Need help finding what you are looking for?

Contact Us

PUBLISHER: TrendForce | PRODUCT CODE: 1794797

PUBLISHER: TrendForce | PRODUCT CODE: 1794797

Overview of Global Electronics Sector's Demand in 2025

PUBLISHED:

PAGES: 5 Pages

DELIVERY TIME: 1-2 business days

SELECT AN OPTION

In 2025, the electronics industry sees diverging trends: strong AI demand, weak consumer devices, early pull-in erases seasonality, and future growth slows.

INFOGRAPHICS

Key Highlights:

- In 2025, AI demand surges while consumer electronics-smartphones, laptops, TVs-see stagnant or minimal growth.

- Tariff and subsidy impacts cause early inventory pull-in, disrupting traditional sales peaks and raising risks in the year's latter half.

- Cloud providers grow capital spending on AI servers, with less tariff impact, squeezing budgets for general servers. "AI alone thrives."

- Edge AI loses momentum; end devices lack compelling AI applications, failing to drive upgrades or noticeable consumer interest.

- By 2026, the industry enters a consolidation phase with slow growth, most products remain weak, and AI server momentum eases; breakthroughs needed for future cycles.

- Tariff uncertainty impacts PC OEMs' and suppliers' production strategies; DRAM supply-demand and other components merit close watch.

Product Code: TRi-0082

Table of Contents

1. Tariffs and Subsidies Have Caused Demand to Be Pulled Forward and Disrupts Traditional Peak Season

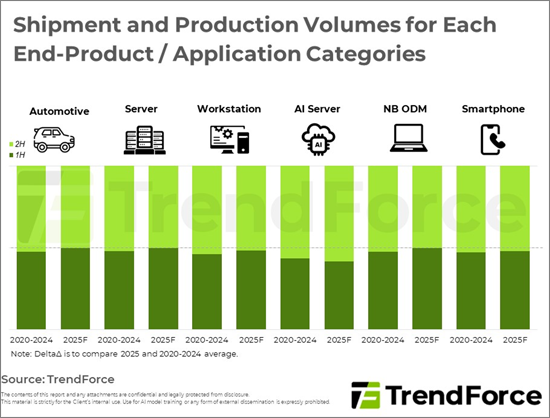

- Shipment and Production Volumes for Each End-Product / Application Categories - Distribution of Annual Shipments Between 1H25 and 2H25 vs. Averages of Previous Five Years

2. Demand Grows Steadily for AI Servers, Which Are Less Affected by Tariff-Related Uncertainties Compared with Other Applications and Have Benefited from CSPs' Increasing Capital Expenditure

3. Subsiding Topic of Edge AI Yet to Ignite Replacement Wave; Killer Applications Pending for the Time Being

4. Looking Ahead to 2026: Industry Enters Low-Speed Growth and Consolidation under Decelerating Increment

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.