PUBLISHER: Roots Analysis | PRODUCT CODE: 1919792

PUBLISHER: Roots Analysis | PRODUCT CODE: 1919792

India Biopharmaceutical Excipients Market, till 2035: Industry Trends and Forecasts - Distribution by Scale of Operation, Modality, Excipient, Chemical Components, Company Size, Source of Manufacturing, End User and Geographical Regions

INDIA BIOPHARMACEUTICAL EXCIPIENTS MARKET: OVERVIEW

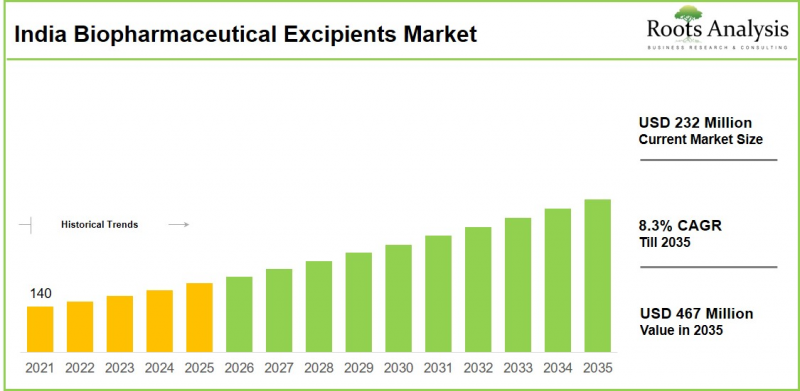

As per Roots Analysis, the India biopharmaceutical excipients market is estimated to grow from USD 232 million in the current year to USD 467 million by 2035 at a CAGR of 9.3% during the forecast period, 2026-2040.

INDIA BIOPHARMACEUTICAL EXCIPIENTS MARKET: GROWTH AND TRENDS

Over time, the increasing popularity of biologics has led to significant transformation in the healthcare sector. Due to their unique advantages over small molecules, such as greater efficacy, specific targeting, and better safety profiles, biologics are anticipated to continue propelling advancements in treatments for cancer, autoimmune diseases, rare illnesses, and genetic disorders.

Biologics are structurally intricate and naturally less stable than small molecules, making them susceptible to both physical (such as aggregation, precipitation, and denaturation) and chemical (such as oxidation, deamidation, and hydrolysis) degradation. To mitigate these challenges, a variety of biopharmaceutical excipients including sugars (sucrose and trehalose), amino acids (arginine), surfactants (polysorbates), and polymeric substances (PEGs) are employed to stabilize formulations, enhance solubility, regulate pH and tonicity, and improve overall bioavailability. In fact, more than 70% of marketed biologics depend on polysorbates as stabilizers, while bulking agents, antioxidants, and preservatives broaden their functional capabilities. Furthermore, excipients have become essential in facilitating advanced drug product formats, including lyophilized vials, prefilled syringes, and ready-to-use liquid formulations. New innovations, especially in lipid-based excipients for mRNA vaccines and therapies, are further broadening the excipient landscape.

Notably the biopharmaceutical excipients market in India is expanding rapidly as it becomes a global center for the production of biologics and generics, bolstered by investments in manufacturing and research and development facilities. The industry exhibits reduced production expenses, a skilled workforce, and governmental initiatives, such as the Production Linked Incentive (PLI) program, which enhances domestic manufacturing of APIs and excipients. Increasing healthcare expenditures, spurred by a growing middle-class population along with the prevalence of chronic diseases, further intensify the need for specialized excipients in biologics formulations. Combined with the growing trend of outsourcing and increasing regulatory support for new excipients, the utilization of biopharmaceutical excipients is expected to experience continued market growth throughout the forecast period.

Growth Drivers: Strategic Enablers of Market Expansion

The demand for biopharmaceutical excipients in India is driven by enhanced R&D and manufacturing capabilities. Investments in biologics by domestic and global companies increase the demand for specialized excipients, such as polyols. Further, government initiatives and the rising prevalence of chronic diseases drive the rapid adoption of affordable excipients in generics and biosimilars.

Market Challenges: Critical Barriers Impeding Progress

Strict regulatory governance leads to delays in the approval of new excipients owing to comprehensive testing and absence of independent routes. Elevated production expenses from advanced facilities restrict affordability in regard to traditional alternatives. Inconsistent quality and differing standards among regions impede the adoption of innovation.

Antibodies: Leading Market Segment

In terms of type of modality, the India biopharmaceutical excipient market is segmented across antibodies, vaccines, cell and gene therapies, proteins / peptides and other biologics. Currently, antibodies segment captures around 50% of the overall market share. Monoclonal antibodies lead the biopharmaceutical excipients market because of their significant presence in the biologics sector, representing the majority of approvals, sales, and production volumes in treatments for cancer and autoimmune disorders.

Buffering Agents: Dominating Market Segment

In terms of type of excipients, the India biopharmaceutical excipient market is segmented across buffering agents, lyoprotectant agents, stabilizers and surfactants, tonicity agents, pH-adjusting agents and others. Currently, majority (~30%) of the market share is held by buffering agents. Buffering agents occupy a considerable market segment in the biopharmaceutical excipients market owing to their crucial role in preserving accurate pH levels, essential for stability, efficacy, and protection against degradation of sensitive biological molecules such as proteins and monoclonal antibodies throughout manufacturing, purification, and formulation.

Contract Manufacturers: Emerging Market Segment

In terms of end-users, the India biopharmaceutical excipient market is segmented across drug developers, hybrid players and contract manufacturers. Currently, majority (~60%) of the market share is held by drug developers. However, contract manufacturers are expected to grow at a higher CAGR of 12.7%.

INDIA BIOPHARMACEUTICAL EXCIPIENTS MARKET: KEY SEGMENTS

Scale of Operation

- Preclinical / Clinical Scale

- Commercial Scale

Type of Modality

- Antibodies

- Vaccines

- Cell and Gene Therapies

- Proteins / Peptides

- Other Biologics

Type of Excipients

- Buffering Agents

- Lyoprotectant Agents

- Solubilizers and Surfactants

- Tonicity Agents

- pH Adjusting Agents

- Others

Chemical Components

- Carbohydrates

- Polymers

- Polyols

- Proteins / Amino Acids

- Others

Company Size

- Small Players

- Mid-sized Players

- Large and Very Large Players

Source of Manufacturing

- In-house

- Outsourcing

End User

- Contract Manufacturers

- Drug Developers

- Hybrid Players

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many biopharmaceutical excipients manufacturers are currently engaged in this market?

- Which are the leading companies in this market?

- Which country dominates the India biopharmaceutical excipients market?

- What are the key trends observed in India biopharmaceutical excipients market?

- What factors are likely to influence the evolution of this market?

- What are the primary challenges faced by biopharmaceutical excipients manufacturers in India?

- What is the current and future India biopharmaceutical excipients market size?

- What is the CAGR of India biopharmaceutical excipients market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

- The report can aid businesses in identifying future opportunities in any sector. It also helps in understanding if those opportunities are worth pursuing.

- The report helps in identifying customer demand by understanding the needs, preferences, and behavior of the target audience in order to tailor products or services effectively.

- The report equips new entrants with requisite information regarding a particular market to help them build successful business strategies.

- The report allows for more effective communication with the audience and in building strong business relations.

COMPLEMENTARY BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.2.1. Market Landscape and Market Trends

- 2.2.2. Market Forecast and Opportunity Analysis

- 2.2.3. Comparative Analysis

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Types of Primary Research

- 2.4.2.1.1. Qualitative Research

- 2.4.2.1.2. Quantitative Research

- 2.4.2.1.3. Hybrid Approach

- 2.4.2.2. Advantages of Primary Research

- 2.4.2.3. Techniques for Primary Research

- 2.4.2.3.1. Interviews

- 2.4.2.3.2. Surveys

- 2.4.2.3.3. Focus Groups

- 2.4.2.3.4. Observational Research

- 2.4.2.3.5. Social Media Interactions

- 2.4.2.4. Key Opinion Leaders Considered in Primary Research

- 2.4.2.4.1. Company Executives (CXOs)

- 2.4.2.4.2. Board of Directors

- 2.4.2.4.3. Company Presidents and Vice Presidents

- 2.4.2.4.4. Research and Development Heads

- 2.4.2.4.5. Technical Experts

- 2.4.2.4.6. Subject Matter Experts

- 2.4.2.4.7. Scientists

- 2.4.2.4.8. Doctors and Other Healthcare Providers

- 2.4.2.5. Ethics and Integrity

- 2.4.2.5.1. Research Ethics

- 2.4.2.5.2. Data Integrity

- 2.4.2.1. Types of Primary Research

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

- 2.5. Robust Quality Control

3. MARKET DYNAMICS

- 3.1. Chapter Overview

- 3.2. Forecast Methodology

- 3.2.1. Top-down Approach

- 3.2.2. Bottom-up Approach

- 3.2.3. Hybrid Approach

- 3.3. Market Assessment Framework

- 3.3.1. Total Addressable Market (TAM)

- 3.3.2. Serviceable Addressable Market (SAM)

- 3.3.3. Serviceable Obtainable Market (SOM)

- 3.3.4. Currently Acquired Market (CAM)

- 3.4. Forecasting Tools and Techniques

- 3.4.1. Qualitative Forecasting

- 3.4.2. Correlation

- 3.4.3. Regression

- 3.4.4. Extrapolation

- 3.4.5. Convergence

- 3.4.6. Sensitivity Analysis

- 3.4.7. Scenario Planning

- 3.4.8. Data Visualization

- 3.4.9. Time Series Analysis

- 3.4.10. Forecast Error Analysis

- 3.5. Key Considerations

- 3.5.1. Demographics

- 3.5.2. Government Regulations

- 3.5.3. Reimbursement Scenarios

- 3.5.4. Market Access

- 3.5.5. Supply Chain

- 3.5.6. Industry Consolidation

- 3.5.7. Pandemic / Unforeseen Disruptions Impact

- 3.6. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Major Currencies Affecting the Market

- 4.2.2.2. Factors Affecting Currency Fluctuations on the Industry

- 4.2.2.3. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Currency Exchange Rate

- 4.2.3.1. Impact of Foreign Exchange Rate Volatility on the Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.4.2. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Value and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.8.3. Trade Policies

- 4.2.8.4. Strategies for Mitigating the Risks Associated with Trade Barriers

- 4.2.8.5. Impact of Trade Barriers on the Market

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. Stock Market Performance

- 4.2.11.7. Cross-Border Dynamics

- 4.2.1. Time Period

- 4.3. Conclusion

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of Biopharmaceutical Excipients

- 6.3. Properties of Ideal Excipients

- 6.4. Classification of Biopharmaceutical Excipients

- 6.4.1. Classification of Excipients based on Route of Administration

- 6.4.2. Classification of Excipients based on Structure

- 6.4.3. Classification of Excipients based on Function

- 6.4.4. Classification of Excipients based on Ability to Interfere with Metabolization and Efflux Mechanisms

- 6.5. Applications of Biopharmaceutical Excipients

- 6.6. Regulatory Scenario

- 6.7. Concluding Remarks

7. MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Biopharmaceutical Excipients Manufacturers: Market Landscape

- 7.2.1. Analysis by Year of Establishment

- 7.2.2. Analysis by Company Size

- 7.2.3. Analysis by Location of Headquarters

- 7.2.4. Analysis by Location of Headquarters and Company Size

- 7.2.5. Analysis by Location of Manufacturing Facilities (Region)

- 7.2.6. Analysis by Scale of Operation

- 7.2.7. Analysis by Type of Excipient based on Chemical Composition

- 7.2.8. Analysis by Type of Excipient based on Function

- 7.2.9. Analysis by Type of Chemical Structure of Excipient

- 7.2.10. Analysis by Type of Formulation

- 7.2.11. Analysis by Type of Biologic

- 7.2.12. Analysis by Global Regulatory Compliance

8. COMPANY COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Overview of Peer Groups

- 8.5. India Biopharmaceutical Excipients Market: Company Competitiveness Analysis

- 8.5.1. Small India Biopharmaceutical Excipient Manufacturers (Peer Group I)

- 8.5.2. Mid-sized India Biopharmaceutical Excipient Manufacturers (Peer Group II)

- 8.5.3. Large India Biopharmaceutical Excipient Manufacturers (Peer Group III)

- 8.6. Capability Benchmarking of India Biopharmaceutical Excipient Manufacturers

9. COMPANY PROFILES: INDIA BIOPHARMACEUTICAL EXCIPIENT MARKET

- 9.1. Chapter Overview

- 9.2. Mitushi Biopharma

- 9.2.1. Company Overview

- 9.2.2. Product Portfolio

- 9.2.3. Financial Information

- 9.2.4. Recent Developments and Future Outlook

- 9.3. VAV Life Sciences

- 9.4. Apothecon Pharmaceuticals

- 9.5. Danaher

- 9.6. Vikram Thermo

- 9.7. Lazuline Biotech

- 9.8. Maas Chemicals

- 9.9. Aditya Chemicals

- 9.10. Sigachi

10. PARTNERSHIPS AND COLLABORATIONS

- 10.1. Chapter Overview

- 10.2. Partnership Models

- 10.3. India Biopharmaceutical Excipient Manufacturers: Partnerships and Collaborations

- 10.3.1. Analysis by Year of Partnership

- 10.3.2. Analysis by Type of Partnership

- 10.3.3. Most Active Players: Analysis by Number of Partnerships

- 10.3.4. Analysis by Geography

- 10.3.4.1. Intercontinental and Intracontinental Agreements

- 10.3.4.2. Local and International Agreements

11. MARKET IMPACT ANALYSIS

- 11.1. Chapter Overview

- 11.1.1. Market Drivers

- 11.1.2. Market Restraints

- 11.1.3. Market Opportunities

- 11.1.4. Market Challenges

- 11.2. Conclusion

12. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET

- 12.1. Chapter Overview

- 12.2. Key Assumptions and Methodology

- 12.3. India Biopharmaceutical Excipient Market: Historical Trends (Since 2021) and Forecasted Estimates (Till 2035)

- 12.4. Roots Analysis Perspective on Market Growth

- 12.5 Scenario Analysis

- 12.5.1. Conservative Scenario

- 12.5.2. Optimistic Scenario

- 12.6. Key Market Segmentations

13. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY SCALE OF OPERATION

- 13.1. Chapter Overview

- 13.2. Key Assumptions and Methodology

- 13.3. India Biopharmaceutical Excipient Market: Distribution by Scale of Operation

- 13.3.1. India Biopharmaceutical Excipient Market for Preclinical / Clinical Scale: Historical Trends (Since 2021) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 13.3.2. India Biopharmaceutical Excipient Market for Commercial Scale, Historical Trends (Since 2021) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 13.4. Data Triangulation and Validation

14. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY TYPE OF MODALITY

- 14.1. Chapter Overview

- 14.2. Key Assumptions and Methodology

- 14.3. India Biopharmaceutical Excipient Market: Distribution by Type of Modality

- 14.3.1. India Biopharmaceutical Excipient Market for Antibodies, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.2. India Biopharmaceutical Excipient Market for Vaccines, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.3. India Biopharmaceutical Excipient Market for Cell and Gene Therapies, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.4. India Biopharmaceutical Excipient Market for Proteins / Peptides, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.3.5. India Biopharmaceutical Excipient Market for Other Biologics, Historical Trends (Since 2023) and Forecasted Estimates (Since 2023) and Forecasted Estimates (Till 2035)

- 14.4. Data Triangulation and Validation

15. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY TYPE OF EXCIPIENT

- 15.1. Chapter Overview

- 15.2. Key Assumptions and Methodology

- 15.3. India Biopharmaceutical Excipient Market: Distribution by Type of Excipient

- 15.3.1. India Biopharmaceutical Excipient Market for Buffering Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.3.2. India Biopharmaceutical Excipient Market for Lyoprotectant Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.3.3. India Biopharmaceutical Excipient Market for Solubilizers and Surfactants, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.3.4. India Biopharmaceutical Excipient Market for Tonicity Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.3.5. India Biopharmaceutical Excipient Market for pH Adjusting Agents, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.3.6. India Biopharmaceutical Excipient Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 15.4. Data Triangulation and Validation

16. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY CHEMICAL COMPONENTS

- 16.1. Chapter Overview

- 16.2. Key Assumptions and Methodology

- 16.3. India Biopharmaceutical Excipient Market: Distribution by Chemical Components

- 16.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Carbohydrates, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 16.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Polymers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 16.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Polyols, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 16.3.4. Biopharmaceutical Excipients Manufacturing Services Market for Proteins / Amino Acids, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 16.3.5. Biopharmaceutical Excipients Manufacturing Services Market for Others, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 16.4. Data Triangulation and Validation

17. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY COMPANY SIZE

- 17.1. Chapter Overview

- 17.2. Key Assumptions and Methodology

- 17.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Company Size

- 17.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Small Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 17.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Mid-sized Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 17.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Large and Very Large Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 17.4. Data Triangulation and Validation

18. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY SOURCE OF MANUFACTURING

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by Source of Manufacturing

- 18.3.1. Biopharmaceutical Excipients Manufacturing Services Market for In-house, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 18.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Outsourcing, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 18.4. Data Triangulation and Validation

19. INDIA BIOPHARMACEUTICAL EXICIPIENT MARKET, BY END USER

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Biopharmaceutical Excipients Manufacturing Services Market: Distribution by End User

- 19.3.1. Biopharmaceutical Excipients Manufacturing Services Market for Contract Manufacturers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.3.2. Biopharmaceutical Excipients Manufacturing Services Market for Drug Developers, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.3.3. Biopharmaceutical Excipients Manufacturing Services Market for Hybrid Players, Historical Trends (since 2021) and Forecasted Estimates (till 2035)

- 19.4. Data Triangulation and Validation

20. CONCLUDING REMARKS

21. APPENDIX I: TABULATED DATA

22. APPENDIX II: LIST OF COMPANIES AND ORGANIZATIONS