PUBLISHER: Zhar Research | PRODUCT CODE: 1415050

PUBLISHER: Zhar Research | PRODUCT CODE: 1415050

Supercapacitor, Pseudocapacitor, CSH and BSH Hybrid Market Forecasts in 26 Lines, 110 Manufacturers Appraised, Technology Analysis, Roadmaps, Next Successes 2024-2044

Summary

| REPORT STATISTICS | |

|---|---|

| SWOT appraisals: | 6 |

| Chapters: | 12 |

| Forecast lines 2024-2044: | 26 |

| Key conclusions: | 30 |

| Companies: | 116 |

| New infograms: | 137 |

| 2023/4 research papers reviewed: | 153 |

Create a $1 billion supercapacitor business. Supercapacitors are made in 22 countries by over 100 manufacturers but the data-based analysis in a new, commercially-oriented Zhar Research report shows that a shakeout and regrowth are ahead. The market will reach $17 billion but not through today's dominant sector of on-road vehicles. The 486-page report, "Supercapacitor, pseudocapacitor, CSH and BSH hybrid market forecasts in 26 lines, 110 manufacturers appraised, deep technology analysis, roadmaps, next successes 2024-2044" is much more thorough and up-to-date than anything previously available. It even closely examines the capacitor-supercapacitor hybrids essential for new radar, the new hydrogen-supercapacitor and supercapacitor-only trains and many off-road vehicles newly adopting battery-supercapacitor hybrids. No other report takes 100 close-packed pages to analyse 110 manufacturers with comment, pie charts and strategies. Your potential acquisitions and partners are appraised.

Dr. Peter Harrop, CEO of Zhar Research says, "Here come less-intermittent, zero-emission electricity sources such as wave-power and open-ocean tidal power plus microgrids and unmanned mining. Expect laser guns, electromagnetic and electrodynamic weapons, thermonuclear fusion power, widespread robotics. They all need supercapacitors and their variants for fit-and-forget and handling massive pulses and currents even when very cold."

With a flood of new research on supercapacitors in 2023 and 2024, it is time for a new report that is both up-to-date and forward-looking, with clarity and expert insight including scope for mergers, potential winners and losers and how research needs redirecting to optimise benefits 2024-2044. The needs of 6G Communications in 2030? It is all here with opportunities for value added materials companies highlighted.

There is a glossary at the start and terms are explained throughout. See hundreds of latest research reports discussed and Zhar Research drill down reports also available. Who benefits from the strong move to non-flammable, less toxic, large versions? Why the rush into battery-supercapacitor hybrids, with orders to prove it? Only lithium-ion capacitors or do the two new options have potential? Why the strong research on metal oxide framework MOF and MXene electrodes in the last year but graphene triumphant so far?

The report, "Supercapacitor, pseudocapacitor, CSH and BSH hybrid market forecasts in 26 lines, 110 manufacturers appraised, deep technology analysis, roadmaps, next successes 2024-2044" is essential reading for those seeking success in providing the research, funding, added value materials, devices and applications.

This uniquely-useful, commercially-oriented report starts with 54 pages of Executive Summary and Conclusions sufficient for those in a hurry. See 16 new infograms, 6 SWOT appraisals, technology and market roadmap 2024-2044, 30 key conclusions. For example, Europe has fewer manufacturers than China or the USA and is a net importer. Time to wake up. See 26 supercapacitor forecast lines plus 20 forecast lines 2024-2044 for equipment fitting them.

The 30-page introduction is mainly new infograms, summaries and comparisons succinctly giving the latest context. Notably that means electrification and the need for storage, how going electric will dwarf the hydrogen economy but both need electrical storage. See how energy harvesting creates markets for storage, the beyond-grid opportunity, examples of needs for delayed electricity. Then see the energy storage toolkit and operating parameter comparisons. For instance, on one page, 34 parameters for Li-ion battery, supercapacitor and LIC variant are compared. Next come the design and chemistry of capacitors including supercapacitors and chapter ends by explaining how supercapacitors are more than energy storage and how, in the real world, there is lively competition between all capacitor and battery technologies with many examples. There follow four chapters on next technologies and five chapters on the applications that will make the money 2024-2044 then a large final chapter comparing the companies.

Chapter 3 is "Future design principles, materials, research pipeline for supercapacitors including 2024". These 54 pages particularly appraise the latest situation with electrolyte chemistries and their matched active electrode morphologies plus membranes all identifying your best opportunities to supply value added materials in future and to create and sell the most successful devices. For example, there is much detail on the many ways graphene assists and a warning that the feeble research on reducing self-leakage does not reflect the strong market need for improvement in this parameter.

Chapter 4 "Future design of pseudocapacitors, CSH and BSH hybrid supercapacitors" (28 pages) looks closer at these improving technologies, including aspects capable of making BSH the largest value market. Understand the relative commercial potential of supercapacitor variants 2024-2044. That includes mechanisms of pseudocapacitance and its influence on CSH and BSH and potential as a separate product. What about sodium-ion capacitors as a form of battery supercapacitor hybrid BSH and other BSH proposals in the flood of 2023 and 2024 research? Capacitor-supercapacitor hybrid design is at the end of the chapter, important as several markets move towards them. Aluminium versions anyone?

The 28 pages of Chapter 5 cover "Flexible, stretchable, fabric, micro and structural supercapacitors including paper, wire and cable. See assessment of whether all that research, even including transparent, solid state and biodegradable versions and even ones within integrated circuits can lead to commercial success and why.

Chapter 6 takes 19 pages to cover "Structural supercapacitors" with research now pivoting from car bodywork to aircraft and to smart casing for electronics for better chance of commercial success. Why do aerogels pop up here?

Now come the markets that will earn the big money 2024-2044. Chapter 7 introduces them with "Emerging markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other". It takes only 11 pages because it consists mainly of new infograms, tables and pie charts covering such things as "Market analysis for the six most important applicational sectors" in 6 columns, 5 lines and "Market propositions of the most-promising supercapacitor families 2024-2044" in 6 columns, 3 lines. Another describes largest lithium-ion capacitors offered by 7 manufacturers with 4 parameters and comment.

The market detail then starts with Chapter 8. "Energy sector emerging markets for supercapacitors and their variants" (49 pages), starting with "Overview: poor, modest and strong prospects 2024-2044" and mostly detailing the opportunities in "thermonuclear power", "less-intermittent grid electricity generation: wave, tidal stream, elevated wind", beyond-grid power and fast chargers for electric vehicles land and air because all read to the strengths of supercapacitors. See both examples and intentions.

Chapter 9 is 48 pages on "Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships". Chapter 10 at 29 pages is "Emerging applications in 6G Communications, electronics and small electrics" again with compact comparisons and infograms. Chapter 11, "Emerging military and aerospace applications" in 19 pages analysing and comparing key aspects of this rapidly emerging sector demanding all three - CSH, supercapacitor and BSH. For example, electrodynamic and electromagnetic weapons including force field all use supercapacitors and also military hybrid and diesel vehicles because they are not replaced by battery electric as seen on-road because their duty cycles are too demanding. Chapter 12 is 100 pages comparing 110 companies in detail in ten columns plus colour coding and pie charts.

That is why we suggest that the report, "Supercapacitor, pseudocapacitor, CSH and BSH hybrid market forecasts in 26 lines, 110 manufacturers appraised, technology analysis, roadmaps, next successes 2024-2044" is essential reading for investors, value-added materials suppliers, device manufacturers, product and system integrators with much to interest legislators, researchers, users and other interested parties as well.

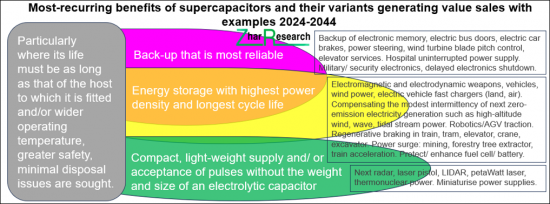

Most-recurring benefits of supercapacitors and their variants generating value sales with examples 2024-2044. Source, "Supercapacitor, pseudocapacitor, CSH and BSH hybrid market forecasts in 26 lines, 110 manufacturers appraised, deep technology analysis, roadmaps, next successes 2024-2044" .

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Definitions

- 1.4. Energy storage toolkit

- 1.4.1. The basic options

- 1.4.2. Detailed options

- 1.5. 12 Primary conclusions: markets

- 1.6. Infogram: the most impactful market needs

- 1.7. Infogram: relative commercial significance of supercapacitor variants 2024-2044

- 1.8. Market propositions and uses of the most-promising supercapacitor families 2024-2044

- 1.9. Analysis of supply and potential for large devices

- 1.10. 17 primary conclusions: technologies and manufacturers

- 1.11. Infogram: the energy density-power density, life, size and weight compromise

- 1.12. Strategies to achieve less storage make EDLC and BSH more adoptable

- 1.13. How research needs redirecting: 5 columns, 7 lines

- 1.14. Market forecasting rationale, SWOT appraisals and roadmaps 2024-2044

- 1.14.1. Overview

- 1.14.2. Maximum addressable market by application and technology

- 1.14.3. SWOT appraisals

- 1.14.4. Roadmap of market-moving events - technologies, industry and markets 2024-2044

- 1.15. Supercapacitors and variants forecasts by 26 lines 2024-2044

- 1.15.1. Supercapacitors and variants market by five types $ billion 2024-2044 table, graph

- 1.15.2. Supercapacitors and variants value market percent by five regions 2024-2044 table, graph

- 1.15.3. Supercapacitors and variants value market percent by five applications 2024-2044: table, graph

- 1.15.4. Supercapacitors and variants value market % by three Wh categories 2024-2044

- 1.15.5. EDLC value market % by active electrode morphology 2024-2044

- 1.15.6. Pie charts for 2024 of manufacturer number by product size made, country and percentage using acetonitrile

- 1.15.7. Supercapacitors and variants: Number of manufacturers, % acetonitrile, average product life years 2014-2044

- 1.16. Background forecasts by 20 lines 2024-2044

2. Introduction

- 2.1. Electrification and the need for storage

- 2.1.1. Going electric dwarfs the hydrogen economy but both need electrical storage

- 2.1.2. Energy harvesting creates markets for storage

- 2.1.3. The beyond-grid opportunity

- 2.1.4. Examples of needs for delayed electricity

- 2.1.5. Conventional component formats but also structural electrics and electronics

- 2.2. Energy storage toolkit

- 2.2.1. The basic options

- 2.2.2. Detailed options

- 2.2.3. Voltage and capacitance for cells of supercapacitors and hybrids

- 2.2.4. Energy density vs power density

- 2.2.5. 34 parameters for Li-ion battery, supercapacitor and LIC variant compared

- 2.3. Design and chemistry of capacitors including supercapacitors and variants

- 2.4. SWOT appraisal of supercapacitors and their variants

- 2.5. Charge-discharge characteristics of lithium-ion battery vs supercapacitor

- 2.6. Supercapacitors are more than energy storage

- 2.7. Lively competition between all capacitor and battery technologies

3. Future design principles, materials, research pipeline for supercapacitors including 2024

- 2.1. Overview

- 3.2. Factors influencing key supercapacitor parameters driving sales

- 3.3. Materials choices in general

- 3.4. Strategies for improving supercapacitors

- 3.4.1. General

- 3.4.2. Prioritisation of active electrode-electrolyte pairings

- 3.5. Significance of graphene in supercapacitors and variants

- 3.5.1. Overview

- 3.5.2. Graphene supercapacitor SWOT appraisal

- 3.5.3. Vertically-aligned graphene for ac and improved cycle life

- 3.5.4. Frequency performance improvement with graphene

- 3.5.5. Graphene textile for supercapacitors and sensors

- 3.5.6. Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 3.6. Other 2D and allied materials for supercapacitors with examples of research

- 3.6.1. MOF and MXene and combinations are the focus

- 3.6.2. Tantalum carbide MXene hybrid as a biocompatible supercapacitor electrodes

- 3.6.3. Covalent graphene-MOF hybrids for high-performance asymmetric supercapacitors

- 3.6.4. MOFs to prevent stacking layers of graphene and graphene derivatives and increase energy density

- 3.6.5. CNT

- 3.7. Research on supercapacitor electrode materials and structures in 2024

- 3.8. Research on supercapacitor electrode materials and structures in 2023

- 3.9. Important examples from earlier

- 3.10. Electrolytes for supercapacitors and variants

- 3.10.1. General considerations including organic electrolytes

- 3.10.2. Supercapacitor electrolyte choices

- 3.10.3. Focus on aqueous supercapacitor electrolytes

- 3.10.4. Ionic liquid electrolytes in supercapacitor research

- 3.10.5. Focus on solid state, semi-solid-state and flexible electrolytes

- 3.10.6. Hydrogels as electrolytes for semi-solid supercapacitors

- 3.10.7. Supercapacitor concrete and bricks

- 3.11. Membrane difficulty levels and materials used and proposed

- 3.12. Reducing self-discharge: great need, little research

4. Future design of pseudocapacitors, CSH and BSH hybrid supercapacitors

- 4.1. Overview

- 4.2. Exploiting pseudocapacitance

- 4.2.1. Understanding pseudocapacitance

- 4.2.2. Three mechanisms that give rise to pseudocapacitance and the intrinsic/ extrinsic phenomena

- 4.2.3. Ferrimagnetic pseudocapacitors

- 4.2.4. Pseudocapacitor optimisation routes emerging

- 4.2.5. Further reading on pseudocapacitors to 2024

- 4.3. Design of battery-supercapacitor hybrids

- 4.3.1. Overview

- 4.3.2. Large opportunities arriving with large LIC

- 4.3.2. The many advantages of LIC

- 4.3.3. Zinc-ion capacitors in 2024 and 2023 research

- 4.3.4. Sodium-ion capacitors

- 4.3.5. Other BSH research in 2024 and 2023

- 4.4. Capacitor supercapacitor hybrid CSH design

5. Flexible, stretchable, fabric, micro and structural supercapacitors including paper, wire and cable

- 5.1. Overview including printed supercapacitors

- 5.2. Editable supercapacitors

- 5.3. Paper supercapacitors and variants

- 5.4. Textile and fabric supercapacitors and variants including biomimetics

- 5.5. Both flexible and transparent

- 5.6. Fabric, tubular flexible and wearable

- 5.7. Wire and cable supercapacitors

- 5.8. Micro-supercapacitors

6. Structural supercapacitors

- 6.1. Needs, formats and cost breakdown

- 6.2. Structural supercapacitors for aircraft

- 6.2.1. Imperial College London

- 6.2.2. Texas A&M University

- 6.3. Structural supercapacitors for boats and other applications: University of California San Diego

- 6.4. Structural supercapacitors for road vehicles

- 6.4.1. MIT-Lamborghini work on an MOF supercar body

- 6.4.2. Imperial College London and Durham University

- 6.4.3. Queensland University of Technology Australia

- 6.4.4. Trinity College Ireland

- 6.5. Structural supercapacitors for electronics and devices: Vanderbilt University USA

7. Emerging markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other

- 7.1. Implications for the market 2024-2044

- 7.2. Overview

- 7.3. Relative commercial significance of supercapacitor variants 2024-2044

- 7.4. Market propositions of the most-promising supercapacitor families 2024-2044

- 7.5. Mismatch between market potential and sizes made

- 7.6. Analysis of supply and potential for large devices

- 7.6.1. Overview

- 7.6.2. Largest lithium-ion capacitors offered by manufacturer with parameters and uses

- 7.6.3. Markets for the largest BSH

- 7.6.4. Market analysis for the six most important applicational sectors

8. Energy sector emerging markets for supercapacitors and their variants

- 8.1. Overview: poor, modest and strong prospects 2024-2044

- 8.2. Thermonuclear power

- 8.2.1. Overview

- 8.3.2. Applications of supercapacitors in fusion research

- 8.3.3. Other thermonuclear supercapacitors

- 8.3.4. Hybrid supercapacitor banks for thermonuclear power: Tokyo Tokamak

- 8.3.5. Helion USA supercapacitor bank

- 8.3.6. First Light UK supercapacitor bank

- 8.3. Less-intermittent grid electricity generation: wave, tidal stream, elevated wind

- 8.3.1. Supercapacitors in utility energy storage for grids and large UPS

- 8.3.2. 5MW grid measurement supercapacitor

- 8.3.3. Tidal stream power applications

- 8.3.4. Wave power applications

- 8.3.5. Airborne Wind Energy AWE applications

- 8.3.6. Taller wind turbines tapping less-intermittent wind: protection, smoothing

- 8.4. Beyond-grid supercapacitors: large emerging opportunity

- 8.4.1. Overview

- 8.4.2. Beyond-grid buildings, industrial processes, minigrids, microgrids, other

- 8.4.3. Beyond-grid electricity production and management

- 8.4.4. The off-grid megatrend

- 8.4.5. The solar megatrend

- 8.4.6. Hydrogen-supercapacitor rural microgrid Tapah, Malaysia

- 8.4.7. Supercapacitors in other microgrids, solar buildings

- 8.4.8. Fast charging of electric vehicles including buses and autonomous shuttles

- 8.5. Hydro power

9. Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships

- 9.1. Overview of supercapacitor use in land transport

- 9.2. On-road applications face decline but off-road vibrant

- 9.3. How the value market for supercapacitors and their variants in land vehicles will move from largely on-road to largely off-road

- 9.4. Emerging vehicle and allied designs with large supercapacitors

- 9.4.1. Industrial vehicles: Rutronik HESS

- 9.4.2. Heavy duty powertrains and active suspension

- 9.5. Tram and trolleybus regeneration and coping with gaps in catenary

- 9.6. Material handling (intralogistics) supercapacitors

- 9.7. Mining and quarrying uses for large supercapacitors

- 9.7.1. Overview and future open pit mine and quarry

- 9.7.2. Mining and quarrying vehicles go electric

- 9.7.3. Supercapacitors for electric mining and construction

- 9.8. Research relevant to large supercapacitors in vehicles

- 9.9. Large supercapacitors for trains and their trackside regeneration

- 9.9.1. Overview

- 9.9.2. Supercapacitor diesel hybrid and hydrogen trains

- 9.9.3. Supercapacitor regeneration for trains on-board and trackside

- 9.9.4. Research pipeline relevant to supercapacitors for trains

- 9.10. Marine use of large supercapacitors and the research pipeline

10. Emerging applications in 6G Communications, electronics and small electrics

- 10.1. Overview

- 10.2. Substantial growing applications for small supercapacitors

- 10.3. Supercapacitors in wearables, smart watches, smartphones, laptops and similar devices

- 10.3.1. General

- 10.3.2. Wearables needing supercapacitors

- 10.4. 6G Communications: new supercapacitor market from 2030

- 10.4.1. Overview with supercapacitor needs

- 10.4.2. New needs and 5G inadequacies

- 10.4.3. 6G massive hardware deployment: proliferation but many compromises

- 10.4.4. Objectives of NTTDoCoMo, Huawei, Samsung and others

- 10.4.5. Progress from 1G-6G rollouts 1980-2044

- 10.4.6. 6G underwater and underground

- 10.5. Asset tracking growth market

- 10.6. Battery support and back-up power supercapacitors

- 10.7. Hand-held terminals supercapacitors

- 10.8. Internet of Things nodes, wireless sensors and their energy harvesting modes with supercapacitors

- 10.8.1. Overview

- 10.8.2. Sensor inputs and outputs

- 10.8.3. Ten forms of energy harvesting for sensing and power for sensors

- 10.8.4. Supercapacitor transpiration electrokinetic harvesting for battery-free sensor power supply

- 10.9. Supercapacitor peak power for data transmission, locks, solenoid activation, e-ink update, LED flash

- 10.10. Smart meters using supercapacitors

- 10.11. Spot welding supercapacitors

11. Emerging military and aerospace applications

- 11.1. Overview

- 11.2. Military applications: electrodynamic and electromagnetic weapons now a strong focus

- 11.2.1. Overview: laser weapons, beam energy weapons, microwave weapons, electromagnetic guns

- 11.2.2. Electrodynamic weapons: coil and rail guns

- 11.2.3. Electromagnetic weapons disabling electronics or acting as ordnance

- 11.2.4. Pulsed linear accelerator weapon

- 11.3. Military applications: unmanned aircraft, communication equipment, radar, plane, ship, tank, satellite, guided missile, munition ignition, electromagnetic armour

- 11.3.1. CSH sales increasing

- 11.3.2. Force Field protection

- 11.3.3. Supercapacitor- diesel hybrid heavy mobility army truck

- 11.3.4. 17 other military applications now emerging

- 11.4. Aerospace: satellites, More Electric Aircraft MEA and other growth opportunities

- 11.4.1. Overview: supercapacitor numbers and variety increase

- 11.4.2. More Electric Aircraft MEA

- 11.4.3. Better capacitors sought for aircraft

12. 110 supercapacitor, pseudocapacitor and LIC companies assessed in 10 columns across 100 pages

- 12.1. Overview and analysis of metrics from the company appraisals

- 12.2. Supercapacitor, pseudocapacitor and LIC manufacturers assessed in 10 columns across 96 pages