic sourdoughs and seeded loaves often highlighted on social media has led producers to refine their crust technologies to maintain a premium appeal. Yet, given its everyday utility and operational efficiency, frozen bread is poised to remain the sector's backbone.

Among the product categories, frozen cakes and pastries are leading the charge with a robust CAGR of 6.74%. Upscale cafes, airline catering teams, and luxury hotels are driving this growth, aiming to elevate dessert offerings and enrich guest experiences. Within this segment, croissants shine brightest, accounting for nearly two-thirds of the incremental revenue across plain, filled, and plant-based varieties. Operators are capitalizing on this trend, introducing pastry baskets priced at an average of USD 3.50 per guest, appealing to both premium and mainstream customers. Dark kitchens, seeking flexible and delivery-friendly products to streamline operations, are increasingly turning to frozen pizza crusts. Meanwhile, as the cafe culture in the GCC leans towards portion-controlled, freezer-to-oven baked goods, frozen muffins are witnessing a surge in demand. These developments collectively position frozen cakes and pastries as the most dynamic growth engine in the regional frozen bakery market.

The GCC Frozen Bakery Market Report is Segmented by Product Type (Frozen Bread, Frozen Cakes and Pastries, Frozen Croissants, Frozen Dough, Frozen Pizza Crusts, Frozen Muffins and Cookies, Other Frozen Bakery Products), Category (Conventional, Free From), Distribution Channel (On Trade, Off Trade), and Geography (UAE, Saudi Arabia, Kuwait, Qatar, Oman, Bahrain). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Americana Group Inc.

- Sunbulah Group

- Agthia Group

- Al Karamah Dough Production Ltd

- Almarai Company (Lusine)

- Switz Group

- IFFCO Group

- ID Fresh

- Atyab Food Industries

- Kawan Food Berhad

- Dofreeze

- Aryzta AG

- Dawn Foods

- Grupo Bimbo (Panattiere)

- Bridgford Foods

- General Mills (Pillsbury)

- Fine Fair Food Market (FFFMC)

- Bahrain Flour Mills

- Bakemart

- Gourmet Gulf

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of food-service chains across the GCC

- 4.2.2 Increased adoption of blast-freezing technology in in-store bakeries

- 4.2.3 Rising demand for thaw-and-serve SKUs in convenience retail

- 4.2.4 GCC tourism driving demand for premium viennoiserie

- 4.2.5 National food-security plans mandating cold-chain investments

- 4.2.6 Surge in dark-kitchen aggregators sourcing frozen dough

- 4.3 Market Restraints

- 4.3.1 Mandates on salt- and trans-fat reformulation

- 4.3.2 Fluctuating refrigerated freight rates

- 4.3.3 Urban millennials shifting preference to fresh artisan bread

- 4.3.4 Slow localization of equipment leading to higher cap-ex hurdles

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Frozen Bread

- 5.1.2 Frozen Cakes and Pastries

- 5.1.3 Frozen Croissants

- 5.1.4 Frozen Dough

- 5.1.5 Frozen Pizza Crusts

- 5.1.6 Frozen Muffins and Cookies

- 5.1.7 Other Frozen Bakery Products

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Free From

- 5.3 Distribution Channel

- 5.3.1 On Trade

- 5.3.2 Off Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Specialist Bakeries

- 5.3.2.4 Online Retail Retails

- 5.3.2.5 Others

- 5.4 By Geography

- 5.4.1 United Arab Emirates

- 5.4.2 Saudi Arabia

- 5.4.3 Kuwait

- 5.4.4 Qatar

- 5.4.5 Oman

- 5.4.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Americana Group Inc.

- 6.4.2 Sunbulah Group

- 6.4.3 Agthia Group

- 6.4.4 Al Karamah Dough Production Ltd

- 6.4.5 Almarai Company (Lusine)

- 6.4.6 Switz Group

- 6.4.7 IFFCO Group

- 6.4.8 ID Fresh

- 6.4.9 Atyab Food Industries

- 6.4.10 Kawan Food Berhad

- 6.4.11 Dofreeze

- 6.4.12 Aryzta AG

- 6.4.13 Dawn Foods

- 6.4.14 Grupo Bimbo (Panattiere)

- 6.4.15 Bridgford Foods

- 6.4.16 General Mills (Pillsbury)

- 6.4.17 Fine Fair Food Market (FFFMC)

- 6.4.18 Bahrain Flour Mills

- 6.4.19 Bakemart

- 6.4.20 Gourmet Gulf

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK