PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445557

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1445557

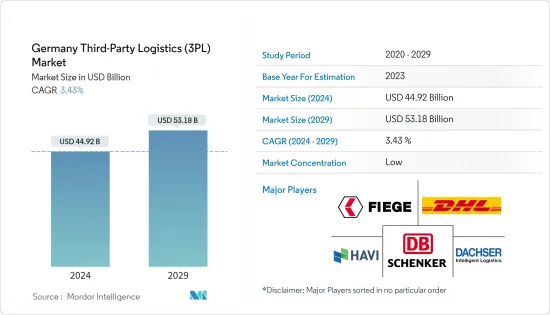

Germany Third-Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Germany Third-Party Logistics Market size is estimated at USD 44.92 billion in 2024, and is expected to reach USD 53.18 billion by 2029, growing at a CAGR of 3.43% during the forecast period (2024-2029).

Key Highlights

- As Germany is a regional hub, it is a preferred location for manufacturers who can have support from the ecosystem of leading shippers and third-party logistics providers (3PLs) in the country. The demand for warehousing space has expanded in the past decade, and over the forecast period, it is expected to be boosted by growth in regional trade and e-commerce.

- E-commerce is one of the major factors driving the market growth. The country has been among the top five revenue generating through e-commerce. The emergence of e-commerce in recent years has boosted the growth of the 3PL market. Given the increasing domestic market, and the projected greater efficiencies in inventory forecasting and stock management, the need for warehouse supply is expected to moderate in the future.

- Not only is Germany's logistics infrastructure world-class, but its companies are also global logistics leaders. In fact, the world's largest logistics service provider is a German company - Deutsche Post (DHL). Deutsche Bahn operates Europe's largest rail network, and Lufthansa Cargo is one of the world's leading global air freight companies.

- With the onset of COVID-19, the 3PL logistics market saw an upward trajectory, with the increase in demand coming especially from the e-commerce sector.

Germany Third-Party Logistics (3PL) Market Trends

Growth in the Automotive Sector to Drive the German 3PL Market

The automotive sector is the backbone industry in Germany, and the German automotive sector is a global leader.

Germany is the world's premium car production hub. Of all premium branded vehicles produced globally, 65% are German OEM-manufactured. Of all vehicles produced globally, 40% of vehicles were produced in Europe - of which 23% were made in Germany in 2021. Within Europe, more than 80% are German OEM-badged vehicles - 57% of these vehicles were made in Germany. The western European light vehicle production sector is a predominantly premium sector focused.

German vehicles were mainly exported to European countries. Other leading regions for vehicle export included North and South America, as well as Asia. The list of leading import countries for German motor vehicles included the US, the UK, and China among the top three. The country exports EUR 20-25 billion worth of cars to the US.

Volkswagen, BMW, and Daimler occupy the top three slots, with suppliers including Bosch, Schaffler, and ZF also coming out top internationally. The industry plans to invest EUR 150 billion in digitalization, electric mobility and drive systems, hydrogen technology and transport safety in the coming years.

Increasing Demand for E-commerce Fulfillment Services

The 3PL logistics sector is restless, seeing the growing demand for logistics services generated by the boom and evolution of e-commerce. Germany has one of the largest e-commerce markets in Europe. The number of e-commerce consumers, internet penetration, and the average amount spent per year are all above the European average.

In 2021, total sales amounted to USD 127.5 billion, which translated to a 24% growth compared to 2020. It is expected that the online population in Germany will increase from 62.4 million in 2020 to 68.4 million in 2025. E-commerce penetration in 2021 reached 77% in the German market.

As a result of strict COVID lockdown measures throughout 2020 and 2021, many German consumers increased their online purchases and bought goods like groceries and sanitary items online for the very first time. Key reasons for consumers to shop online include home delivery, 24/7 availability, and convenience.

Germany Third-Party Logistics (3PL) Industry Overview

The market is relatively fragmented, with the presence of a large number of local and international players, including Dachser, DB Schenker, DHL Supply Chain, Fiege Logistics, and Havi. While the country is undergoing regulatory changes, the 3PL market is experiencing expansions, mergers, and acquisitions, increasing its grasp over the national and international markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.2.3 Oppurtunities

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Policies and Regulations

- 4.5 General Trends in the Warehousing Market

- 4.6 Demand from Other Segments, such as CEP, Last Mile Delivery, and Cold Chain Logistics

- 4.7 Insights into E-commerce Business

- 4.8 Technological Developments in the Logistics Sector

- 4.9 Industry Attractiveness - Porter's Five Forces Analysis

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Automobile

- 5.2.2 Construction

- 5.2.3 Consumer and Retail (including E-commerce)

- 5.2.4 Life Sciences and Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL

- 6.2.2 DB Schenker

- 6.2.3 Dachser

- 6.2.4 Hellmann Worldwide Logistics

- 6.2.5 WemoveBW GmbH

- 6.2.6 Helm

- 6.2.7 Honold

- 6.2.8 Havi

- 6.2.9 FIEGE Logistics

- 6.2.10 Kuehne + Nagel

- 6.2.11 APL Logistics

- 6.2.12 Rigterink Logistics

- 6.2.13 Ziegler Logistics Deutschland*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of the Transportation and Storage Sector to Economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries