PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684605

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684605

Food Industry Heat Processing Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

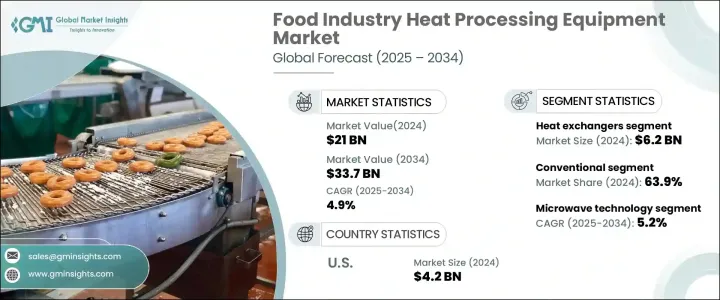

The Global Food Industry Heat Processing Equipment Market, valued at USD 21 billion in 2024, is set to grow at a steady CAGR of 4.9% between 2025 and 2034. This growth is fueled by the increasing global population and changing consumer lifestyles, which are driving demand for ready-to-eat and processed food products. As consumers prioritize convenience, extended shelf life, and consistent quality, the adoption of advanced heat processing equipment is becoming essential for food manufacturers. These systems not only enhance production efficiency but also ensure compliance with stringent food safety standards and sustainability goals.

Advancements in heat processing technologies, such as microwave and induction systems, are revolutionizing the market by offering greater precision and energy efficiency. These innovations align with global efforts to reduce energy consumption and minimize food waste, making them a preferred choice among manufacturers. According to the International Association for Food Protection (IAFP), regulatory frameworks emphasizing energy-efficient solutions and strict food safety requirements are further encouraging the adoption of cutting-edge equipment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21 Billion |

| Forecast Value | $33.7 Billion |

| CAGR | 4.9% |

The heat exchangers segment reached USD 6.2 billion in 2024 and is forecast to grow at a CAGR of 5.2% through 2034. Heat exchangers are highly efficient in applications like pasteurization, sterilization, and cooking, making them indispensable for processing temperature-sensitive products such as dairy and beverages. Their ability to provide precise temperature control while promoting energy efficiency has solidified their position as a critical component in the industry. Data from the International Association for Food Industry Suppliers (IAFIS) highlights the significant market share of heat exchangers, driven by their reliability and operational benefits.

In terms of heat technology types, conventional systems dominated the market in 2024, capturing a 63.9% share. These technologies, including gas and electricity-based heating, remain widely adopted due to their availability, cost-effectiveness, and versatility across various food processing operations. Meanwhile, microwave technology is expected to grow at a CAGR of 5.2% through 2034, rapidly gaining traction in the industry. Known for its operational efficiency and quick processing capabilities, microwave heating is establishing itself as a dominant force in heat processing.

The U.S. market for food industry heat processing equipment generated USD 4.2 billion in 2024 and is anticipated to grow at a 5% CAGR through 2034. The country's extensive food production capacity, combined with technological advancements, is driving this growth. Rising demand for processed foods, coupled with a growing focus on energy-efficient solutions, significantly contributes to market expansion in the region. Insights from the Food Processing Suppliers Association (FPSA) underscore the U.S. market's emphasis on continuous innovation and sustainability, positioning it as a global leader in the adoption of advanced heat processing equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for processed and ready-to-eat foods

- 3.6.1.2 Technological advancements in heat processing equipment

- 3.6.1.3 Increasing focus on energy efficiency and sustainability

- 3.6.1.4 Growing food safety and quality standards

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Complex maintenance and operational requirements

- 3.6.1 Growth drivers

- 3.7 Technological landscape

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Heat Exchangers

- 5.3 Pasteurizers & Sterilizers

- 5.4 Evaporators

- 5.5 Dehydration Equipment

- 5.6 Fryers

- 5.7 Ovens

- 5.8 Others (blanchers, roasters, etc.)

Chapter 6 Market Estimates and Forecast, By Operation, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates and Forecast, By Heat Technology, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Conventional (gas, electricity).

- 7.3 Infrared

- 7.4 Microwave

- 7.5 Induction

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Bakery and confectionery (bread, cakes).

- 8.3 Meat, poultry, and seafood.

- 8.4 Dairy products (milk, cheese).

- 8.5 Fruits and vegetables.

- 8.6 Beverages (juices, soft drinks).

- 8.7 Snacks (chips, nuts).

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Alfa Laval

- 11.2 Barry-Wehmiller Companies, Inc.

- 11.3 Bühler Group

- 11.4 FMT Food Machinery & Technology

- 11.5 GEA Group

- 11.6 Heat and Control, Inc.

- 11.7 IDMC Limited

- 11.8 JBT Corporation

- 11.9 Krones AG

- 11.10 Marel

- 11.11 Scherjon Dairy Equipment

- 11.12 SPX FLOW

- 11.13 Tetra Pak

- 11.14 Thermo Fisher Scientific

- 11.15 TSC Food Processing Equipment