PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740914

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1740914

Renewable Energy Transformer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

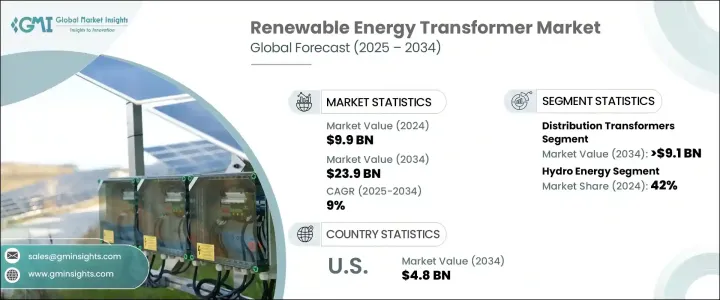

The Global Renewable Energy Transformer Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 23.9 billion by 2034. Driven by an aggressive global transition toward clean energy sources, the market is witnessing substantial momentum. Countries across the world are investing heavily in solar, wind, and hydroelectric power projects, leading to a massive demand for transformers capable of efficiently handling the dynamic nature of renewable energy inputs. As utility providers modernize aging infrastructure and governments enforce stricter renewable energy targets, the need for technologically advanced transformers that can ensure grid stability has never been higher.

The rise of distributed energy resources (DERs) and microgrids, combined with advancements in energy storage technologies, are further boosting the importance of specialized transformers. Companies are increasingly integrating AI-driven monitoring systems and IoT-enabled sensors into transformer designs, aiming to optimize grid performance, minimize energy loss, and enable predictive maintenance. The steady growth of electric vehicles, expanding decentralized power generation, and investments in smart cities are reinforcing the necessity for high-performance renewable energy transformers, creating promising opportunities across global markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $23.9 Billion |

| CAGR | 9% |

The increasing shift toward solar and wind power, along with a worldwide push for cleaner energy adoption, is fueling this market expansion. As energy storage systems receive more investments and power grids are modernized, there is a growing need for transformers that can efficiently manage the variability of renewable energy flows. The development of digital monitoring systems and smart grid technologies is driving innovations in transformer designs, further contributing to market growth. Government mandates and renewable energy usage targets set by utility companies continue to play a major role in boosting demand.

Despite the positive outlook, challenges such as complex regulatory environments, ongoing supply chain disruptions, and fluctuating raw material prices remain critical concerns. The industry is responding by focusing on advanced, customizable transformer designs that meet evolving energy and environmental standards. Trade policies, including tariffs on imported steel, aluminum, and electrical components enacted during the Trump administration, have significantly impacted production costs, pushing manufacturers to adjust strategies. Many companies are relocating or expanding production facilities to cost-effective regions like Taiwan, Mexico, and Vietnam to better manage expenses and minimize risks.

In terms of product types, distribution transformers dominate the market and are projected to generate USD 9.1 billion by 2034. These transformers play a vital role in integrating renewable energy sources like solar and wind into the existing grid. Innovations such as IoT sensors and real-time performance monitoring are enhancing their reliability and operational efficiency. Power transformers, which are critical for transmitting high-capacity electricity from large-scale renewable installations to urban centers, are also seeing robust growth, supported by advancements in insulation and cooling technologies.

The renewable energy transformers market from the hydro energy segment accounted for a 42% share in 2024 and is anticipated to grow at a CAGR of 8% by 2034. Expanding hydropower projects, along with increasing offshore and onshore wind installations, are key drivers for market growth. The demand for transformers designed to handle the fluctuating outputs of solar photovoltaic systems is also rising significantly.

The U.S. Renewable Energy Transformer Market generated USD 1.9 billion in 2024. With a growing adoption of solar and wind technologies, coupled with infrastructure modernization efforts and smart grid integration, the U.S. market is poised for sustained expansion.

Key companies operating in the Global Renewable Energy Transformer Market include Aditya Energy, ABC Transformers, GE Vernova, ACTOM, Acutran, AEP Group, Celme, Hammond Power Solutions, CG Power, Daelim, Deltron Electricals, Eaton, Elsewedy Electric, HD Hyundai Electric, Hitachi Energy, Hyosung Heavy Industries, MGM Transformers, Mitsubishi Electric, Ormazabal, Prolec Energy, Siemens Energy, Virginia Transformer, and WEG. These companies are prioritizing product innovation in energy efficiency and sustainability, incorporating advanced monitoring systems, and strategically expanding into emerging markets to meet the rising demand for renewable energy infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, ‘000 Units)

- 5.1 Key trends

- 5.2 Distribution transformer

- 5.3 Power transformer

- 5.4 Inverter duty transformer

- 5.5 Others

Chapter 6 Market Size and Forecast, By Cooling, 2021 - 2034 (USD Million, ‘000 Units)

- 6.1 Key trends

- 6.2 Dry type

- 6.3 Oil immersed

Chapter 7 Market Size and Forecast, By Rating, 2021 - 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 ≤ 10 MVA

- 7.3 > 10 MVA to ≤ 100 MVA

- 7.4 > 100 MVA to ≤ 600 MVA

- 7.5 > 600 MVA

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, ‘000 Units)

- 8.1 Key trends

- 8.2 Hydro energy

- 8.3 Wind farm

- 8.4 Solar PV

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, ‘000 Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 Russia

- 9.3.4 UK

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Qatar

- 9.5.4 Egypt

- 9.5.5 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 ABC Transformers

- 10.2 ACTOM

- 10.3 Acutran

- 10.4 Aditya Energy

- 10.5 AEP Group

- 10.6 Celme

- 10.7 CG Power

- 10.8 Daelim

- 10.9 Deltron Electricals

- 10.10 Eaton

- 10.11 Elsewedy Electric

- 10.12 GE Vernova

- 10.13 Hammond Power Solutions

- 10.14 HD Hyundai Electric

- 10.15 Hitachi Energy

- 10.16 Hyosung Heavy Industries

- 10.17 MGM Transformers

- 10.18 Mitsubishi Electric

- 10.19 Ormazabal

- 10.20 Prolec Energy

- 10.21 Siemens Energy

- 10.22 Virginia Transformer

- 10.23 WEG