Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644282

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1644282

North America Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

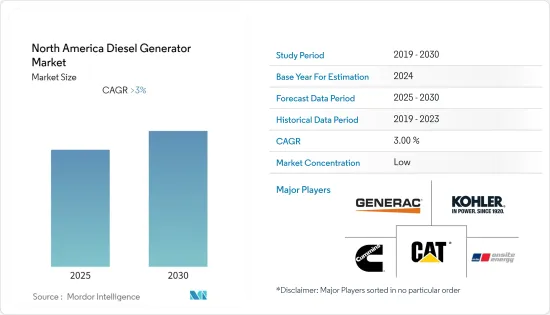

The North America Diesel Generator Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 negatively impacted the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- In the long run, the market is likely to be driven by things like a growing need for constant power and more power outages in the region caused by natural disasters.

- On the other hand, the move toward cleaner energy sources is a major thing that slows the growth of the market.

- Nevertheless, with the increasing deployment of data centers in the region with the Internet of Things' (IoT) adoption, the demand for diesel generator sets is expected to create enormous opportunities for diesel generator deployment.

- The United States is expected to lead the generator sets market in the North American region due to the increasing number of infrastructure projects and rising number of power outages in the country.

North America Diesel Generators Market Trends

Industrial Sector is to Dominate the Market

- The industrial sector is most likely to dominate the market for diesel generators. During power outages, i.e., to prevent production risks and in places where grid connectivity is limited, industrial operations depend heavily on electricity generated by diesel generators. As of 2021, the primary consumption in North America was about 113.70 exajoules, which was around 4% higher than in 2020 (108.79 exajoules).

- The rapid development of new industries and the increasing number of power outages due to natural calamities like hurricanes are considered significant factors that are driving the North American diesel generator market's growth.

- Various industrial activities, such as mining, oil and gas exploration, and railways, require heavy-duty generators for operation. The growing number of applications in various industries is also expected to drive the market.

- Though diesel is more expensive than gas, it has a higher energy density, so more energy can be extracted from the same fuel. Diesel is less flammable than gas and other fuels, making it safer to store and handle.

- Moreover, diesel generators are more reliable, and the initialization of diesel generator sets is more economical than that of gas generator sets. Due to the ease of transportation and storage of diesel, easy on-site fuel availability has also made diesel generator sets more popular than gas generator sets.

- Due to a sharp rise in manufacturing, the United States and Canada are expected to have a lot of industrial growth in the next few years. This is expected to drive the demand for diesel generators in the industrial sector during the forecast period.

The United States is Expected to Dominate in the Market

- The United States is the leading generator sets market in the North American region due to the increasing number of infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the nation, and rising commercial office space. The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power backup devices.

- In addition, the rapid growth in various end-use sectors, such as infrastructure, telecommunications, information technology (IT), and IT-enabled services, is expected to spur the demand for generator sets in the United States. For instance, in April 2022, Google announced it would invest around USD 9.5 billion in new offices and data centers in the United States by the end of 2022. Such investments are likely to increase demand for generator sets during the forecast period.

- Moreover, the rising oil and gas exploration activities in the United States are expected to boost the demand for diesel generators as the major oil and gas drilling and production processes are operated in remote areas where little or no power utility is available. Hence, diesel generators are required for proper operations in the oil and gas sector.

- According to the BP Statistical Review of World Energy 2022, oil production in the United States had an annual growth rate of 0.9%. Since the last decade, the country has registered a growth rate of 7.7%. The total amount of crude oil produced in the United States was 16,585 thousand barrels per day in 2021. The United States held an 18.5 percent share in global crude oil production in 2021.

- Furthermore, the use of diesel generators as critical power generation sources has significantly increased in recent years. According to the National Weather Service, the weather pattern in the country has changed in the past few years, contributing to the turbulent hurricanes. Hurricanes produce extremely high and dangerous winds, lightning, hail, and massive flooding. As a result, the demand for backup power diesel generators in the country is increasing.

- Therefore, as per the abovementioned points, the demand for diesel generators is estimated to increase in the United States during the forecasted period.

North America Diesel Generators Industry Overview

The North American diesel generator market needs to be more cohesive. Some of the key players in the market (not in particular order) include Caterpillar Inc., Cummins Inc., Generac Holdings Inc., MTU Onsite Energy Corp., and Kohler Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70579

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Less than 75 kVA

- 5.1.2 Between 75-375 kVA

- 5.1.3 More than 375 kVA

- 5.2 Application

- 5.2.1 Standby Power

- 5.2.2 Prime/ Continuous Power

- 5.2.3 Peak Shaving

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Caterpillar Inc.

- 6.3.2 Cummins Inc.

- 6.3.3 Generac Holdings Inc.

- 6.3.4 MTU Onsite Energy Corp.

- 6.3.5 Kohler Co.

- 6.3.6 Aggreko plc

- 6.3.7 Briggs & Stratton Corporation

- 6.3.8 Winco Inc.

- 6.3.9 Multiquip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.