PUBLISHER: Roots Analysis | PRODUCT CODE: 1891239

PUBLISHER: Roots Analysis | PRODUCT CODE: 1891239

Biopharmaceutical Excipients Market (2nd Edition): Industry Trends and Global Forecasts: Distribution by Scale of Operation, Modality, Excipient, Chemical Components, Company Size, Source of Manufacturing, End User and Geographical Regions 2025-2035

Biopharmaceutical Excipients Market: Overview

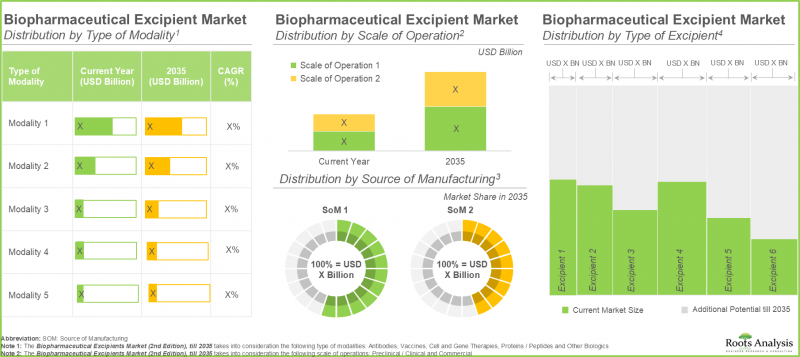

As per Roots Analysis, the global biopharmaceutical excipients market is estimated to grow from USD 3.3 billion in the current year to USD 6.3 billion by 2035, at a CAGR of 6.6% during the forecast period, till 2035.

Scale of Operation

- Preclinical / Clinical Scale

- Commercial Scale

Type of Modality

- Antibodies

- Vaccines

- Cell and Gene Therapies

- Proteins / Peptides

- Other Biologics

Type of Excipients

- Buffering Agents

- Lyoprotectant Agents

- Solubilizers and Surfactants

- Tonicity Agents

- pH Adjusting Agents

- Others

Chemical Components

- Carbohydrates

- Polymers

- Polyols

- Proteins / Amino Acids

- Others

Company Size

- Small Players

- Mid-sized Players

- Large and Very Large Players

Source of Manufacturing

- In-house

- Outsourcing

End User

- Contract Manufacturers

- Drug Developers

- Hybrid Players

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Middle East and North Africa

- Latin America

Biopharmaceutical Excipients Market: Growth and Trends

Over the years, the increasing popularity of biologics has resulted in a significant shift within the healthcare sector. In the past ten years, the annual rate of biopharmaceutical approvals (which includes monoclonal antibodies, recombinant proteins, vaccines, and gene therapies) by the USFDA has consistently risen, with biologics accounting for over 40% of all newly approved drugs. As of October 2024, there are more than 12,700 biologic products undergoing clinical trials globally, emphasizing the level of innovation in this area. Considering their unique advantages over small molecules such as improved efficacy, precise targeting, and better safety profiles, biologics are projected to continue propelling advancements in treatments for cancer, autoimmune diseases, rare disorders, and genetic conditions.

Nevertheless, biologics possess a complex structure and are naturally less stable than small molecules, making them susceptible to physical degradation (such as aggregation, precipitation, and denaturation) and chemical degradation (including oxidation, deamidation, and hydrolysis). To overcome these challenges, various biopharmaceutical excipients, such as sugars (including sucrose and trehalose), amino acids (such as arginine), surfactants (for example, polysorbates), and polymeric agents (like PEGs), are employed to stabilize formulations, increase solubility, regulate pH and tonicity, and enhance overall bioavailability. In fact, more than 70% of marketed biologics depend on polysorbates as stabilizing agents, while bulking agents, antioxidants, and preservatives enhance their functional effectiveness. Further, excipients have become essential for facilitating advanced drug product formats, including lyophilized vials, prefilled syringes, and ready-to-use liquid formulations. Ongoing innovations, especially in lipid-based excipients for mRNA vaccines and therapeutics, are expanding the landscape of excipients even further. Combined with the increasing tendency towards outsourcing and enhanced regulatory support for innovative excipients, the application of biopharmaceutical excipients is set for continued market growth throughout the forecast period.

Biopharmaceutical Excipients Market: Key Insights

The report delves into the current state of the biopharmaceutical excipients market and identifies potential growth opportunities within the industry. Some key findings from the report include:

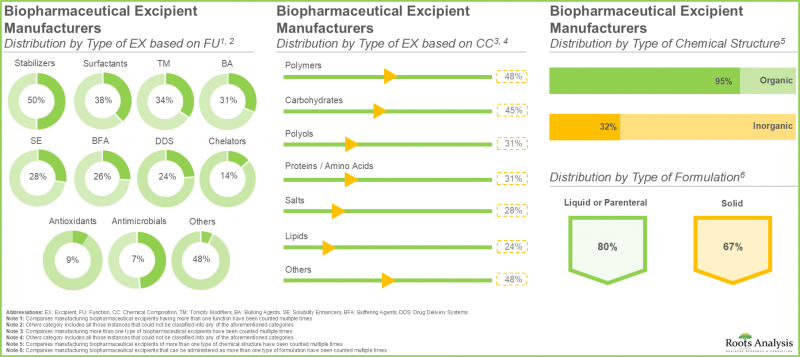

- The current market landscape features the presence of close to 60 manufacturers that claim to offer services for biopharmaceutical excipients across the world; of these, majority (40%) are headquartered in Europe.

- Close to 50% of the companies manufacture polymer-based biopharmaceutical excipients; of these, majority (~65%) of the excipients are being used as stabilizers in drug formulations.

- Stakeholders are actively upgrading their existing capabilities in order to enhance their respective portfolios and gain a competitive edge over other players active in the biopharmaceutical excipients manufacturing domain.

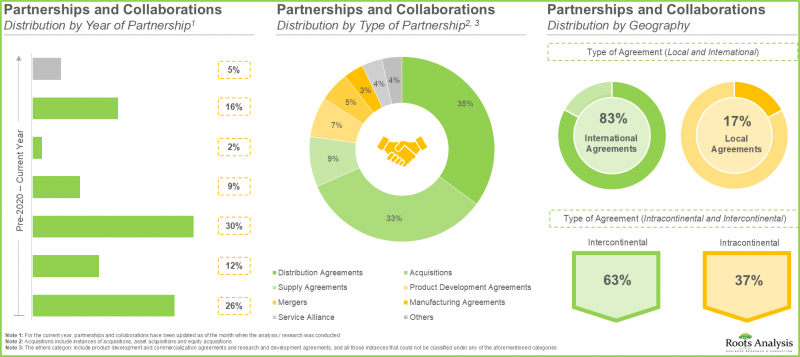

- Majority of the deals inked in this domain were distribution agreements, indicating a strategic focus on expanding market reach and ensuring broad availability of specialized excipients across diverse geographic regions.

- Driven by the growing demand for biologics, CMOs have significantly expanded their existing capacities and capabilities; notably, majority of the expansion initiatives have been undertaken by players based in Europe.

- Our proprietary framework serves as a strategic tool for developers, enabling them to evaluate vendors based on their specific requirements for biopharmaceutical excipients manufacturing.

- Driven by the growing adoption of biologic therapies, innovations in multifunctional excipients, the biopharmaceutical excipients market is anticipated to witness robust growth in the coming years.

- Currently, majority of the market share is captured by antibodies subsegment owing to the widespread use of monoclonal antibodies, which play a vital role in targeted therapies for cancer, autoimmune, and infectious diseases.

- Carbohydrates sub-segment is estimated to capture most of the market share in the current year, due to the extensive use of starch, sucrose, and dextrose in drug formulations as stabilizers and bulking agents for biologics.

Biopharmaceutical Excipients Market: Key Segments

Commercial Scale of Operation Accounts for the Largest Share of Biopharmaceutical Excipients Market

In terms of scale of operation, the biopharmaceutical excipients market is segmented across preclinical / clinical and commercial scale. In the current year, the commercial scale segment occupies the higher biopharmaceutical excipients market share (close to 90%) and is likely to grow at a higher CAGR (6.8%) during the forecast period. This dominance is fueled by the increased demand for biologics, necessitating substantial amounts of excipients to maintain product stability, solubility, and efficacy during large-scale production. With an increasing number of biologic drugs moving into commercial manufacturing phases, the demand for excipients rises significantly, leading to a larger market share for commercial-scale operations.

Solid Tumors Segment to Hold the Highest Revenue in the Biopharmaceutical Excipient Market

In the current year, antibodies segment constitutes most of the biopharmaceutical excipient market size (around 50%) and is likely to grow at a higher CAGR (8.7%) during the forecast period. This results from the swift expansion and mass manufacturing of monoclonal antibodies and antibody-driven therapies, necessitating various excipients to maintain the stability, solubility, and safety of these intricate biologics.

Europe Accounts for the Largest Share of the Biopharmaceutical Excipients Market

In terms of geographical regions, Europe is likely to capture majority (35%) of the biopharmaceutical excipients market share in the current year, and this trend is unlikely to change in the future as well. This results from the significant presence of well-established biotech and pharmaceutical firms in the sector. The focus of major industry leaders drives substantial funding and speeds up the integration of AI technologies in pharmaceutical production. Further, this sector gains advantages from its developed pharmaceutical ecosystem, strong R&D capacities, and favorable regulatory framework, which enhances its leading position. Significantly, the Asia-Pacific market is expected to expand to the highest CAGR (7.7%) throughout the forecast period until 2035.

Example Players in the Biopharmaceutical Excipients Market

- Avantor

- Spectrum Chemical Manufacturing

- Actylis

- Pfanstiehl

- Biospectra

- BOC Sciences

- Merck KGaA

- CG Chemkalien

- Evonik

- BASF Pharma

- Mass Chemicals

- Gangwal

- Mitushi Biopharma

- Nagase Vitta

Biopharmaceutical Excipients Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the biopharmaceutical excipients market, focusing on key market segments, including [A] type of modality, [B] type of excipient, [C] chemical components, [D] company size, [E] source of manufacturing, [F] end user and [G] key geographical regions.

- Market Landscape: A comprehensive evaluation of biopharmaceutical excipients companies, considering various parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters, [D] location of manufacturing facilities, [E] type of excipient, [F] scale of operation, [G] type of formulation, [H] type of biologic and [I] global regulatory compliance.

- Company Profiles: In-depth profiles of companies engaged in the manufacturing of biopharmaceutical excipients headquartered in North America, Europe and Asia-Pacific focusing on [A] company overview, [B] biopharmaceutical excipient offering, [C] recent developments and [D] an informed future outlook.

- Company Competitiveness Analysis: A comprehensive competitive analysis of biopharmaceutical manufacturers, examining factors, such as supplier strength, service strength and number of manufacturing facilities.

- Partnerships and Collaborations: A detailed analysis of the partnerships inked between stakeholders in the biopharmaceutical excipients market based on several relevant parameters, such as [A] year of partnership, [B] type of partnership, [C], year and type of partnership and [D], geographical distribution of partnership activity.

- Recent Expansions: A detailed analysis of the recent expansions undertaken by various biopharmaceutical excipient manufacturers, based on several relevant parameters, such as [A] year of expansion, [B] type of expansion, [C] type of excipient, [D] type of expansion (region and country), [E] location of expanded facility (region), [F] location of expanded facility (country), [G] most active players (in terms of number of recent expansions) and [H] geographical distribution (region and country).

- Capacity Analysis: An estimate of the global installed capacity for biopharmaceutical excipients taking into consideration the capacities of various biopharmaceutical excipient manufacturers, along with information on the distribution of available global biopharmaceutical excipient production capacity based on several relevant parameters, such as [A] company size, [B] scale of operation and [C] key geographical regions.

- Vendor Selection Framework: An insightful vendor selection framework highlighting the parameters that should be considered when outsourcing biopharmaceutical excipients manufacturing operations.

- Market Impact Analysis: In-depth analysis of the factors that can impact the growth of the biopharmaceutical excipients market. It also features identification and market analysis of [A] key drivers, [B] potential restraints, [C] emerging opportunities, and [D] existing challenges.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Biopharmaceutical Excipients

- 6.3. Properties of Ideal Excipients

- 6.4. Classification of Biopharmaceutical Excipients

- 6.4.1. Classification of Excipients based on Route of Administration

- 6.4.2. Classification of Excipients based on Structure

- 6.4.3. Classification of Excipients based on Function

- 6.4.4. Classification of Excipients based on Ability to Interfere with Metabolization and Efflux Mechanisms

- 6.5. Applications of Biopharmaceutical Excipients

- 6.6. Regulatory Scenario

- 6.7. Concluding Remarks

7. MARKET LANDSCAPE: BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURERS

- 7.1. Chapter Overview

- 7.2. Biopharmaceutical Excipients Manufacturers: Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Location of Headquarters and Company Size

- 7.2.5. Analysis by Location of Manufacturing Facilities (Region)

- 7.2.6. Analysis by Scale of Operation

- 7.2.7. Analysis by Type of Excipient based on Chemical Composition

- 7.2.8. Analysis by Type of Excipient based on Function

- 7.2.9. Analysis by Type of Chemical Structure of Excipient

- 7.2.10. Analysis by Type of Formulation

- 7.2.11. Analysis by Type of Biologic

- 7.2.12. Analysis by Global Regulatory Compliance

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Overview of Peer Groups

- 8.5. Company Competitiveness Analysis

- 8.5.1. Biopharmaceutical Excipient Manufacturers Headquartered in North America

- 8.5.2. Biopharmaceutical Excipient Manufacturers Headquartered in Europe

- 8.5.3. Biopharmaceutical Excipient Manufacturers Headquartered in Asia-Pacific

9. BIOPHARMACEUTICAL EXCIPIENT MANUFACTURERS: COMPANY PROFILES OF PLAYERS BASED IN NORTH AMERICA

- 9.1. Chapter Overview

- 9.2. Avantor

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Biopharmaceutical Excipient Offerings

- 9.2.4. Manufacturing Facilities

- 9.2.5. Recent Developments and Future Outlook

- 9.3. Spectrum Chemical Manufacturing

- 9.4. Actylis

- 9.5. Pfanstiehl

- 9.6. Biospectra

- 9.7. BOC Sciences

10. BIOPHARMACEUTICAL EXCIPIENT MANUFACTURERS: COMPANY PROFILES OF PLAYERS BASED IN EUROPE

- 10.1. Chapter Overview

- 10.2. Merck KGaA

- 10.2.1. Company Overview

- 10.2.2. Financial Information

- 10.2.3. Biopharmaceutical Excipient Offerings

- 10.2.4. Manufacturing Facilities

- 10.2.5. Recent Developments and Future Outlook

- 10.3. CG Chemkalien

- 10.4. Evonik

- 10.5. BASF Pharma

11. BIOPHARMACEUTICAL EXCIPIENT MANUFACTURERS: COMPANY PROFILES OF PLAYERS BASED IN ASIA-PACIFIC

- 11.1. Chapter Overview

- 11.2. Mass Chemicals

- 11.2.1. Company Overview

- 11.2.2. Financial Information

- 11.2.3. Biopharmaceutical Excipient Offerings

- 11.2.4. Manufacturing Facilities

- 11.2.5. Recent Developments and Future Outlook

- 11.3. Gangwal

- 11.4. Mitushi Biopharma

- 11.5. Nagase Vitta

12. PARTNERSHIPS AND COLLABORATIONS

- 12.1. Chapter Overview

- 12.2. Partnership Models

- 12.3. Biopharmaceutical Manufacturers: Partnerships and Collaborations

- 12.3.1. Analysis by Year of Partnership

- 12.3.2. Analysis by Type of Partnership

- 12.3.3. Analysis by Year and Type of Partnership

- 12.3.4. Analysis by Type of Excipient

- 12.3.5. Most Active Players: Analysis by Number of Partnerships

- 12.3.6. Analysis by Geography

- 12.3.6.1. Local and International Agreements

- 12.3.6.2. Intracontinental and Intercontinental Agreements

13. RECENT EXPANSIONS

- 13.1. Chapter Overview

- 13.2. Biopharmaceutical Excipient Manufacturing Market: Recent Expansions

- 13.2.1. Analysis by Year of Expansion

- 13.2.2. Analysis by Type of Expansion

- 13.2.3. Analysis by Year and Type of Expansion

- 13.2.4. Analysis by Type of Excipient

- 13.2.5. Analysis by Type of Expansion (Country)

- 13.2.6. Analysis by Location of Expanded Facility (Region)

- 13.2.7. Analysis by Location of Expanded Facility (Country)

- 13.2.8. Analysis by Type of Expansion and Location of Manufacturing Facility

- 13.2.9. Most Active Players: Analysis by Number of Recent Expansions

- 13.2.10. Geographical Analysis

14. CAPACITY ANALYSIS

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. Biopharmaceutical Excipient Manufacturing: Installed Global Capacity

- 14.3.1. Analysis by Company Size

- 14.3.2. Analysis by Scale of Operation

- 14.3.3. Analysis by Location of Manufacturing Facility

- 14.4. Concluding Remarks

15. VENDOR SELECTION FRAMEWORK

- 15.1. Reasons to Outsource in Isotope Manufacturing

- 15.2. Commonly Outsourced Operations in Isotope Manufacturing

- 15.3. Key Parameters

- 15.4. Methodology for Vendor Selection Framework

- 15.5. Benchmarking of Parameters

- 15.6. Value Addition vs Evaluation Complexity Matrix

- 15.7. Case Study Assessment of Merck

- 15.8. Overview of Vendor Assessment Dashboard

- 15.8.1. Scenario I

- 15.8.2. Scenario II

- 15.8.3. Scenario III

16. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 16.1. Chapter Overview

- 16.2. Market Drivers

- 16.3. Market Restraints

- 16.4. Market Opportunities

- 16.5. Market Challenges

- 16.6. Conclusion

17. GLOBAL BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET

- 17.1. Chapter Overview

- 17.2. Assumptions and Methodology

- 17.3. Biopharmaceutical Manufacturing Services Market, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 17.3.1. Roots Analysis Perspective on Market Growth

- 17.3.2. Scenario Analysis

- 17.3.2.1. Conservative Scenario

- 17.3.2.2. Optimistic Scenario

- 17.4. Key Market Segmentations

18. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY SCALE OF OPERATION

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Scale of Operation

- 18.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Preclinical / Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 18.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 18.4. Data Triangulation and Validation

19. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY TYPE OF MODALITY

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Type of Modality

- 19.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Antibodies, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Cell and Gene Therapies, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.3.4. Biopharmaceutical Excipients Manufacturing Services Market for Proteins / Peptides, Historical Trends (since 2021) and Forecasted Estimate, (till 2035)

- 19.3.5. Biopharmaceutical Excipients Manufacturing Services Market for Other Biologics, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.4. Data Triangulation and Validation

20. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY TYPE OF EXCIPIENTS

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Type of Excipient

- 20.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Buffering Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Lyoprotectant Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Solubilizers and Surfactants, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.3.4. Biopharmaceutical Excipients Manufacturing Services Market for Tonicity Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.3.5. Biopharmaceutical Excipients Manufacturing Services Market for pH Adjusting Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.3.6. Biopharmaceutical Excipients Manufacturing Services Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 20.4. Data Triangulation and Validation

21. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY CHEMICAL COMPONENTS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Chemical Components

- 21.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Carbohydrates, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 21.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Polymers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 21.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Polyols, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 21.3.4. Biopharmaceutical Excipients Manufacturing Services Market for Proteins / Amino Acids, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 21.3.5. Biopharmaceutical Excipients Manufacturing Services Market for Others, Historical Trends (since 2021)and Forecasted Estimates (till 2035)

- 21.4. Data Triangulation and Validation

22. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY COMPANY SIZE

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Company Size

- 22.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Small Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 22.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Mid-sized Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 22.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Large and Very Large Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 22.4. Data Triangulation and Validation

23. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY SOURCE OF MANUFACTURING

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Source of Manufacturing

- 23.3.1. Biopharmaceutical Excipients Manufacturing Services Market for In-house, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 23.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Outsourcing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 23.4. Data Triangulation and Validation

24. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY END USER

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by End User

- 24.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Contract Manufacturers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 24.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Drug Developers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 24.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Hybrid Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 24.4. Data Triangulation and Validation

25. BIOPHARMACEUTICAL EXCIPIENTS MANUFACTURING SERVICES MARKET, BY GEOGRAPHICAL REGIONS

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Geographical Regions

- 25.3.1. Biopharmaceutical Excipients Manufacturing Services Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.1.1. Biopharmaceutical Excipients Manufacturing Services Market in the US, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.1.2. Biopharmaceutical Excipients Manufacturing Services Market in Canada, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2. Biopharmaceutical Excipients Manufacturing Services Market in Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.1. Biopharmaceutical Excipients Manufacturing Services Market in France, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.2. Biopharmaceutical Excipients Manufacturing Services Market in Germany, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.3. Biopharmaceutical Excipients Manufacturing Services Market in Italy, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.4. Biopharmaceutical Excipients Manufacturing Services Market in Spain, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.5. Biopharmaceutical Excipients Manufacturing Services Market in the UK, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.2.6. Biopharmaceutical Excipients Manufacturing Services Market in Rest of Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3. Biopharmaceutical Excipients Manufacturing Services Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3.1. Biopharmaceutical Excipients Manufacturing Services Market in China, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3.2. Biopharmaceutical Excipients Manufacturing Services Market in India, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3.3. Biopharmaceutical Excipients Manufacturing Services Market in South Korea, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3.4. Biopharmaceutical Excipients Manufacturing Services Market in Japan, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.3.5. Biopharmaceutical Excipients Manufacturing Services Market in Rest of Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.4. Biopharmaceutical Excipients Manufacturing Services Market in Middle East and Africa, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.4.1. Biopharmaceutical Excipients Manufacturing Services Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.4.2. Biopharmaceutical Excipients Manufacturing Services Market in UAE, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.4.3. Biopharmaceutical Excipients Manufacturing Services Market in Egypt, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.5. Biopharmaceutical Excipients Manufacturing Services Market in Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.5.1. Biopharmaceutical Excipients Manufacturing Services Market in Brazil, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.5.2. Biopharmaceutical Excipients Manufacturing Services Market in Mexico, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.5.3. Biopharmaceutical Excipients Manufacturing Services Market in Rest of Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.3.1. Biopharmaceutical Excipients Manufacturing Services Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 25.4. Biopharmaceutical Excipients Manufacturing Services Market , by Geographical Regions: Market Dynamics Assessment

- 25.4.1. Penetration Growth (P-G) Matrix

- 25.4.2. Market Movement Analysis

- 25.5. Data Triangulation and Validation

26. CONCLUDING INSIGHTS

27. EXECUTIVE INSIGHTS

28. APPENDIX I: TABULATED DATA

29. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS

List of Tables

- Table 6.1 Classification of Biopharmaceutical Excipients based on Function

- Table 7.1 Biopharmaceutical Excipient Manufacturers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 7.2 Biopharmaceutical Excipient Manufacturers: Information on Type of Excipient based on Chemical Composition and Function

- Table 7.3 Biopharmaceutical Excipient Manufacturers: Information on Scale of Operation, Type of Formulation, Type of Excipient (based on Chemical Structure), Type of Biologic and Global Regulatory Compliance

- Table 9.1 Biopharmaceutical Excipient Manufacturers in North America: List of Companies Profiled

- Table 9.2 Avantor: Company Snapshot

- Table 9.3 Avantor: Biopharmaceutical Excipient Offerings

- Table 9.4 Avantor: Information on Manufacturing Facilities

- Table 9.5 Avantor: Recent Developments and Future Outlook

- Table 9.6 Spectrum Chemical Manufacturing: Company Snapshot

- Table 9.7 Spectrum Chemical Manufacturing: Biopharmaceutical Excipient Offerings

- Table 9.8 Spectrum Chemical Manufacturing: Information on Manufacturing Facilities

- Table 9.9 Spectrum Chemical Manufacturing: Recent Developments and Future Outlook

- Table 9.10 Actylis: Company Snapshot

- Table 9.11 Actylis: Biopharmaceutical Excipient Offerings

- Table 9.12 Actylis: Information on Manufacturing Facilities

- Table 9.13 Actylis: Recent Developments and Future Outlook

- Table 9.14 Pfanstiehl: Company Snapshot

- Table 9.15 Pfanstiehl: Biopharmaceutical Excipient Offerings

- Table 9.16 Pfanstiehl: Information on Manufacturing Facilities

- Table 9.17 Pfanstiehl: Recent Developments and Future Outlook

- Table 9.18 Biospectra: Company Snapshot

- Table 9.19 Biospectra: Biopharmaceutical Excipient Offerings

- Table 9.20 Biospectra: Information on Manufacturing Facilities

- Table 9.21 Biospectra: Recent Developments and Future Outlook

- Table 9.22 BOC Sciences: Company Snapshot

- Table 9.23 BOC Sciences: Biopharmaceutical Excipient Offerings

- Table 9.24 BOC Sciences: Information on Manufacturing Facilities

- Table 9.25 BOC Sciences: Recent Developments and Future Outlook

- Table 10.1 Biopharmaceutical Excipient Manufacturers in Europe: List of Companies Profiled

- Table 10.2 Merck KGaA: Company Snapshot

- Table 10.3 Merck KGaA: Biopharmaceutical Excipient Offerings

- Table 10.4 Merck KGaA: Information on Manufacturing Facilities

- Table 10.5 Merck KGaA: Recent Developments and Future Outlook

- Table 10.6 CG Chemkalien: Company Snapshot

- Table 10.7 CG Chemkalien: Biopharmaceutical Excipient Offerings

- Table 10.8 CG Chemkalien: Information on Manufacturing Facilities

- Table 10.9 CG Chemkalien: Recent Developments and Future Outlook

- Table 10.11 Evonik: Company Snapshot

- Table 10.12 Evonik: Biopharmaceutical Excipient Offerings

- Table 10.13 Evonik: Information on Manufacturing Facilities

- Table 10.14 Evonik: Recent Developments and Future Outlook

- Table 10.15 BASF Pharma: Company Snapshot

- Table 10.16 BASF Pharma: Biopharmaceutical Excipient Offerings

- Table 10.17 BASF Pharma: Information on Manufacturing Facilities

- Table 10.18 BASF Pharma: Recent Developments and Future Outlook

- Table 11.1 Biopharmaceutical Excipient Manufacturers in Asia-Pacific: List of Companies Profiled

- Table 11.2 Mass Chemicals: Company Snapshot

- Table 11.3 Mass Chemicals: Biopharmaceutical Excipient Offerings

- Table 11.4 Mass Chemicals: Information on Manufacturing Facilities

- Table 11.5 Mass Chemicals: Recent Developments and Future Outlook

- Table 11.6 Gangwal: Company Snapshot

- Table 11.7 Gangwal: Biopharmaceutical Excipient Offerings

- Table 11.8 Gangwal: Information on Manufacturing Facilities

- Table 11.9 Gangwal: Recent Developments and Future Outlook

- Table 11.10 Mitushi Bopharma: Company Snapshot

- Table 11.11 Mitushi Biopharma: Biopharmaceutical Excipient Offerings

- Table 11.12 Mitushi Biopharma: Information on Manufacturing Facilities

- Table 11.13 Mitushi Biopharma: Recent Developments and Future Outlook

- Table 11.14 Nagase Vitta: Company Snapshot

- Table 11.15 Nagase Vitta: Biopharmaceutical Excipient Offerings

- Table 11.16 Nagase Vitta: Information on Manufacturing Facilities

- Table 11.17 Nagase Vitta: Recent Developments and Future Outlook

- Table 12.1 Biopharmaceutical Excipient Manufacturers Market: List of Partnerships and Collaborations, Since 2016

- Table 12.2 Partnerships and Collaborations: Information on Type of Agreement

- Table 13.1 Biopharmaceutical Excipient Manufacturers Market: List of Expansions, Since 2020

- Table 14.1 Capacity Analysis: Information on Company Size of Biopharmaceutical Excipient Manufacturers

- Table 14.2 Capacity Analysis: Information on Average Capacity by Company Size

- Table 14.3 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Total Capacity by Company Size

- Table 28.1 Biopharmaceutical Excipient Manufacturers: Distribution by Year of Establishment

- Table 28.2 Biopharmaceutical Excipient Manufacturers: Distribution by Company Size

- Table 28.3 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters

- Table 28.4 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters and Company Size

- Table 28.5 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Manufacturing Facilities (Region)

- Table 28.6 Biopharmaceutical Excipient Manufacturers: Distribution by Scale of Operation

- Table 28.7 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Composition

- Table 28.8 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Function

- Table 28.9 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Chemical Structure of Excipient

- Table 28.10 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Formulation

- Table 28.11 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Biologic

- Table 28.12 Biopharmaceutical Excipient Manufacturers: Distribution by Global Regulatory Compliance

- Table 28.13 Avantor: Consolidated : Business Segment-wise Revenues and Consolidated Financial Details (USD Million), Since 2021

- Table 28.14 Merck KGaA: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since

2021

- Table 28.15 CG Chemkalien: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since 2021

- Table 28.16 Evonik: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since 2021

- Table 28.17 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2016

- Table 28.18 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 28.19 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2016

- Table 28.20 Partnerships and Collaborations: Distribution by Type of Excipients

- Table 28.21 Most Active Players: Distribution by Number of Partnerships

- Table 28.22 Partnerships and Collaborations: Distribution by Country

- Table 28.23 Partnerships and Collaborations: Distribution by Region

- Table 28.24 Recent Expansions: Cumulative Year-wise Trend, Since 2016

- Table 28.25 Recent Expansions: Distribution by Type of Expansion

- Table 28.26 Recent Expansions: Distribution by Type of Excipient

- Table 28.27 Recent Expansions: Distribution by Type of Expansion (Country)

- Table 28.28 Recent Expansions: Distribution by Location of Expanded Facility (Region)

- Table 28.29 Recent Expansions: Distribution by Type of Expansion and Location of Manufacturing Facility

- Table 28.30 Most Active Players: Distribution by Number of Recent Expansions

- Table 28.31 Recent Expansions: Distribution by Geography

- Table 28.32 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Range of Installed Capacity

- Table 28.33 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Company Size

- Table 28.34 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Scale of Operation

- Table 28.35 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Region)

- Table 28.36 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Country)

- Table 28.37 Global Biopharmaceutical Excipients Market, Historical Trends (since 2021) and Forecasted Estimates (till 2035): Base Scenario (USD Million)

- Table 28.38 Global Biopharmaceutical Excipients Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Million)

- Table 28.39 Global Biopharmaceutical Excipients Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Million)

- Table 28.40 Global Biopharmaceutical Excipients Market: Distribution by Scale of Operation

- Table 28.41 Biopharmaceutical Excipients Market for Preclinical / Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.42 Biopharmaceutical Excipients Market for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.43 Global Biopharmaceutical Excipients Market: Distribution by Type of Modality

- Table 28.44 Biopharmaceutical Excipients Market for Antibodies, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.45 Biopharmaceutical Excipients Market for Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.46 Biopharmaceutical Excipients Market for Cell and Gene Therapies, Historical

Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million) Table 28.47 Biopharmaceutical Excipients Market for Proteins / Peptides, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.48 Biopharmaceutical Excipients Market for Other Biologics, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.49 Global Biopharmaceutical Excipients Market: Distribution by Type of Excipient

- Table 28.50 Biopharmaceutical Excipients Market for Buffering Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.51 Biopharmaceutical Excipients Market for Lyoprotectant Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.52 Biopharmaceutical Excipients Market for Solubilizers and Surfactants, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.53 Biopharmaceutical Excipients Market for Tonicity Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.54 Biopharmaceutical Excipients Market for pH Adjusting Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.55 Biopharmaceutical Excipients Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.56 Global Biopharmaceutical Excipient Market: Distribution by Chemical Components

- Table 28.57 Biopharmaceutical Excipients Market for Carbohydrates, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.58 Biopharmaceutical Excipients Market for Polymers, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.59 Biopharmaceutical Excipients Market for Polyols, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.60 Biopharmaceutical Excipients Market for Proteins / Amino Acids, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Table 28.61 Biopharmaceutical Excipients Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.62 Biopharmaceutical Excipients Market: Distribution by Company Size

- Table 28.63 Biopharmaceutical Excipients Market for Small Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.64 Biopharmaceutical Excipients Market for Mid-sized Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.65 Biopharmaceutical Excipients Market for Large and Very Large Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Figure 22.66 Biopharmaceutical Excipients Market: Distribution by Source of Manufacturing

- Figure 22.67 Biopharmaceutical Excipients Market for In-house, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.68 Biopharmaceutical Excipients Market for Outsourcing, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.69 Biopharmaceutical Excipients Market: Distribution by End-User

- Table 28.70 Biopharmaceutical Excipients Market for Contract Manufacturers, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.71 Biopharmaceutical Excipients Market for Drug Developers, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.72 Biopharmaceutical Excipients Market for Hybrid Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.73 Biopharmaceutical Excipients Market: Distribution by Geographical Regions

- Table 28.74 Biopharmaceutical Excipients Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.75 Biopharmaceutical Excipients Market in the US, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.76 Biopharmaceutical Excipients Market in Canada, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.77Biopharmaceutical Excipients Market in Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035), ,Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.78 Biopharmaceutical Excipients Market in France, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.79 Biopharmaceutical Excipients Market in Germany, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Table 28.80 Biopharmaceutical Excipients Market in Italy, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.81 Biopharmaceutical Excipients Market in Spain, Historical Trends (since 2021) and Forecasted Estimates (till 2035) ,Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.82 Biopharmaceutical Excipients Market in the UK, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.83 Biopharmaceutical Excipients Market in Rest of Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.84 Biopharmaceutical Excipients Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.85 Biopharmaceutical Excipients Market in China, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.86 Biopharmaceutical Excipients Market in India, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.87 Biopharmaceutical Excipients Market in South Korea, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.88 Biopharmaceutical Excipients Market in Japan, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.89 Biopharmaceutical Excipients Market in Rest of Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.90 Biopharmaceutical Excipients Market in Middle East and Africa, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.91 Biopharmaceutical Excipients Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.92 Biopharmaceutical Excipients Market in UAE, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.93 Biopharmaceutical Excipients Market in Egypt, Historical Trends (since 2021) and

Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.94 Biopharmaceutical Excipients Market in Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.95 Biopharmaceutical Excipients Market in Brazil, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.96 Biopharmaceutical Excipients Market in Mexico, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

- Table 28.97 Biopharmaceutical Excipients Market in Rest of Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035), Conservative, Base and Optimistic Scenarios (USD Million)

List of Figures

- Figure 2.1 Research Methodology: Project Methodology

- Figure 2.2 Research Methodology: Data Sources for Secondary Research

- Figure 2.3 Research Methodology: Robust Quality Control

- Figure 3.1 Market Dynamics: Forecast Methodology

- Figure 3.2 Market Dynamics: Key Market Segmentation

- Figure 4.1 Lessons Learnt from Past Recessions

- Figure 5.1 Executive Summary: Biopharmaceutical Excipient Manufacturers Landscape

- Figure 5.2 Executive Summary: Market Trends

- Figure 5.3 Executive Summary: Market Sizing and Opportunity Analysis

- Figure 6.1 Properties of an Ideal Excipient

- Figure 6.2 Classification of Biopharmaceutical Excipients based on Ability to Interfere with Metabolization and Efflux Mechanisms

- Figure 6.3 Applications of Biopharmaceutical Excipients

- Figure 7.1 Biopharmaceutical Excipient Manufacturers: Distribution by Year of Establishment

- Figure 7.2 Biopharmaceutical Excipient Manufacturers: Distribution by Company Size

- Figure 7.3 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters

- Figure 7.4 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Headquarters and Company Size

- Figure 7.5 Biopharmaceutical Excipient Manufacturers: Distribution by Location of Manufacturing Facilities (Region)

- Figure 7.6 Biopharmaceutical Excipient Manufacturers: Distribution by Scale of Operation

- Figure 7.7 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Chemical Composition

- Figure 7.8 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Excipient based on Function

- Figure 7.9 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Chemical Structure of Excipient

- Figure 7.10 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Formulation

- Figure 7.11 Biopharmaceutical Excipient Manufacturers: Distribution by Type of Biologic

- Figure 7.12 Biopharmaceutical Excipient Manufacturers: Distribution by Global Regulatory Compliance

- Figure 8.1 Company Competitiveness Analysis: Overview of Peer Group I

- Figure 8.2 Company Competitiveness Analysis: Overview of Peer Group II

- Figure 8.3 Company Competitiveness Analysis: Overview of Peer Group III

- Figure 8.4 Company Competitiveness Analysis: Biopharmaceutical Excipient Manufacturers Headquartered in North America (Peer Group I)

- Figure 8.5 Company Competitiveness Analysis: Biopharmaceutical Excipient Manufacturers Headquartered in Europe (Peer Group II)

- Figure 8.6 Company Competitiveness Analysis: Biopharmaceutical Excipient Manufacturers Headquartered in Asia-Pacific (Peer Group III)

- Figure 9.1 Avantor: Consolidated: Business Segment-wise Revenues and Consolidated Financial Details (USD Million), Since 2021

- Figure 10.1 Merck KGaA: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since 2021

- Figure 10.2 CG Chemkalien: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since 2021

- Figure 10.3 Evonik: Business Segment-wise Revenues and Consolidated Financial Details (EUR Billion), Since 2021

- Figure 12.1 Partnerships and Collaborations: Cumulative Year-wise Trend, Since 2016

- Figure 12.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 12.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership, Since 2016

- Figure 12.4 Partnerships and Collaborations: Distribution by Type of Excipients

- Figure 12.5 Most Active Players: Distribution by Number of Partnerships

- Figure 12.6 Partnerships and Collaborations: Distribution by Country

- Figure 12.7 Partnerships and Collaborations: Distribution by Region

- Figure 13.1 Recent Expansions: Cumulative Year-wise Trend, Since 2016

- Figure 13.2 Recent Expansions: Distribution by Type of Expansion

- Figure 13.3 Recent Expansions: Distribution by Type of Excipient

- Figure 13.4 Recent Expansions: Distribution by Type of Expansion (Country)

- Figure 13.5 Recent Expansions: Distribution by Location of Expanded Facility (Region)

- Figure 13.6 Recent Expansions: Distribution by Type of Expansion and Location of Manufacturing Facility

- Figure 13.7 Most Active Players: Distribution by Number of Recent Expansions

- Figure 13.8 Recent Expansions: Distribution by Geography

- Figure 14.1 Biopharmaceutical Excipient Manufacturing Installed Global Capacity: Distribution by Range of Installed Capacity

- Figure 14.2 Biopharmaceutical Excipients Manufacturing Installed Global Capacity: Distribution by Company Size

- Figure 14.3 Biopharmaceutical Excipients Manufacturing Installed Global Capacity: Distribution by Scale of Operation

- Figure 14.4 Biopharmaceutical Excipients Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Region)

- Figure 14.5 Biopharmaceutical Excipients Manufacturing Installed Global Capacity: Distribution by Location of Manufacturing Facility (Country)

- Figure 16.1 Global Biopharmaceutical Excipients Market, Historical Trends (since 2021) and Forecasted Estimates (till 2035): Base Scenario (USD Million)

- Figure 16.2 Global Biopharmaceutical Excipients Market, Forecasted Estimates (till 2035): Conservative Scenario (USD Million)

- Figure 16.3 Global Biopharmaceutical Excipients Market, Forecasted Estimates (till 2035): Optimistic Scenario (USD Million)

- Figure 17.1 Global Biopharmaceutical Excipients Market: Distribution by Scale of Operation

- Figure 17.2 Biopharmaceutical Excipients Market for Preclinical / Clinical Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 17.3 Biopharmaceutical Excipients Market for Commercial Scale, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 18.1 Global Biopharmaceutical Excipients Market: Distribution by Type of Modality

- Figure 18.2 Biopharmaceutical Excipients Market for Antibodies, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 18.3 Biopharmaceutical Excipients Market for Vaccines, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 18.4 Biopharmaceutical Excipients Market for Cell and Gene Therapies, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 18.5 Biopharmaceutical Excipients Market for Proteins / Peptides, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 18.6 Biopharmaceutical Excipients Market for Other Biologics, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.1 Global Biopharmaceutical Excipients Market: Distribution by Type of Excipient

- Figure 19.2 Biopharmaceutical Excipients Market for Buffering Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.3 Biopharmaceutical Excipients Market for Lyoprotectant Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.4 Biopharmaceutical Excipients Market for Solubilizers and Surfactants, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.5 Biopharmaceutical Excipients Market for Tonicity Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.6 Biopharmaceutical Excipients Market for pH Adjusting Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 19.7 Biopharmaceutical Excipients Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 20.1 Global Biopharmaceutical Excipients Market: Distribution by Chemical Components

- Figure 20.2 Biopharmaceutical Excipients Market for Carbohydrates, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 20.3 Biopharmaceutical Excipients Market for Polymers, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 20.4 Biopharmaceutical Excipients Market for Polyols, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 20.5 Biopharmaceutical Excipients Market for Proteins / Amino Acids, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 20.6 Biopharmaceutical Excipients Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 21.1 Biopharmaceutical Excipients Market: Distribution by Company Size

- Figure 21.2 Biopharmaceutical Excipients Market for Small Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 21.3 Biopharmaceutical Excipients Market for Mid-sized Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 21.4 Biopharmaceutical Excipients Market for Large and Very Large Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 22.1 Biopharmaceutical Excipients Market: Distribution by Source of Manufacturing

- Figure 22.2 Biopharmaceutical Excipients Market for In-house, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 22.3 Biopharmaceutical Excipients Market for Outsourcing, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 23.1 Biopharmaceutical Excipients Market: Distribution by End-User

- Figure 23.2 Biopharmaceutical Excipients Market for Contract Manufacturers, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 23.3 Biopharmaceutical Excipients Market for Drug Developers, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 23.4 Biopharmaceutical Excipients Market for Hybrid Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.1 Biopharmaceutical Excipients Market: Distribution by Geographical Regions

- Figure 24.2 Biopharmaceutical Excipients Market in North America, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.3 Biopharmaceutical Excipients Market in the US, Historical Trends (since 2021) and

Forecasted Estimates (till 2035) (USD Million)

- Figure 24.4 Biopharmaceutical Excipients Market in Canada, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.5 Biopharmaceutical Excipients Market in Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.6 Biopharmaceutical Excipients Market in France, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.7 Biopharmaceutical Excipients Market in Germany, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.8 Biopharmaceutical Excipients Market in Italy, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.9 Biopharmaceutical Excipients Market in Spain, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.10 Biopharmaceutical Excipients Market in the UK, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.11 Biopharmaceutical Excipients Market in Rest of Europe, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.12 Biopharmaceutical Excipients Market in Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.13 Biopharmaceutical Excipients Market in China, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.14 Biopharmaceutical Excipients Market in India, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.15 Biopharmaceutical Excipients Market in South Korea, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.16 Biopharmaceutical Excipients Market in Japan, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.17 Biopharmaceutical Excipients Market in Rest of Asia-Pacific, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.18 Biopharmaceutical Excipients Market in Middle East and Africa, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.19 Biopharmaceutical Excipients Market in Saudi Arabia, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.20 Biopharmaceutical Excipients Market in UAE, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.21 Biopharmaceutical Excipients Market in Egypt, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.22 Biopharmaceutical Excipients Market in Latin America, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.23 Biopharmaceutical Excipients Market in Brazil, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.24 Biopharmaceutical Excipients Market in Mexico, Historical Trends (since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.25 Biopharmaceutical Excipients Market in Rest of Latin America, Historical Trends (Forecasted Estimates (till 2035) (USD Million)

since 2021) and Forecasted Estimates (till 2035) (USD Million)

- Figure 24.26 Penetration Growth (P-G) Matrix: Geographical Regions

- Figure 24.27 Market Movement Analysis: Geographical Regions

- Figure 25.1 Concluding Insights: Biopharmaceutical Excipient Manufacturers Market Landscape

- Figure 25.2 Concluding Insights: Partnerships and Collaborations

- Figure 25.3 Concluding Insights: Recent Expansions

- Figure 25.4 Concluding Insights: Capacity Analysis

- Figure 25.5 Concluding Insights: Biopharmaceutical Excipients Market Forecast and Opportunity Analysis