PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851117

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851117

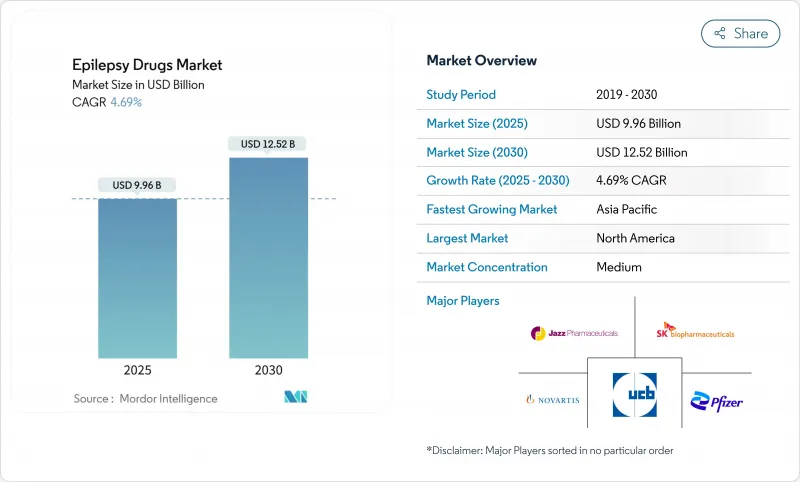

Epilepsy Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anti-epileptic drugs market is valued at USD 9.96 billion in 2025 and is forecast to reach USD 12.52 billion by 2030, expanding at a 4.69% CAGR.

This advance reflects the successful launch of third-generation antiseizure medicines, fast adoption of genetic precision tools, and the growth of tele-neurology services that improve adherence. Demand keeps rising as physicians seek safer agents for focal seizures and drug-resistant epilepsy, yet pricing pressure from patent expirations and periodic API shortages temper topline momentum. North America retains leadership through deep reimbursement coverage, while Asia-Pacific shows the strongest trajectory as China and India invest in epilepsy awareness campaigns and broaden access to advanced therapies. Competitive intensity is sharpening because niche innovators are winning share in orphan indications and digital-health ecosystems.

Global Epilepsy Drugs Market Trends and Insights

Surge in Approvals of Third-Generation Antiseizure Medications with Improved Safety Profiles

Global regulators are clearing a steady stream of next-wave agents such as cenobamate, brivaracetam, cannabidiol and diazepam nasal formulations that demonstrate higher seizure-reduction rates and fewer adverse reactions than legacy drugs. SK Biopharmaceuticals reported a 46.6% year-on-year jump in Xcopri sales to USD 102.4 million during Q1 2025. Real-world data presented at the 2025 American Academy of Neurology meeting showed an 84% median seizure cut in focal-seizure adults treated with cenobamate, while an Israeli observational study cited 27.5% seizure freedom among pharmaco-resistant patients using the same molecule. The FDA's April 2025 decision to extend diazepam nasal spray to children aged 2-5 broadens rescue options. Collectively these advances raise expectations for better long-term outcomes and spur clinicians to transition treatment-resistant cases onto newer regimens.

Precision Genetics and AI-Enhanced EEG Diagnostics Are Improving Drug Selection and Treatment Success Rates

Artificial-intelligence algorithms now parse millions of clinical records to flag monogenic epilepsies years before typical diagnosis, enabling earlier and more appropriate therapy. Children's Hospital of Philadelphia validated a model that detects genetic epilepsies 3.6 years sooner by screening 89 million annotations from 32,000 patients. Whole-exome sequencing yields a 14% diagnostic hit rate, and 59% of those findings align with precision therapies, though real-world uptake still lags at 32% for reimbursement and access reasons. As payer coverage widens and AI achieves regulatory endorsement, clinicians are expected to pair genotype insights with third-generation drugs, reinforcing personalized care pathways across the anti-epileptic drugs market.

Patent Expirations Erode Margins of Legacy Blockbuster AED Brands

UCB's Vimpat and several other long-standing leaders face steep price drops as exclusive protections lapse. The Federal Trade Commission is scrutinizing industry tactics to block or delay generic entry and insists that savings reach patients. While erosion can exceed 70% within the first year post-expiry, it also pushes prescribers to experiment with innovative agents still under patent, shifting volume toward companies that maintain rich late-stage pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Tele-Neurology Platforms, Raising Prescription Refill Frequency and Long-Term Adherence

- Orphan-Drug Incentives Expediting Therapies for Rare Epileptic Encephalopathies

- Recurring API Shortages for Carbamazepine and Levetiracetam Disrupt Supply Continuity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Third-generation compounds dominated with 39.64% share of the anti-epileptic drugs market in 2024 thanks to superior safety and dual-mechanism action. Cenobamate's phase 3 data showed 25.8% seizure freedom over 12 months across varied doses. This progress underpins a forecast in which the segment broadens its lead through 2030, while second-generation agents grow at 6.32% CAGR on the back of extensive real-world familiarity and favorable side-effect profiles.

Moving forward, synergy between third-generation drugs and precision diagnostics will likely speed therapy switches for refractory patients, anchoring revenue streams for innovators. Even so, first-generation staples remain cornerstones in resource-limited settings because of well-known pharmacokinetics and low cost, preserving a multi-tier landscape within the anti-epileptic drugs market.

Focal seizures accounted for 61.34% of anti-epileptic drugs market size in 2024, a position that mirrors the higher prevalence of partial-onset conditions globally. First-line choices include lamotrigine and levetiracetam, while carbamazepine retains broad acceptance in cost-sensitive regions.

Unclassified/Combined Seizures segment is anticipated to record a 5.98% growth rate during the forecast period. Genomic research reveals distinct architectures for focal versus generalized epilepsies, giving pipeline developers fresh targets. As precision screening becomes routine, clinicians expect to fine-tune therapy even within the focal subgroup, yielding incremental volume growth and higher adherence across the anti-epileptic drugs market.

The Epilepsy Drugs Market Report is Segmented by Drug Generation (First Generation Anti-Epileptics and More), Seizure Type (Focal Seizures and More), Patient Type (Adult and Pediatric), Route of Administration (Oral and More), Distribution Channel (Hospital Pharmacy and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held a 40.02% share of the anti-epileptic drugs market in 2024 due to comprehensive insurance coverage, specialist density, and rapid uptake of third-generation products. Xcopri's 46.6% sales surge in Q1 2025 underscores the region's appetite for differentiated therapies. Regulatory flexibility supports tele-health prescription renewal programs that improve adherence, yet cost-containment policies create downward price pressure and keep CAGR at 3.96% through 2030.

Asia-Pacific exhibits the fastest 5.98% CAGR as governments scale public health budgets and widen diagnostic infrastructure. Despite sizable progress, China's treatment gap persists, underscoring latent opportunity for branded and quality-assured generics. Japan's late-stage trials for cannabidiol formulations and India's push toward local manufacturing diversify the regional offer set and accelerate growth within the anti-epileptic drugs market.

Europe balances innovation against stringent cost controls, producing a steady 4.35% CAGR. SK Biopharmaceuticals markets cenobamate in 23 European countries via Angelini, seeking higher penetration of refractory cases. South America and the Middle East & Africa, while smaller, advance on telemedicine pilots and pragmatic diagnostic guidelines tailored to resource-limited settings. These efforts collectively raise awareness, reduce stigma, and expand the anti-epileptic drugs market footprint across emerging economies.

- Bausch Health

- Cipla

- Dr. Reddy's Laboratories

- Eisai

- GlaxoSmithKline

- H. Lundbeck

- Jazz Pharmaceuticals

- Johnson & Johnson

- Marinus Pharmaceuticals Inc.

- Novartis

- Ovid Therapeutics Inc.

- Pfizer

- Sanofi

- SK Biopharmaceuticals Co. Ltd.

- Sun Pharmaceuticals Industries

- Sunovion Pharmaceuticals

- Supernus Pharmaceuticals

- Teva Pharmaceutical Industries

- UCB

- Zydus Lifesciences

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in approvals of third-generation antiseizure medications with improved safety profiles

- 4.2.2 Precision genetics and AI-enhanced EEG diagnostics are improving drug selection and treatment success rates

- 4.2.3 Rapid adoption of tele-neurology platforms, raising prescription refill frequency and long-term adherence

- 4.2.4 Orphan-drug incentives expediting therapies for rare epileptic encephalopathies

- 4.2.5 Growing pool of patients with drug-resistant epilepsy, driving demand for combination and add-on therapies

- 4.2.6 Rising investments in cannabinoid- and neurosteroid-based pipelines

- 4.3 Market Restraints

- 4.3.1 Patent expirations erode margins of legacy blockbuster AED brands

- 4.3.2 Recurring API shortages for core molecules such as carbamazepine and levetiracetam disrupting supply continuity

- 4.3.3 Stringent payer controls and step-therapy mandates limit uptake of premium-priced novel ASMs

- 4.3.4 Complex titration and safety monitoring restrict adoption of cannabidiol and specialty formulations

- 4.4 Supply Chain Analysis

- 4.5 Pipeline Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers / Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Generation

- 5.1.1 First Generation Anti-Epileptics

- 5.1.2 Second Generation Anti-Epileptics

- 5.1.3 Third Generation Anti-Epileptics

- 5.2 By Seizure Type

- 5.2.1 Focal (Partial) Seizures

- 5.2.2 Generalized Seizures

- 5.2.3 Unclassified / Combined Seizures

- 5.3 By Patient Type

- 5.3.1 Adult

- 5.3.2 Pediatric

- 5.4 By Route of Administration

- 5.4.1 Oral

- 5.4.2 Intravenous

- 5.4.3 Nasal / Buccal

- 5.4.4 Subcutaneous

- 5.5 By Distribution Channel

- 5.5.1 Hospital Pharmacy

- 5.5.2 Retail Pharmacy

- 5.5.3 Others

- 5.6 By Geography (Value)

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Bausch Health Companies Inc.

- 6.4.2 Cipla Ltd.

- 6.4.3 Dr. Reddy's Laboratories

- 6.4.4 Eisai Co. Ltd

- 6.4.5 GlaxoSmithKline PLC

- 6.4.6 H. Lundbeck A/S

- 6.4.7 Jazz Pharmaceuticals PLC

- 6.4.8 Johnson & Johnson (Janssen)

- 6.4.9 Marinus Pharmaceuticals Inc.

- 6.4.10 Novartis AG

- 6.4.11 Ovid Therapeutics Inc.

- 6.4.12 Pfizer Inc.

- 6.4.13 Sanofi SA

- 6.4.14 SK Biopharmaceuticals Co. Ltd.

- 6.4.15 Sun Pharmaceutical Industries Limited

- 6.4.16 Sunovion Pharmaceuticals Inc.

- 6.4.17 Supernus Pharmaceuticals Inc.

- 6.4.18 Teva Pharmaceutical Industries Ltd.

- 6.4.19 UCB SA

- 6.4.20 Zydus Lifesciences

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment