PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444957

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444957

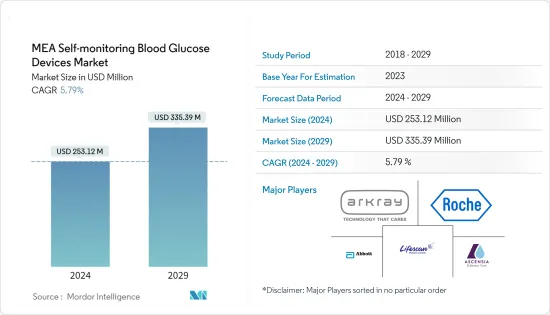

MEA Self-monitoring Blood Glucose Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The MEA Self-monitoring Blood Glucose Devices Market size is estimated at USD 253.12 million in 2024, and is expected to reach USD 335.39 million by 2029, growing at a CAGR of 5.79% during the forecast period (2024-2029).

The COVID-19 pandemic positively impacted the Middle East and Africa self-monitoring blood glucose market growth. Patients with diabetes, infected with COVID-19 may experience elevated blood glucose, abnormal glucose variability, and diabetic complications. The prevalence of diabetes in people with COVID-19 caused a significant increase in severity and mortality of COVID-19 in people with either type 1 (T1DM) or type 2 diabetes mellitus (T2DM), especially in association with poor glycemic control. While new-onset hyperglycemia and new-onset diabetes (both T1DM and T2DM) have been increasingly recognized in the context of COVID-19 and have been associated with worse outcomes. To avoid aggravation, a patient's blood glucose should be monitored regularly, which has underlined the importance of self-monitoring blood glucose devices. Pandemic emergency has created a rise in remote care from both patients and providers and removed many long-standing regulatory barriers.

73 million adults (20-79) are living with diabetes in the IDF MENA Region in 2021. This figure is estimated to increase to 95 million by 2030. 48 million adults in the IDF MENA Region are living with Impaired Glucose Tolerance, which places them at increased risk of developing type 2 diabetes. Diabetes is responsible for 796,000 deaths in the IDF MENA Region in 2021. USD 33 billion was spent on healthcare for people with diabetes in 2021.

The Middle East and African region had witnessed an alarming increase in the prevalence of diabetes, in recent years, the rate of diabetes is at an all-time high, mainly due to lifestyle changes. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day to maintain nominal blood glucose levels, such as administering additional insulin or ingesting additional carbohydrates by monitoring their blood glucose levels. Diabetes poses an emerging healthcare burden across the region.

Owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

MEA Self-monitoring Blood Glucose Devices Market Trends

Test strips Segment holds Highest Market Share in the current year

The test strips segment holds the highest market share of around 71.5% in the Middle East and African Self-monitoring Blood Glucose Market in the current year.

Blood glucose test strips are small disposable strips and a key component of blood glucose testing. When blood is placed onto the test strip, it reacts with a chemical called glucose oxidase producing gluconic acid from the glucose in the blood. At the other end of the test strip, the meter transfers a current to the test strip. The test strip includes electric terminals, which allow the meter to measure the current between the terminals. The current between the terminals changes depending on the level of gluconic acid produced. The blood glucose meter then uses an algorithm to work out the blood glucose level based on the difference in current.

The growth in market volume and share of test strips are expected to be higher than that of glucose meters because of the difference in use-case frequency. The Glucometer is a one-time purchase. However, test strips, on the other hand, are a continuous investment, as a test strip needs to be disposed of after one use. Thus, it presents a considerable cost impact to the consumers. The market's growth is expected to be spurred by the rising diabetic population. While an average glucose meter lasts anywhere between six months and three years, presenting a one-time cost, during the same time frame, the corresponding use of multiple (in the range of thousands) test strips may occur, causing a recurrent cost impact. Overall, the demand for blood glucose test strips is projected to grow significantly over the forecast period.

Governments in the Middle East identified the threat of diabetes and started to respond with various policies, initiatives, and programs. Six out of 15 countries in this region still do not contain a national operational action policy for diabetes. Many countries still do not include a national strategy to reduce overweight, obesity, and physical inactivity, which are important risk factors for diabetes. Most counties fully implemented national diabetes treatment guidelines. However, constant measures are being taken to minimize diabetic complications. Therefore, the studied market is anticipated to grow due to the factors above.

Saudi Arabia is expected to register highest CAGR in the Middle East and Africa Self-monitoring Blood Glucose Market over the forecast period

Saudi Arabia is expected to register a CAGR of about 6.42% in the Middle East and Africa Self-monitoring Blood Glucose Market over the forecast period.

More than one in ten people in Saudi Arabia is living with diabetes, and the prevalence of the disease will almost double by 2045, according to the International Diabetes Federation 2021 report. The report mentioned that 4.27 million people in Saudi Arabia include diabetes. The rise in the number of people with type 2 is driven by a complex interplay of socio-economic, demographic, environmental, and genetic factors. Key contributors include urbanization, an aging population, decreasing levels of physical activity, and increased levels of overweight and obesity.

Saudi Government in July 2022 announced that Saudi Arabia saw a growing demand for quality healthcare services spurred by changes, including an increasing and aging population and a growing prevalence of lifestyle diseases such as diabetes and obesity. The government and private sector are involved in working on healthcare entities, certifications, and regulations. The government is taking steps to include 100% of Saudi citizens covered by insurance. They are working towards ensuring affordability, access, and quality digital healthcare and primary care with cost-effectiveness.

Therefore, owing to the factors above, the growth of the studied market is anticipated in the Middle East and Africa Region.

MEA Self-monitoring Blood Glucose Devices Industry Overview

The Middle East and African self-monitoring blood glucose devices market is fragmented, with few major manufacturers boasting a global market presence. In contrast, the remaining manufacturers are confined to other local regions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Component

- 5.1.1 Glucometer Devices

- 5.1.2 Test Strips

- 5.1.3 Lancets

- 5.2 Geography

- 5.2.1 Egypt

- 5.2.2 Iran

- 5.2.3 Saudi Arabia

- 5.2.4 Oman

- 5.2.5 South Africa

- 5.2.6 Rest of Middle East and Africa

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes population

- 6.2 Type-2 Diabetes population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Abbott Diabetes Care

- 7.1.2 Roche Diabetes Care

- 7.1.3 Platinum Equity (LifeScan)

- 7.1.4 Arkray

- 7.1.5 Ascensia Diabetes Care

- 7.1.6 Agamatrix Inc.

- 7.1.7 Medisana

- 7.1.8 Trivida

- 7.1.9 I-Sens

- 7.2 Company Share Analysis

- 7.2.1 Abbott Diabetes Care

- 7.2.2 Platinum Equity (LifeScan)

- 7.2.3 Roche Diabetes Care

- 7.2.4 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS