PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440153

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1440153

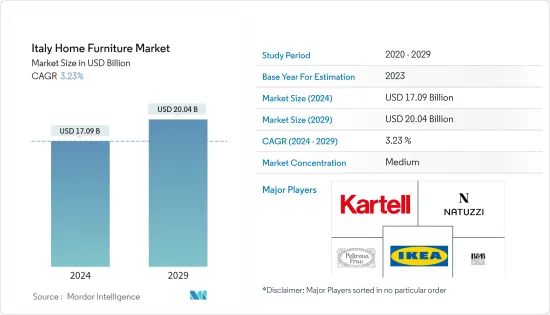

Italy Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Italy Home Furniture Market size is estimated at USD 17.09 billion in 2024, and is expected to reach USD 20.04 billion by 2029, growing at a CAGR of 3.23% during the forecast period (2024-2029).

The Average revenue index of Italy's furniture market existed at 159.2 in the year 2022. The furniture business is critical to the Italian economy. Italy is one of the world's major furniture exporters and the world's fourth-largest furniture maker. Some of the primary causes driving the expansion of the Italian home furniture sector are increased per capita GDP, households, and urbanization. The country is well-known for the high quality of its furniture and is one of the major makers of home furnishings in the European Union. Living/dining room furniture is one of the most popular types of home furnishings in the country.

Lockdowns in European nations due to Covid-19 disrupted numerous economic activities and harmed the supply chain of the home furniture industry. Although some nations gradually resumed operations, factories remain shuttered or are not working at full capacity. As a result, supply to European importers was seriously impacted, and they were already seeking alternative sources.

Exports account for a major share of the total production of Italian furniture production. "Made in Italy" became a trademark recognized by foreign retailers and consumers worldwide. The key factors of this success are large investments in design, a business model based on industrial districts, and a high propensity to export. The top two markets for Italian exports are France and Germany. Some other prominent export regions of Italian furniture products include the Asia-Pacific region, The United States, and Canada.

Italy Home Furniture Market Trends

Rising E-Commerce Sales in the Furniture Industry in Italy

Italy is the 13th largest E-commerce market, with revenue growth of 33% in 2021. During the same year, homeware and furniture in Italy had a market share of 9% in the e-commerce segment. The internet's role grew in importance, providing consumers the ability to buy at lower prices and a greater choice of options. Furniture is slowly but steadily becoming a dominant industry in Italian e-commerce.

In 2021, the value of business-to-customer (B2C) e-commerce purchases in Italy's furniture and home living segment was USD 3.58 billion. It is likely to expand further in the following years. Ikea.com, mano mano, leroymerlin, and mondoconv are among Italy's largest e-commerce home furnishings players during 2022.

Specialized Retailers Dominate the Market

Specialist channels dominate home furniture sales in Italy. Independent retailers like IKEA and Bo-Concept include a stronghold and control a significant market share. New store openings and acquisitions drive growth in the specialty sector. New stores generally open in parallel to new shopping center developments. Over the years, specialty retailers grew into large-scale retail chains but are now facing stiff competition from multiple fronts, including online retailers and mass merchants.

Multibrand stores are also very common in Italy, unlike other regions worldwide. The country includes around 2000 multi-brand stores selling luxury/high-end and low-end home furniture products. Some prominent Italian multi-brand stores are Interni, Salvioni, and Mollura. In the year 2022, the furniture market in Italy reached a level of USD 16,922 Million with continuous growth.

Italy Home Furniture Industry Overview

The Italian home furniture market is fragmented with players such as Natuzzi, Molteni, Scavolini, and Poltrona Frau. Due to the intensifying competition from international companies, the players are using 3D technologies, such as providing 3D tools to display model furniture designs by graphic designers on their websites. It can help companies maintain their dominant positions in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS & INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Innovations in the Furniture Industry

- 4.7 Impact of COVID 19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Wood

- 5.1.2 Metal

- 5.1.3 Plastic

- 5.1.4 Other Furniture

- 5.2 By Type

- 5.2.1 Kitchen Furniture

- 5.2.2 Living Room Furniture

- 5.2.3 Dining Room Furniture

- 5.2.4 Bedroom Furniture

- 5.2.5 Other Furniture

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets & Hypermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competion Overview

- 6.2 Company Profiles

- 6.2.1 Kartell

- 6.2.2 IKEA

- 6.2.3 B&B Italia

- 6.2.4 Poliform

- 6.2.5 Minotti

- 6.2.6 Molteni & Company

- 6.2.7 Luxury Living Group

- 6.2.8 Friul IntangLi

- 6.2.9 Natuzzi Italia

- 6.2.10 Poltrona Frau

- 6.2.11 PoltroneSofa

- 6.2.12 Scavolini

- 6.2.13 Calligaris

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US