Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1690152

North America Frozen Desserts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 159 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

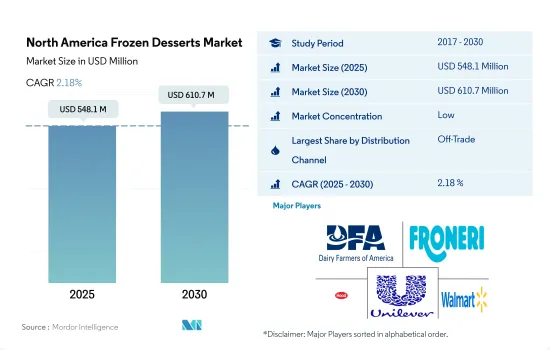

The North America Frozen Desserts Market size is estimated at 548.1 million USD in 2025, and is expected to reach 610.7 million USD by 2030, growing at a CAGR of 2.18% during the forecast period (2025-2030).

Rise in modern grocery retailing including hypermarkets and online stores fuels the sales through off-trade channels

- The off-trade segment recorded a high market share, primarily driven by hypermarkets and supermarkets. Supermarkets/Hypermarkets have always maintained a strong lead in terms of the sales of frozen desserts. The proximity factor of these channels, especially in large and developed cities, gives them the added advantage of influencing the consumer's decision to choose from a large variety of products available in the market. For instance, in the United States, supermarkets and hypermarkets accounted for over 66% of frozen dessert sales in terms of value in 2022.

- The online channel is projected to be the fastest-growing distribution channel for frozen desserts in North America. It is expected to register a CAGR of 2.4% during the forecast period. In Canada, online sales of frozen desserts registered a growth of 17% in terms of volume from 2017 to 2022, attributed to the increasing investment by modern grocery stores in the online delivery infrastructure in response to the changing purchasing behaviors of Canadian consumers. For instance, the survey conducted in 2021 reported that nearly 22% of Canadians plan to buy groceries online regularly.

- In the United States, major brands have partnered with online retailers to aid consumer convenience. For instance, prominent online retailers include Instacart, Amazon Fresh, Walmart, Kroger, Shipt, Thrive Market, Whole Foods, and FreshDirect. Key brands of frozen desserts available in Walmart's online stores include Van Leeuwen, Great Value, Edwards, and Marie Callender's.

Increasing demand for low-calorie desserts among the North American population

- Compared to 2021, the frozen desserts market in North America recorded an increase of 1.18% in 2022. In the last three years, consumers in North America preferred low-calorie desserts. Sorbet and frozen custard are the two main segments of the frozen dessert market. The demand for low-calorie desserts is increasing, thus boosting the market for frozen desserts. Sorbet and frozen custard have lower milk fat percentages than other dairy sweets like ice cream. The frozen dessert category in the region is expected to rise by 3.93% by 2025.

- Compared to other countries, the United States holds a 15.38% share of the North American market. The availability of frozen desserts in several retail locations, such as Walmart and Amazon, boosts the market's growth. Frozen desserts are available at varied prices (low, medium, and high). The base selling price of frozen desserts is USD 2.45, which can go as high as USD 130, thus increasing consumer affordability. With shares of 66.69%, supermarket/hypermarket chains were substantially more active in product provision than other retailing types during the review period.

- The market has observed a rising volume of individuals preferring ice creams due to the growing demand for low-fat dairy desserts. In Mexico, the ice cream segment held a share of 34.25% in terms of consumption volume during the review period.

North America Frozen Desserts Market Trends

The consumption of milk and dairy products is influenced by factors such as population growth, changing dietary preferences, and economic conditions, leading to variations in milk consumption patterns over time

- In 2020, the output of raw milk grew by 2.15%. In 2021, the growth rate of raw milk production was 3.4% higher than in 2019. The US Department of Agriculture (USDA) states that the demand for ice cream continued to rebound and grew by 4% Y-o-Y in 2020. In November 2021, milk production in the United States totaled 18.0 billion pounds, down by 0.4% from November 2020. The number of milk cows on US farms was 9.39 million heads, 47,000 less than in November 2020. Production per cow in the United States averaged 1,922 pounds in November 2021, three pounds above November 2020 and 10,000 heads lesser than in October 2021.

- In 2019, the consistency of raw milk production saw a modest increase as raw milk output experienced a minimal increase of 0.36% compared to 2018. The declining raw milk production was due to the closure of milk manufacturing facilities in the area and associated macroeconomic factors like rising milk demand but falling milk prices.

- When the statistics are compared to 2016, the growth rate of milk production in North America increased by 1.83% in 2019. In the United States, big farms managed 55.2% of all herds, and the number of milking cows increased to 1,953 heads. Such substantial dairy enterprises were increasingly found throughout the region's West, Southwest, and Upper Midwest. Similarly, the region gained 1.10% momentum in 2018. The average number of milking cows was 9.41 million heads in 2018, up by 40,000 heads over the previous year. The amount of milk produced per cow reached a record-high 5,781 pounds in 2018.

North America Frozen Desserts Industry Overview

The North America Frozen Desserts Market is fragmented, with the top five companies occupying 23.25%. The major players in this market are Dairy Farmers of America Inc., Froneri International Limited, HP Hood LLC, Unilever PLC and Walmart Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70349

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Per Capita Consumption

- 4.2 Raw Material/commodity Production

- 4.2.1 Milk

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Distribution Channel

- 5.1.1 Off-Trade

- 5.1.1.1 By Sub Distribution Channels

- 5.1.1.1.1 Convenience Stores

- 5.1.1.1.2 Online Retail

- 5.1.1.1.3 Specialist Retailers

- 5.1.1.1.4 Supermarkets and Hypermarkets

- 5.1.1.1.5 Others (Warehouse clubs, gas stations, etc.)

- 5.1.2 On-Trade

- 5.1.1 Off-Trade

- 5.2 Country

- 5.2.1 Canada

- 5.2.2 Mexico

- 5.2.3 United States

- 5.2.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Cedar Crest Specialties Inc.

- 6.4.2 Dairy Farmers of America Inc.

- 6.4.3 Double Rainbow Canada China Holdings Group Inc.

- 6.4.4 Froneri International Limited

- 6.4.5 HP Hood LLC

- 6.4.6 Perry's Ice Cream

- 6.4.7 Turkey Hill Dairy

- 6.4.8 Unilever PLC

- 6.4.9 Walmart Inc.

- 6.4.10 Wells Enterprises Inc.

7 KEY STRATEGIC QUESTIONS FOR DAIRY AND DAIRY ALTERNATIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.