PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801908

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801908

Diabetes Care Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

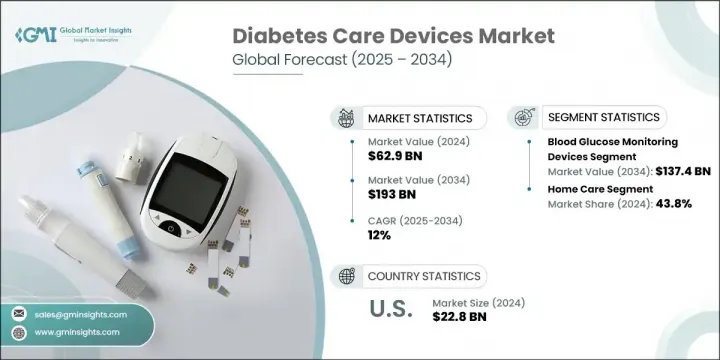

The Global Diabetes Care Devices Market was valued at USD 62.9 billion in 2024 and is estimated to grow at a CAGR of 12% to reach USD 193 billion by 2034. This growth is driven by the rising global diabetes burden, continuous technological breakthroughs, and increased funding from both public and private sectors. Diabetes care devices are essential medical tools that support individuals in managing diabetes by enabling effective blood glucose monitoring and insulin administration. As the number of individuals living with diabetes continues to rise worldwide, the demand for reliable and user-friendly care devices continues to grow.

Innovations focused on making these tools less invasive, more accurate, and cost-effective are propelling demand. Companies are investing heavily in R&D to bring forward advanced devices that ensure better comfort and disease management. The market is also experiencing a shift toward smarter, integrated solutions that provide seamless glucose tracking and insulin delivery to meet growing consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $62.9 Billion |

| Forecast Value | $193 Billion |

| CAGR | 12% |

In 2024, the blood glucose monitoring devices segment generated USD 42.2 billion and projected to hit USD 137.4 billion by 2034, growing at a CAGR of 12.7%. Their extensive use in hospitals, diagnostic labs, and homecare setups underpins this growth. Devices like CGMs and self-monitoring meters offer continuous updates, helping users regulate their lifestyle, food intake, and insulin schedules based on real-time glucose data. Regular monitoring is vital to avoid spikes or drops in glucose levels, which can lead to serious health issues. These tools provide round-the-clock feedback, ensuring users remain proactive in their diabetes management and minimizing long-term complications.

The home care segment held 43.8% share in 2024. The ability to manage diabetes at home has become a crucial convenience for many, eliminating the need for frequent clinical visits. Devices designed for home use now offer similar capabilities as those used in professional settings. Advanced features like real-time glucose trend analysis, alarms, and data tracking help patients make quick and informed decisions about food intake, insulin doses, and daily routines. This growing trend of home-based diabetes management continues to attract individuals looking for independence and improved quality of life.

United States Diabetes Care Devices Market generated USD 22.8 billion in 2024. This strong performance is due to the growing diabetic population and the rapid adoption of innovative diabetes technologies. An aging population more prone to chronic conditions further intensifies demand for efficient diabetes management solutions. The market's momentum in the region is supported by access to high-end healthcare infrastructure, favorable reimbursement scenarios, and consumer awareness around preventative care and early diagnosis.

Key companies influencing the Global Diabetes Care Devices Market include Tandem Diabetes Care, Becton, Dickinson and Company, Ypsomed Holding, Insulet, Sanofi, Dr. Reddy's Laboratories, Medtronic, Dexcom, Ascensia Diabetes Care, Sinocare, Platinum Equity Advisors, Abbott Laboratories, ARKRAY, DarioHealth, Eli Lilly and Company, Pendiq, Novo Nordisk, F. Hoffmann-La Roche, Bionime, and Nova Biomedical. Leading players in the diabetes care devices market are focusing on enhancing product innovation and portfolio diversification to meet the evolving needs of users. Companies are introducing smart, wearable devices with real-time data analytics and Bluetooth connectivity to improve glucose tracking. Strategic collaborations with digital health platforms help integrate data into broader health ecosystems. Mergers and acquisitions are also being used to expand geographic presence and access new customer bases. Continuous investments in R&D ensure devices become less invasive, more accurate, and easier to use.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of diabetes across the world

- 3.2.1.2 Rising technological advancements in diabetes care devices

- 3.2.1.3 Increasing investments by public and private organizations for diabetes care

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of diabetes care devices

- 3.2.2.2 Rigorous regulatory framework

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain and distribution analysis

- 3.7 Reimbursement scenario

- 3.7.1 Coding and reimbursement

- 3.7.2 Reimbursement policies and public healthcare sector insurance coverage for insulin delivery systems

- 3.7.2.1 U.S.

- 3.7.2.2 Europe

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood glucose monitoring devices

- 5.2.1 Self-monitoring blood glucose meters

- 5.2.2 Continuous glucose monitors

- 5.2.3 Testing strips

- 5.2.4 Lancets

- 5.3 Insulin delivery devices

- 5.3.1 Insulin pumps

- 5.3.1.1 Tubed pumps

- 5.3.1.2 Tubeless pumps

- 5.3.2 Pens

- 5.3.2.1 Reusable

- 5.3.2.2 Disposable

- 5.3.3 Pen needles

- 5.3.3.1 Standard

- 5.3.3.2 Safety

- 5.3.4 Syringes

- 5.3.5 Other insulin delivery devices

- 5.3.1 Insulin pumps

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospital

- 6.3 Ambulatory surgical centres

- 6.4 Diagnostic centres

- 6.5 Homecare

- 6.6 Other end use

Chapter 7 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.3.7 Sweden

- 7.3.8 Belgium

- 7.3.9 Denmark

- 7.3.10 Finland

- 7.3.11 Norway

- 7.3.12 Lithuania

- 7.3.13 Latvia

- 7.3.14 Estonia

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Colombia

- 7.5.5 Chile

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Turkey

- 7.6.5 Egypt

- 7.6.6 Israel

- 7.6.7 Kuwait

- 7.6.8 Qatar

Chapter 8 Company Profiles

- 8.1 Abbott Laboratories

- 8.2 ARKRAY

- 8.3 Ascensia Diabetes Care

- 8.4 B. Braun Melsungen

- 8.5 Becton, Dickinson and Company

- 8.6 Bionime

- 8.7 DarioHealth

- 8.8 Dexcom

- 8.9 Dr. Reddy’s Laboratories

- 8.10 Eli Lilly and Company

- 8.11 F. Hoffmann-La Roche

- 8.12 Insulet

- 8.13 Medtronic

- 8.14 Nova Biomedical

- 8.15 Novo Nordisk

- 8.16 Pendiq

- 8.17 Platinum Equity Advisors

- 8.18 Sanofi

- 8.19 Sinocare

- 8.20 Tandem Diabetes Care

- 8.21 Ypsomed Holding