PUBLISHER: Reed Electronics Research | PRODUCT CODE: 1858293

PUBLISHER: Reed Electronics Research | PRODUCT CODE: 1858293

Yearbook of World Electronics Data Volume 3 2025 - World Summary and Overview of Electronics Production & Markets in CEE

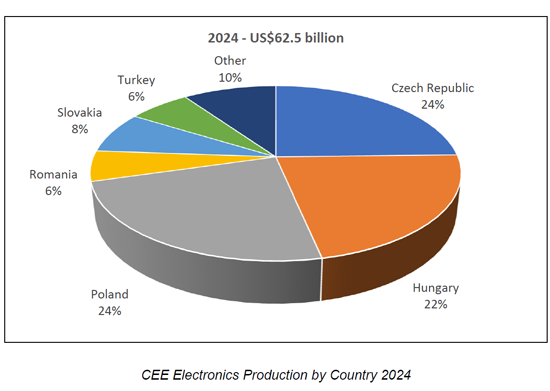

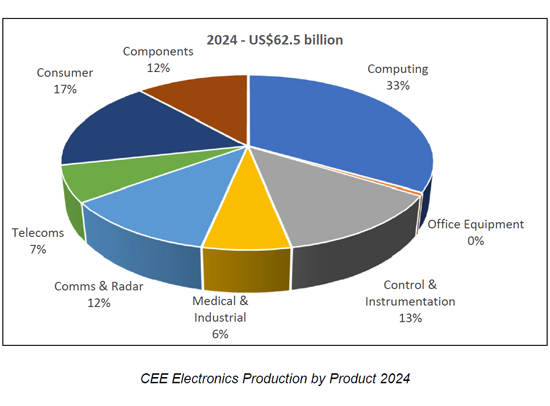

CEE's electronics industry is focused on a small number of major global OEMs and electronic manufacturing services providers with the focus on the 3C segments. In total, the 3C segments amounted to US$42.8 billion in 2024, 77.5% of electronics equipment output. 3C production is centered on five countries with Poland, Slovakia and Turkey major centres for TV production. Production in the Czech Republic is focused on computing while Hungary is produces a combination of computing and consumer electronics related equipment.

After declining in 2023, on the back of the slowdown in the PC market, the production of computer equipment surged in 2024 with growth of 21.5% with output forecast to increase by a further 12.3% in 2025. Growth has been driven by the demand for servers and other equipment related to AI and data centres. The Czech Republic, Hungary and Poland have been the main beneficiaries with computer related output in the three countries increasing by 28.2% in 2024 and a forecasted 13.2% in 2025.

The focus on 3C has been a key factor in the growth of electronics industry across CEE. However, with volume manufacturing in the hands of a relatively few companies the region continues to be vulnerable to the individual strategies of the company. Companies will need to balance the advantages of producing in close proximity to the European market against the advantages offered through lower costs by utilising manufacturing facilities in China and increasingly other Asian countries.

Industrial and high-end communications equipment production within the region will continue to take an increasing share of production, although in overall percentage terms it will remain low because of the dominant position held by the 3C segment. Although this will be led by foreign investment as companies look to move production from higher cost West European locations or in the case of non-European companies look to establish a low-cost manufacturing base to serve the European market, it is also an area where indigenous companies will compete.

The region is already a production base for many of the leading European Electronic Manufacturing Services (EMS) providers with the proportion of production undertaken in the region forecast to increase over the period to 2028. Although the major players with large volume production plants will continue to dominate in value terms companies over the period there will be significant investment by medium-sized companies looking for a lower-cost European production base.

Within CEE, components accounted for only 11.6% of electronics output in 2024. There are a number of indigenous companies although they tend to be small and focused on passive components. Foreign companies who have established operations in the country including Infineon Technologies and onsemi, both companies expanding their existing semiconductor facilities in the region with onsemi in June 2024 announcing plans to invest US$2 billion to expand silicon carbide wafer production at its existing operations in the Czech Republic.

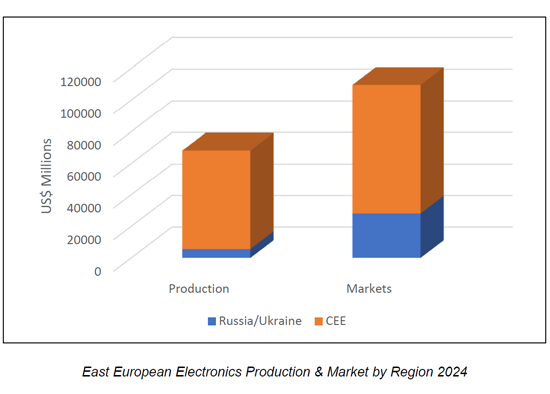

Apart from the impact on Europe and globally, Russia's invasion of Ukraine continues to influence the country's electronics industry. For the current report we have provided information on the structure of the industry in 2024. The forecasts for Russian production and markets, which are largely based on an analysis of ITC and UN trade data, limited government statistics and Russian media sources, assume that output in US dollars will increase by 9.1% in 2024 and 14.5% in 2025. Following two years of double-digit declines output for the Ukrainian electronics industry increased by 20.9% in 2024 and is forecast to increase by a further 9.5% in 2025. In 2024, Russia and Ukraine accounted for 8.2% of electronics production in the region and 25.6% of the market. At the end of 2024 electronics production in Russia and Ukraine was an estimated US$5.6 billion and compared to US$5.1 billion in the prior year, with growth in value terms being driven by developments in Russia. In the same period the electronics market increased by 5.1% to US$28.1 billion (2023: US$26.7 billion).

Published since 1991 'the Volume 3 of the Yearbook of World Electronics Data' provides:

- Unique World Summary covering the 53 countries in the Yearbook of World Electronics Data series

- A single source solution allowing you to track the electronics industry in 13 countries in CEE

- 13 major product groups.

- Market and production forecasts.

- CD-option allows you to manipulate the data quickly and easily: produce your own subsets or summaries of the data, create your own forecasts or cut and paste the data into your own in-house reports and presentations.

Who will benefit ?

The Yearbook is essential research providing key data for all areas of the electronics industry including:

- Distributors and manufacturers of electronic components and materials.

- Suppliers of electronic production equipment.

- OEMs.

- EMS Providers.

- Government, including investment organizations.

- Financial and industry analysts.

- Academic institutes & universities tracking developments in the electronics industry.

The Yearbook of World Electronics Data

'The Yearbook of World Electronics Data series' presents market and production statistics for the GLOBAL electronics industry. Available in three published volumes covering 53 countries and 13 major product groups, the yearbook is used in the formulation of business and market planning, in tracking trends based on a clear understanding of how the industry has developed historically and to provide a basis for medium and long-term forecasting.

53 country coverage, 13 major product groups

... comparable country by country and product by product.

13 countries covered:

|

|

|

TABLE OF CONTENTS

1. INTRODUCTION

2. WORLD SUMMARY DATA

- 2.1. Economic Overview

- 2.2. Electronics Overview

- 2.2.1. Americas

- 2.2.2. Japan

- 2.2.3. Asia

- 2.2.4. Western Europe

- 2.2.5. Central and Eastern Europe

- 2.3. Summary of World Electronics Production 2022

- 2.4. Summary of World Electronics Production 2023

- 2.5. Summary of World Electronics Production 2024

- 2.6. Summary of World Electronics Production 2025

- 2.7. Summary of World Electronics Markets 2022

- 2.8. Summary of World Electronics Markets 2023

- 2.9. Summary of World Electronics Markets 2024

- 2.10. Summary of World Electronics Markets 2025

- 2.11. Summary of World Electronics Markets 2026

- 2.12. Summary of World Electronics Markets 2027

- 2.13. Summary of World Electronics Markets 2028

3. CENTRAL & EASTERN EUROPE SUMMARY DATA

- 3.1. Central & Eastern Europe Economic Overview

- 3.2. Central & Eastern Europe Electronics Overview

- 3.3. Imports 2021-2022

- 3.4. Exports 2021-2022

- 3.5. Consolidated Summary of East Europe Production 2022

- 3.6. Consolidated Summary of East Europe Production 2023

- 3.7. Consolidated Summary of East Europe Production 2022

- 3.8. Consolidated Summary of East Europe Production 2023

- 3.9. Summary of East Europe Medical & Industrial Production

- 3.10. Summary of East Europe Consumer Production

- 3.11. Summary of East Europe Components Production

- 3.12. Consolidated East Europe Summary of Markets 2022

- 3.13. Consolidated East Europe Summary of Markets 2023

- 3.14. Consolidated East Europe Summary of Markets 2024

- 3.15. Consolidated East Europe Summary of Markets 2025

- 3.16. Consolidated East Europe Summary of Markets 2026

- 3.17. Consolidated East Europe Summary of Markets 2027

- 3.18. Consolidated East Europe Summary of Markets 2028

- 3.19. Summary of East Europe Medical & Industrial Markets

- 3.20. Summary of East Europe Consumer Markets

- 3.21. Summary of East Europe Components Markets

4. COUNTRY DATA

- 4.1. BULGARIA

- 4.1.1. Economic Outlook

- 4.1.2. Electronics Industry Structure

- 4.1.3. Bulgaria Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.1.4. Bulgaria Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.2. CROATIA

- 4.2.1. Economic Outlook

- 4.2.2. Electronics Industry Structure

- 4.2.3. Croatia Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 3.2.4. Croatia Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.3. Czech Republic

- 4.3.1. Economic Outlook

- 4.3.2. Electronics Industry Structure

- 4.3.3. Czech Republic Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.3.4. Czech Republic Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.4. Estonia

- 4.4.1. Economic Outlook

- 4.4.2. Electronics Industry Structure

- 4.4.3. Estonia Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.4.4. Estonia Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.5. HUNGARY

- 4.5.1. Economic Outlook

- 4.5.2. Electronics Industry Structure

- 4.5.3. Hungary Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.5.4. Hungary Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.6. LITHUANIA

- 4.6.1. Economic Outlook

- 4.6.2. Electronics Industry Structure

- 4.6.3. Lithuania Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.6.4. Lithuania Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.7. POLAND

- 4.7.1. Economic Outlook

- 4.7.2. Electronics Industry Structure

- 4.7.3. Poland Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.7.4. Poland Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.8. ROMANIA

- 4.8.1. Economic Outlook

- 4.8.2. Electronics Industry Structure

- 4.8.3. Romania Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.8.4. Romania Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2006-2012

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.9. RUSSIA

- 4.9.1. Economic Outlook

- 4.9.2. Electronics Industry Structure

- 4.9.3. Russia Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.9.4. Russia Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.10. SLOVAKIA

- 4.10.1. Economic Outlook

- 4.10.2. Electronics Industry Structure

- 4.10.3. Slovakia Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.10.4. Slovakia Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.11. SLOVENIA

- 4.11.1. Economic Outlook

- 4.11.2. Electronics Industry Structure

- 4.11.3. Slovenia Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.11.4. Slovenia Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.12. TURKEY

- 4.12.1. Economic Outlook

- 4.12.2. Electronics Industry Structure

- 4.12.3. Turkey Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.12.4. Turkey Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

- 4.13. UKRAINE

- 4.13.1. Economic Outlook

- 4.13.2. Electronics Industry Structure

- 4.13.3. Ukraine Production

- EDP 2022-2025

- Office Equipment 2022-2025

- Control & Instrumentation 2022-2025

- Medical & Industrial 2022-2025

- Communications & Radar 2022-2025

- Telecommunications 2022-2025

- Consumer 2022-2025

- Video 2022-2025

- Audio 2022-2025

- Personal 2022-2025

- Components 2022-2025

- Active 2022-2025

- Passive 2022-2025

- Other 2022-2025

- 4.13.4. Ukraine Markets

- EDP 2022-2028

- Office Equipment 2022-2028

- Control & Instrumentation 2022-2028

- Medical & Industrial 2022-2028

- Communications & Radar 2022-2028

- Telecommunications 2022-2028

- Consumer 2022-2028

- Video 2022-2028

- Audio 2022-2028

- Personal 2022-2028

- Components 2022-2028

- Active 2022-2028

- Passive 2022-2028

- Other 2022-2028

5. APPENDICES

- 5.1. World Exchange Rates

- 5.2. Gide to the Interpretation of the Statistics

- 5.3. Guide to International Statistical Classifications

- 5.4. Guide to the Definition of the Electronic Product Headings

- 5.5. List of Sources