PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643136

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1643136

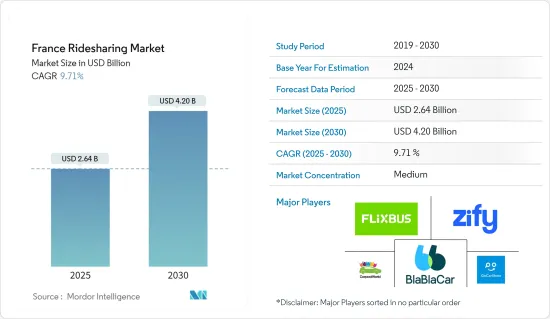

France Ridesharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The France Ridesharing Market size is estimated at USD 2.64 billion in 2025, and is expected to reach USD 4.20 billion by 2030, at a CAGR of 9.71% during the forecast period (2025-2030).

Rapid penetration of the internet and smartphones has increased the usability of ridesharing applications and created awareness at the same time. Technological advancements such as navigation service, live traffic data, and mapping, which are imperative for ridesharing services, have also propelled the market in France.

Key Highlights

- Global warming has manifolded due to human activities, and as per the report, the transportation sector contributes to 14% of total global CO2 emissions. 95% of the world's transportation energy involves burning fossil fuels, largely gasoline and diesel. To reduce CO2 emissions, the government is setting ambitious targets for the emission of CO2 for road vehicles and encouraging ride-sharing to achieve the Paris Agreement on Climate Change.

- The court of appeal in Paris has ordered vehicle owners willing to share their car with passengers not to charge any more than what it costs to drive them to their destination and has cracked down on the model of making a profit out of the country's carpooling schemes. This has increased the adoption of carpooling rides in the country.

- Rising strikes from the carpool operators for the higher and regulated pay rates, criminal cases for nonprofessional drivers (UberPoP), resistance from traditional transport services, and complex transport policies can restrain the growth of ridesharing in France.

- However, ridesharing offers cost-effective, eco-friendly, and alternative options to meet new people is expected to boost the market. Furthermore, it involves very limited physical infrastructure (if any) to boost and comes at a very limited cost.

France Ridesharing Market Trends

Rise in Demand for Carpool and Bike Pool Services is Expected to Drive the Market Growth

- A significant increase in the preference for carpool and bikepool services among regular office commuters is the major factor contributing to the growth of ridesharing services. In addition, the rise in the services offered by the leading market players, including BlaBlaCar, Uber, and goCarShare, and the option to choose convenient pick-up and drop locations are encouraging users to opt for ridesharing services.

- Ridesharing services rely on mobile applications to connect passengers with drivers. As internet penetration increases, more people have access to smartphones and can easily download and use ridesharing apps. The convenience of booking rides through mobile apps becomes more accessible with widespread internet access.

- According to StatCounter, as of June 2023, more than 50 percent of internet traffic in France came through mobile phones. Computers, Desktop and laptops' share of internet traffic was approximatly 44 percent. Other devices, such as tablets, accounted for about three percent of overall web traffic in France.

- Furthermore, ridesharing service providers offer advantages such as affordable pick-up and drop-off, co-passenger information, economical ride fares, and higher convenience than traditional transport service providers.

- In addition, several service providers offer various facilities, discounts, and offers, such as monthly passes on shared rides, to decrease the expenses of daily commuters. Thus, the rise in demand for carpooling and bikepool services collectively drives the ridesharing market's growth.

Dynamic Membership Type Segment is Expected to Hold Significant Market Share

- Dynamic subscription models may offer users flexibility regarding the number of rides they can take within a specific period. This flexibility allows users to adapt subscriptions to their changing transportation needs.

- Dynamic ridesharing offers carpoolers considerably more flexibility than conventional programs. Travelers can provide or request rides just minutes before their desired departure times or make scheduled appointments for one-time, one-way trips.

- The dynamic ridesharing service is based on a mobile application that allows people to make real-time arrangements for sharing car rides in an urban area, both as drivers and passengers. A smart matching algorithm would offer, in a short period, the best matching between the driver and the passenger, learning from users' feedback and improving its suggestions over time to better fulfill users' expectations.

- Domestic and international tourists often rely on ridesharing services for convenient transportation during their stays. Dynamic subscription models can provide them with flexibility and cost predictability, making it an attractive and convenient option for exploring the city or communicating between their hotel and tourist attractions.

- According to Insee, the number of overnight hotel stays in France, in July 2023, hotel establishments in France recorded approximately 13.6 million overnight stays by domestic guests. Meanwhile, overnight stays by inbound travelers reached about 9.5 million that month.

France Ridesharing Industry Overview

The French ridesharing market is semi-consolidated and dominated by major players like BlaBlaCar, GoCarShare, Zify France, Flix Mobility, and Carpool World. These major players, with a prominent market share, focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

- December 2023 - Uber and Carrefour teamed up to allow drivers of the ride-hailing company to access the French supermarket chain's charging points for electric vehicles; Uber invested EUR 0.3 million (USD 0.323 million) to allow its VTC (tourist vehicle with driver) drivers using EVs to charge their cars at Carrefour Energies' stations in France.

- January 2023 - Flix announced its partnership with Daimler Buses to manufacture high-performance electric long-distance buses and also announced the testing of 2 prototype coaches running on electricity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Analysis of the Mobility sector in France (Recent launch of e-bike and motor vehicle sharing by major automotive OEMs)

- 4.4 Market Drivers

- 4.4.1 France is Widely Considered to be the First Adopters of Ridesharing among major Countries in Europe

- 4.4.2 Growing Cost of Vehicle Ownership

- 4.4.3 Socio-economic and Demographic Factors are Highly Favorable to Ridesharing as the French Public is known to Rely on Shared Transport Services as one of the Key Modes of Travel

- 4.4.4 Incentives Provided by Local Agencies to Passengers and Riders of Ridesharing to Promote Development of Alternative Modes of Transport mainly Driven by Frequent Strikes by Local Train Employee Bodies

- 4.4.5 Rise in Demand for Carpool and Bike Pool Services

- 4.5 Market Restraints

- 4.5.1 Last mile connectivity remains a concern as compared to other models

- 4.5.2 Operational challenges for operators due to the dynamic nature of the industry and increasing investments in the ride hailing industry

- 4.6 PESTLE Analysis French Ridesharing Industry

- 4.7 Analysis of the socio economic and behavioral patterns promoting adoption of ridesharing in France

- 4.8 Impact of COVID-19 on the mobility industry

- 4.9 Analysis of Ridesharing Revenue Models (Commissions| Indirect Revenue| White-Label Software)

5 MARKET SEGMENTATION

- 5.1 By Membership Type

- 5.1.1 Fixed

- 5.1.2 Dynamic

- 5.1.3 Corporate

6 COMPETITIVE LANDSCAPE FRANCE RIDESHARING MARKET

- 6.1 Company Profiles

- 6.1.1 Bla bla Car

- 6.1.2 goCarShare

- 6.1.3 Zify France

- 6.1.4 Flix Mobility

- 6.1.5 Carpool World

- 6.1.6 Mobicoop (Roulexmalin)

- 6.1.7 Uber Technologies Inc.

7 INVESTMENT SCENARIO AND MARKET OUTLOOK