PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910874

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910874

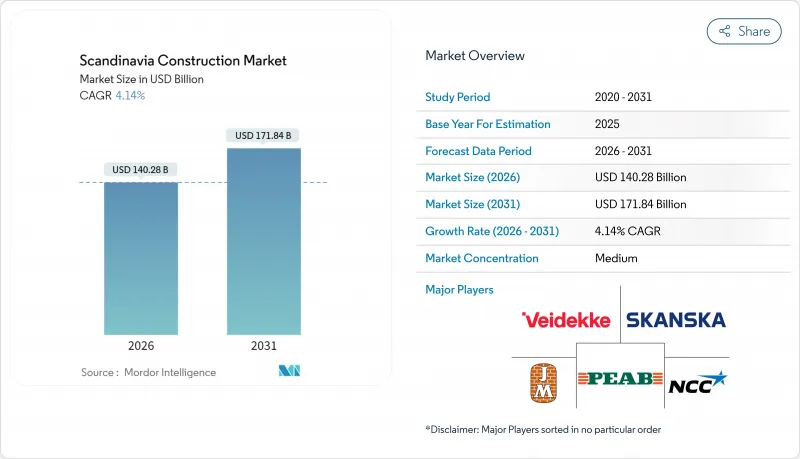

Scandinavia Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Scandinavia Construction Market was valued at USD 134.70 billion in 2025 and estimated to grow from USD 140.28 billion in 2026 to reach USD 171.84 billion by 2031, at a CAGR of 4.14% during the forecast period (2026-2031).

Activity rebounded after a steep 11% contraction in 2024 and a further 4% dip in early 2025 as monetary easing, infrastructure stimulus, and stabilising material costs restored confidence. Infrastructure outlays-especially rail corridors, tunnels and energy-related assets-are widening order books, while residential building begins to stabilise as mortgage rates retreat. Adoption of modern construction methods, stringent carbon rules, and rising private capital allocations are reshaping competitive strategies across the region. Contractors with strong prefabrication capabilities, robust labour pipelines, and digital project controls are winning the largest share of new tenders and achieving higher margins despite lingering cost pressures.

Scandinavia Construction Market Trends and Insights

Growing Adoption of Mass Timber and Cross-Laminated Timber (CLT) in Sustainable Construction

Nordic climate targets are accelerating the shift from concrete and steel to engineered wood. Denmark imposed whole-building carbon limits in 2023, and Sweden and Finland will follow in 2025, giving timber a regulatory head start. Finland's Katajanokan Laituri-7,600 m3 of prefabricated timber-became the nation's largest wood building in 2024, while Malmo's 12-storey ETC Hyllie project signals high-rise mainstreaming. Developers report faster sales and rental premiums on timber assets thanks to aesthetic appeal and lower embodied carbon. Factories supplying CLT panels now operate at near capacity, widening the addressable pool for prefabricated and hybrid solutions across the Scandinavia construction market.

Urban Rail and Transit Infrastructure Expansions to Support Growing City Populations

Governments are prioritising rail corridors that double as economic arteries. Sweden selected contractors for the North Bothnia Line and advanced Stockholm's first driverless metro, underscoring a pivot toward automated, high-frequency transit. Norway allocated USD 40.13 billion for rail through 2036, demonstrating sustained funding even amid fiscal prudence. Projects integrate housing, manufacturing and logistics sites, aligning transport planning with long-term competitiveness. As a result, rail packages now represent a growing slice of the Scandinavia construction market pipeline and attract specialised PPP financiers.

Tight Monetary Policy and High Interest Rates Reducing Mortgage Affordability

Elevated policy rates slashed Norwegian housing starts by 33% and new-home sales by 45% in 2023. Swedish housing investment dropped 55% that year, the steepest fall since the early 1990s. Central banks now signal cuts to 2% by late 2025. Developers pivoted to energy-efficient, modular units offering lower operating costs and flexible financing to maintain sales velocity. Prefabrication and value engineering are emerging as buffers that protect margins across the Scandinavia construction market until borrowing costs normalise.

Other drivers and restraints analyzed in the detailed report include:

- Widening Urban Housing Shortage Driving Multi-Family and High-Density Development

- Reshoring of Manufacturing and Construction of Clean-Energy Facilities

- Labour Availability Constraints Due to Ageing Workforce and Skills Mismatch

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure overtook other segments as the principal growth engine, set for a 5.85% CAGR through 2031. Sweden's green-lit North Bothnia Line and Norway's USD 42.56 billion rail plan headline robust public pipelines. Residential activity still contributed the largest 47.30% revenue slice in 2025, but rising mortgage eligibility thresholds curbed starts until rate cuts filter through. Commercial projects in logistics and light industry benefited from reshoring and e-commerce tailwinds, cushioning the Scandinavia construction market during the recent downturn.

Public spending now targets resilience and climate targets rather than pure capacity. Rail corridors integrate renewable generation, carbon-capture hubs and broadband conduits. Contractors with design-build-operate credentials secure recurring revenue streams across asset lifecycles. Meanwhile, traditional homebuilders are branching into civil packages or partnering with infrastructure specialists to offset residential cyclicality.

New projects accounted for 82.40% of 2025 turnover, but renovation will expand at 5.25% annually as owners pursue carbon-footprint reductions. Denmark's 7.1 kg CO2e/m2/year limit set for July 2025 is steering investments toward deep-retrofit programmes . Environmental Product Declarations became standard procurement criteria, driving demand for expertise in life-cycle analysis.

Projects now bundle insulation upgrades, smart-grid readiness and indoor-air improvements, elevating renovation from maintenance to strategic asset-value creation. Firms fluent in holistic building diagnostics, tenant engagement and performance guarantees command price premiums and protect backlog diversity within the Scandinavia construction market.

The Scandinavian Construction Market Report is Segmented by Sector (Residential, Commercial and Infrastructure), by Construction Type (New Construction and Renovation), by Construction Method (Conventional On-Site and Modern Methods of Construction), by Investment Source (Public and Private) and by Country (Denmark, Sweden and Norway). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Veidekke ASA

- Skanska AB (Sweden)

- NCC AB

- Peab AB

- JM AB

- AF Gruppen ASA

- Obos Bbl

- YIT Oyj

- SRV Yhtiot Oyj

- HENT AS

- Betonmast AS

- Ramboll Group A/S

- Kemp & Lauritzen A/S

- MT Hojgaard Holding A/S

- Skanska Norge AS

- Skanska Oy (Finland) - Nordic Ops

- Icop AS

- Implenia Norge AS

- O.M. Fjeld AS

- Lemminkainen Infra AS

- Peikko Group Oy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Adoption of Mass Timber and Cross-Laminated Timber (CLT) in Sustainable Construction

- 4.2.2 Urban Rail and Transit Infrastructure Expansions to Support Growing City Populations

- 4.2.3 Widening Urban Housing Shortage Driving Multi-Family and High-Density

- 4.2.4 Reshoring of Manufacturing and Construction of Clean Energy Facilities

- 4.2.5 Cross-Border Rail and Infrastructure Projects Secured by PPP Models

- 4.3 Market Restraints

- 4.3.1 Tight Monetary Policy and High Interest Rates Reducing Mortgage Affordability

- 4.3.2 Labour Availability Constraints Due to Ageing Workforce and Skills Mismatch

- 4.3.3 Supply Chain Instability and Construction Material Inflation Pressuring Margins

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of Scandinavian Countries with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Country

- 5.5.1 Denmark

- 5.5.2 Sweden

- 5.5.3 Norway

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Veidekke ASA

- 6.4.2 Skanska AB (Sweden)

- 6.4.3 NCC AB

- 6.4.4 Peab AB

- 6.4.5 JM AB

- 6.4.6 AF Gruppen ASA

- 6.4.7 Obos Bbl

- 6.4.8 YIT Oyj

- 6.4.9 SRV Yhtiot Oyj

- 6.4.10 HENT AS

- 6.4.11 Betonmast AS

- 6.4.12 Ramboll Group A/S

- 6.4.13 Kemp & Lauritzen A/S

- 6.4.14 MT Hojgaard Holding A/S

- 6.4.15 Skanska Norge AS

- 6.4.16 Skanska Oy (Finland) - Nordic Ops

- 6.4.17 Icop AS

- 6.4.18 Implenia Norge AS

- 6.4.19 O.M. Fjeld AS

- 6.4.20 Lemminkainen Infra AS

- 6.4.21 Peikko Group Oy

7 Market Opportunities & Future Outlook