PUBLISHER: MTN Consulting, LLC | PRODUCT CODE: 1881278

PUBLISHER: MTN Consulting, LLC | PRODUCT CODE: 1881278

Energy & Sustainability Tracker - Telcos, 2025: New Joint Study with Teral Research - Telco Energy Use Flatlined in 2024, but GHG Emissions Fell Again Due to Renewables and Scope 3 Efforts

Why this report

Climate change is worsening, and every sector must help meet this challenge. The ICT sector is no exception. Within ICT, network operators consume enormous amounts of energy and have a massive carbon footprint. While the growth in ICT comes from webscale operators (aka hyperscalers) investing in data centers for cloud and AI, the telco sector remains a larger energy problem. In 2024, telcos consumed 340.6 Terawatt hours (TWh) of energy, or 340,572 GWh. That's more than double that of webscale. The telco carbon footprint is also multiple times larger, due to a weaker adoption rate of renewables. For the networking business to improve its sustainability, the telco sector needs the most attention.

Economics also matter. Telcos spend an average of 4-5% of their operating expenses on energy, with some spending over 10%. The volatility of these costs is a primary concern. Natural disasters, war, and trade restrictions can all impact the price of carbon-based energy. Climate change itself, by intensifying extreme weather and causing population displacement, will make reliance on imported carbon sources even riskier. In contrast, renewable energy from local wind, solar, or hydro sources tends to have more stable prices. The march toward carbon neutrality could therefore also stabilize the cost model for the average telco.

VISUALS

Report overview

This report provides a detailed assessment of energy usage and sustainability in the telecommunications industry. We analyze energy consumption, renewable use, and emissions for 66 telcos representing about 85% of the global market. We examine the global industry and present metrics on usage, efficiency, and emissions for all companies. The report includes rankings to highlight leaders and recent improvers, as well as laggards, who often need supplier help to boost efficiency and renewability.

For all 66 telcos, we present data on energy use and Scope 1 and 2 emissions, based on their ESG reports. A subset of 50 companies also report enough Scope 3 data to allow for a value chain analysis. A subset of 32 publish traffic data, which lets us analyze traffic carried per unit of energy consumed and similar metrics.

This analysis extends MTN Consulting's research into network operator energy use, which began five years ago. The study relies on our proprietary telco financial tracker, with market data through June 2025. It is supplemented by new financial data gathered for this report, including Net PP&E for all 66 telcos from 2019 to 2024.

Scope and limitations

This report analyzes telecom operators, or telcos. These companies provide access-based services directly to end users, based on ownership of spectrum or regulator-issued licenses. This includes fixed, mobile, cable TV, and satellite providers. Our sample of 66 telcos is large and representative across all regions and segments. We are confident this is the best resource available for tracking energy use in the telco industry.

The telco business model has evolved, but most moves outside the core market have been reversed or failed to scale, as seen with AT&T's acquisition and subsequent spinoff of Time Warner. Some telcos are part of larger corporate groups and own infrastructure beyond telecom networks, like data centers or retail shops. However, almost all energy a telco consumes is tied directly to its network infrastructure, usually 80-90% of the total. For a mobile operator, the RAN alone is often 50-60% or more of total energy use. Data centers typically account for less than 10% of consumption, though this can reach 20-30% and may climb as Telco AI deployments mature.

Our database focuses on pure telcos or the telco division of a larger entity. In a few cases, like Softbank and Comcast, we must use corporate-level energy data because that is all they report. However, we only include financial metrics for their telco operations. Consequently, metrics like energy used per unit of revenue may be slightly overstated for these two companies.

Data and methodology

For the 66 telcos in this report, we present financial metrics alongside energy-related indicators: total energy and electricity consumption, renewable energy share, and greenhouse gas emissions by type. Data covers 2019-2024.

Compiling a consistent dataset was challenging. Unlike financial reporting, energy disclosures lack clear standards. Companies vary widely in what they report, and ESG data are not always audited. We reviewed dozens of sustainability reports, relying on verified data where possible and estimating where necessary to create comparable time series. We believe this is the most objective and comprehensive review of its kind.

Financial data is sourced from our latest Telco Tracker, supplemented with newly collected Net PP&E data. Energy and emissions figures are generally "as reported," but we made estimates in some cases. For instance, some companies do not report full historical Scope 3 data. We have energy and Scope 1-2 data for all 66 telcos. Scope 3 data is available for 50, and traffic data for 32.

A company can claim renewable electricity use when it (1) generates renewable power on-site; (2) purchases renewable electricity from the grid and retains the associated renewable energy certificates (RECs); (3) owns off-site renewable generation and retires the RECs; or (4) signs purchased power agreements (PPAs) with third-party suppliers of green power, and then also transfer the RECs.

When companies update their historical data, we modify our database to reflect this, as updates usually stem from improved methodologies. We do not restate data if it would change the reported scope.

A note on public vs. private companies

In telecom, nearly all major companies are public and now issue some form of ESG report. The quality and transparency vary, but few sizable telcos report no energy data. Our experience in reviewing hundreds of these reports helps us judge data credibility and make necessary estimates.

One caveat: our focus on public companies introduces a small reporting bias. Public companies face greater pressure to use renewables and commit to emissions reductions. The companies we do not track, which are often private, likely have weaker environmental records. Altice Europe and BSNL are examples. There is a minor issue with Scope 3 emissions as well: the companies that do not publish a full set of reliable scope 3 stats may be less environmentally friendly than the average. However, when we estimate global Scope 3 totals, we assume missing companies have the same average footprint as those included. This means we are likely slightly underestimating the telecom industry's environmental problem.

MTN Consulting Partnership with Teral Research

This report is the kickoff product for a new service called Telecom Energy & Sustainability (TES). TES is a collaboration between MTNC and Teral Research (TR).

Organizations covered:

|

|

Table of Contents

1. Overview

2. Analysis

3. Global results

4. Company results

5. Rankings

6. Raw data

7. About

List of Figures and Charts

Global, and for each of 66 companies:

- Revenues ($M) and YoY % growth

- Capex ($M) and Capex/Revenue ratio

- Net PP&E ($M) and YoY % growth

- Capex and Net PP&E growth

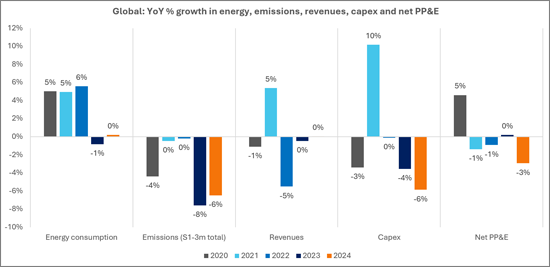

- YoY % growth in energy, emissions, revenues, capex and net PP&E

- Correlation between financial, energy input, and emissions output metrics, 2019-24

- Energy consumption in GWh and electricity's share of total energy, 2019-24

- YoY growth rates in electric use vs. total energy consumption

- Energy intensity vs. electric intensity (MWh per $1M in revenues), 2019-24

- Energy intensity, Net PP&E basis

- Renewable energy consumption in GWh and % total

- Carbon footprint by emissions type (market-based), millions of metric tons of CO2-equivalent

- Market-based vs. location-based carbon footprint (S1-2-3 total), millions of metric tons of CO2-equivalent

- Scope 3 emissions as % of S1-2-3 total, market-based vs. location-based

- Emissions intensity in MT CO2-equivalent per $M of revenue

- Emissions intensity in MT CO2-equivalent per $M of Net PP&E

Additional charts for each company:

- Company vs. global average: Energy intensity in MWh per $M of revenue

- Company vs. global average: Energy intensity in MWh per $M of revenue

- Company vs. global average: S1-S3m emissions intensity in MT CO2-equivalent per $M of revenue

- Company vs. global average: Renewable energy as % total consumption

Individual charts ranking all telcos by the following key metrics that we track:

- Capex ($M)

- Net PP&E ($M)

- Revenues ($M)

- Electricity consumption

- Energy consumption

- Renewable energy consumption (MWh)

- % renewable energy

- Capex/Revenue

- Electric as % total energy

- Scope 3 as % of total S1-3 emissions

- YoY % change in energy consumption

- Electricity intensity (MWh per $M in revenue)

- Energy intensity (MWh per $M in revenue)

- Energy intensity of fixed asset base (MWh per $1M in Net PP&E)

- Revenue from 1MWh electricity used ($)

- Revenue from 1MWh energy used ($)

- Emissions intensity: S1-2m per $M in Net PP&E

- Emissions intensity: S1-2m per $M in revenue

- Emissions intensity: S1-3m per $M in Net PP&E

- Emissions intensity: S1-3m per $M in revenue

- S1

- S2l

- S2m

- S1-2l

- S1-2m

- S3

- S1-3m